Due Diligence

What is a Due Diligence clause and do I need one?

Learn what a Due Diligence clause is, how to use it, and what it means for you.

Property Investment

12 min read

“What type of property investor should I be?”

This is still one of the most common questions we get here at Opes Partners.

Because there are so many ways you could invest, a lot of Kiwis struggle to figure out what the right path for them should be.

That’s why in this article you’ll get an unbiased review of the different ways you can become a property investor. That includes New Builds and existing properties.

Now here at Opes Partners we help investors buy New Builds. And we have a range of New Builds you could buy through us, so there is an incentive for me to tell you that New Builds are the perfect buy.

I’m not going to do that. Instead, I’ll honestly explain the pros and cons of each strategy. Then I’ll take a step back and you can decide which is the right strategy for you.

There are a handful of main paths you can take when investing in property. These sit underneath the 3 main umbrella strategies.

The umbrella strategies are:

This is a hands-off investment strategy where you buy a property and wait for it to go up in value.

You can either buy a New Build or an existing property. This is also the strategy we help investors use here at Opes Partners.

Here’s an example of an investor following the New Build strategy:

And here’s an example of someone who buys existing properties:

This is a more active strategy. Here you buy a property and then do it up. Here you also have two options:

Here’s an example of someone following the BRRRR strategy:

And another case study of someone following a Flipping strategy:

This is the most complicated, and expensive strategy. It’s where you become a developer. Again, you have 2 options:

And here are two case studies of investors who are developing properties. The first is an example of a develop to hold. The second is a developer who buys and sells.

Here are the 4 main differences between each of these pathways.

Some property investment strategies take more money than others to get started.

Buy and Hold strategies are the least expensive to get started. They also require the least amount of prior knowledge.

You only need a 20% deposit to buy a New Build. And you only need a 35% deposit to buy an existing property.

But that’s it. There’s no renovation spend required or coaching costs. You buy a finished property and wait.

Renovation strategies can take more money to get going. For starters, you’ll need to buy an existing properties. That means you need a 35% deposit.

You also need to have the money for the renovations. This is usually around the $50k+ mark.

Some investors take this further and also pay to get a property coach. These tend to cost around $20k a year (depending on who you use).

Not everyone uses a property coach, but many investors do.

But you’ve got to get experience somehow. You either pay for the experience of others or you gain your own experience by making mistakes along the way.

A development strategy requires the most start-up capital. You’ll typically need around $500k for construction if you already own the land.

If you’re looking to buy the land as well, you’ll need about a million in cash.

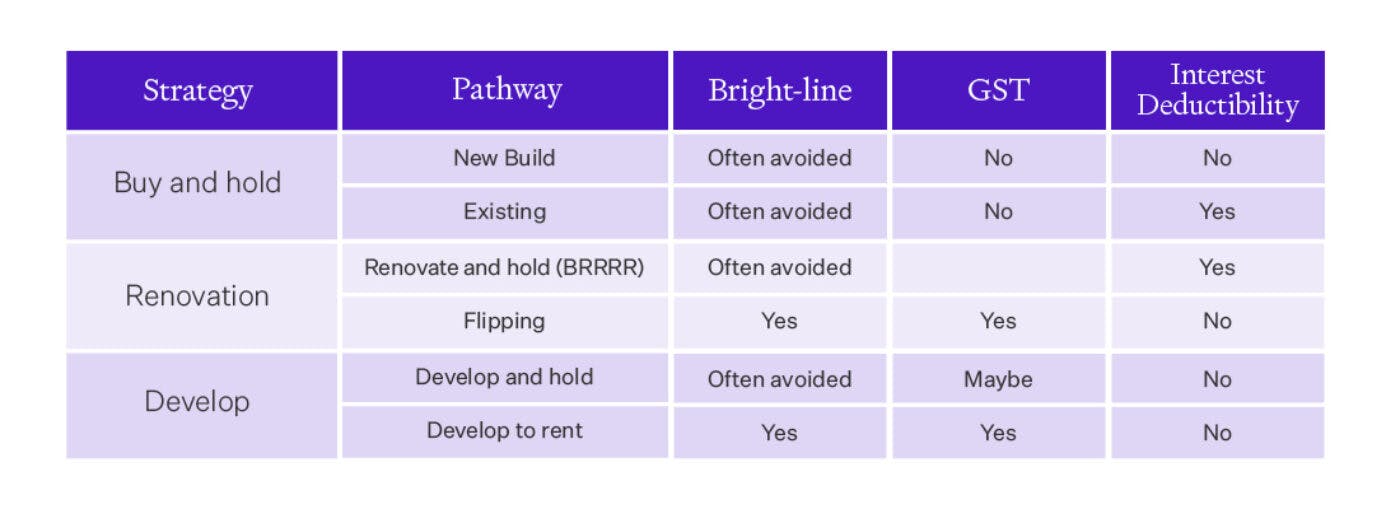

Next are the differences in the tax you pay.

New Build properties sidestep most property investment taxes. The government wants people to buy New Builds, so they get special rules.

For instance, you have a shorter 5-year Bright-Line Test. New Builds are also exempt from interest deductibility rules.

You’ll pay more tax if you buy an existing property. They face higher taxes through interest deductibility. They also have a longer 10-year Bright-Line Test.

This applies to both the Existing Buy and Hold and BRRRR strategies.

But a lot of investors avoid paying tax under the Bright-Line Test. They just hold their properties for longer than the 5 to 10-year test. After that they sell and keep all the profits.

Flippers face different tax headaches. Flippers don’t hold on to their properties so they don’t earn any rent. So the interest deductibility doesn’t impact them, but you will pay tax under the Bright-Line and potentially GST as a flipper.

Developing on your own site you won’t trigger the Bright-Line Test if you hold for long enough. But you will have to pay GST and pay more tax under interest deductibility.

On the flip side if you are developing to sell, its the opposite. You’ll pay GST and the Bright-Line Test, but you won’t get caught out through interest deductibility.

So you’ll pay substantially more tax as your strategy gets more active.

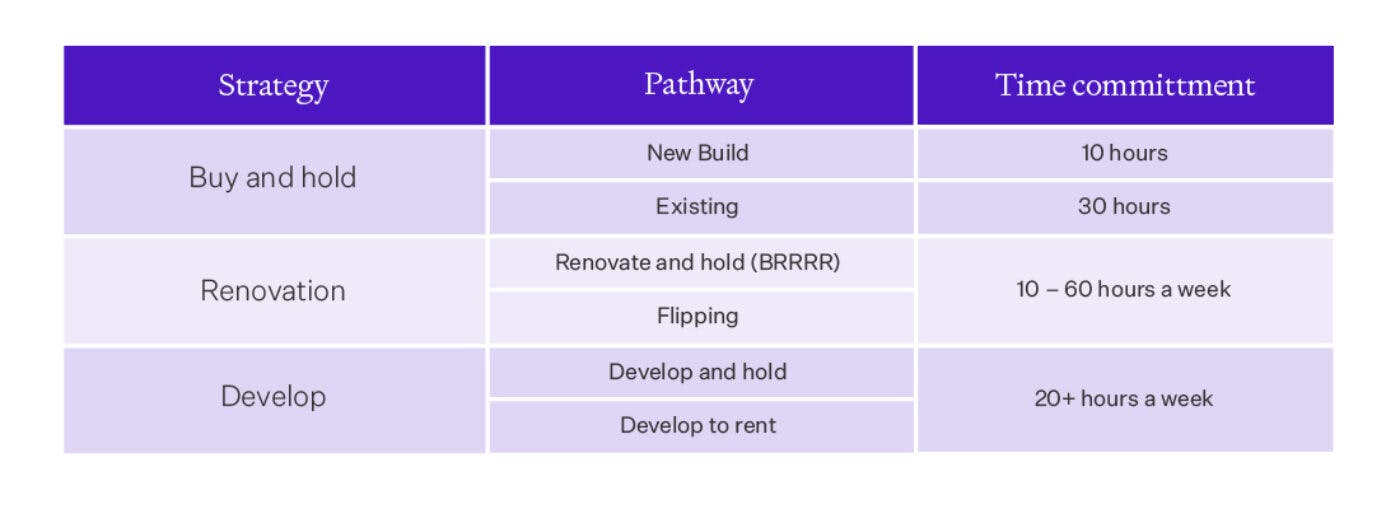

There are also differences in the time each strategy takes.

It doesn’t take long to buy a New Build as part of a buy-and-hold strategy. You’ll likely only need about 10 hours to buy and settle the property in total.

If you’re buying existing, you’ll likely spend more time at open homes. So, it might take 30 hours to find, buy and own the property.

But that’s it. A buy-and-hold strategy is a hands-off, low-risk investment option. You buy a property and let the market do its thing for 15 years before coming back to it.

And because your strategy stretches many years, the ups and downs of the market don’t matter that much ... if the long-term trend is up.

If you’re renovating, you’re looking at about 10 hours a week (even if you’re not doing the work yourself).

But the sky is the limit if you want to do the work yourself. Tradesmen make a full-time job out of it.

So, on top of a hefty time commitment, there is a medium amount of risk involved in this. That’s because you might:

Flipping has a bit more risk than a standard renovation strategy. That’s because you have to find a buyer at the other end.

If you don’t, you’ve got an empty house that’s not earning any money … and you’re still paying interest to the bank.

Developing properties means committing at least 20 hours a week. That’s just to project manage the build. That’s not assuming that you’re building the property yourself.

This is a much higher risk, and sometimes you have major price blowouts or delays in construction.

The highest risk and highest amount of time is developing to sell. It takes so much time, even if you’re working with a real estate agent to sell them.

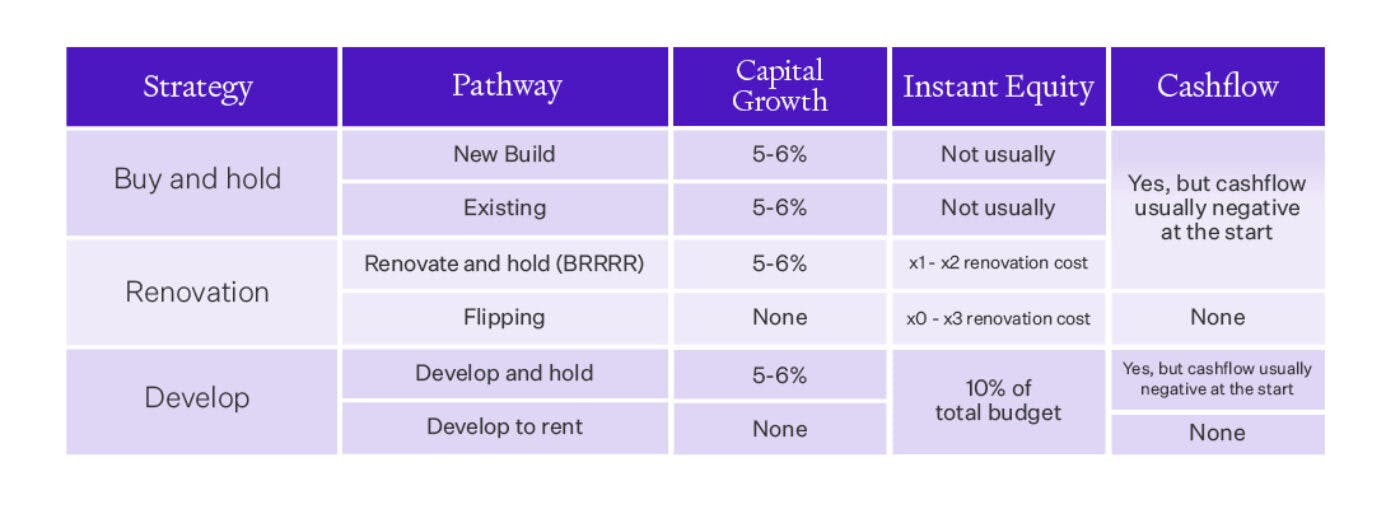

And finally there are differences in the amount of money you might make.

Here at Opes Partners we assume New Builds and existing properties go up in value by 5-6% per year (on average).

You might not make any money through instant equity.

And at today’s interest rates you’ll likely need to top up the property by $300 - $600 a week although this should come down over time.

So you will primarily make money through your property going up in value.

Renovating properties to rent means you’ll likely get some instant equity. That means you spend $50,000 renovating your property (for example) and it goes up in value by $100,000.

Your property will likely also go up in value over time. Again that might be by 5-6% per year (on average).

Even if you’re renovating to rent out, these properties will likely be negatively-geared. That means the rent doesn’t cover all the costs so you’ve got to “top-up” the property.

If you go ahead and flip, you won’t make any capital gains through the property going up in value. That’s because you’re buying and selling so quickly.

With this strategy, you make your money in instant equity. You put $50k in and your property sells by $50-200k more. So, you can make 0-3x your renovation costs. But, sometimes you won’t make any money … if a flip has turned pear-shaped.

If you’re developing to rent, you’ll get the long-term capital growth, but you’ll also hopefully get a 10% uplift during construction.

You are still looking at a cashflow loss during the initial period, while interest rates are high.

If you are developing to sell, you don’t get any market growth, but you do get the instant equity of (hopefully) 10%.

Some investors like to get help when investing in property. The company you talk to depends on which strategy you want.

If you want to invest in New Builds, talk to a property investment company. These businesses will help you create a financial plan.

They will then find you a New Build investment property to buy.

We here at Opes Partners are one example of a property investment company, but there are others out there too. These include:

If you want to buy an existing property you’ll need to talk to a property finder like iFindProperty. Or you might approach a standard real estate agent to find you a property.

If on the other hand you want to renovate, you might approach a property coaching company.

If you want the BRRRR strategy, you might talk to someone like:

If flipping is more your thing you’ll want a property coaching company that focuses on this. Asset Lab is a good example of the type of company you need to talk to.

But if developing is more your thing, you want to talk to someone like Gilligan Rowe and Associates. They have an online property development school.

If you want to develop a property and sell it, then a house builder like G.J. Gardner might be able to help.

Now that you know what the different pathways are, you can pick what strategy is right for you.

If you’re too busy with work or family, a hands-off New Build investment might suit you.

But maybe you’ve got some trade experience and spare time in the evenings. Then you might enjoy taking on some extra risk to make money in a BRRRR project.

Or if you’ve been thinking that your backyard could be a good spot for a development … maybe you’ll go for that option.

There are many ways you can be successful with property. It’s all about knowing the risks and the rewards of each.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.