Opes

What’s the difference between opes and buying from a developer directly?

Many investors who focus on New Builds ask: “Why would I use a buyers’ agent like Opes Partners? Why not go to a developer directly?”

Property Investment

13 min read

Author: Ed McKnight

Our Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Laine Moger

Journalist and Property Educator with six years of experience, holds a Bachelor of Communication (Honours) from Massey University.

Considering a property coach?

You might be wondering whether you're really going to get good advice, or if you're just going to get a biased sales pitch.

In this article we'll break down how to discover if your property coach will give you genuine advice … or is just trying to sell you a property.

Many Kiwis dream of becoming property investors, but no-one teaches you how to do this at school.

Some investors will figure it out by reading books or getting their hands dirty on a renovation project.

If that’s not for you, a property coach may be more appropriate. That’s because a coach can either teach you how to invest or find potential investment properties for you.

These businesses call themselves different things – like coaches, mentors, or property partners. Generally, they fall into three categories –

We at Opes Partners fall into that last category. We offer a complimentary property advice programme and earn a fee if we can find the right investment for you.

Because this service includes guiding you through the property process, it generally suits investors who want to take a hands-off, passive approach.

That's why these type of property coaches tend to recommend new properties, which are bought from a developer.

For property coaches in that third category, you might think: "How can I trust your advice if you have a financial interest in recommending me a property?"

One listener of the Property Academy Podcast recently asked:

"Hi Ed, been a listener of your podcast since last year. How do you balance your product (i.e. project in a suburb say Rolleston) against bias in your content? Isn't it conflict of interest if you're saying Rolleston is booming on your show when you're marketing projects there? Thanks, Matthew"

This is a great question and one worth answering. So let’s unpack it step-by-step by first considering what financial incentives property coaches have.

Some in the property industry worry that unscrupulous property coaches will try to “just sell a property” to an investor, even knowing that it’s not a good investment.

After all, “that’s their financial incentive”.

But is that really how people in business operate?

Accountants and lawyers often bill by the hour. These professionals are incentivised to sell you additional billable hours that you don't need by that logic.

But, on the whole, do we see that practice widely spread across the accounting and legal professions?

No.

That’s because while it may make sense in the short term to bill for hours not worked, or to sell a product that someone doesn’t need, it doesn’t work out in the long run.

Client-service businesses need ongoing customers to be sustainable.

If word gets out that a property coach’s advice is poor, or that it’s just a thinly veiled sales pitch, the business won’t do well.

Like any industry, there will be ethical and unethical property coaches.

A good property coach doesn’t want to recommend new-build properties to people they aren't the right fit for. If they do, they'll get a bad reputation and ruin their business in the long run.

For instance, here at Opes Partners, before we even show properties to an investor, we first determine whether new-builds are the right fit for the investor’s strategy.

The pros and cons of new-builds are also detailed on our website and on the Property Academy Podcast.

And if an investor isn’t right for this strategy, we will tell them.

That honest approach helps create long-term relationships with investors, which allows us to be a sustainable and growing business.

Key takeaways:

Actionable tip:

The next question some in the property investment community ask is "can you be unbiased if you have a financial interest in recommending a property?"

The answer is … it depends. And it chiefly depends on how the property coach decides which property to recommend.

Will they recommend any property that someone pays them to, or will they only recommend something they’ve specifically chosen?

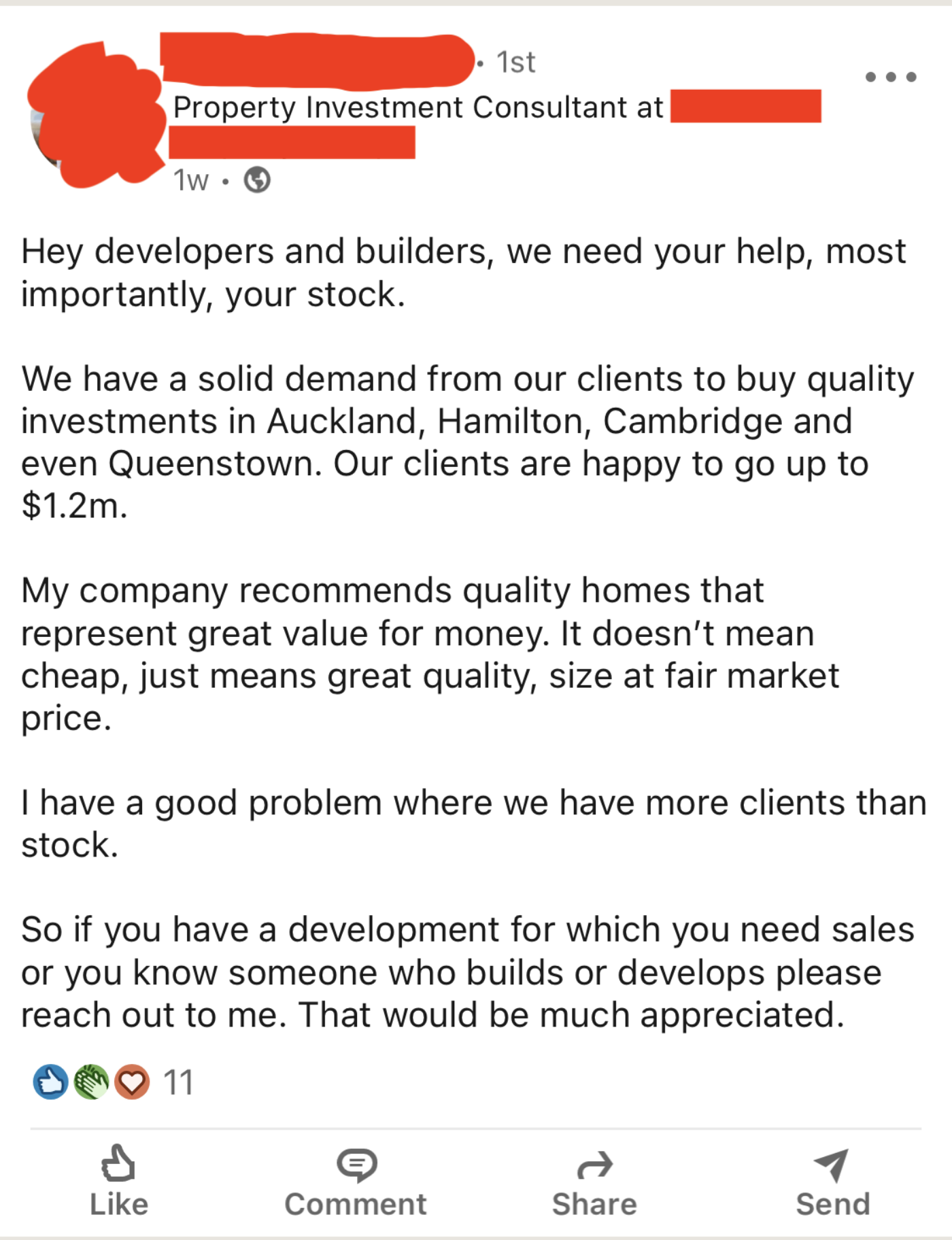

Here's a screenshot from a LinkedIn post from a property coach who took to social media to find properties to sell. Rather than looking for something specific, the approach was to look for anything:

That’s one approach.

On the other hand, some property coaches will only look for specific properties in chosen areas because they believe it will generate the best return.

For instance, at Opes Partners one of the areas we have previously recommended is Rolleston in Canterbury.

The recommendation was not given to investors because we happened to have properties there to sell.

Instead, we went to find the properties in that area, because we believed they would make a good investment.

Another example is the Tauranga market. Between 2014 and 2017, we recommended several developments to investors within the Bay of Plenty.

We no longer do that. Not because properties aren't being built there or that we couldn’t get them on our books. But because prices are so high, our reading of the data doesn't support continued investment.

Key takeaways:

Actionable tip:

Even if your property coach has a commitment to honesty and improvement, many biases could come into play.

But there are ways to mitigate these.

Each business will come up with their own ways to address bias. For instance, here are some of the measures we've put in place here at Opes Partners to stop bias creeping in:

In every industry, there will be good and bad companies.

There will be companies interested in genuinely helping their clients and others out there to make a quick buck.

There's no list online of biased and unbiased property coaches or financial advisers. So you will need to do your research and make the decision yourself.

Once you’ve done that, you may even decide a property coach isn’t the right fit for you … and that’s OK.

Although you may also decide that you are the sort of investor who prefers a passive investment strategy … in which case finding an unbiased property coach may be the right next step for you.

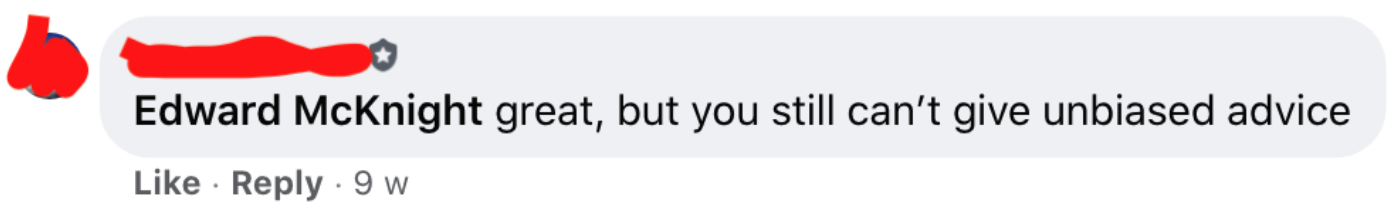

Even after all of this, some in the property investment community will still think property coaches who earn a fee when recommending a property can't give unbiased advice.

Here’s one such investor talking about it on Facebook 👇

Here's a story about Andrew Nicol, the Managing Director of Opes Partners, that shows the commitment some property coaches have to honest advice.

Andrew worked with a pair of investors who already had 2 properties under contract, which they were running due diligence on. This meant the couple had the right to buy these properties, but they could still pull out if they wanted.

The investors found these properties through another, competing property coaching company.

Technically, Andrew's financial incentive would have been to say "don't invest in either of those … here are better properties that I can get you."

That didn’t happen.

Instead, gesturing to one property, he said: "This one here probably isn't the right fit for the portfolio you want to create. Let's see if we can find something more appropriate.

"But this second one is better than anything I've got available right now. I think you should invest in it."

Yes, even when it means earning less money, the right property coach will tell you to go with a competitor’s recommendation if it's right for you.

That’s because unbiased property coaches understand that it is the long-term relationship with the investor that genuinely matters.

Our Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.