Property Investment

What is a Wealth Plan?

Discover how Opes' Wealth Plan helps you reach financial freedom and turn your goals into reality.

Opes

5 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Thinking about working with Opes Partners? You're probably wondering: “How much money have your investors made?”

That's a fair question and an important one, too. If you’re thinking about using a property investment company ... you want to know that they can pick a good investment.

In this article, you’ll see examples of properties investors have purchased through Opes. You'll also find out how much money the investors have made.

The first property is a standalone house. It has 3 bedrooms, 1 bath and a garage.

The investor paid $445k for the property. That was in May 2015.

It was a New Build, so the investor waited a year while the property got built. They then got the mortgage and paid for (settled) the property almost a year later in April 2016.

At the time, the property rented for $500 per week.

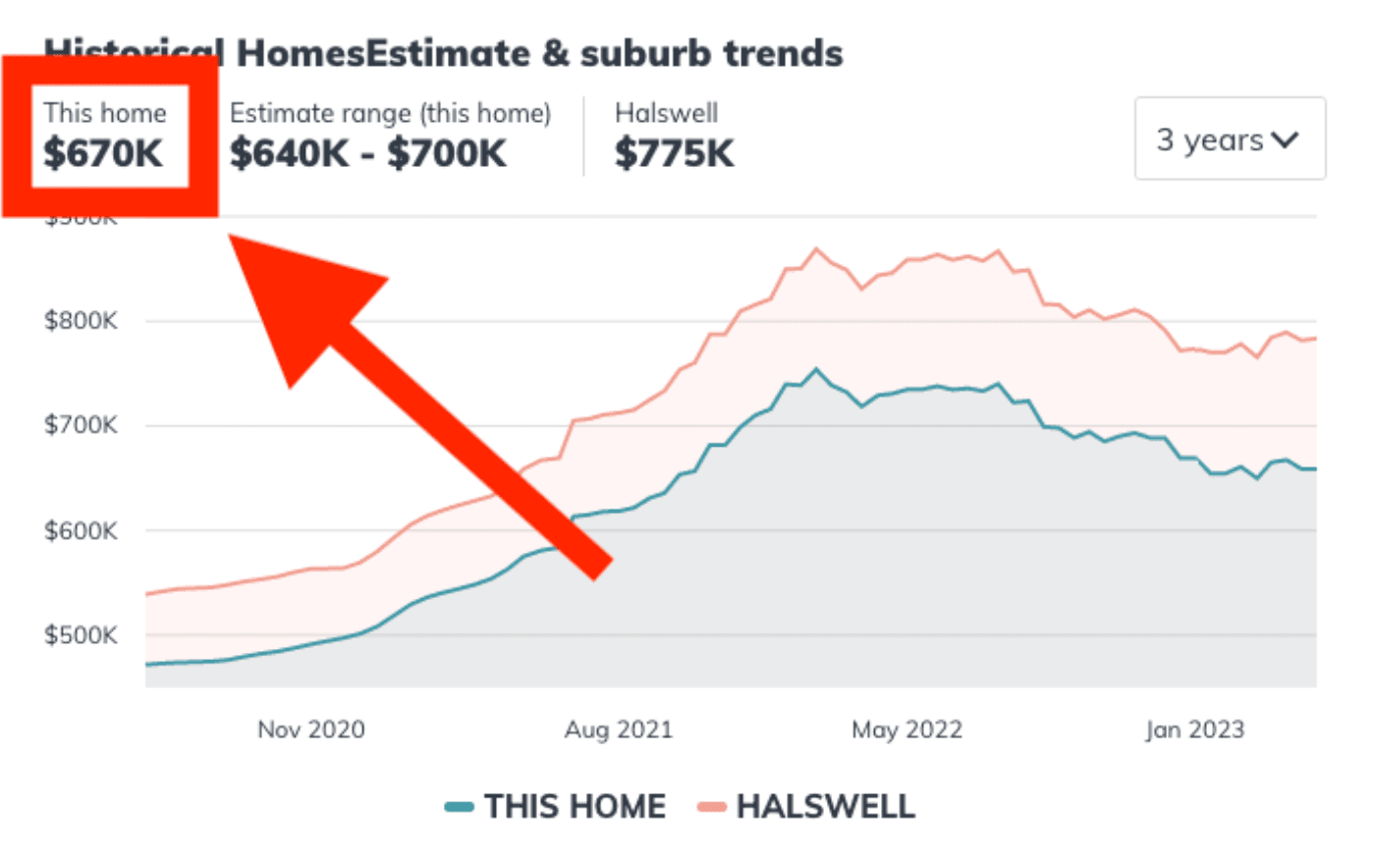

This property is now worth $670k, according to Homes.co.nz.

So the investor has made $225,000 over the last 8 years. And the property increased in value by 5.24% a year (on average).

That is above the standard 5% rate we use in our forecasting. In other words, the investor has made more money than they thought they would.

Over the same period, Christchurch house prices have gone up by an average 4.66% per year.

So this investor made more money than the average homebuyer.

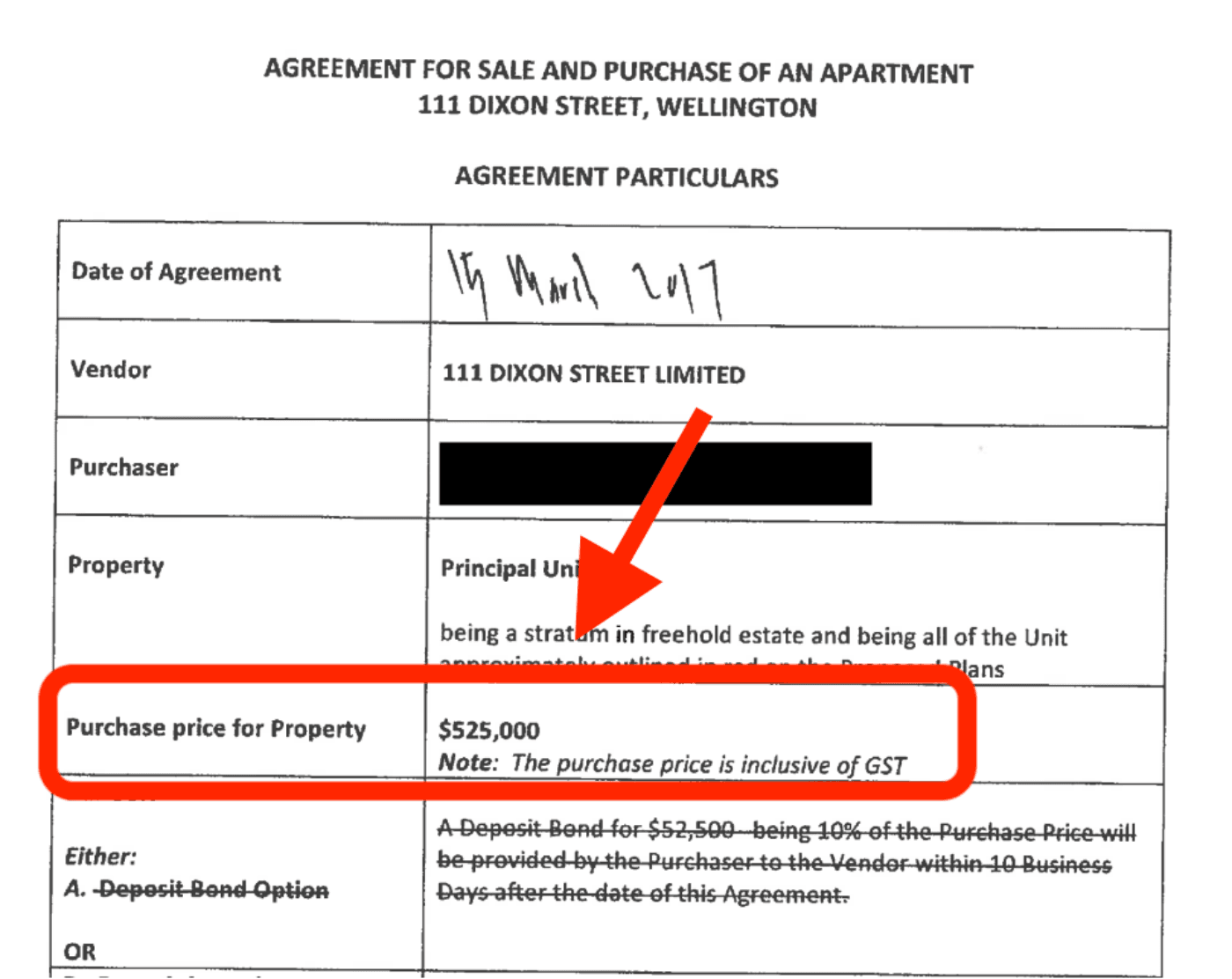

In 2017, an investor bought a dual-key apartment in Wellington through Opes.

A dual-key apartment is where you have two apartments in one property. In this case there was a 1-bedroom apartment and a studio apartment.

They signed up to pay $525,000 for an apartment in March 2017. The developer expected the build to take 2 years, so construction was due to finish in May 2019.

There were big delays in the build. Apartments often experience delays, but on top of that there was also Covid. In the end, the development took an extra two years to complete. That’s 4 years in total.

By the time the property settled (4 years after signing), it was worth $840,000. And the investor had made $315,000 just while the property was being built.

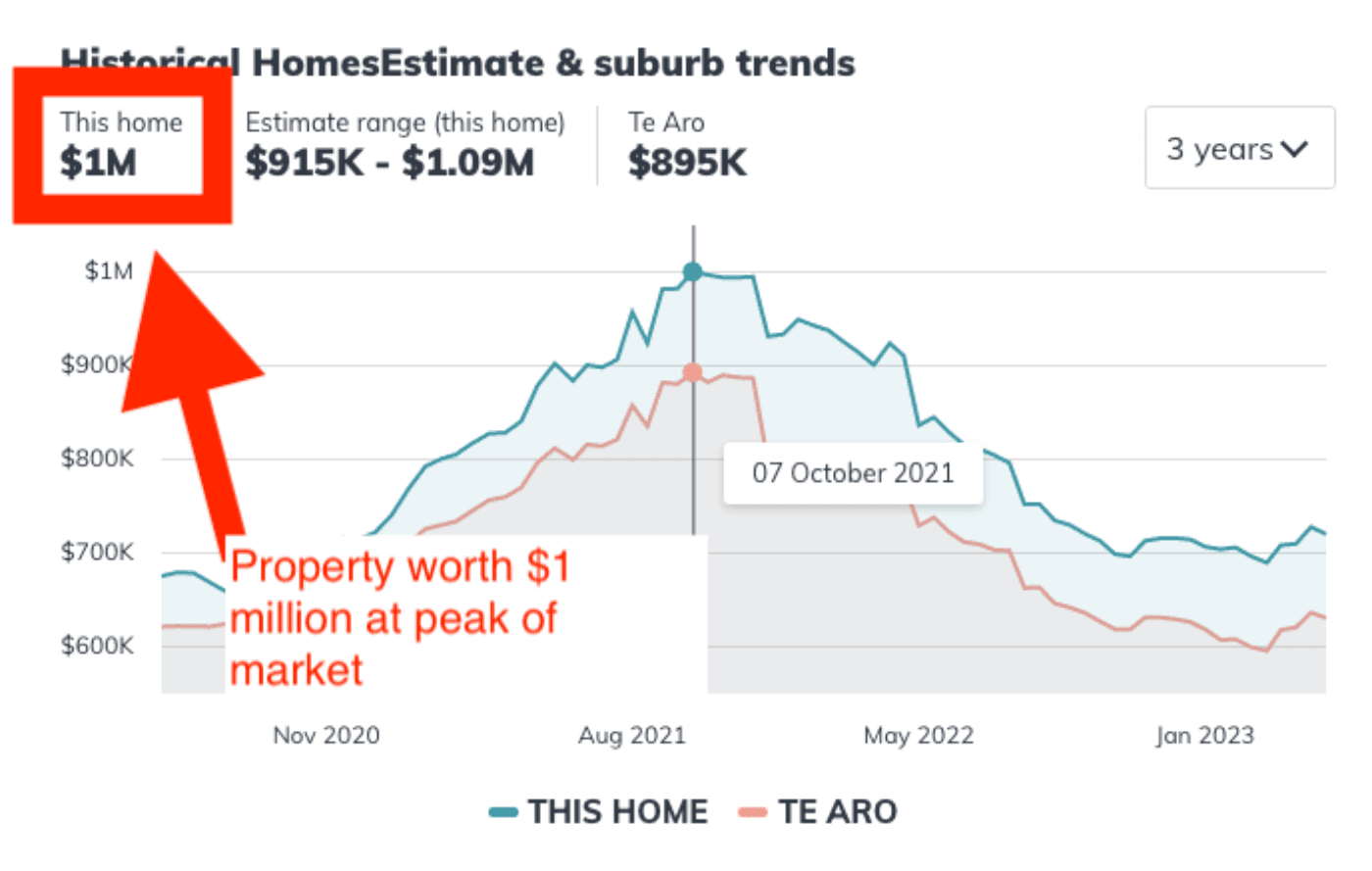

At the peak of the market (late 2021), this home was worth up to $1,000,000.

But, since then Wellington house prices have fallen in a big way. Wellington City property prices are down 24.3%.

Today the property is worth $730,000.

That’s a 39% increase, and the investor has made $205,000 over the last 6 years.

Bear in mind, we forecast that apartments will increase by 3.5% a year.

So, if the value of the property followed our modelling, it would have increased by 23% in total.

Since the property went up in value by 39%, the investor has made about $85,000 more money than they thought they would.

But you probably want to know how this compares to if the investor bought a different property.

Wellington City prices have gone up 30% since the investor bought the apartment.

As mentioned, the investor’s property has gone up in value by 39%. So they have made about $47,500 more money than if they’d purchased an average property at the same price.

The investor is currently renting this for $960 a week.

- The studio is renting for $440 a week

- The 1-bedroom is renting for $520 a week

When the investor first looked at the apartments, he expected they'd get $650 per week together.

That means the rent on these apartments has gone up by 6.7% per year (on average).

That’s faster than the 4.7% a year we typically forecast here at Opes Partners. But, it is on track with the broader market in the Wellington Region.

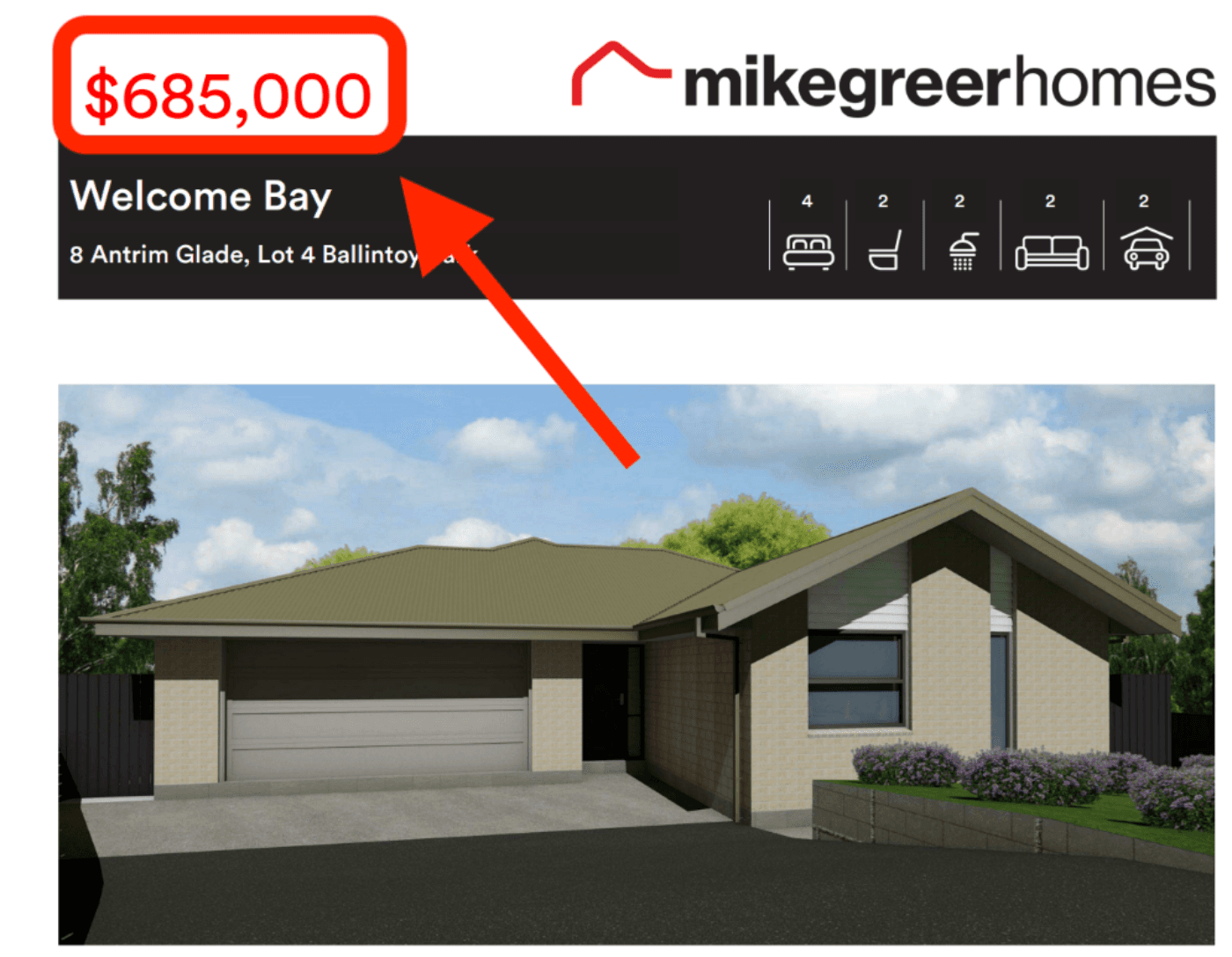

The final property we’ll look at is a 4 bedroom, 2 bath, standalone house in Tauranga.

The investor purchased this for $685,000 in April 2017.

The property took 10 months to build and was complete in February 2018.

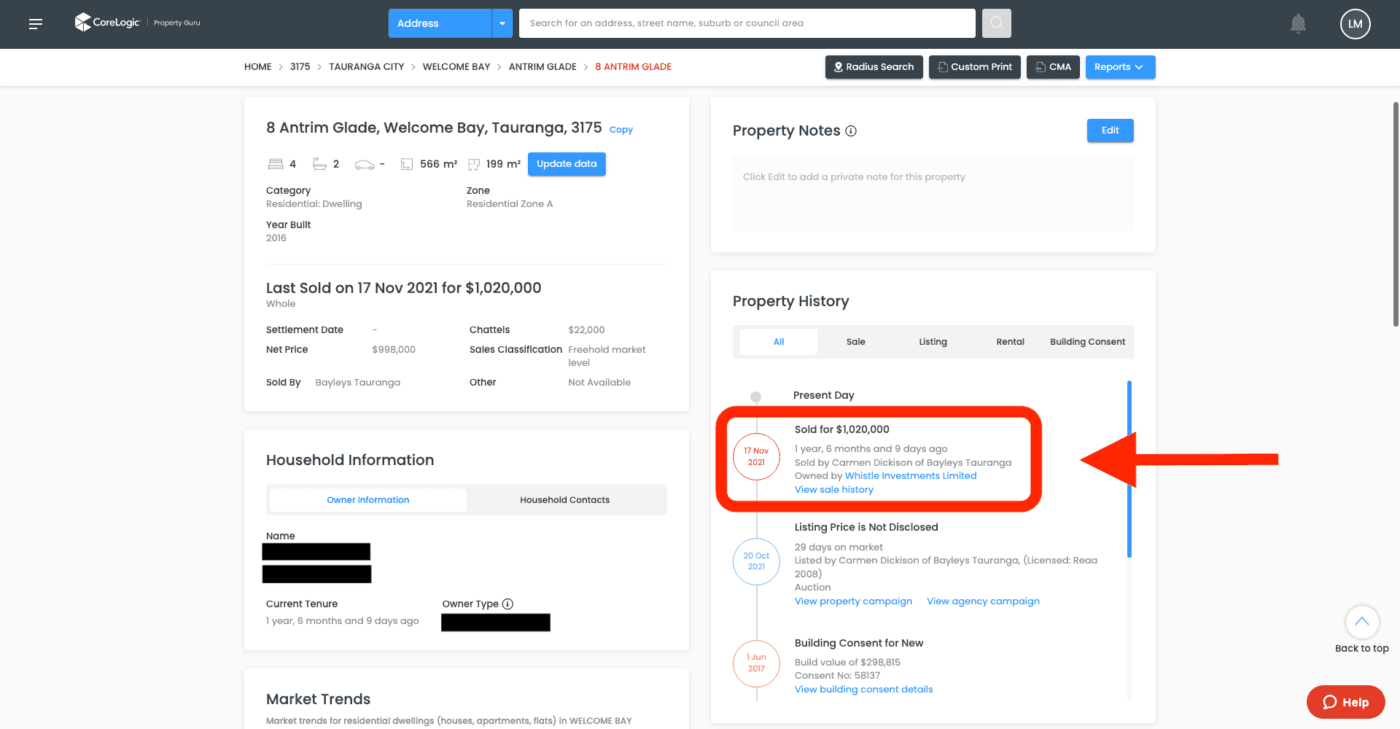

This investor had a change of circumstance and sold the property. They got the timing right and sold at the peak of the market – November 2021.

They sold for $1,020,000. That's right, they made $335,000 from the property going up in value.

That means they sold the property for 49% more than they bought it for.

That works out to be 9.1% per year. Again, faster than the 5% we use when forecasting how fast house prices grow in Tauranga.

Over the same period, the average value of a property in Welcome Bay increased 52.8%. So this property increased at roughly the same rate as the rest of the suburb.

After reading this article, you might wonder ... “do Opes investors always make more money than the rest of the market?”

The answer is “not always”.

(Sadly), we are not property investment oracles. We don't have any special magic power to predict the market. Every. Single. Time.

But we do our best to try to get it right more often than not. That’s why we use data and number crunching to inform our investment recommendations.

We aim to help you be a more successful property investor than if you found a property on your own.

But even after that number crunching, high investment returns aren't 100% guaranteed. They're not locked in.

Investing comes with risk. The question is then how you manage it.

If you’re interested in how to manage risk, check out our ebook. You'll learn Everything That Can Go Wrong With Your New Build Investment Property (And How To Fix It).

What’s the common thread with these investors?

They’ve all seen phenomenal increases in the value of their investments. And in some cases the value of their property has gone up faster than the surrounding market.

But the most important factor is they’ve stayed in the market for several years.

Take the Christchurch investor as an example. They purchased their investment for $445,000. At the time, did they think it would be worth $225,000 more just 8 years later? No, they couldn’t see how house prices could go up any more.

But, they took a punt anyway, invested, and now are better off for it.

You might read this article and think “Of course these people have made money ... property prices have gone crazy!”

But when these Kiwis decided to invest, those gains weren’t obvious. It’s only obvious in retrospect.

To get these types of gains, you’ve got to stay in the market for the long term.

Your next step is to book a portfolio planning session. This is where a financial adviser will create you a financial plan. They will then find properties that fit your plan.

Book your free sessionManaging Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser