Mortgages

Current NZ mortgage interest rates and 6 things to consider

Stay updated on NZ mortgage interest rates in 2026. Get the latest rates, insights, and expert tips to help you choose the best mortgage option.

Mortgages

14 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Peter Norris

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

We predict that the OCR will fall to 3% by December 2025 and that the fixed 1-year mortgage interest rate will be 4.9%.

That’s because Interest rates went down in 2024. And it looks like interest rates will keep dropping.

A fair question is: “How low will they go?”

There are lots of different interest rates. But, here at Opes, we help people get mortgages and invest in property. So, investors ask most often about mortgage interest rates.

By 2026, we expect the 1-year mortgage interest rate to be around 4.9%. It will likely then stay there for the next year.

But, of course, this is my best guess. No one knows for sure. The exact numbers will likely be wrong, but it's the general direction we're trying to pick.

It’s also important to recognise that interest rates impact investors differently:

So, let’s go through the different interest rates and how they might impact your investments and properties.

The OCR (official cash rate) is the Reserve Bank's interest rate. It influences other interest rates.

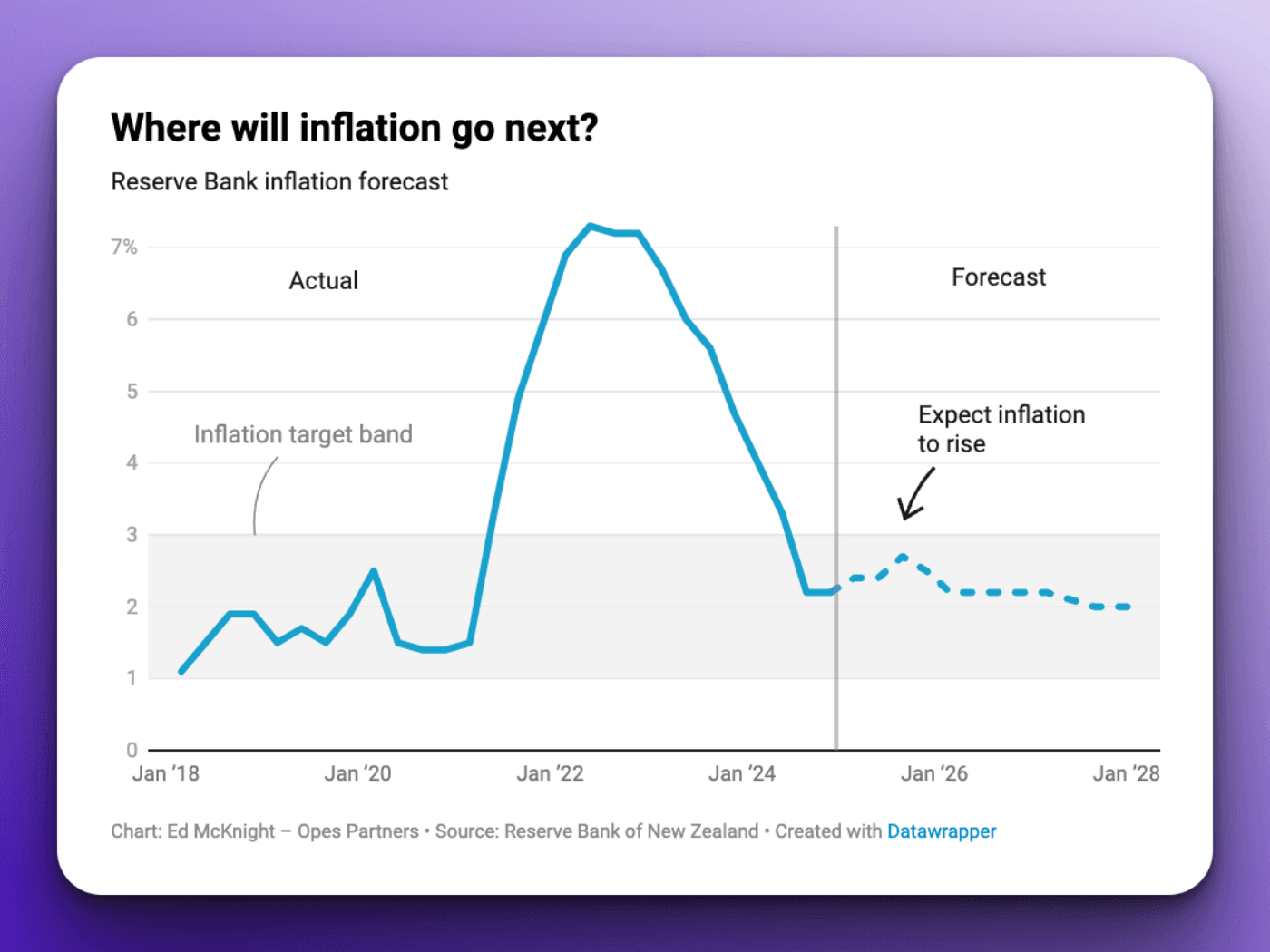

The Reserve Bank’s job is to keep inflation between 1-3%. Currently, CPI inflation is 2.2%. It’s very close to the mid-point of that target band.

And that means the Reserve Bank can lower the OCR.

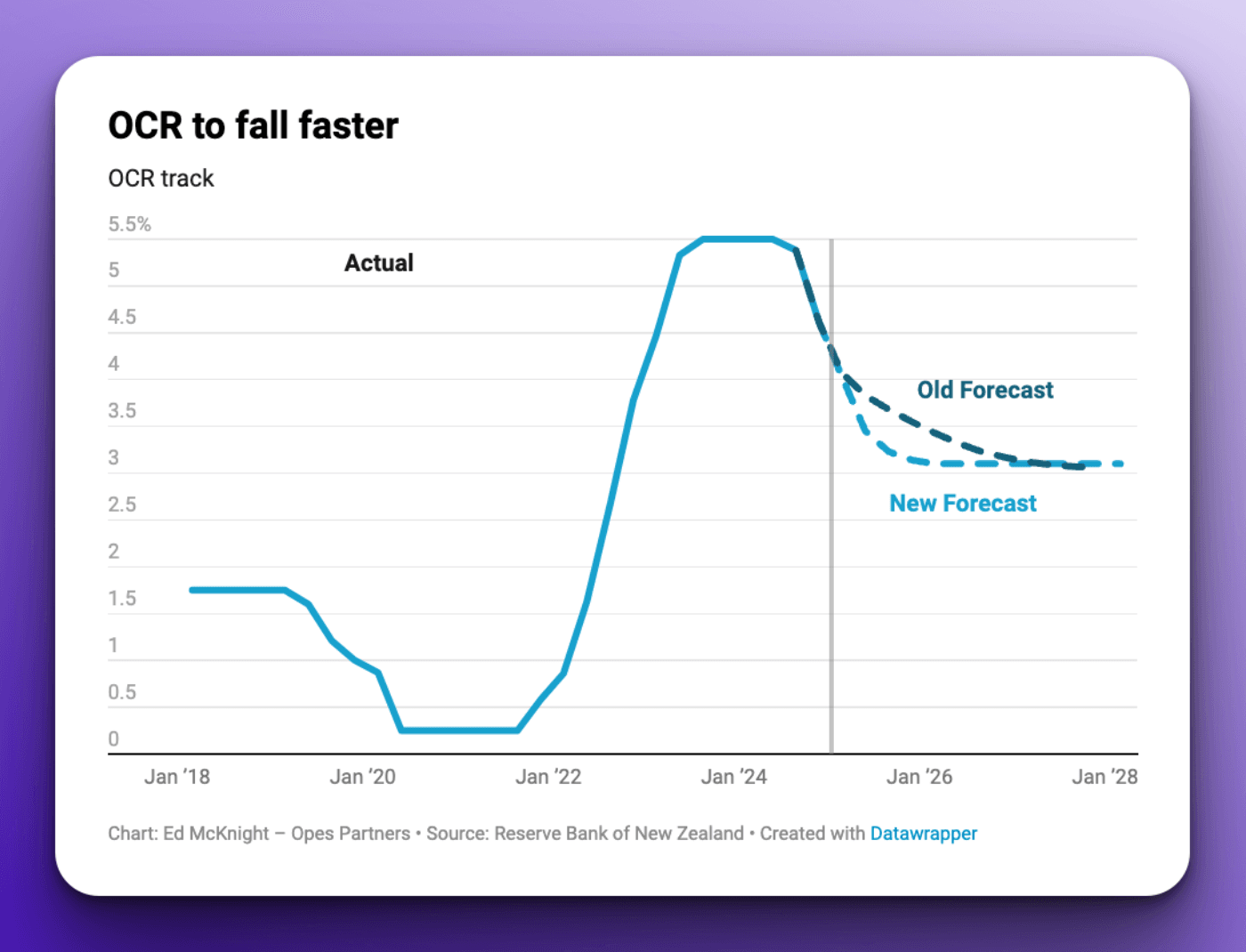

I’ll explain more about the relationship between inflation and the OCR below. But, for now, the important thing to realise is that the Reserve Bank has already cut the OCR from 5.5% to 3.75%.

So, from the recent peak, the OCR has gone down 1.75%

Every quarter, the Reserve Bank updates its OCR forecast. They think the OCR will drop to 3% by the end of 2025. That implies a further 0.75% worth of cuts by the end of 2025.

Many trusted economists think the OCR will land between 2.75% - 3% by the end of 2025.

This is different from what our central bank thought just 3 months ago. Back in November 2024, they thought the OCR would only fall to 3.5% by the end of 2025.

So, that means that the OCR will likely fall faster than previously thought. That gives space for other interest rates to fall, too.

The Reserve Bank meets 7 times a year to review the OCR. The 7 meetings for 2025 are:

Not all the dates for 2026 have been released yet. But, so far, we know the Reserve Bank will meet on 18th February 2026, 8th April 2026, 27th May 2026 and 8th July 2026.

This gives you a sense of when the OCR could change. Though, bear in mind that the Reserve Bank can decide to meet at any time to change the OCR. In practice this only happens when major crises come up. For instance, the Covid-19 pandemic.

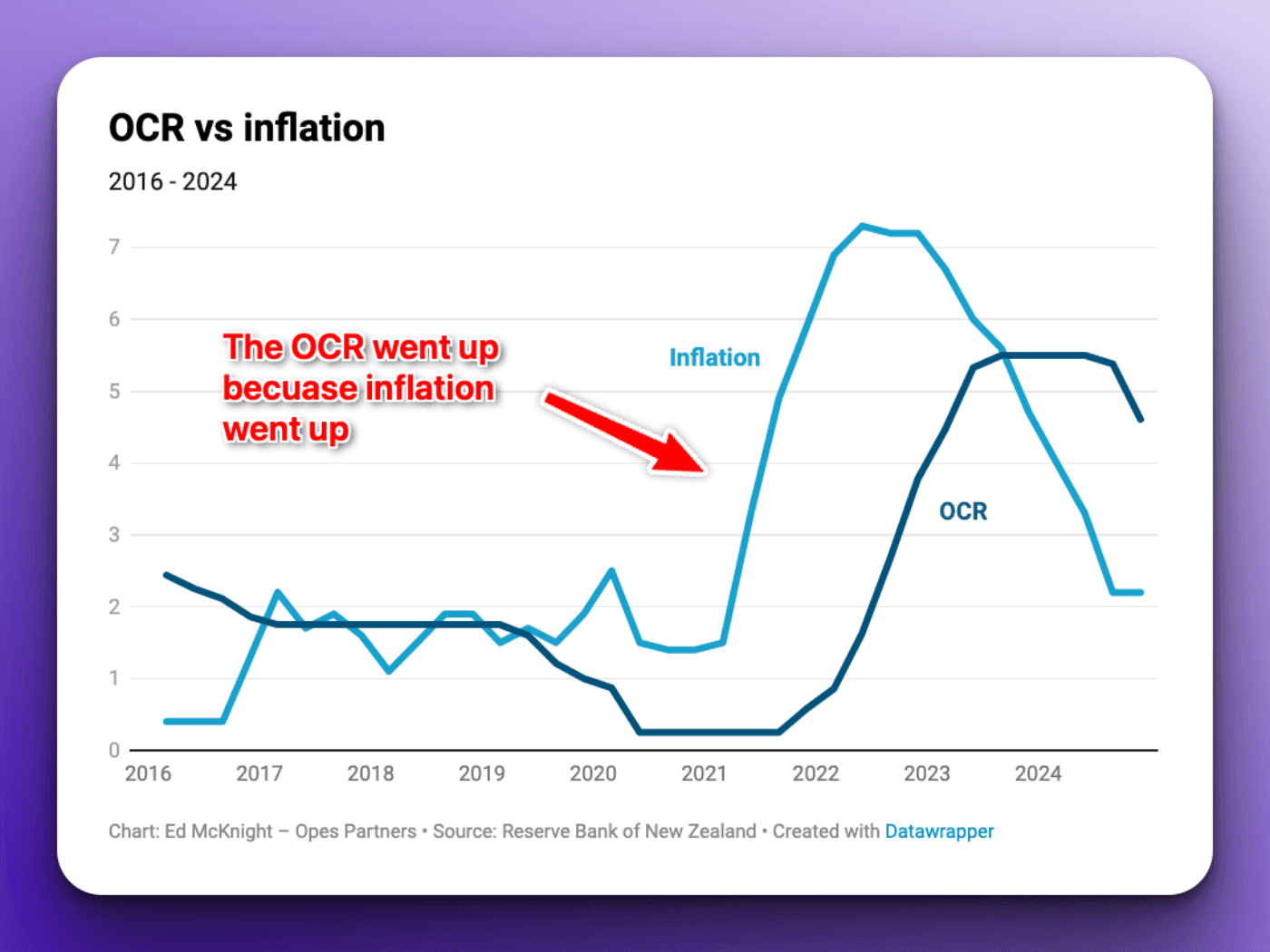

The Reserve Bank uses the OCR to influence inflation. That’s because the Reserve Bank’s job (mandate) is to keep inflation between 1 – 3%.

In 2022, inflation leapt to 7.3%. The Reserve Bank responded by hiking the OCR up to 5.5% from 0.25%. A massive 5.25% jump.

To understand why they did this, you need to ask yourself: “What makes inflation go up?”

Us economists often say – “It’s too much money chasing too few goods.” Said more simply, interest rates were too low coming out of Covid-19. So, all of us Kiwis were spending lots of money.

That meant businesses could put their prices up without losing too many sales.

And that. That is inflation. Businesses putting up their prices.

What’s the Reserve Bank to do? They hike up interest rates. That means borrowers have to pay more in interest to the banks for our mortgages. So, we have less money to spend.

That makes the economy tough for businesses. This means they can’t increase their prices as fast. So inflation goes down.

Now that inflation is down (back at 2.2%), the Reserve Bank can start bringing interest rates down.

As long as inflation stays low, the Reserve Bank has the space to bring the OCR down. And that means that other interest rates (like your mortgage interest rate and term deposit rates) can also fall.

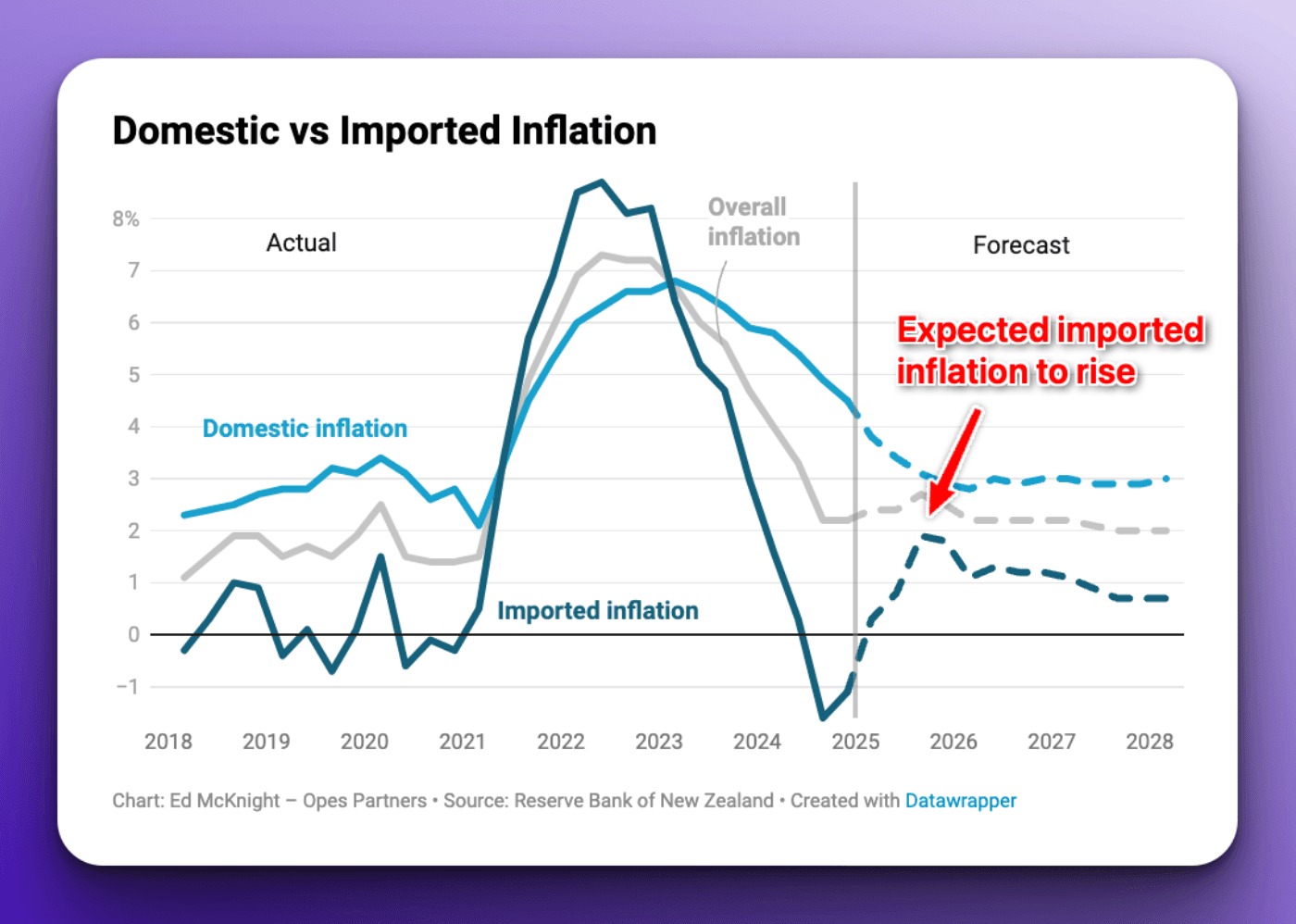

The make-up of inflation also matters. Us economists often break down inflation into domestic (non-tradeable inflation) and imported (tradeable) inflation.

At the moment, homegrown inflation is still high at 4.5%. But, it is coming down.

Imported inflation is currently negative. Prices are falling. That brings the overall inflation level down.

But imported inflation won’t stay negative forever.

As imported inflation starts to pick up and go to a more normal level, inflation will go up. That’s why the Reserve Bank thinks inflation will increase a bit in 2025.

They think inflation will stick within its target band of 1 – 3%. But, we might get an annual inflation rate of 2.7%.

That will limit how far the OCR and interest rates will fall. Don’t expect the OCR to dip much under 3%.

Where do the banks think mortgage interest rates will go?

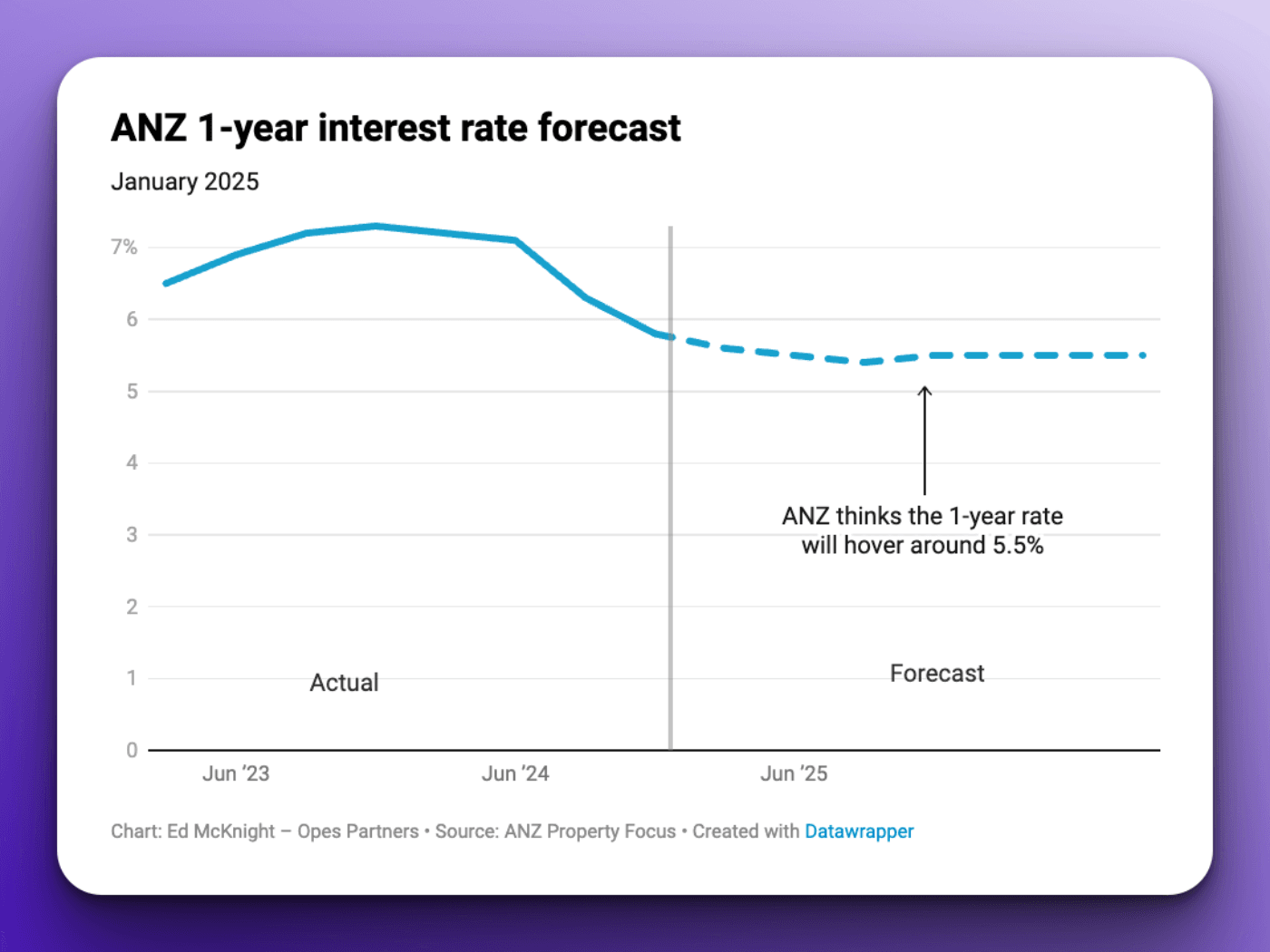

ANZ is the only major bank that publishes specific interest rate predictions.

ANZ thinks the 1-year interest rate will fall slightly throughout 2025 to 5.4% by mid-2025. They then think that the 1-year rate will stabilise around 5.5% throughout 2026.

The bank’s latest predictions are now out of date. They were released before the most recent OCR announcement. So, they don’t include that change in mood from the Reserve Bank around lowering the OCR faster.

But they’re still the latest predictions we have.

If you look at ANZ’s forecast for different interest rates, they see rates increasing more than decreasing over the next 12-18 months.

So, the Reserve Bank might cut another 0.75% off the OCR. But ANZ doesn’t reckon mortgage interest rates will come down much more. Why’s that?

Firstly, you need to understand that markets (banks, borrowers and savers) will often price in things they think will happen in the future. So, if everyone thinks that the Reserve Bank will cut the OCR, the market will move today.

So, today’s interest rates can already include the fact that the OCR may be cut in the future.

Just look at the numbers before the Reserve Bank’s most recent OCR announcement. Throughout 2024, ASB dropped its 1-year interest rate from 7.45% to 5.5%. That’s a 1.95% drop.

But the OCR had only dropped 1.25%.

So, the market had moved faster than the OCR.

So, what a lot of borrowers forget is that interest rates have already fallen by a lot in 2024. So now the OCR is catching up to where the market is. It’s not that every OCR cut adds more fuel to the interest rate drops.

The second thing you need to know is how ANZ comes up with their mortgage interest rate forecast.

First, ANZ forecasts the wholesale interest rate (the swap rate). Think of this as how much it costs the bank to borrow money and lend it to you and me for our mortgage.

So they forecast their costs. Then, they add a margin. That’s effectively their interest rate forecast.

ANZ and Westpac think it’ll cost them to borrow money (the swap rate). Both banks don’t think the swap rates will come down much more.

In other words, the Reserve Bank thinks they’ll keep cutting the OCR. But the banks basically say, “But that’s all pretty much priced in.” i.e. the market has already priced those future OCR cuts in.

So if the mortgage interest rate cuts will be small over the next year, where could they go over the long term. Previously, I’ve always thought the 1-year mortgage interest rate would end up around 4.5%.

These days, I think that will be closer to 5%.

Of course, sometimes interest rates will be higher, sometimes lower. The future is uncertain. After all, it hasn't happened yet.

But one way to approximate the long-term 1-year mortgage interest rate is to look at the neutral OCR.

This concept of neutral OCR means they’re not trying to speed up the economy (to get inflation a bit higher).

At the same time, they’re not trying to slow down the economy to get inflation down.

Back in 2022, they used to estimate that the long-term neutral OCR was around 2-2.5%.

More recently, the Reserve Bank has predicted that the neutral OCR is closer to 2.75%.

So, how do you get from estimating the neutral OCR to predicting the 1-year mortgage interest rate?

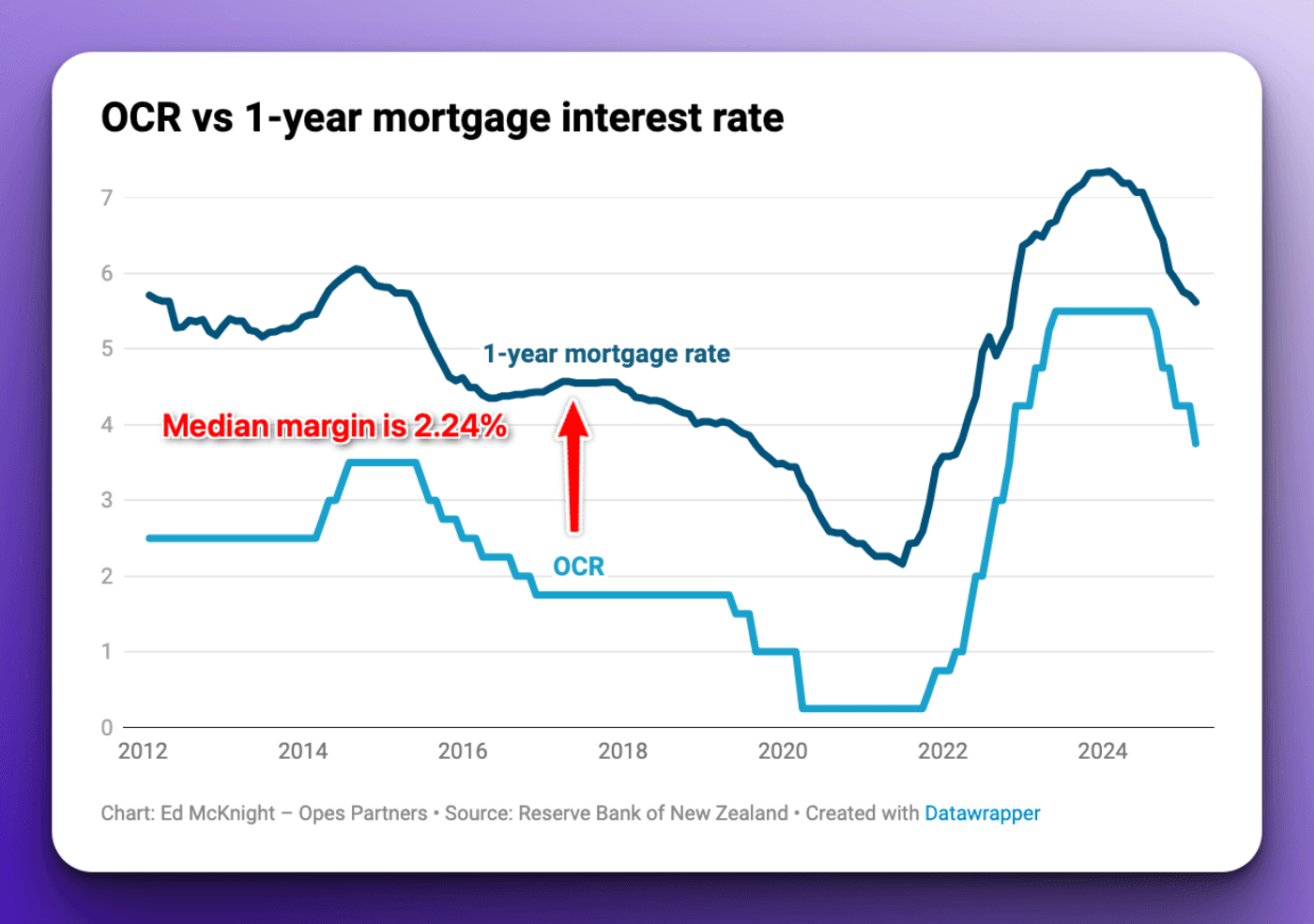

Looking back over the last 20+ years, the average difference between the OCR and the 1-year fixed rate is 2.24%. That’s about as close to 2.25% as you can get.

There are differences from month to month, but the pair follow the same broad trend over time.

If the long-term neutral OCR is around 2.75%, then the 1-year rate should hover around 5% over the long term.

5% is probably a fair assumption, if not a little more on the conservative side.

Remember, there are lots of interest rates. It’s not just mortgages and the OCR. So, let’s look at some of the other interest rates.

If you are a retiree or have a lot of money – you probably care about the term deposit rates. This is how much the bank will pay you to lend them your money for 30 days – 5 years.

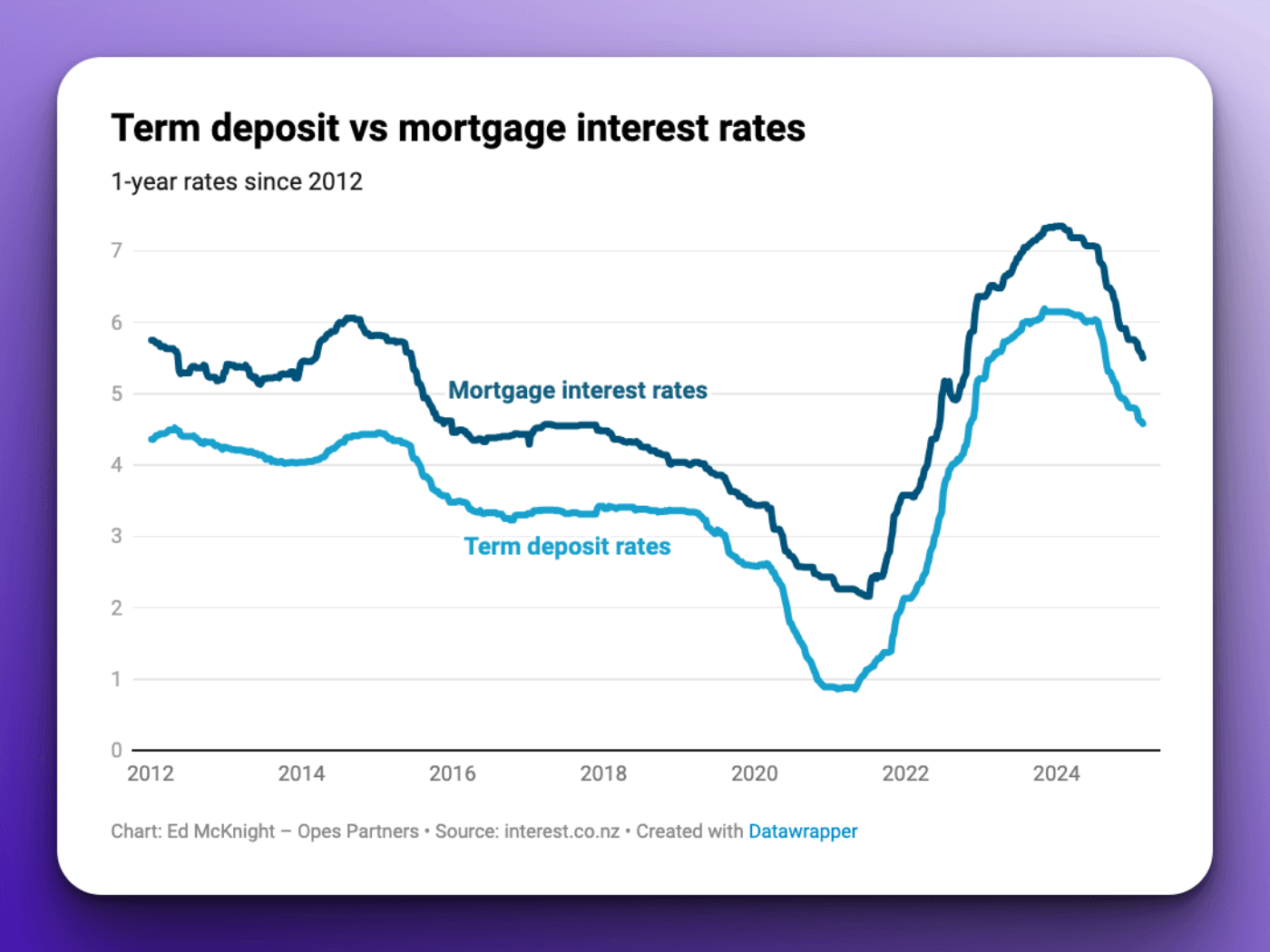

It’s important to realise that term deposit and mortgage rates go hand in hand.

To lend you money for a mortgage – the bank first has to borrow the money from someone else. One of the big places banks get money is through term deposits.

If the 1-year mortgage interest rate goes down – so does the 1-year term deposit rate.

The 1-year mortgage interest rate is typically 1.2% above the 1-year term deposit rate. That’s been the median margin since 2002.

So because mortgage interest rates are falling, term deposit rates will likely also fall.

That’s the bad news. But, the good news is – because mortgage interest rates are likely to stabilise in 2025 – the same should be true for term deposit rates. That’s good news for savers.

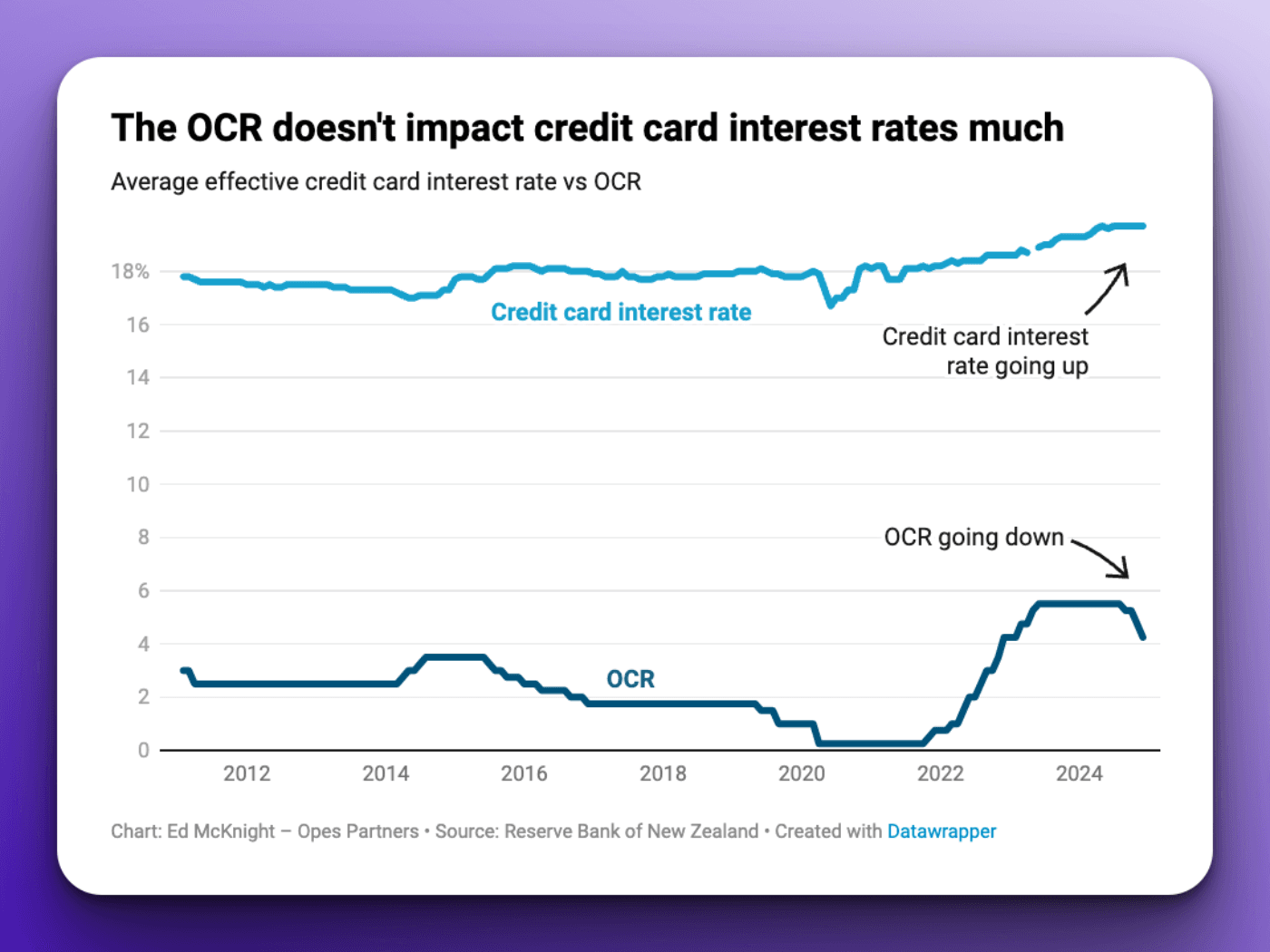

Many Kiwis take out personal loans or have debt on a credit card. So you might wonder – “Ok if the OCR is going down – will my credit card interest rate go down too?”

The answer is – “probably not.” At least, not by much.

That’s because the OCR has a big impact on some interest rates and not on others.

For instance, the floating mortgage interest rate is correlated very strongly to the OCR. If the OCR goes down by 0.5%, the floating interest rate will usually go down by 0.5%.

But it’s a different story for credit card interest rates. Yes, generally, if the OCR goes down, so do credit card interest rates. But, the trend is weak.

Between September 2021 and May 2023, the Reserve Bank hiked the OCR by 5.25%. But, the effective credit card interest rate only went up 0.7%.

Since then the OCR has dropped 1.75%. Meanwhile, the average effective credit card interest rate went up 0.8%.

Currently, the effective credit card interest rate is close to 20%. The median over the last 10 years has been 18%.

Even as the OCR drops – don’t expect credit card interest rates to drop much. They’ll likely stay around 18 – 20%. Though, it really depends on which credit card you have.

Credit cards with more benefits tend to have higher interest rates. Those with few extra benefits tend to have lower rates.

Most people take out a mortgage when they buy a house. And around two-thirds of houses in New Zealand have a mortgage.

So when interest rates fall, borrowers can take on more debt while keeping their repayments the same.

For instance, if you take out a $500,000 mortgage at a 7% interest rate, you’ll pay $3,327 a month back to the bank.

But if interest rates fall to 5%, then you can afford to take out a $620,000 mortgage and keep that repayment the same. That’s why lower interest rates tend to push up house prices.

Similarly, when you apply for a mortgage, the bank will test your mortgage application with a high interest rate. This is to make sure you can afford your mortgage even if interest rates go up.

As interest rates fall, the banks lower these servicing test rates.

This combination means that as interest rates fall, borrowers are both willing and more able to take on more debt to pay for a house. This tends to push up house prices.

Changing interest rates impact your investments in different ways.

Term deposits make less money when interest rates fall. Let’s say that you could get a 6% interest rate for 1 year while term deposit rates were high.

That means for every $100,000 invested, you’d make $6,000 a year.

But if term deposit rates fall to 4%, then for every $100,000 you invest, you then only make $4,000 a year. This is why economists often say that falling interest rates benefit borrowers but hurt savers.

Share prices tend to go up when interest rates are down. That’s because there is less incentive to invest in shares and funds when interest rates are high.

Why’s that? Well, term deposits are safer than shares. They have less risk. You know what your return is up front, and that return is fixed. You don’t get that with shares.

So, when interest rates are high, term deposits have a higher low-risk return. Some investors will switch from shares to term deposits. That decreases demand for shares, and prices tend to stabilise or go down.

But, it’s the opposite when interest rates go down. The return from term deposits is smaller. So, investors switch to shares. This increases demand for shares, pushing prices up.

My personal go-to mortgage strategy is to fix my mortgages for the 1-year rate no matter what. Previously, this has led to a low average interest rate.

Sure, the 1-year rate is the most expensive today compared to the 18-month or 2-year rate. But once interest rates come down, today's longer-term rates will look expensive.

That's why many mortgage brokers say borrowers want shorter-term rates.

68% of mortgage brokers say customers prefer locking in for 1 year or less. That's according to Tony Alexander's Mortgage adviser survey (February 2025).

In that same survey, less than 10% of advisers say customers prefer the 18-month term. It’s the same story with fixing for 2-years.

Right now, there is more risk in fixing for too long than fixing for too short.

Some investors ask, "What happens if your forecasts are wrong?"

They will be.

They are just best guesses based on the facts we have today. When the facts change, we change the forecast.

You can't predict the future with 100% accuracy.

But either way, we do know which way interest rates are heading.

So, if you're a conservative investor, either:

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser