Property Market

How is the Wellington property market going?

Dive into Wellington's property market trends with key insights on house prices, growth areas, and investment opportunities for 2025.

Property Market

4 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Wellington yields tend to be higher than Auckland and some other parts of the country.

The median yield investors are willing to accept in Wellington is 4.55%. This is 0.29% higher than the country’s median.

But gross yields vary widely depending on which suburb you choose to investigate.

Investors always ask: “What’s a good yield in today’s market?”

When you see it asked online, most people respond: “Well, it depends.”

It depends on your strategy. It depends on where you buy it. It depends on what you buy.

It’s not a straightforward answer, but as a property investor you still want an answer.

Here at Opes Partners, we want investors to be as informed as possible. That’s why we searched out the data. That way you can make an informed decision with your investment properties.

In this article, you’ll learn what a good rental yield looks like in Wellington.

Quick facts:

Wellington properties tend to have higher yields than some other parts of the country.

The median yield is 4.55%, a few points above the national average.

But some fetch a lower or higher yield; 25% of properties have a yield of 3.8% or below.

But 25% of properties have a gross yield of 5.3% or more.

Of course, it depends on the property type too.

A gross yield of 4.8% is good for a growth property, like a townhouse. But that gross yield for a yield property would be pretty poor.

Here at Opes Partners, we aim for a 4.5-4.8% gross yield for growth properties (houses and townhouses).

We then aim for a 6% gross yield for yield properties (dual-key apartments). These sorts of properties earn a higher rental yield but don’t go up in value as fast.

To get these numbers the team at Opes hired someone to get data from Trade Me and OneRoof.

The Trade Me listings show what properties are renting for. We then match that with OneRoof data to see what those properties are worth.

This shows us the gross yield property investors are willing to accept. We then did this for every property on Trade Me.

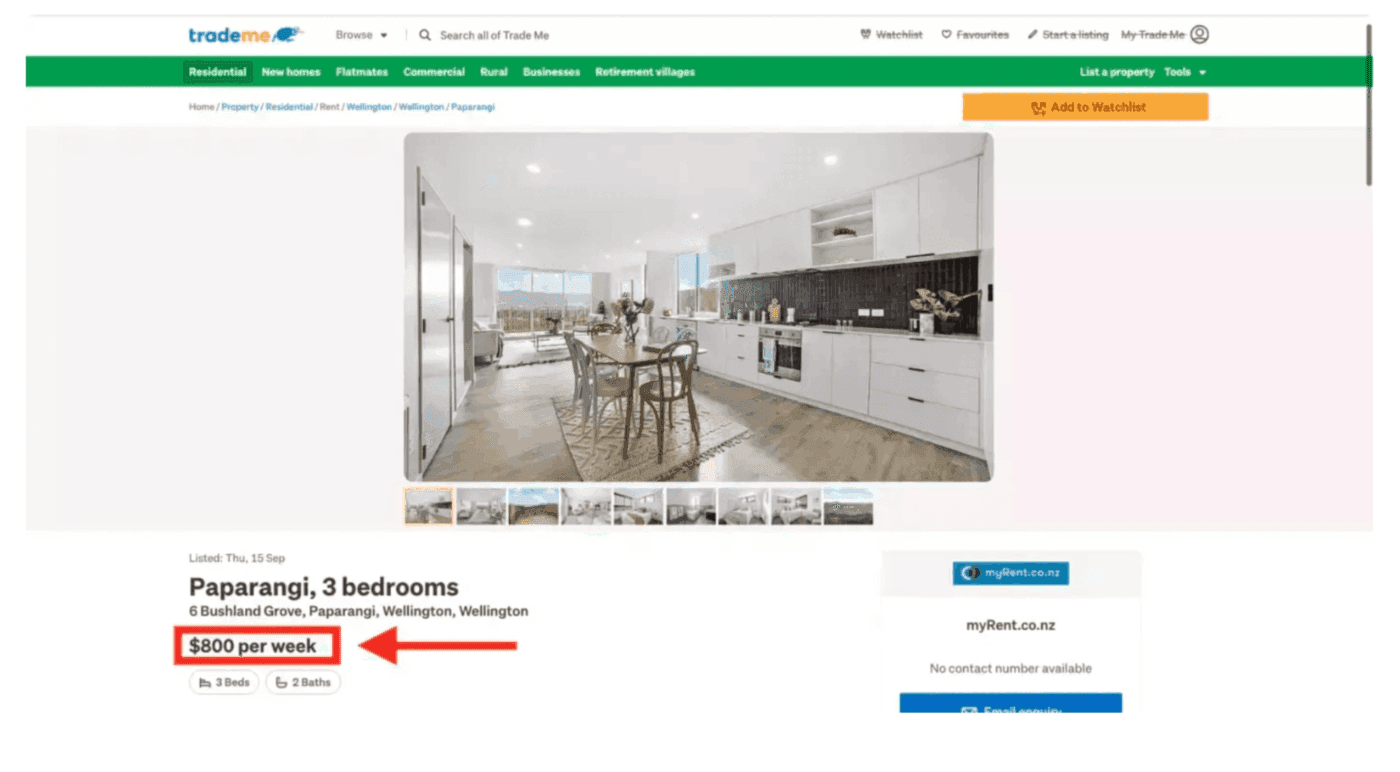

For instance, here is a property available for rent at the time we did the analysis:

It’s a 3-bed New Build townhouse in Wellington, and it’s available to rent for $800 a week.

Then, we cross-referenced this with OneRoof’s estimated valuation.

And in this instance, this property is estimated to be worth $920,000, giving it a gross yield of 4.52%. Today, that is above the country’s average.

We then use a computer to do this over 7,000 times.

After cleaning up the data, we’ve now got figures no-one else has.

Gross yields vary widely depending on which suburb you choose to investigate.

So, which suburbs in the Wellington property market have the highest gross rental yields?

Navigate the map to find the suburbs where houses produce the most cash for their investors.

Rental yields have fallen across New Zealand since 1993. While rents have gone up, so have property prices.

Since property prices have gone up faster than rents, the average gross yield has gone down over time.

More recently, property prices have fallen and that’s caused rental yields to recover.

However, the rental market is currently quiet … Wellington is flush with properties available to rent.

Trade Me data says there’s 290 more rentals on the market than at the same period last year.

Marie Baker, from Leaders Property Management, says the supply of rental properties is currently exceeding demand.

Why is this? The economy is slow. There’s an unprecedented amount of job cuts within the Public Service in Wellington and this is likely to continue.

In turn, a sluggish housing market is swelling the number of available rental properties. Houses that would have otherwise sold, have now turned to the rental option.

Fewer people are looking, and there are generally longer periods of vacancy.

This graph is a great initial indicator of what yields other investors are accepting in your district of interest.

But once you get down to looking at a single property, you’re going to want a more specific answer to your yield queries.

For a more comprehensive look at the Return On Investment (ROI), use these free tools:

Use this handy spreadsheet to measure the amount of return on investment versus the cost of that investment.

Head to this page for a more comprehensive dive into the different types of yields (e.g. net and gross). How they are calculated and how this information can best inform you as a property investor.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.