Property Investment

What is a Wealth Plan?

Discover how Opes' Wealth Plan helps you reach financial freedom and turn your goals into reality.

Opes

8 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

At one of our recent webinars, Katie asked: “Opes vs enable.me, what’s the difference?”

It’s a good question.

enable.me specialises in financial planning and strategy, but it also has a property investment business – Momentum Realty.

So, if you’re about to invest in property you might wonder, “Should I use Opes Partners or should I use enable.me?”

To be clear, you’re on the Opes Partners website. And yes, we’re about to talk about a competitor. But we believe in being blatantly honest here at Opes Partners.

So here’s the truth.

Some people are better off using enable.me rather than using us.

That’s right, some investors shouldn’t use us … instead, they should use our competitor.

The truth is we respect enable.me. That’s why we put Hannah McQueen (enable.me’s founder) on the list of our top 10 financial advisers in New Zealand.

So, in this article you’ll get an honest review of the top 7 differences between enable.me and Opes Partners. That way you can decide which is the right property investment company for you.

Just so you know, we talked to enable.me while writing this article. Their feedback is included throughout.

enable.me describe themselves as experts in financial planning and strategy.

In my view, one of the things that separate them from other financial advisers is that they’re experts in budgeting.

We often call them the Opes Partners of budgeting.

They were the first company that really helped Kiwis manage where their money is going.

Over time the business has grown to include other investment types and financial services.

Here’s an example. If you want their help buying an investment property, an enable.me coach will help you decide what sort of property to look for.

Then you might decide to find that property through their sister-company, Momentum Realty.

If you want help with KiwiSaver, you might talk to AdviceFirst.

These three brands (enable.me, Momentum Realty and AdviceFirst) are owned by the same company.

So throughout this article we’ll refer to enable.me and Momentum Realty interchangeably.

Now let’s get into the main differences between Opes Partners and the enable.me group of companies.

enable.me’s core service is financial planning and strategy. Part of this is budgeting, helping you be better with money.

They can also help with investment properties and KiwiSaver through their sister companies.

But they don’t have in-house mortgage advisers or property managers.

Instead, they have a relationship with Squirrel for mortgages. They also have relationships with property managers around the country they can introduce you to.

Of course, you can use whichever mortgage adviser or property manager you like.

But your enable.me coach will help set the criteria for your investment property.

Then you might work with Momentum Realty to choose the property.

Then you might use an external mortgage broker to get the mortgage. And an external property manager to manage the property.

Opes Partners is different. We don’t do budgeting, managed funds or KiwiSaver. We only advise on investment property (and a little bit of insurance).

That’s why we’ve chosen to have our own mortgage advisers and property managers in-house. They’re called Opes Mortgages and Opes Property Management.

So, if you want all your money advice (shares, property, KiwiSaver) in one place, enable.me could be a good fit for you.

If you’d prefer to have all your property in one place:

Then Opes Partners could be the better fit.

Here at Opes, we don’t charge for our advice. Instead, we keep the lights on by charging the developer a marketing fee.

It’s a bit like how a mortgage adviser gets paid by the bank when they find the right mortgage for you.

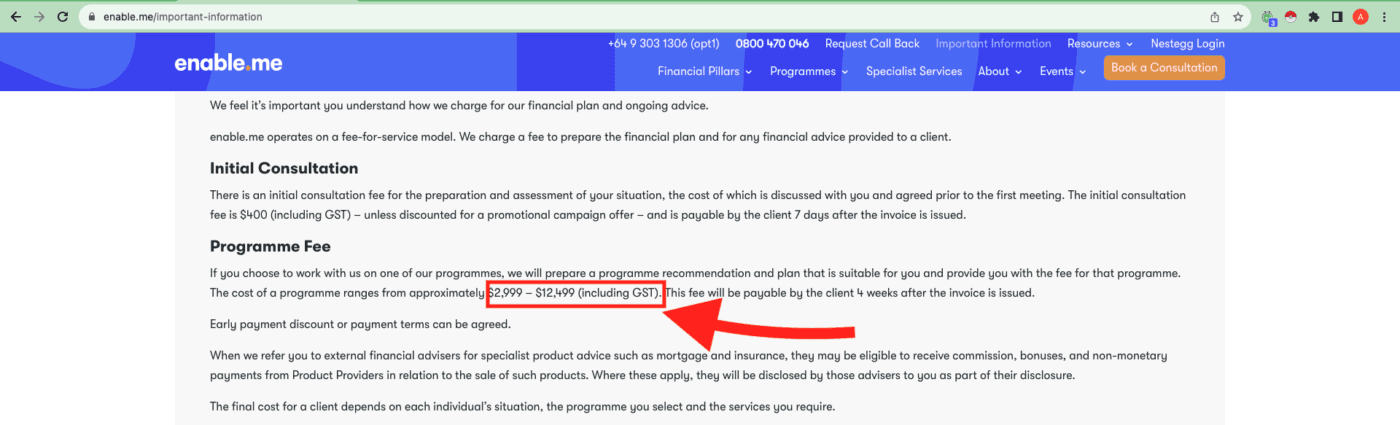

To get property advice from enable.me you’ll need to become a client and pay a fee.

They charge between $2,999 – $12,499 for their financial planning services.

To be clear, Momentum Realty will also charge the developer a fee.

So if you work with enable.me’s group of companies, they’ll charge both you and the developer. If you work with Opes Partners we only charge the developer a fee.

Some investors genuinely prefer to pay a fee for their financial advice, even though the company also earns a commission.

If you’re that sort of investor, enable.me may be a better fit for you.

If you don’t want to pay for your financial advice, then Opes Partners could be a better fit.

Both Momentum Realty (enable.me’s sister company) and Opes Partners recommend New Builds to property investors.

But there are differences in the types of properties we recommend.

Around half the properties Momentum Realty has are progressive payment builds.

The other half are turnkey contracts.

Progressive payment builds tend to have more hidden interest costs.

They also don’t always include everything you need to rent the property. enable.me told us that their properties “often” include everything you need to rent it out.

So if you are buying a property through them, it’s worth double checking this point.

In my view progressive payment builds are higher risk.

Opes Partners only focus on turnkey contracts.

That’s where you pay a fixed price to the developer, and you don’t pay as much money while the property is being built.

If you want a turnkey property then Opes Partners or enable.me could be a good fit for you.

But, if you are set on a progressive payments build, then enable.me is a better fit. That’s because we here at Opes Partners don’t do progressive payment builds.

Momentum Realty's properties tend to have a higher price tag than the ones we recommend.

The median price of properties on Momentum Realty’s website is $815,000.

We did the same analysis for the 118 properties we had on our stock list on the same day. Our median price was $699,000.

On the whole our properties tend to have a lower price tag.

To be clear, that doesn’t mean their properties are overpriced. They recommend different areas (more below) to us. So that higher price could represent fair value based on the area and property type.

But if you have more money and can afford a higher priced property, enable.me could be a good fit for you.

If you can’t afford a more expensive property (or don’t want to pay that much), then Opes Partners might be a better fit for you.

Opes Partners and Momentum Realty (enable.me’s sister company) recommend properties in different regions.

At the time of writing Momentum Realty has properties listed in:

These are not the areas our company recommends right now.

Here at Opes, we tend to focus on Auckland, Canterbury, Wellington and Otago.

Now to be fair, Momentum Realty (enable.me’s sister company) also recommend properties in these areas.

So Momentum Realty and enable.me do recommend a higher number of areas than we do.

But, we have more properties across the country and more properties in each region.

At the time of writing, Opes Partners have over double the number of properties that Momentum Realty has.

There are also differences in the locations we recommend within each region.

enable.me tend to prefer standalone houses on the outskirts of different cities.

Of the 9 properties they currently have available in Auckland, 7 are in:

These are suburbs that are either in rural Auckland or on the fringes of the city.

Opes Partners, on the other hand, have 49 available, and tend to recommend closer to the city centre.

So, if you prefer investing in standalone houses on the fringes of a city, enable.me’s group of companies could be a really good fit.

If you’d prefer more central properties, Opes Partners may be the better choice for you.

According to their website, Momentum Realty (enable.me’s sister company) work with 11 developers.

This includes some well-known names like Golden Homes, Wolfbrook and Mike Greer.

On the other hand, Opes Partners currently has around 97 developers we work with, although we won’t work with all these developers at the same time.

We believe this provides more choice for investors.

But it does mean we work with some developers who you might not have heard of before.

From my experience smaller developers are often worth considering. They have smaller teams and so tend to charge lower prices. But if you’d prefer a bigger-name developer, then enable.me or Opes Partners could be the right fit.

If you’d prefer to give a smaller developer a go, then Opes Partners is likely the better fit.

enable.me’s founder, Hannah McQueen, started and (up until recently) was the main owner of the business.

As mentioned, it was recently sold to AdviceFirst, an insurance company.

The ultimate owner of enable.me is now AMP Group Holdings Limited, which is a large company listed on the Australian Stock Exchange.

As mentioned, Hannah still works in the business, but the company is now Australian owned.

Opes Partners, on the other hand, is Kiwi-owned and the people who own the company work in the business.

Some investors really care about who owns the company. For other investors it doesn’t make a blind bit of difference. Either way, the choice is yours.

Ultimately, you can use Opes Partners or enable.me.

But here’s the truth. Some people use both. There are lots of investors who decide to work with enable.me for budgeting and use Opes for property.

After all, enable.me is one of the best companies in New Zealand that helps people budget in a better way.

And we believe Opes has the edge in property investment because that’s all we do.

But now you know the key differences between the companies, you can decide which is right for you.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser