Property Investment

Property Investment

7 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

As a financial adviser, investors often ask me: “What do you think about XYZ company?”

One name that people often ask about is Staircase Financial Management.

You might think: “Hang on Andrew. Your company competes with Staircase. Why don't you just focus on yourself rather than talking about a competitor?”

The reason is simple – I answer every question someone asks. It doesn’t matter what it is. And I do it as openly and honestly as possible. I don’t hide from topics just because they are controversial.

That way you can make the right decision for you.

I also approached Staircase to get their side of the story before I wrote this.

But, keep in mind – I am about to talk about a competitor. So, there’s an incentive for me to be biased. To tell you that they’re bad. And say that you should work with Opes instead.

I’m not going to say that.

And I won’t say whether Staircase is good or bad either. That’s not for me to decide. That’s up to you to form your own opinion.

Instead, I’ll highlight the good things about Staircase. And I’ll also mention a few things that you should know before you choose to work with them.

That way you can make your own informed decision.

And if you think I am being biased … call me out in the comments. Keep me honest.

Staircase Financial Management has been operating since 2001. It used to be called NZ Invest, but it appears to have changed its name around 2016.

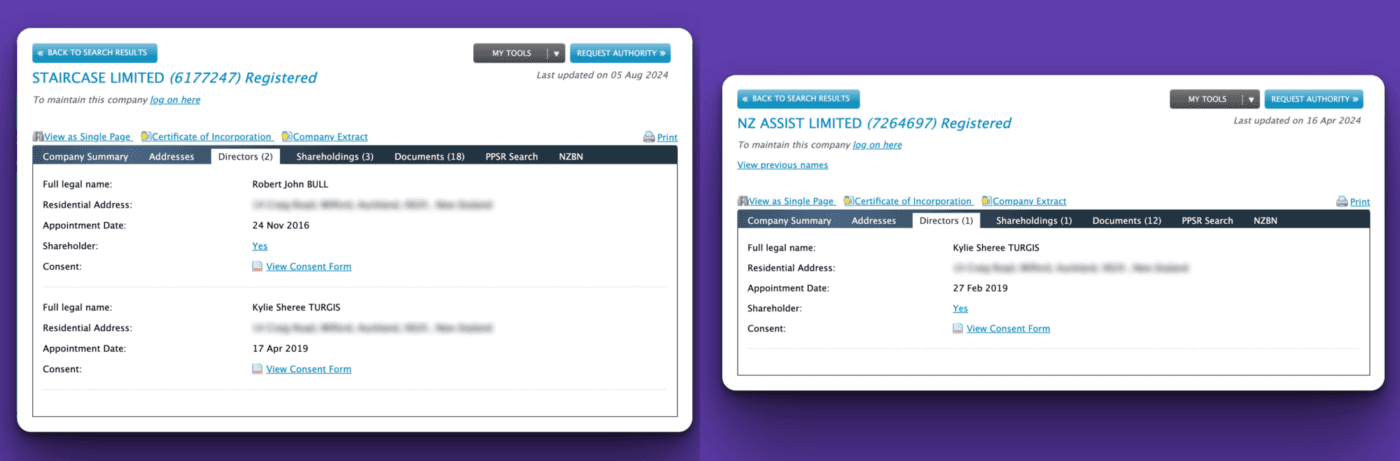

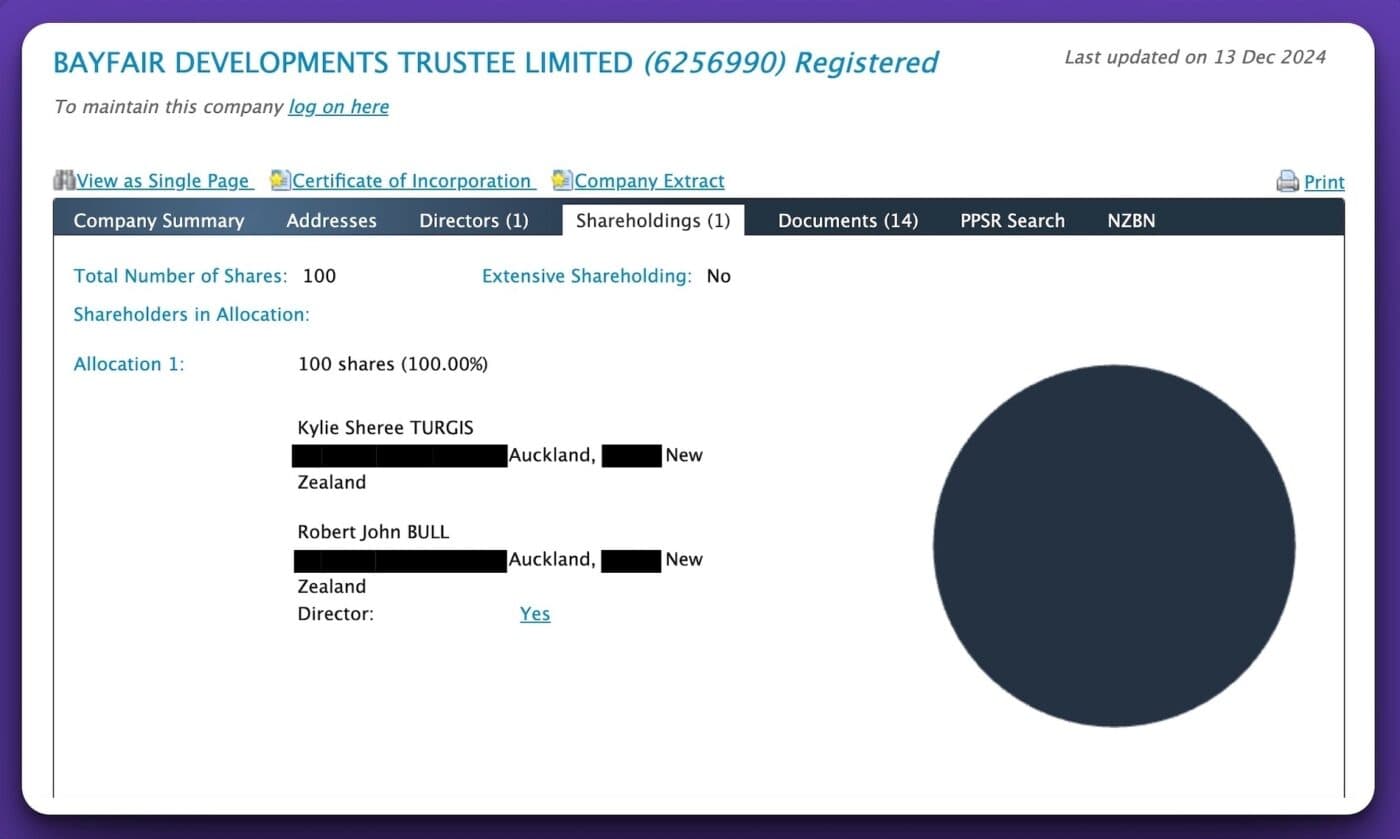

Kylie Turgis and Robert Bull own the company.

Staircase operates in a similar way to Opes. They offer a one-stop shop for property investors. They can help you buy a property.

But, then they also provide mortgage advice, property management, insurance, and accounting ... all under one roof.

I obviously think that’s a good thing.

Because at Opes, we’ve been doing that for years. So I think that bundling these services together is valuable.

And like Opes, Staircase doesn't charge for their financial advice. They are paid by the developers they work with, along with income from their subsidiary companies e.g. property management.

They can help you invest in properties in Auckland, Tauranga, and Queenstown.

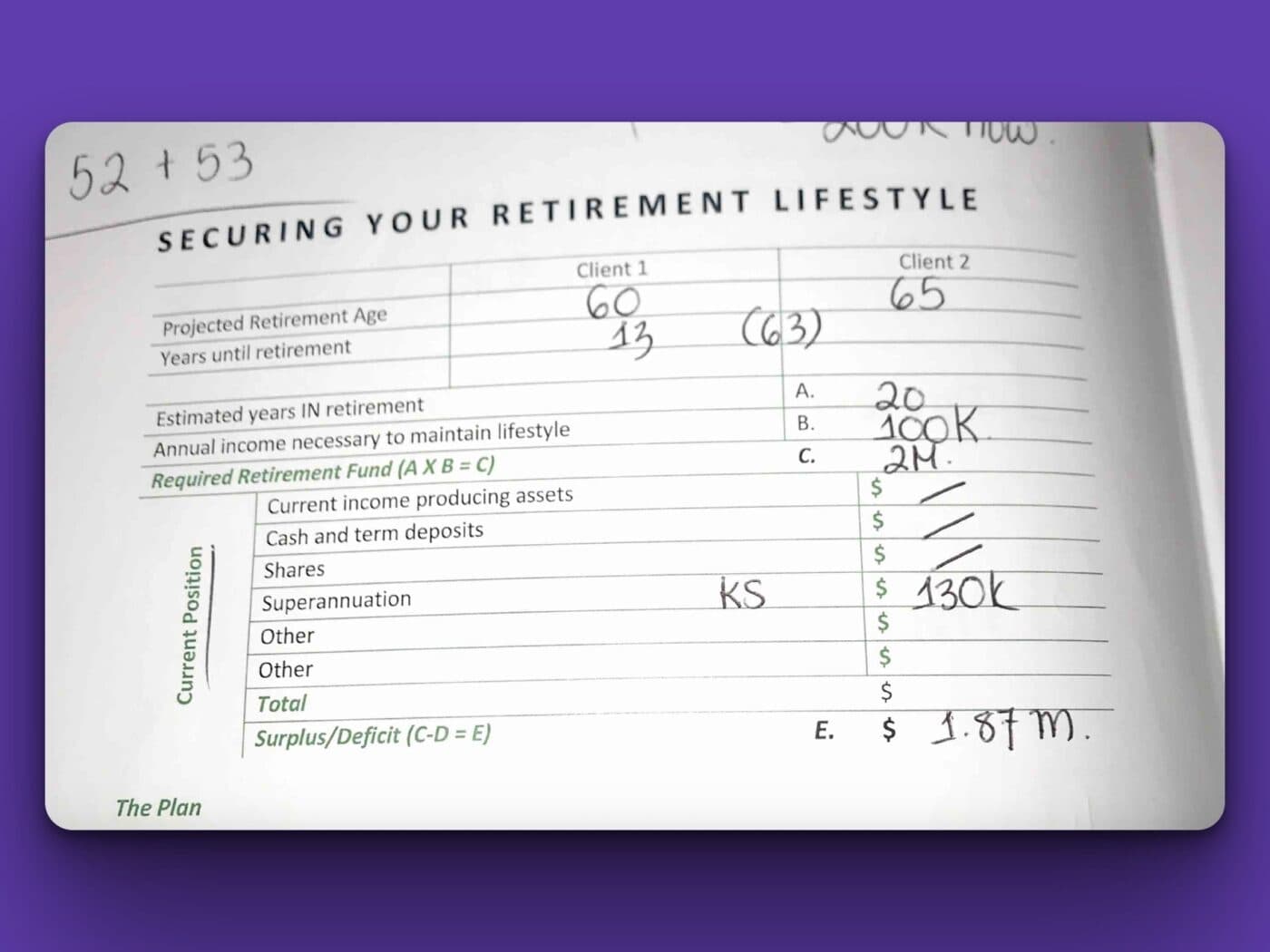

When you work with Staircase, you’ll work with a financial adviser. Through this process you’ll work through a goal-setting workbook. This is to map out your investment plan.

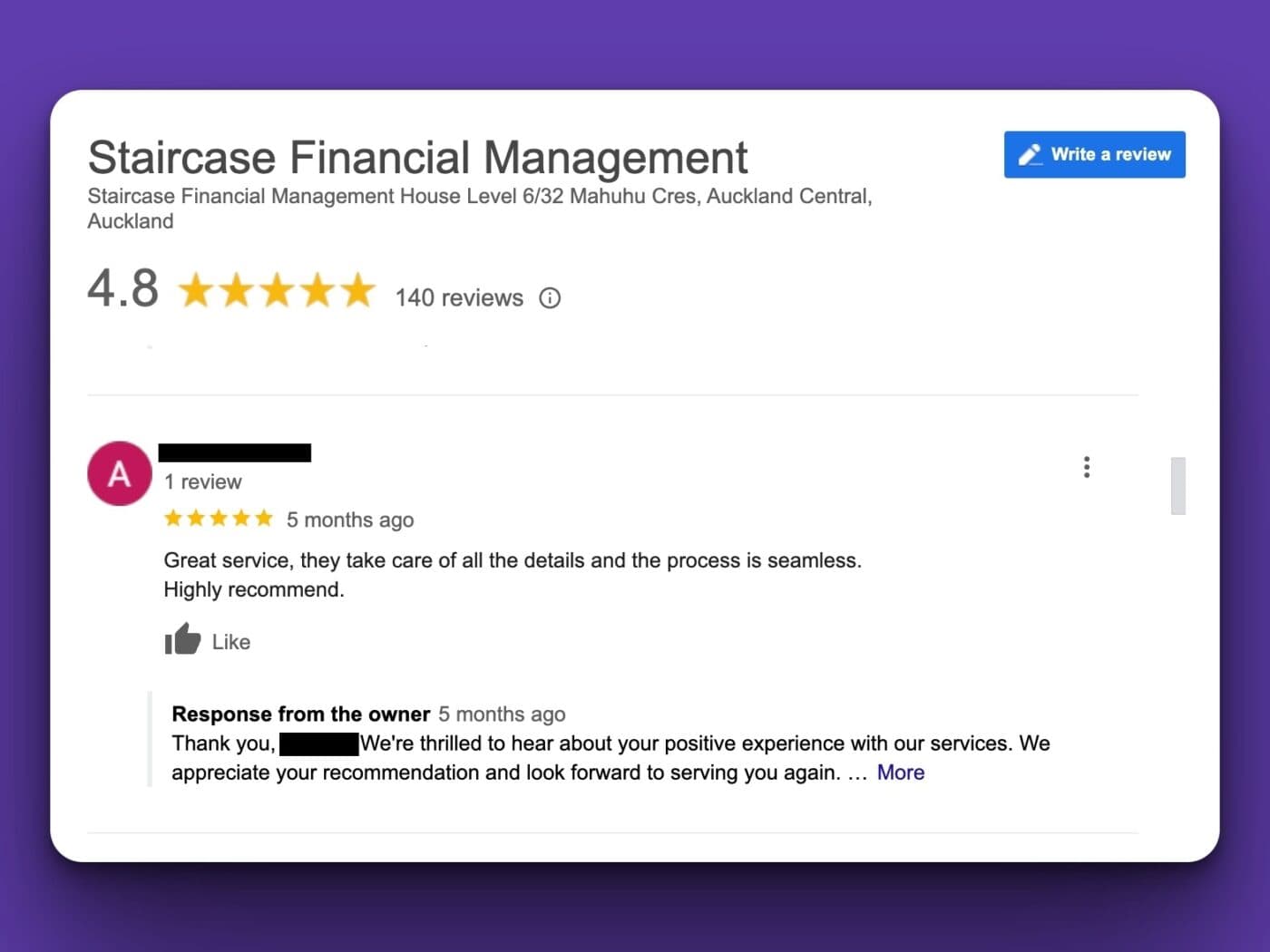

Staircase has a strong 4.8-star rating on Google. This is a good rating for the financial services industry.

So as you can see, I think there are some good things about Staircase:

All of these things I think are good. It would be hypocritical if I said otherwise. Because a lot of this is similar to what my own group (Opes) does.

There are also 3 things you should know before you decide to work with Staircase:

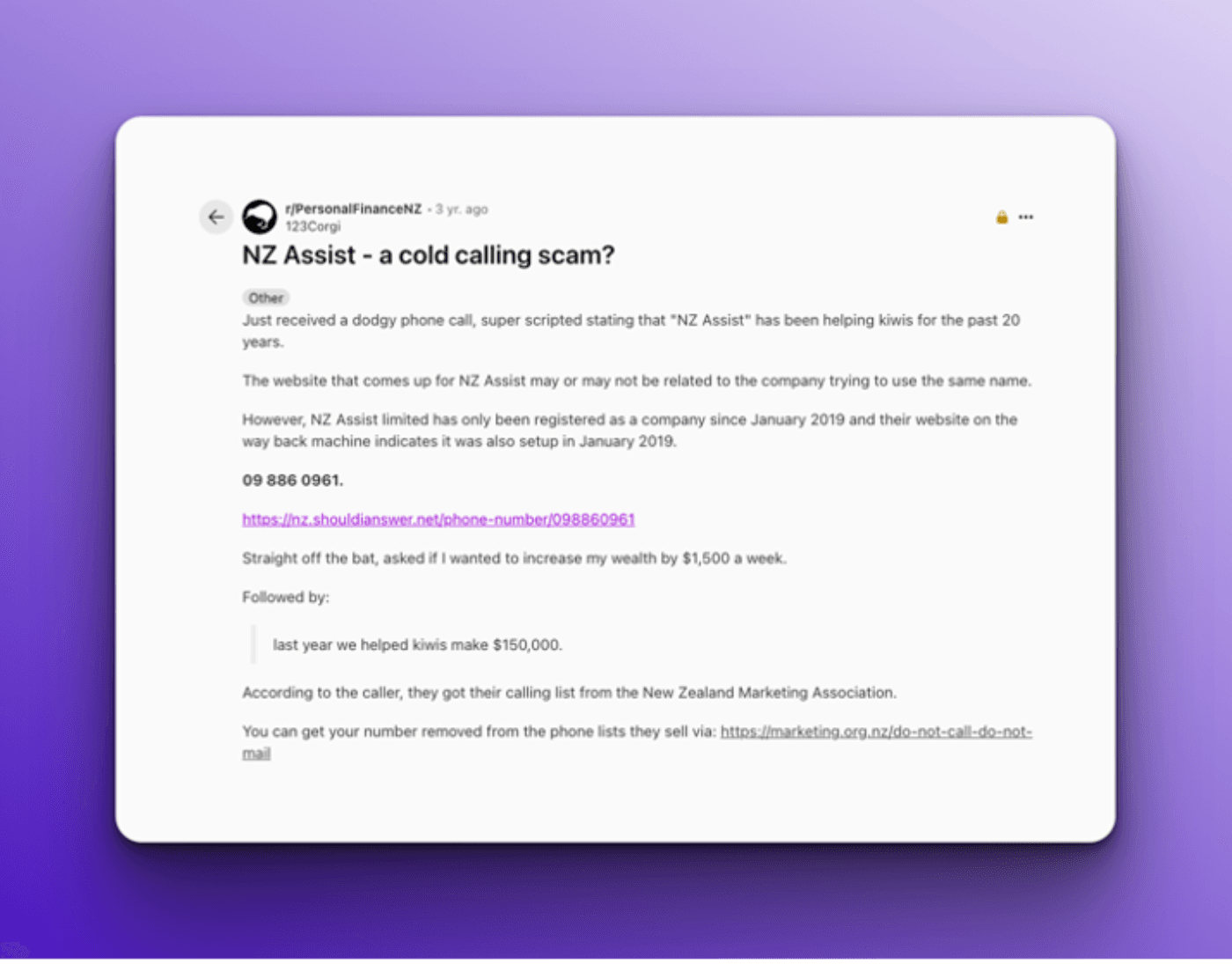

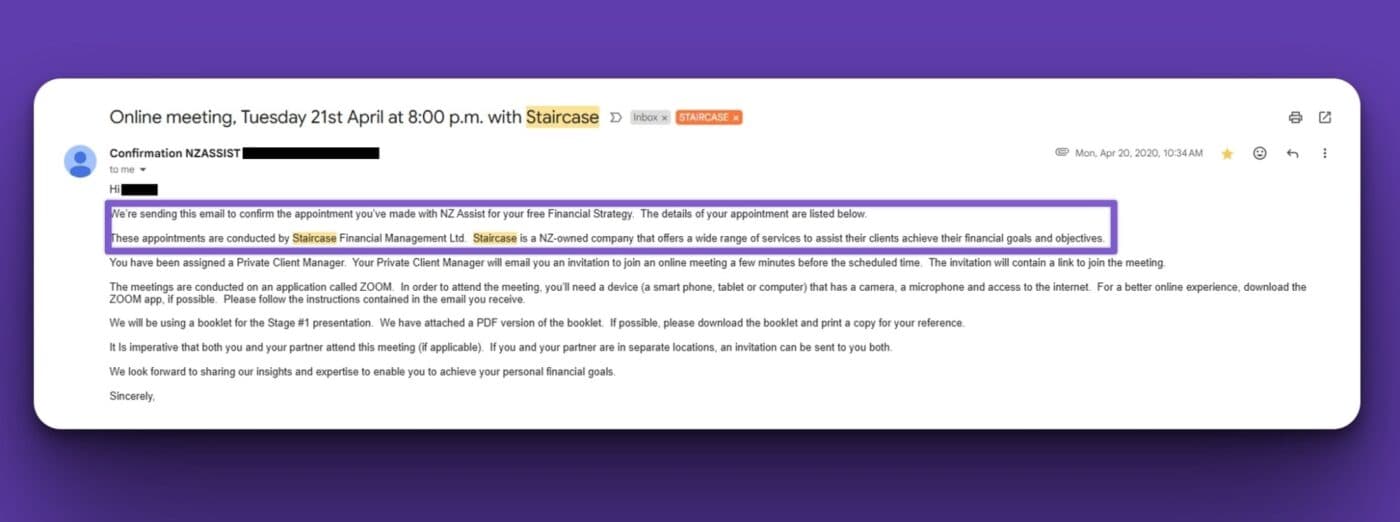

Some investors hear about Staircase through a company called NZ Assist.

This is a company that cold-calls people offering a financial advice meeting. While not publicly affiliated, the two companies share the same director (Kylie Turgis).

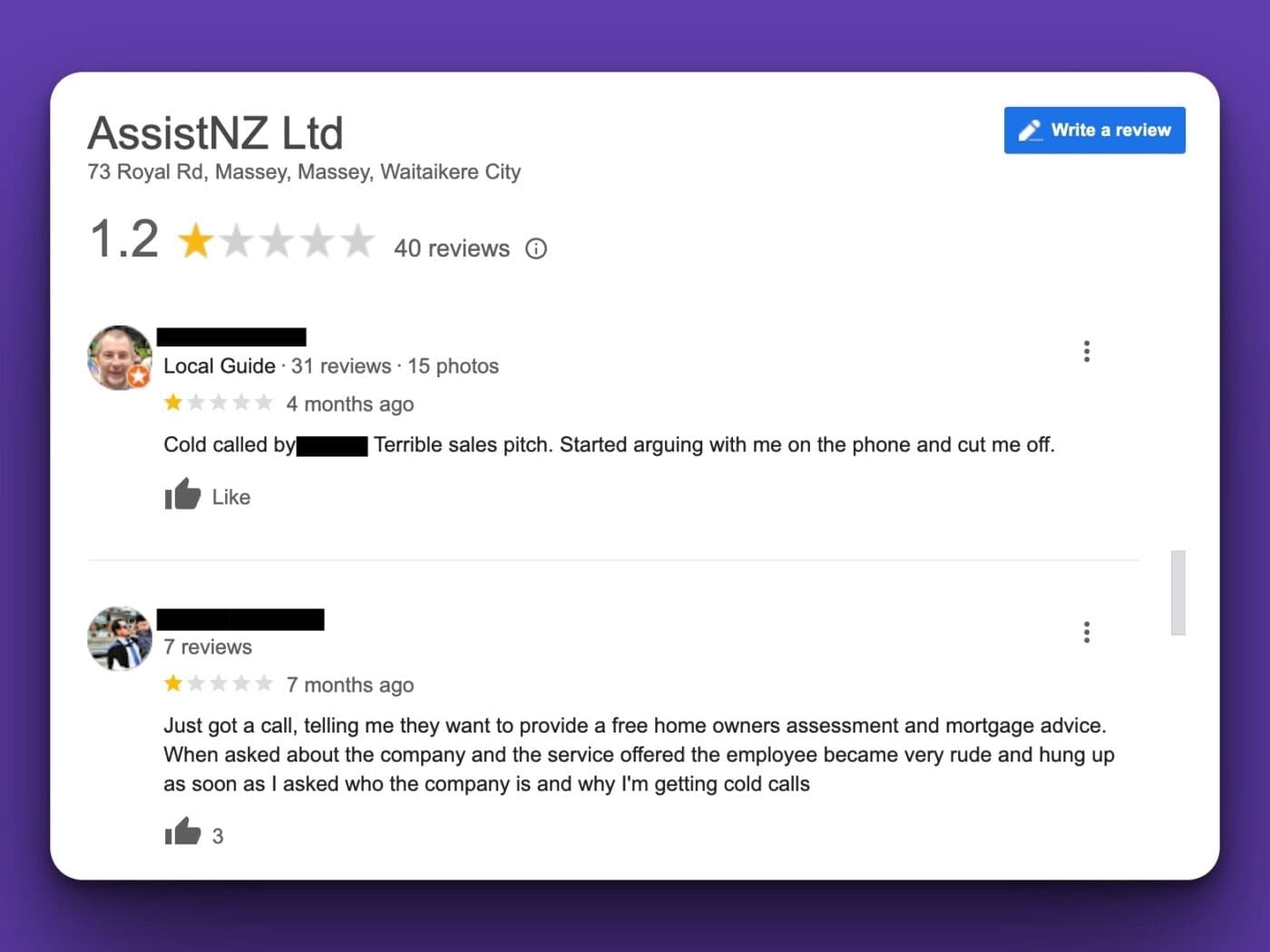

I only mention this because some New Zealanders ask online who NZ Assist is and why they receive unsolicited phone calls.

Some commenters on Reddit asked whether the cold calls were a scam.

While cold calling is legal, it can be unwelcome.

And it’s worth noting that this may be how you come to hear about Staircase.

One investor I spoke with received this email (below) after speaking with NZ Assist.

NZ Assist has received negative reviews on Reddit and Google. Only a few reviews have trickled through to Staircase’s online reviews.

We spoke with Kylie from Staircase. She confirmed that NZ Assist: “was originally established many years ago with the intention of providing contracted telesales services to third parties (as well as Staircase). It is no longer trading.”

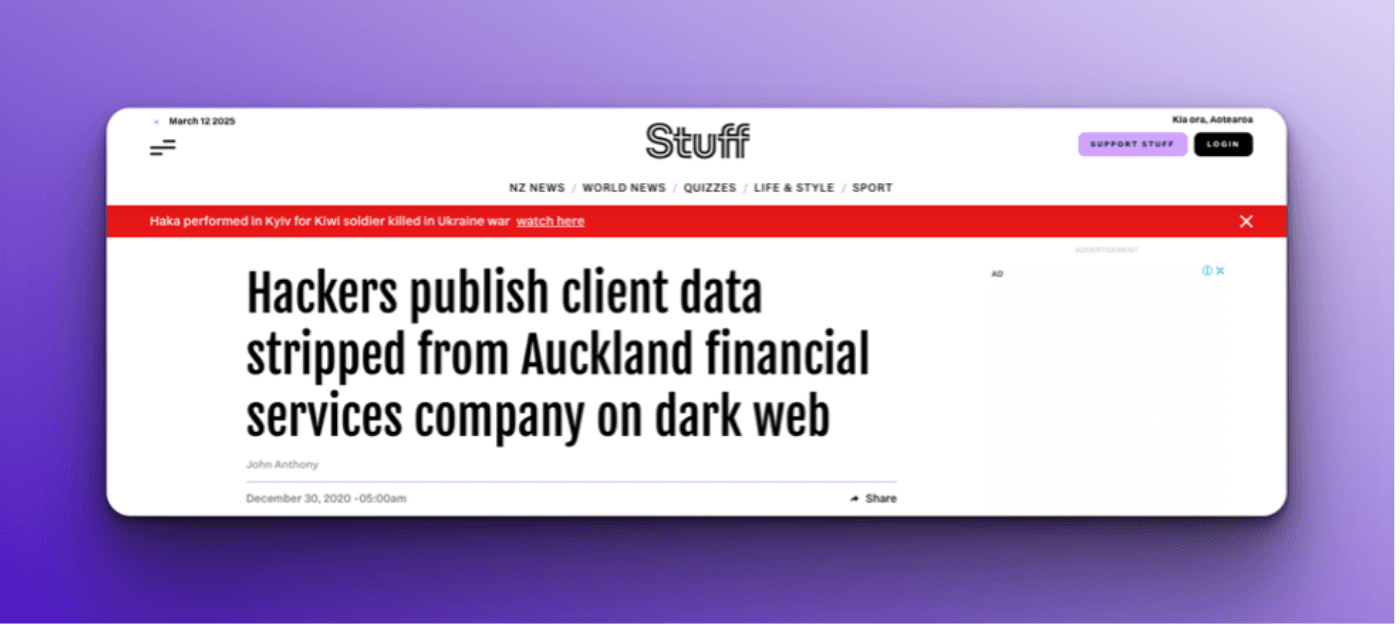

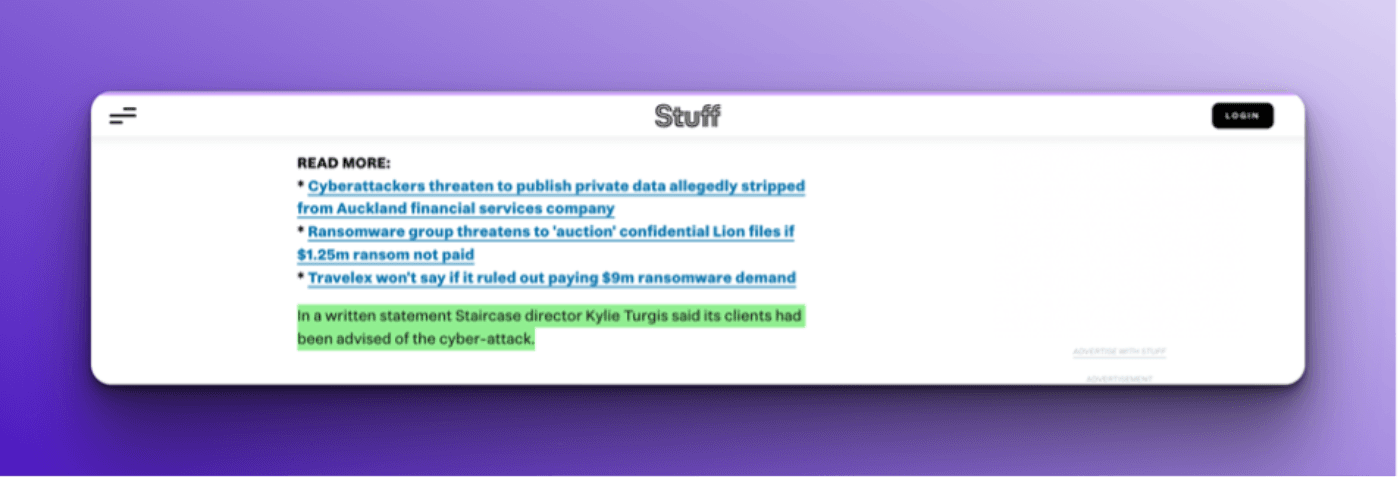

Staircase also experienced a data breach in 2020 according to Stuff.

I’m not mentioning this to take a dig. Ransomware attacks can happen to any company. But if I were researching a financial adviser, this is a fact that I would want to know.

That’s because when you work with a financial adviser, you provide them with a lot of personal financial information.

If you know a company has previously had a breach, then you may want to ask them what they learned.

If it were me, I’d also want to ask how they’ve changed their systems to protect your privacy.

Staircase helps investors buy New Build properties. That’s the same as my company, Opes.

However, a key difference is who owns the properties that are sold.

Sometimes, Staircase (the financial adviser) and the property seller are effectively owned by the same people.

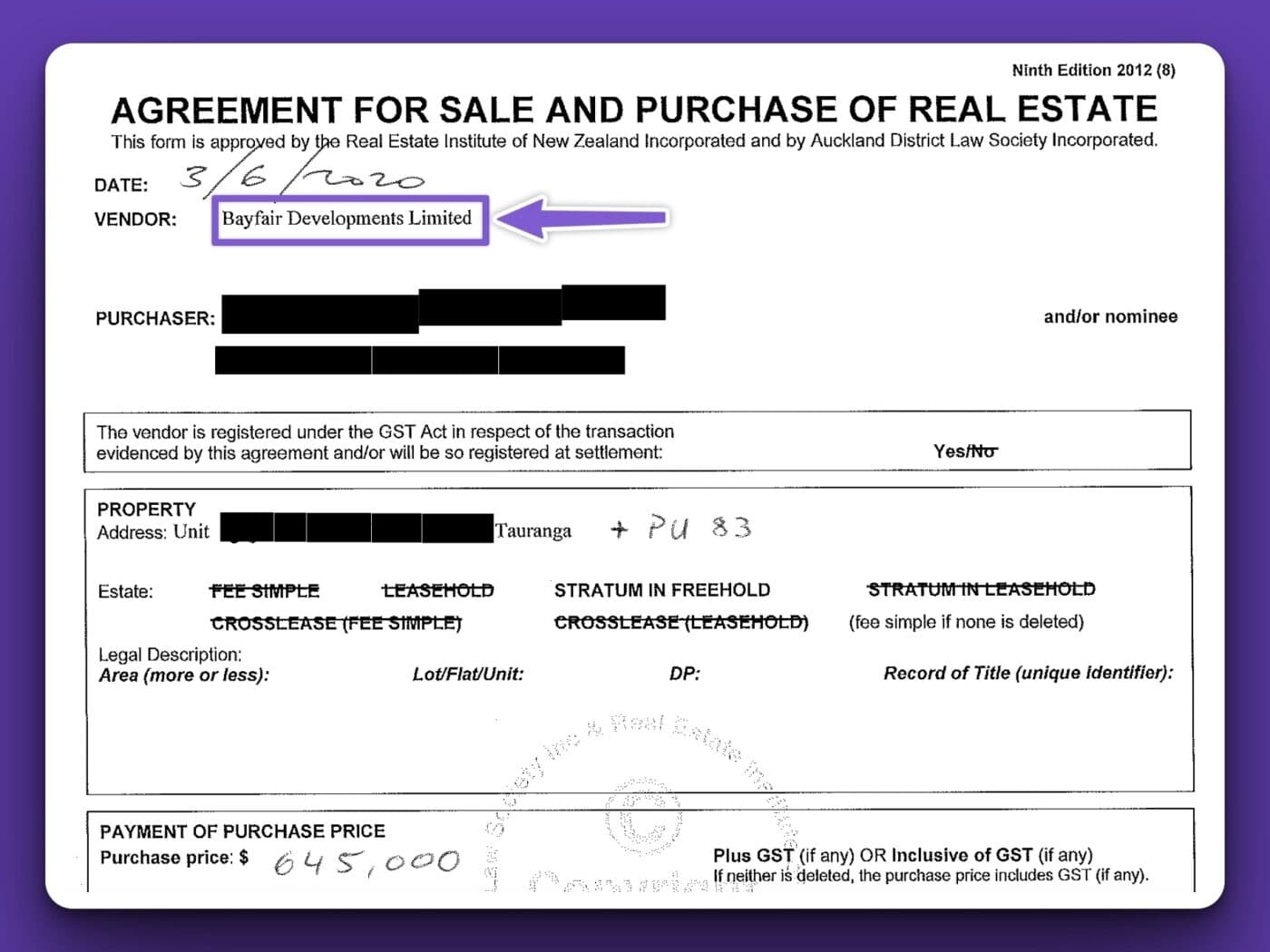

For example, one investor we spoke to bought a property through Bayfair Developments Limited.

He later found out that Staircase’s directors are also the shareholders of that company.

In other words, Robert Bull and Kylie Turgis are the shareholders of Staircase. They are also the ultimate shareholders of Bayfair Developments Limited.

This can create a conflict of interest. Because Staircase’s owners may have a financial incentive to recommend that you buy a property that they also own.

There is nothing inherently wrong with conflicts of interest. As long as they are disclosed. In this case, the investor I spoke to said this wasn’t clearly disclosed to them.

They were unaware of the connection between the two companies.

When I spoke with Kylie from Staircase she said: “Yes, our properties are newbuilds and yes the clients purchase from us, and yes this is fully disclosed to them” (sic).

In this case, there is a difference between what the investor said happened and what Staircase says usually happens.

So, if you decide to use Staircase Financial Management, it’s a good idea to check whether they are effectively “selling their own properties”.

How do you do that? Get the seller’s (vendor) name off the Sale and Purchase Agreement. This is usually a company name.

Then search that name in the companies register. You can then see if the directors and/or shareholders of that company are the same as Staircase Financial Management.

If they are, then you may be entering into a private sale without realising it.

In other words, there is no real estate agent. So you don’t get the same protections as you would under the Real Estate Authority.

You may be comfortable with this. And that’s fine. The key thing is that you are aware of the potential conflict of interest.

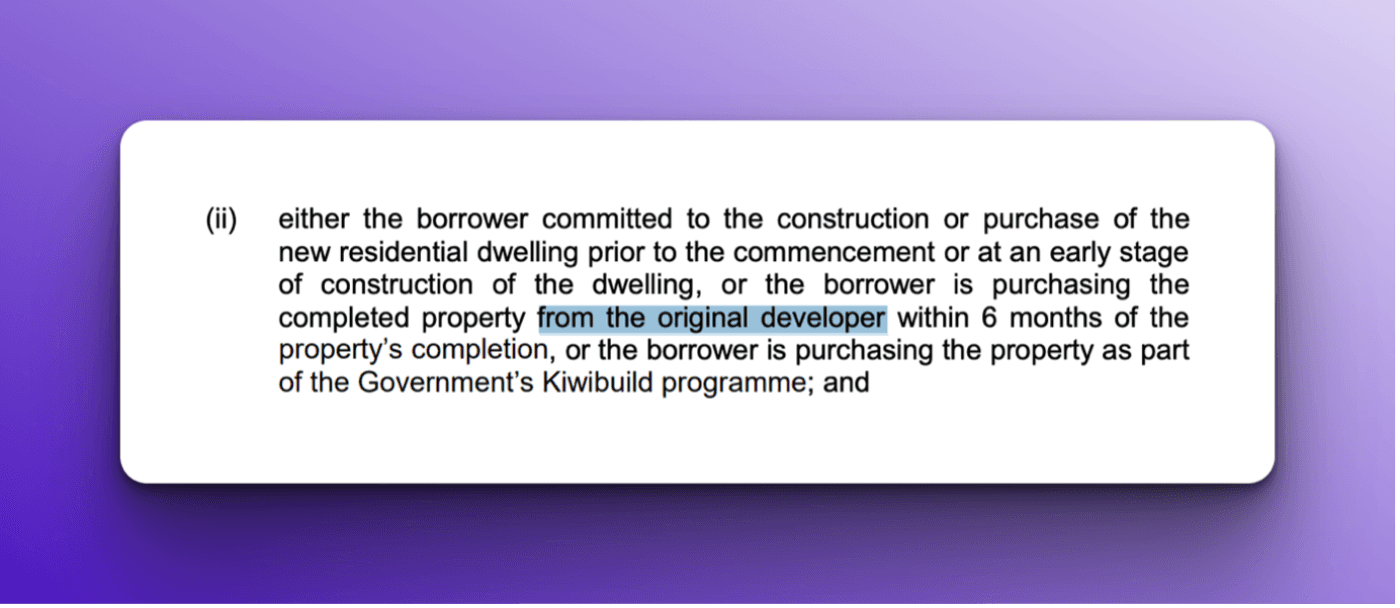

One other thing to mention. My understanding is that sometimes Staircase will buy properties at a discount, mark up the price and resell them.

Again, there’s nothing inherently wrong with this—as long as the properties are genuinely a good price.

However, if this happens you need to know that you will lose some of the benefits of a property being a New Build.

For instance, rather than a 20% deposit, you’ll need a 30% deposit. You’ll also need to follow the Reserve Bank’s Debt to Income Ratios (DTIs).

That’s because you’re not buying the property off the original developer. You’re buying it from a company that has bought the property from the original developer.

So, before buying a property through Staircase, ask: “Who is the seller on this contract?”

If the property is owned by the same people who own Staircase … make sure you’re comfortable with that. You can also check with your mortgage adviser if there is any impact on what you can borrow from the bank.

Your answer may be that you are comfortable. Everything has been disclosed, and you think the property fits your investment goals.

But if not, you might want to ask some questions.

At the end of the day, Staircase is a legitimate option for property investors. They’ve been around for over 20 years, offer a full-service approach, and have strong reviews.

However, it’s worth doing some research.

That's true no matter which property investment company you work with, including Opes.

Staircase’s connection to NZ Assist, past data breach, and the financial stake in some properties they recommend are things to be aware of.

So now it’s up to you to decide for yourself – do you use Staircase, another company, or do it yourself? The decision is yours.

After all, the best investment is an informed investment.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser