Property Investment

Property Investment

13 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Buying what you know makes sense when we are talking about replacing your faithful running shoes, your go-to toothpaste or your favourite pair of jeans … but that doesn’t necessarily translate into a wise property investment strategy.

That’s why many property investors will purchase properties in different cities, especially away from where they usually live.

Though, before we get into how to invest outside the city you live in, it’s essential to consider whether you should purchase a rental property outside your home city.

It's certainly not for everyone and won't fit all property investment strategies. So let's talk about who investing outside of their home city is and isn't right for.

There are some property investment strategies where it would be impractical to invest outside your home city.

For example, if you are following a renovation-based strategy, you might personally complete the renovation yourself. In this case it is more likely you will need to invest in properties that are not too far away from where you currently live.

That’s because renovations require late nights and weekends and being physically present at the property. Travel costs and time can make investing outside your home city impractical for renovation-focussed property investors. That’s not to say it’s impossible, but it will mean a lot of hard work.

Auckland-based office administrator Stephanie Graham and builder Gary Forster featured in the Spring issue of JUNO magazine. Although based in Auckland, the pair bought a run-down property in Hamilton. They travelled down at nights and weekends to work on the property.

As reported in JUNO, the couple said when they looked back, renovating was tough. The travel and late nights took their toll, Graham admitted.

She added: “I used to come to work tired and moaning, with paint all over my hands and say, ‘I’m over it!’ But it is very rewarding, and now we’re really proud.”

Long-term buy and hold investors, on the other hand, will find it more practical to invest outside the city they live in. That’s because they don’t need to be physically present at the property for a sustained time.

There are three main benefits of investing outside your city:

Many of us have significant exposure to the property market and economy that we already live in.

For instance, you might live in Auckland, have a home in the Auckland property market and work for an Auckland-based company.

If a significant event causes the Auckland economy to deteriorate, causing harm to the city’s property market, then having investments outside the region would look like a smart move in retrospect.

Investing outside your home city, therefore, acts as a risk mitigation strategy.

An excellent example of this was the Christchurch earthquakes, where the entire Canterbury economy was impacted. Over the long term, this has affected house prices in the Garden City.

If a Christchurch-based property investor had only held property in the home city, all the eggs would have been in the one basket … home, job and investment properties.

This would mean the investor was likely to be more severely impacted than if they had gradually invested in other regions.

In addition, your home may have increased in value over recent years.

You might congratulate yourself on picking such a good ‘investment’ and want to double down by purchasing more property in your home region.

For example, Manawatu-Whanganui house prices increased significantly between January 2016 and March 2020, with the median house price in the region rising from $215,000 to $430,000 – an enormous $215,500 gain.

And having seen and felt that enormous increase in wealth, it is understandable some Manawatu-Whanganui homeowners might think that growth will continue ...

It’s almost enough to make you forget that prices were flat for the prior 9 years. In fact, from June 2007 to January 2016, the median Manawatu-Whanganui house price declined $25,000.

The point here is that each region in New Zealand can be at different parts of their respective property cycles.

Even if your property grew in value recently, house prices in your home region might now be at the peak of their property cycle. If that’s the case, your capital will be put to better use if you invest in a different area that is currently early in its cycle.

That’s why investing outside your city puts your equity to better use in the near term, than if you only invested in one property market.

Finally, some investors, due to budget limitations, will need to invest outside their city.

That is, they can’t borrow enough to invest in the town they’re currently living in.

This is most likely to impact an investor living in Auckland or Wellington, where the median house price is $910,000 and $677,510 respectively. The minimum deposit for the median Wellington household is, therefore, $135,502.

Not all investors have the equity or deposit required to invest in a Wellington property. That’s why they might consider investment in a more affordable region, like Canterbury, where the median house price is currently just $460,000.

Obviously, investors don’t have to invest in the median property. However, affordable houses will be easier to find in Canterbury.

If investing outside your home city is right for you, let’s talk about the 5 steps you actually need to take to purchase a rental property outside your home-city. There are five steps you would usually take:

If you’re the type of investor who cares about the long-term price of your property, you need to consider where each region sits within its current property cycle.

This includes the long-term economic indicators of the region so you can determine whether a district or city is worth investing in.

Here at Opes, we look at a graph like the one below. This considers where a region’s house prices sit compared to the New Zealand median house price.

This can give a sense of how over-priced or under-priced a region’s houses are compared with their long-term fundamental value.

For instance, the above graph shows that over the last 27 years Otago’s median house price has, on average, been 72.61% of the national median house price.

That means that if the New Zealand median house price was $100,000, on average, we would expect the average house price in Otago to be $72,610.

Right now Otago’s median house price is 86.82% of the national median house price … 19.57% above its long-term average. That suggests that for long-term buy and hold investors, Otago is not the right region to invest in right now.

Let’s look at the other side of the coin and say a region’s house prices are below their long-term average.

Over the medium term (3-7 years) we’d expect house prices there to increase more quickly than the national house price.

Ideally, you want to invest in a region that is at the bottom of its property cycle. The data we’re using here can be used as a proxy for determining which areas are at the most appropriate points in their cycle.

These graphs are all available within the regional property market section of the Opes website, which you can find in the "Where to Invest" section.

Right now, Canterbury, Auckland and Taranaki appear to be at appropriate points in their property cycles.

Once you’ve selected a city or property market to invest in, you need to get even more specific.

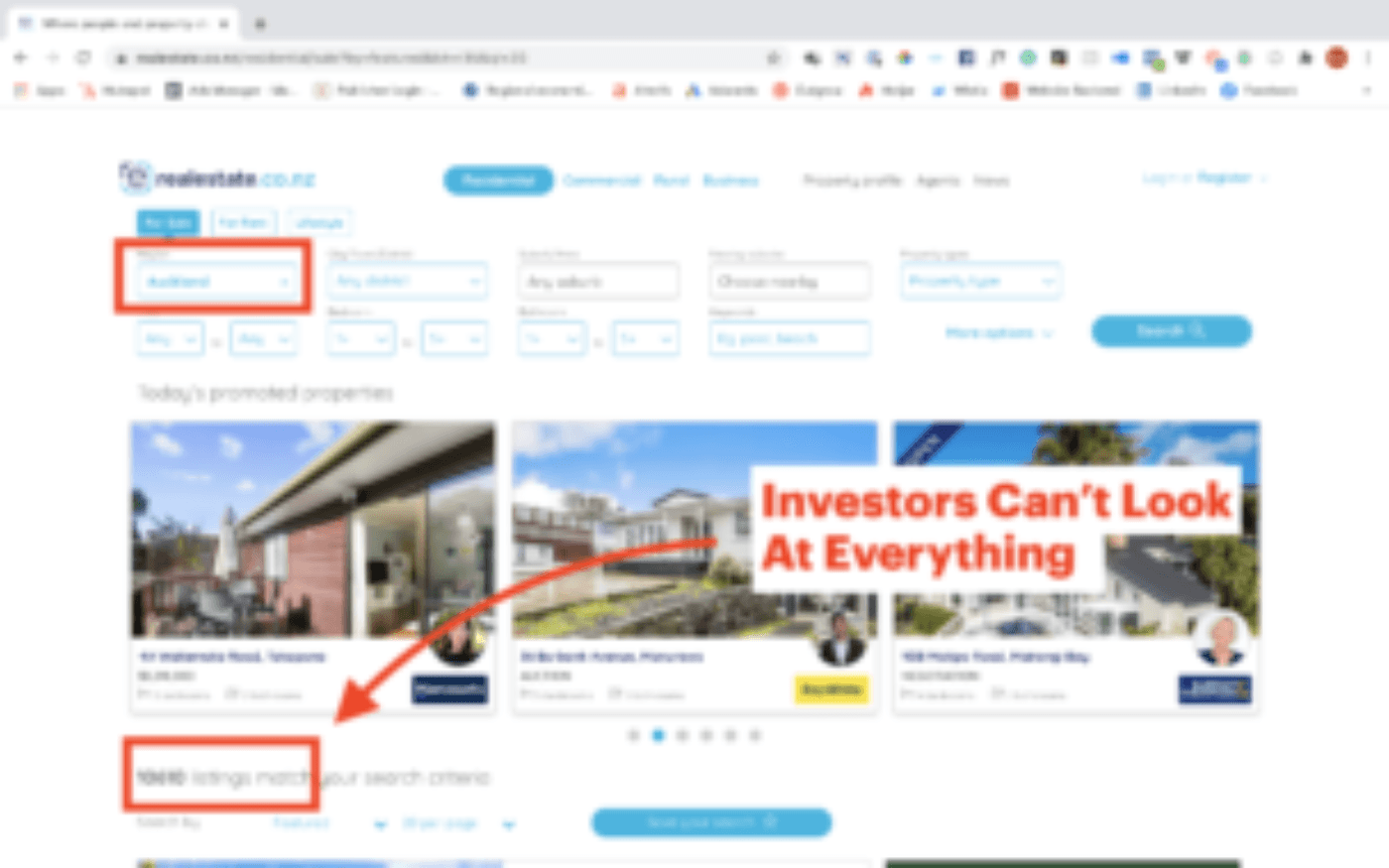

For instance, if you might decide you want to invest in the Auckland property market. If you were to go straight to a website like realestate.co.nz then you would find over 10,000 properties currently for sale … and that doesn’t include every property available to invest in, such as new properties.

It would be a waste of time. Since realestate.co.nz primarily caters for owner-occupiers, many of the properties shown on the website will not be suitable for investors.

That’s why you need to pick a few suburbs you want to look into and conduct research on those.

You can look at hard data like projected population growth; estimates of income per person, or the level of education within a suburb. However, we often find maps like the one below most useful.

This one shows the median gross rental return for suburbs in Wellington.

And this one shows the historical house price growth of Wellington suburbs over the last 20 years. This can be as a loose proxy for future house price growth.

We created maps like these at Opes Partners for our own use – when we look for properties on behalf of investors. We’ve now made them available for all investors to use.

Using both these maps, investors can locate suburbs that have a mix of good rental yields and good historical growth. Ideally, long-term investors will want a combination of both.

These maps are available for the Auckland, Wellington, Hamilton and Christchurch property markets.

As part of your additional research, investors should also look at soft data, such as news about businesses moving into the area, or a sense of whether a suburb is becoming gentrified.

This will add weight to the data you’ve collected and will help you make a more balanced investment decision.

By now you will have picked a region or suburb that you want to invest in, and it’s time to look for actual properties.

You can either do this yourself or work with professionals who can source properties on your behalf.

For instance, if you want to run this process on your own, you have two options:

You can look online on websites like trademe, realestate.co.nz, or specific real estate agents’ websites.

The next option is to build a relationship with developers and real estate agents, asking them to let you know about future opportunities.

This can work well for the serious investor who has the capital to make a decision and purchase a property quickly before it gets released to the broader market.

Be aware, though, that if you’re a first-time investor you don’t want to come across as a shopper. That’s where you take information from real estate agents or developers, but never take action or invest in property with them.

In that case, you’ll quickly find agents and developers taking longer to get back to you or not returning your phone calls. If it is going to be a genuine relationship there has to be value added on both sides.

If a developer or agent knows they’ve got a good deal, they’ll first talk to investors and companies they’ve worked with in the past.

The alternative is to work with a professional property partner or property finding agency to find properties on your behalf.

For full disclosure, this is one part of the service we offer here at Opes.

The benefit of this is that you can partner with on-the-ground experts, who know and understand the local market.

In addition, by partnering with a property investment company you’re more likely to get access to property deals you wouldn’t otherwise get directly from a developer.

That’s because property investment companies work with a wide range of investors, which gives them the scale to form deep relationships with developers and the broader property industry.

That wide client base makes them serious investors in the eyes of the industry, which avoids the ‘shopper’ problem mentioned above.

Say a developer needs a quick sale of properties so they can get bank funding. In this case, they’re likely to approach a property investment company first.

That’s because the property investment company has access to a large number of investors. Only one or two of those need be in a position to act quickly to get the deal and give the developer the sale they need.

Out-of-town investors can, therefore, get the benefit of having relationships on the ground by using a property investment company, without:

Once you have put a property under contract, you’ll go through the due diligence process.

This is where you have already agreed to purchase a property at a given price, with a few conditions. Things like a solicitor approving your sale and purchase agreement; you getting finance from the bank; or a builder’s inspection coming back with no issues.

As well as working with a solicitor to review council documents, it is highly advisable to talk to a local property manager.

To be a successful property investor, you need a tenant paying rent, so you can pay your bills and service the investment mortgage.

However, many investors will purchase an investment property without talking to a local property manager who will find tenants on their behalf.

Each rental market is slightly different.

For each specific property you invest in, you’ll want to know:

As an investor, if you are purchasing a property outside your city, you’re unlikely to have a deep understanding of that local market. So, it’s essential to lean on the expertise of people who are active in that market day-to-day.

All these steps, up until this point, can be completed from the comfort of your home city. The next step is to go and see the property.

Even if you are investing in a new property that hasn’t been built yet, you should still go on a site visit.

Bear in mind, that when you turn up to inspect a property that has been bought off the plans, it might just be a vacant plot of grass.

However, you can use this opportunity to view a property that is going to be similar to yours. For instance, a show home or a recently completed development. This is also the time to build a relationship with the developer you’ll be purchasing from.

However, if you’re living in Christchurch and buying in Auckland, it’s understandable if you don’t want to make the trip to look at something that hasn’t been built yet.

That’s where you can ask a property manager or the developer to walk through a show home or similar property to give you a virtual inspection of the developer’s quality and previous work.

Investing outside the city you live in is an essential step for long-term buy and hold investors. It can help spread your risk, and gain access to property markets that are at a different stage of their cycle.

But because you won’t know the lay of the land the same way you do with your home city, it’s vital to either:

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser