Property Investment

Don’t use Opes if …

In this article you’ll learn why Opes Partners might not be the right fit for some people and why.

Property Investment

5 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

One of the main questions investors ask me is: “Andrew, you give away all this investment information for free.”

“Can’t I just invest without using your company – Opes Partners?”

That’s a good question and an important one, too. As a property investor, you want to make sure you’re making the best decision for your financial future.

And if I’m really honest with you.

Sometimes I work with investors, knowing they are just meeting me for free information. They plan to invest on their own.

That’s normal and naturally happens when you have a free service, like we do at Opes.

So, in this article, let’s be really honest and talk about how you can actually invest without using my company (while still using the information).

But then, look at a few things you miss out on. That way you can make the right decision for you.

And let me be clear – this isn’t a snarky article. I’m not going to shame you if you decide to use my information but not use my service. This is going to be as unbiased as possible.

Let’s talk about how you can invest without using my company (I know this is a weird thing to write).

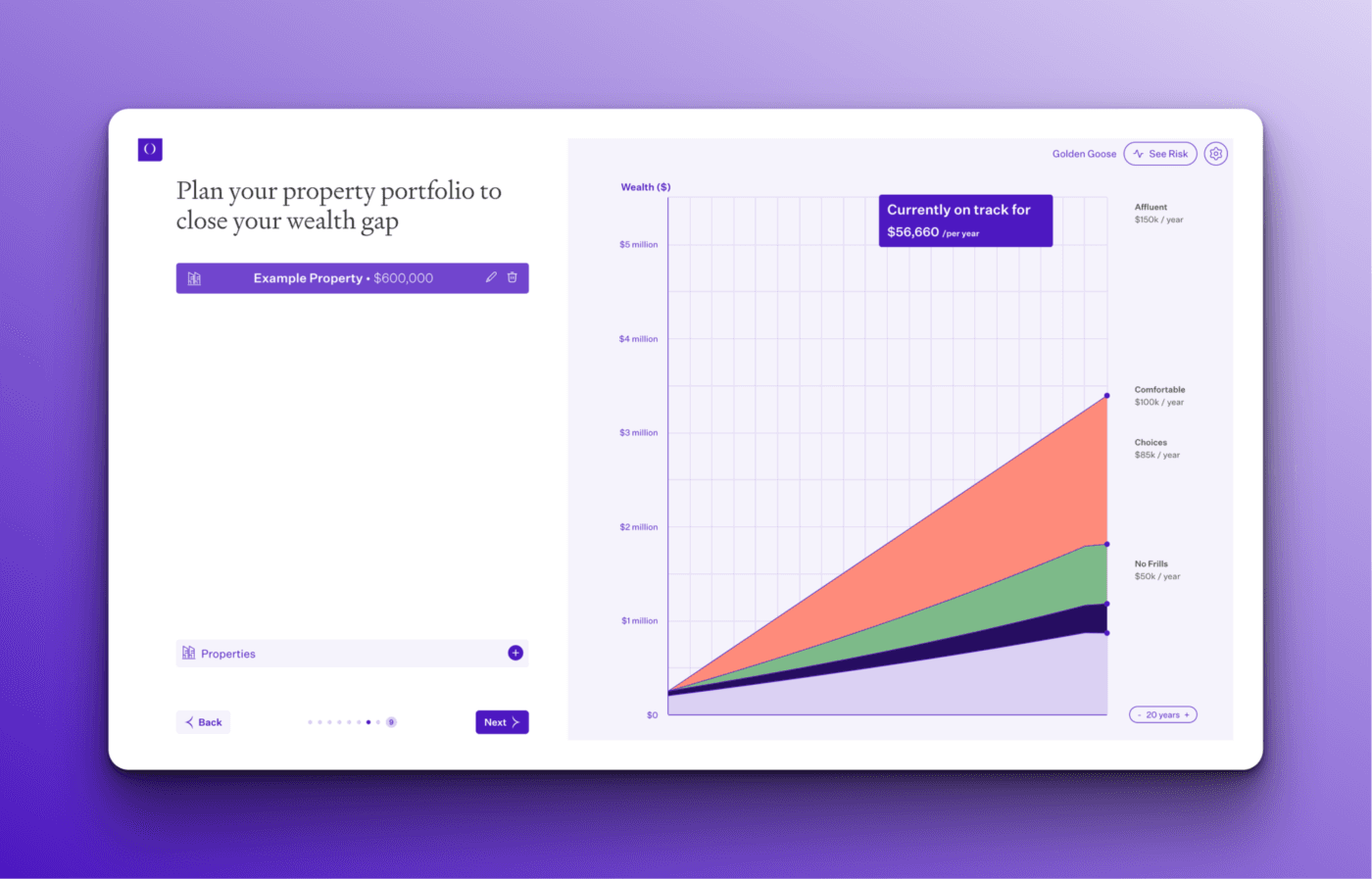

You could meet with one of our financial advisers and create a Wealth Plan. There’s no cost for this. That's because we get paid if you decide to take our advice and buy a property we recommend.

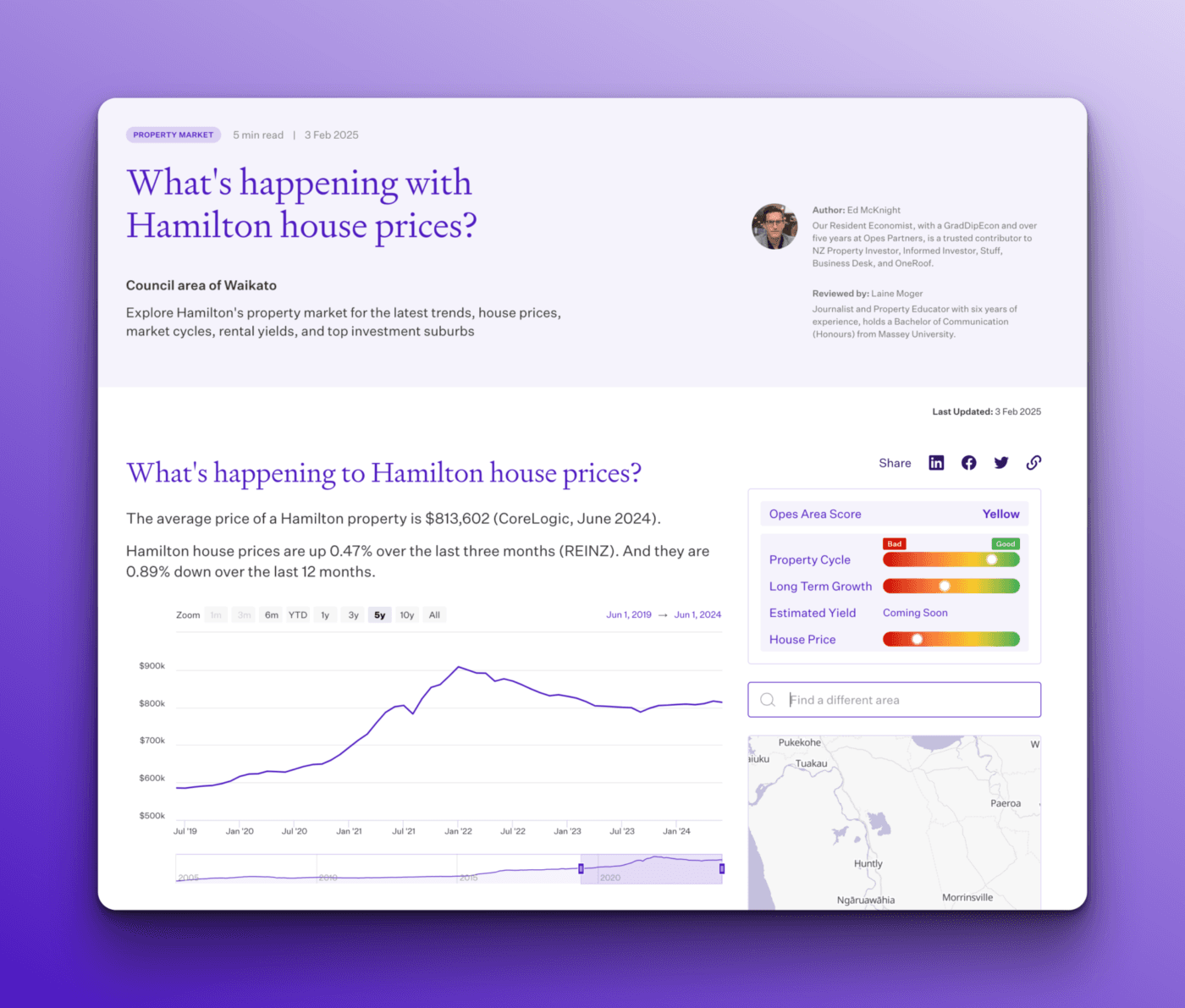

You could talk to one of our financial advisers about which areas we look for properties in. You could read our articles about what to look for in an investment property.

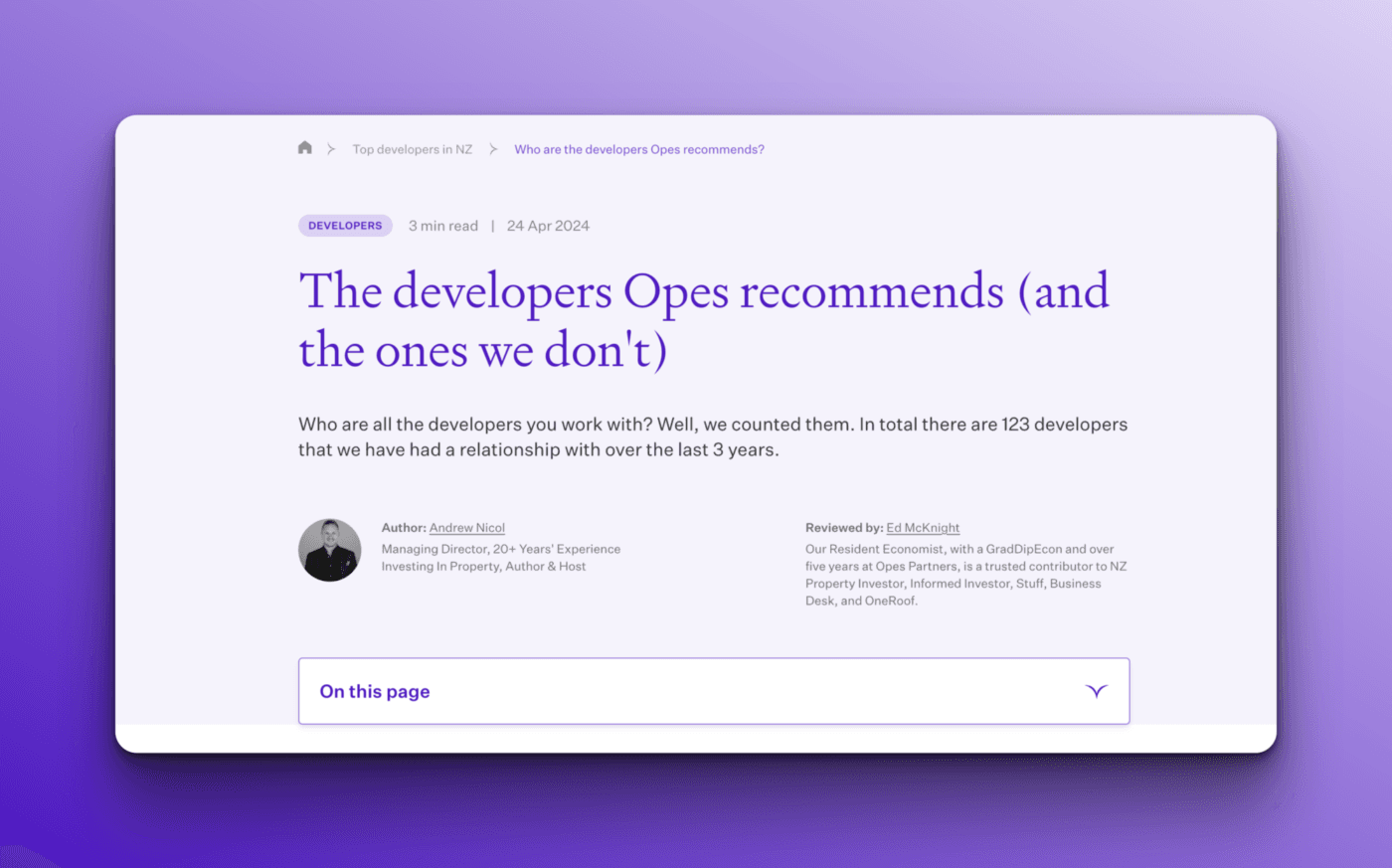

You could go on to our website and look at the developers we work with. You could then talk to those developers. Buy a property through them. And decide not to work with us.

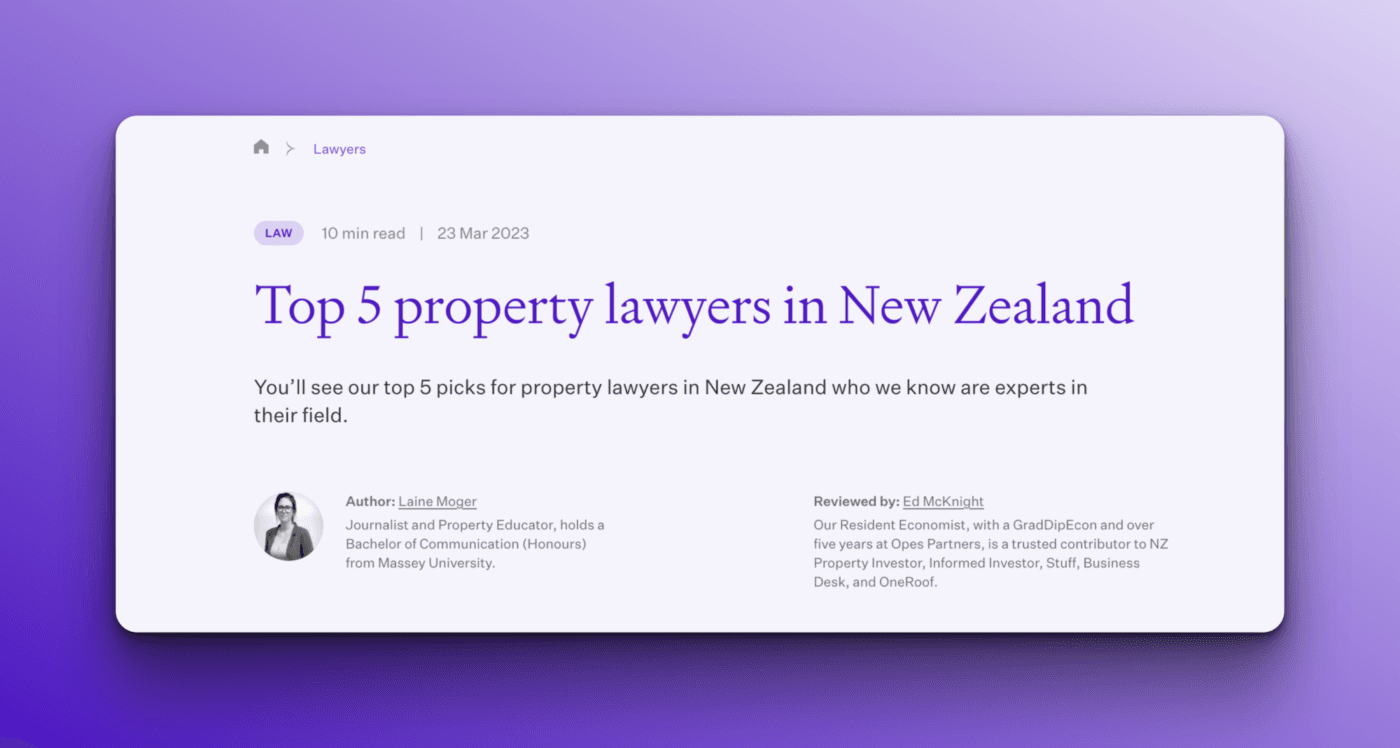

You could look at our lists of the top lawyers we recommend. These are publicly available. You might decide to use one.

While you’re working with your lawyer, you could even take the standard clauses we like to use in contracts and use them yourself.

You could even decide to work with an Opes mortgage adviser. There’s no cost for that, either.

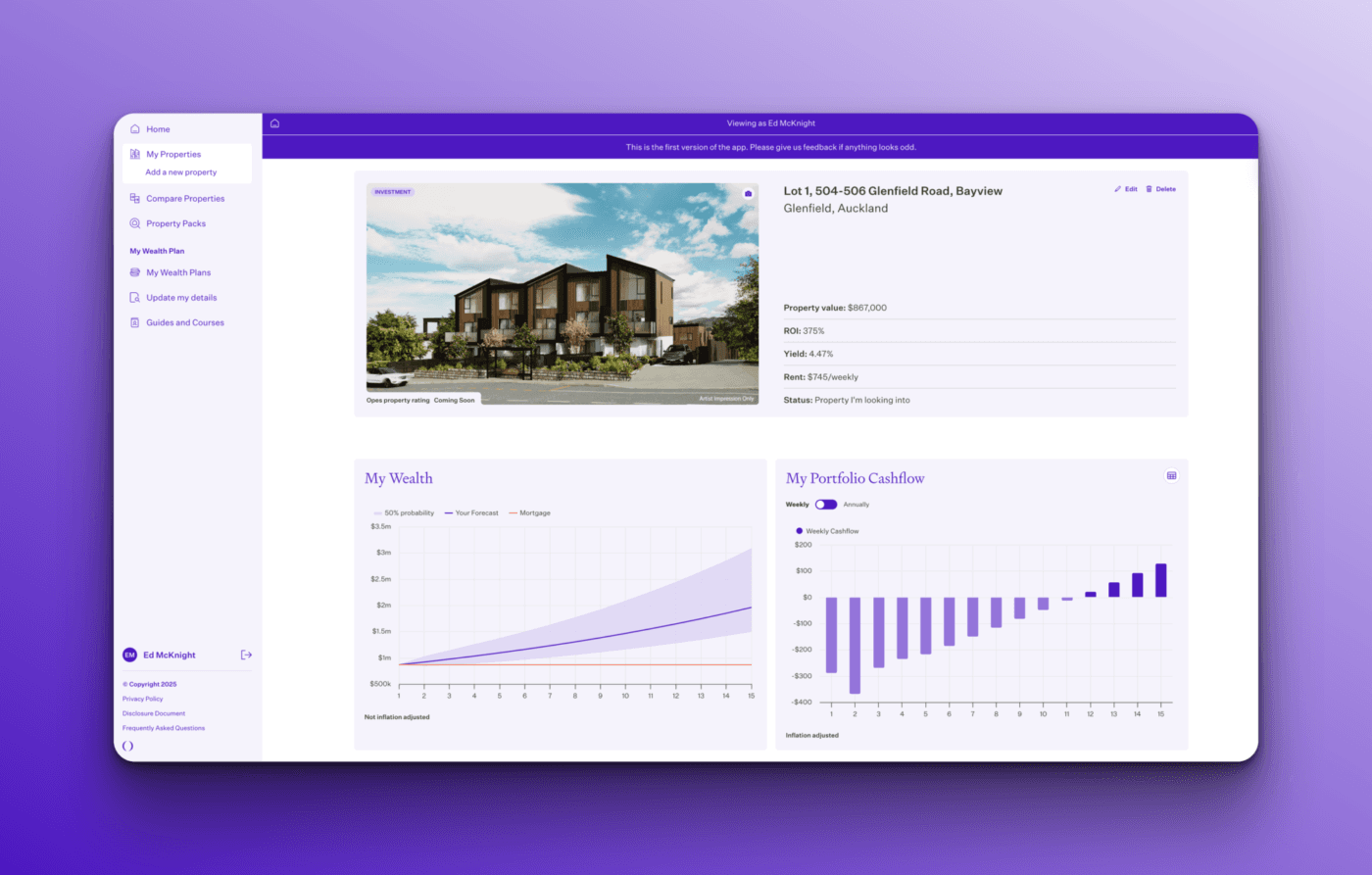

You could log in to Opes+ (our free tool) and run the numbers on your investment property.

While you’re there, you could read our free guides on how to invest (and what to look out for at each stage).

And you could even use our tools like the Area Analyser and Tenant Tool to get free data about where to invest.

You could do all of that and buy an investment property with a different company.

Some people do. And some of them are successful. That’s the truth.

And you might even say: “Andrew, why are you telling me this? Why are you telling me how NOT to use your company? This is the dumbest business decision ever!”

The reason is simple.

Because the above does occasionally happen.

And I want to be really honest: If someone uses my systems, content, and knowledge to grow a portfolio – that’s a win for me.

If they don’t use my company, but they improve their financial future – that is a good outcome.

And just because Opes puts out a lot of free content and information, this doesn’t mean you’re indebted to us. You don’t have to use our service.

But before you run off to Trademe to buy a property directly from a developer. It’s also important to mention what you get if you do work with Opes. Some of the things that aren’t publicly available.

That way, you can make an informed decision about whether to work with us or not.

More from Opes:

There are 4 big things people miss out on if they decide to invest alone.

The first is access to the Opes team – the people who write the content you’re reading. Let me give you an example.

I love Chris Voss. He wrote one of the greatest negotiating books of all time: Never Split the Difference.

And I’ve taken a few tips from that book that I use all the time.

But, if I was heading into a negotiation and I had a choice: get Chris Voss to negotiate for me … or do it myself. I know what I’m taking every time.

Chris – get in there. You’re negotiating for me!

Because while I can learn a lot from a book ... best practices change. There is only so much you can learn from reading content. You’ve got to have experience as well.

And if we bring that back to property investment. Yes, you can learn a lot from our articles and podcasts.

But that will not teach you everything. And one of the things my clients really like is that when something goes wrong, I can step in to sort it out.

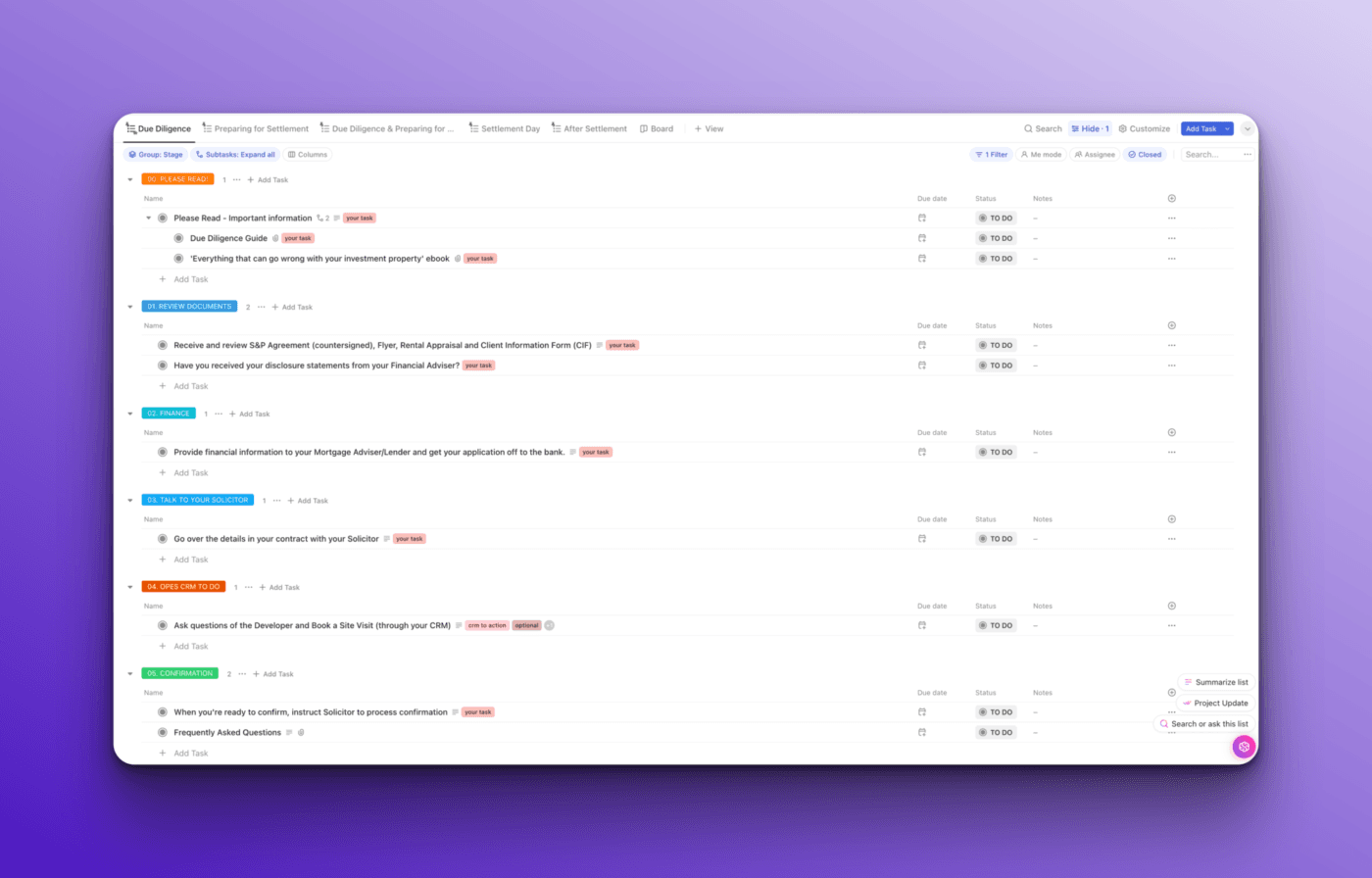

The second big thing is the checklists and software to manage the property process.

Every client we work with gets access to ClickUp. This is a software we use that has all the tasks that investors need to do. That way, they have a checklist of what to do and when.

That means the property process goes more smoothly. And my clients work with a Customer Relationship Manager to dot the I’s and cross the t’s.

Next is the ongoing relationship with your financial adviser. Most investors need more than 1 property to close their Wealth Gap.

So, if you work with us, you get a financial adviser to look over your portfolio every year.

If you decide to get a free Wealth Plan and then go at it alone, you don’t get that ongoing coaching to move towards your financial goals.

There are a few other things.

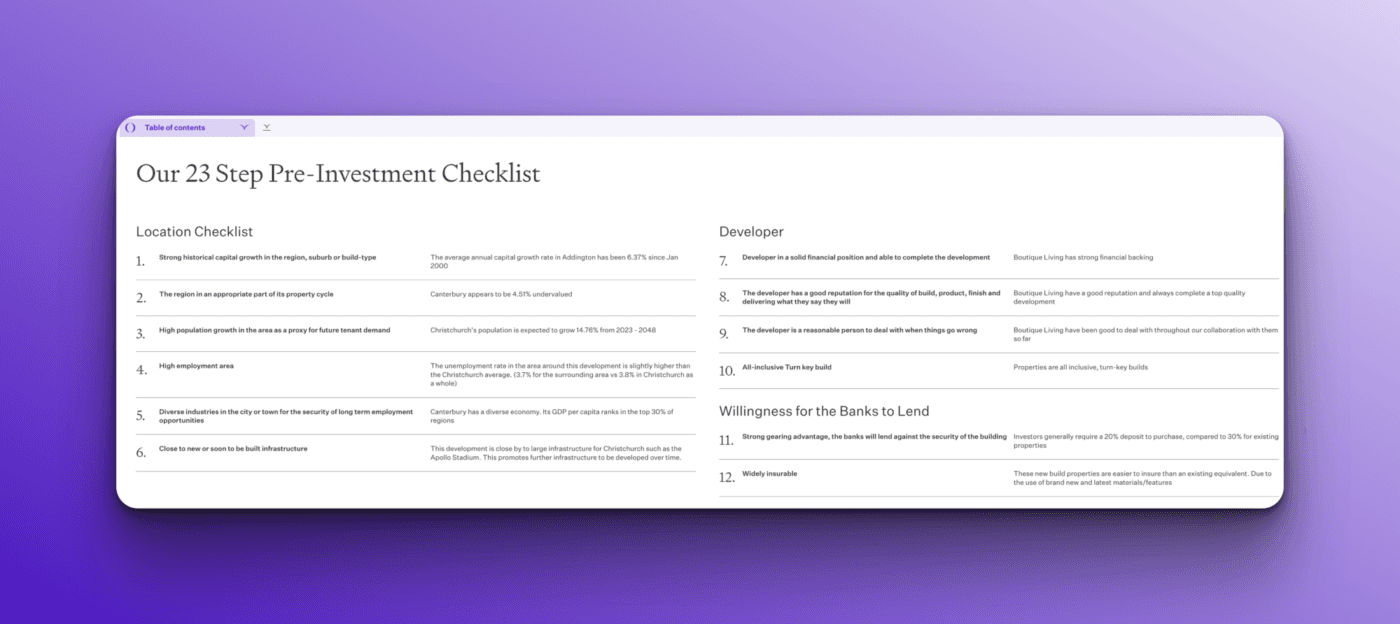

But, the last one I’ll mention is that if you go it alone, you don’t get access to our properties.

I know that seems obvious. But my real estate team are out there looking for the best New Build properties they can find. And boy, do we put the developers through their paces.

You can even see the analysis in our property packs and the 23-step pre-investment checklist.

And while you could look at these screenshots, take the steps, look at the data on our website and try to figure it out yourself … that takes a lot of time.

You absolutely can invest without using our property-finding service. You can do that while using our content, contacts, and information.

But if I can sum it up: there are two types of people.

The people who like working with Opes want to save time. They want it done for them and they like the New Build investment strategy (the Build and Hold).

But others say: “This isn’t the investment strategy for me. I’m going to learn what I can. But ultimately, I want to invest on my own. Because I think this other way will be better for me.”

Both are legitimate ways to think.

It’s up to you to decide which way will suit your investment style.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser