Due Diligence

What do I need to know about signing the contract during due diligence?

In this article, you’ll learn exactly what you need to know about signing a contract during due diligence.

Property Investment

4 min read

Here at Opes Partners, we help over 500 investors buy properties every year.

And one of the main questions I often get asked is: “OK I’ve been through and created a Wealth Plan. Now I’m looking at properties. What is the actual process for buying a property?”

After all, it’s different than just working with a real estate agent, because at Opes you primarily work with a financial adviser.

So when do you sign a contract? When do you pay the money? That’s what you’ll learn in this article.

In your first meeting with your financial adviser you’ll have created a Wealth Plan.

This looks at whether you need to make more investments to hit your financial goals.

If you do need to make more investments, you move on to the property selection meeting.

At this meeting your financial adviser will show you different properties you could invest in. Usually, there are 3-4 options, and you’ll go over the numbers for each.

Once you’ve seen the options, I'll ask: “Do you have a favourite?”

If you do, you have two options:

Just keep in mind that good properties move quickly; they don’t stick around forever. And there’s a good chance other investors are looking at the same properties.

We operate a ‘first come, first served’ system. So the first investor to say “I want to put it under contract and do due diligence” is the person who gets to put it under contract first.

Because other investors are looking at these properties – your next step is to get into the Property Power Position. This is where you control the property, and the developer can’t sell it to anyone else.

But, at the same time, you are not locked in. You can cancel the contract at any time, and you don’t even have to give a reason.

You get into the Property Power Position by first telling your financial adviser you are keen to proceed with a specific unit. They will then submit an Expression of Interest (EOI). They’ll get a few details off you, like who you’ll use as a lawyer and mortgage adviser.

This will put a temporary hold on that property. This means that no other investor working with Opes Partners can take that property off you for a few days.

In the meantime, Opes Licensee Services (our real estate arm) will send you a contract. Once you sign this, you are in the Property Power Position. You have first dibs on the property at that price. The developer can’t sell the property to anyone else or change the price.

That way you can enter due diligence (what we call The Detail Dive) and do all your checks without being rushed.

“Due diligence” is a 10-day period during which a buyer can investigate the property. This is where you’ll see:

In The Detail Dive, you’ll spend time and money to investigate this property. This is to see if it's a good fit for you. If you're not in the Property Power position there’s a risk you start spending money on a property you can’t even buy.

Now, the big question is: “If I sign the contract for a property … am I committed to buying it?”

It's a fair question, because what if you change your mind?

The answer is: No, not yet.

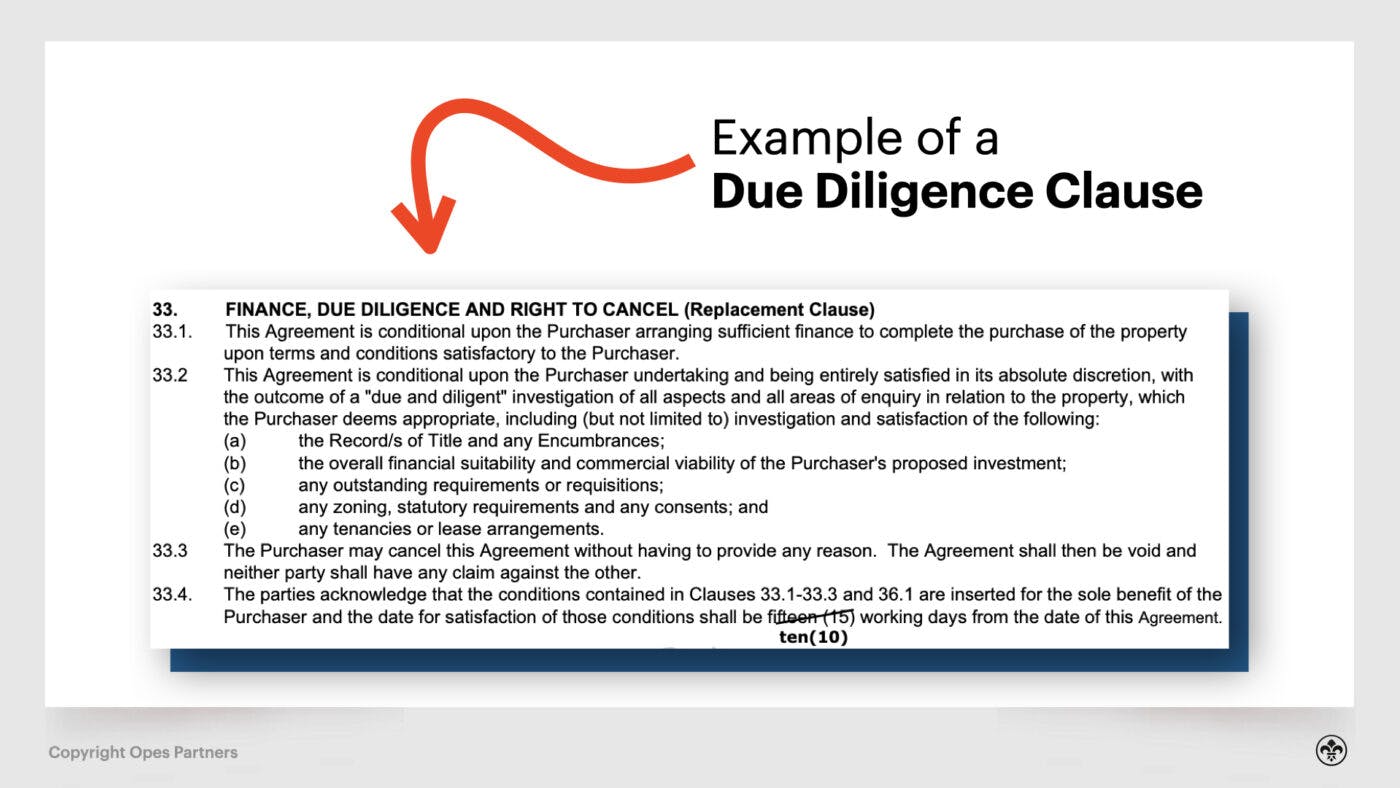

In your contract are clauses that allow you to cancel the contract for any reason.

These are:

These clauses are your safety net. Anytime during due diligence, you can pull out of the deal if something doesn’t feel right ... no questions asked.

If you want to cancel:

So be reassured you will never “accidentally” confirm on a property.

No one has ever said: “Whoops, I didn’t realise I’d bought that property”.

Why? You only confirm your purchase by explicitly telling your lawyer to go unconditional. You have to call them and tell them you want to confirm.

You become “locked in” to the purchase once you move on to Step 3.

Once you’ve completed due diligence and are happy with the investment, you can tell your lawyer to confirm the contract.

We call this “Confirming the Commitment”. That means you are moving ahead with the investment.

Once you confirm and go unconditional, you pay a 10% deposit. You do this within 3–5 days.

This isn’t paid to your developer. Instead, you give it to your lawyer and they pass it on to the developer’s lawyer. They then hold that deposit in trust. The developer can’t access it, and they can’t use it on the development.

For most New Builds, you then pay the rest of the money after the property has been built. That might be 12-18 months later.

Some investors need more than 3-5 days to pay the deposit, and that’s OK. Often, you can say to your lawyer: “I want to confirm that contract, subject to paying the deposit by [insert date here].”

As long as you’re only asking for a week or two, most developers will approve i

Ben has 14 years of experience as a mortgage advisor and background as an investment adviser.

Ben brings a wealth of experience to the table with his 14 years as a mortgage advisor and background as an investment adviser. His dedication to helping clients reach their financial goals is central to his work.