Tax

Do I really need a chattel valuation?

In this article, you’ll learn what a Chattel Valuation is and how it can help you minimise the amount of tax you pay.

New Builds

12 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Our Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Purchasing a property not yet built comes with its own unique set of risks.

Mainly because your property has yet to be constructed. The big risk is the builder goes into liquidation midway through, leaving you with a half-finished property.

This has got a lot of attention in the media as tough times (for everyone) have put a big squeeze on the building industry. So, buyers are desperate for reliable protection.

The Master Build Guarantee offers protection against defects and builder insolvency, covering up to $400,000 for residential builds.

As a result a light has been shone on the Master Build guarantee.

But is it the be-all, end-all “insurance policy” you might think it is? Or are there better alternatives?

In this article, you’ll learn what the Master Build guarantee is and how it works, so you can be well informed in your decision.

Do you have a question or comment about Master build? Feel free to leave your thoughts in the comment section at the end of the page.

Master Build is a membership organisation that represents builders and construction firms.

The Master Build Guarantee is its 10-year protection contract for the purchaser of a New Build home – be it on a progressive payment or turnkey contract.

Essentially, it’s a warranty for your property and it works very similar to other warranties you might get for your oven, fridge or car battery.

However, it’s not a builder putting their money on the line to guarantee their work. You have to pay for the guarantee through Master Build (the membership organisation).

That’s a benefit because the guarantee comes from a third party. So, if the builder goes belly-up, the guarantee survives.

The 10-year protection covers a couple of things:

A Master Build Guarantee is fully transferable. So, if you sell to another buyer it covers things that are not included with general house insurance.

Shane Campbell, a lawyer at Wynn Williams, says the guarantee provides that third party entity (Master Build) and a process to resolve issues, should the worst-case scenario happen, although buyer beware. He also says people commonly trip up on an assumption the Master Build guarantee covers more than it does in practice.

Master Build guarantees are relatively inexpensive, and usually cost about 0.5% to 1% of the build cost.

However, progressive payment contracts at those very high prices ($1 million plus) are uncommon for property investors.

Most of the time the guarantee will be included in the price you pay for the house. For example, Mike Greer homes does this.

It is something to ask your developer about when discussing any future purchase.

If anything happens to your property – prior to any real construction – this guarantee covers the refund of your deposit.

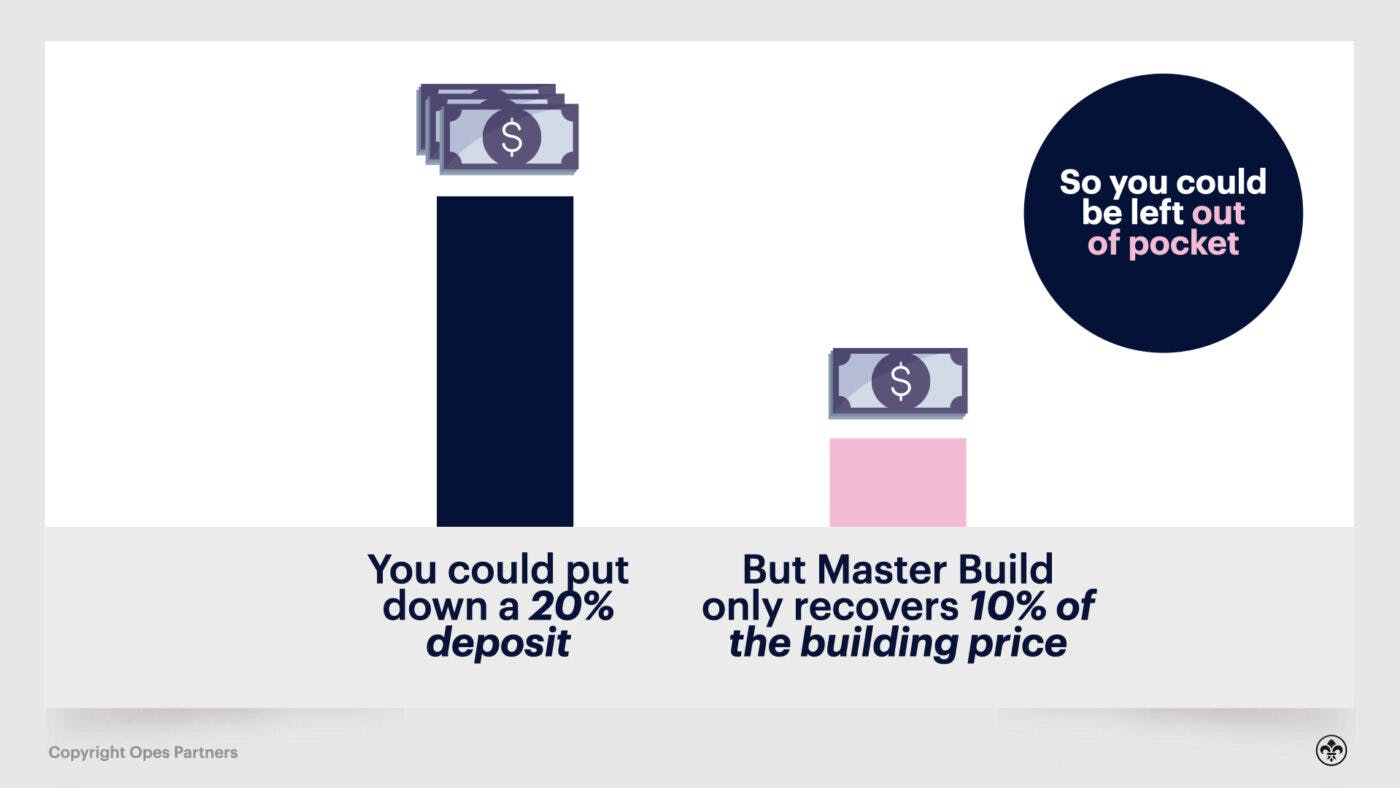

However, Master Build only recovers 10% of the total building price. So, if you’ve put down a 20% deposit you could be left out of pocket.

This primarily impacts progressive payments builds. Under these contracts you pay a deposit to the builder before they start work.

However, this is less of an issue for turnkey contracts, because usually your deposit will be held in a solicitor’s trust account rather than the developer’s business account.

This is the big one for people on progressive payment contracts, because if your builder goes into liquidation halfway through the build, the Master Build guarantee will ensure someone else steps in to finish the build for the same price.

However, there are some very important things to take note of –

That means if building materials have skyrocketed or labour has gone up, you may still have to pay extra money.

Let’s say you have paid 80% of the money to your builder. However, they’ve only done 60% of the work.

That means there’s 40% of the work left to do. You’ve still got 20% of your budget ready. Master Build will put up to 15%.

But that only adds up to 35%, so you need to put in another 5%.

And that assumes the price of materials has not gone up.

The math on this can take a bit to get your head around – but the key point is the Master Build guarantee is not a blank cheque.

Finally, if your builder does go into liquidation your build might take longer while another builder comes on board. During that time you’ll likely be racking up interest costs from the bank.

The Master Build guarantee doesn’t cover these.

Sometimes things go wrong with New Builds like rot, leaks, and electrical defects. Under a Master Build guarantee, these issues are covered until the 10-year period is up.

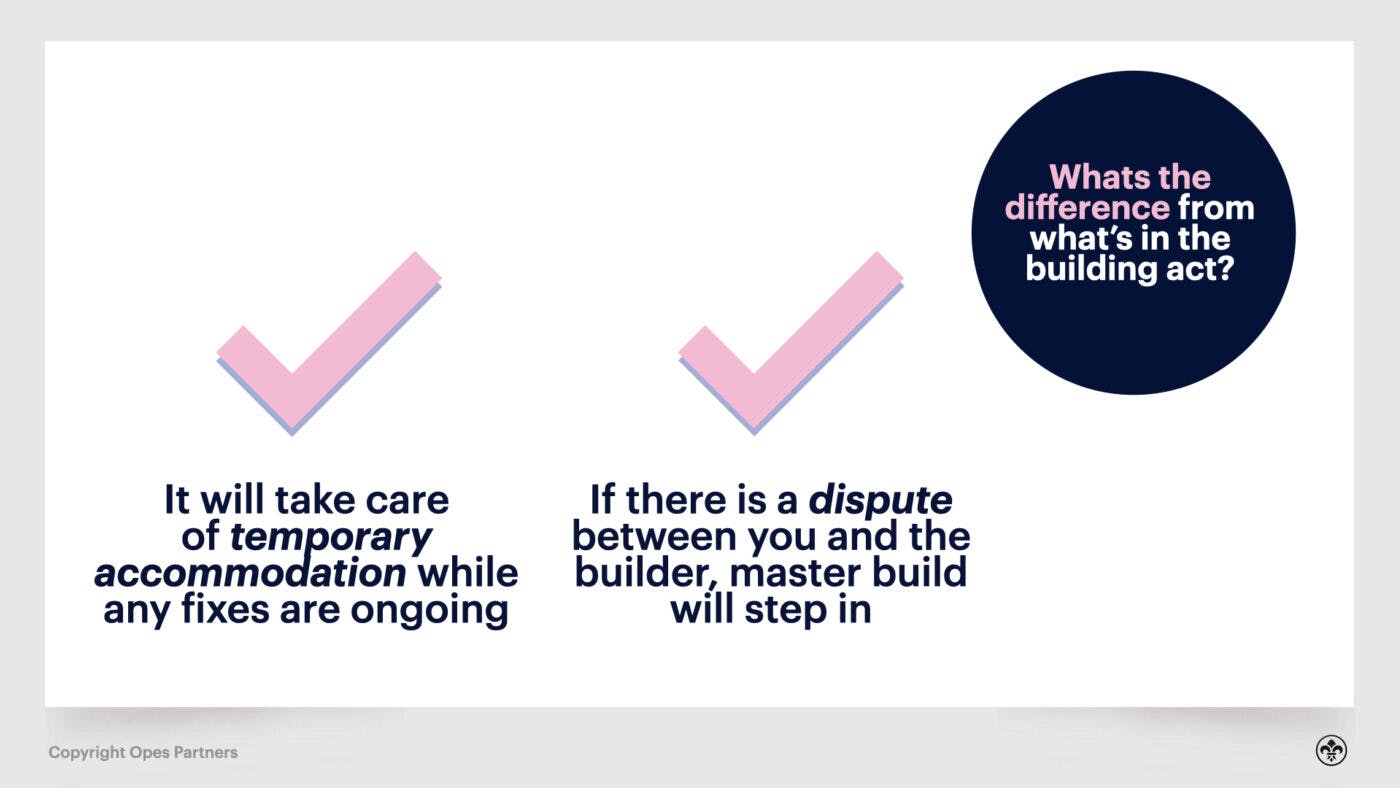

Now to be fair, under the Building Act a builder has to remedy defects within the first 12 months after completion anyway. And on top of that, there is also a 10-year implied warranty.

So how is the Master Build guarantee any different from what’s in the Building Act?

And although you do get a 10-year warranty through the Building Act, it is easier to get this warranty enforced if you have a warranty in place.

For example, if you buy a property without a Master Build guarantee and 5 years later the developer goes into liquidation.

Then, in year 7, you find a structural defect in the property.

If you just have the Building Act implied warranty you need to go after the former directors of the company.

If you have a Master Build guarantee, you go through the association. So it is an easier process.

It is important to stress that this is “worst-case scenario” stuff, but it’s important to know the difference.

There are 2 main types of warranty schemes: Member and Building Company. There used to be third party insurance too, but they have since left the New Zealand market.

Member schemes are where many building companies get together in an association. A building company scheme is where one larger company sets up their own guarantee.

Master Build falls under the member scheme category, but its brand recognition dominates the entire market with about 61% of the people choosing to use this brand (according to a 2018 report from MBIE).

Despite it being the most well-known, there are alternatives to having a Master Build guarantee.

As mentioned, Registered Master Build falls into this category. The main alternative is Halo, which is a guarantee for members of NZ Certified Builders.

Halo is an insurance based product, which has some important differences with Master Build as a guarantee (more on this below).

Building company schemes are specific to the developer itself.

For instance, Golden Homes and Signature Homes both provide their own guarantees, which you can find out about from the developer’s website.

Here’s a table breaking down the popularity by type, according to MBIE stats, 2018:

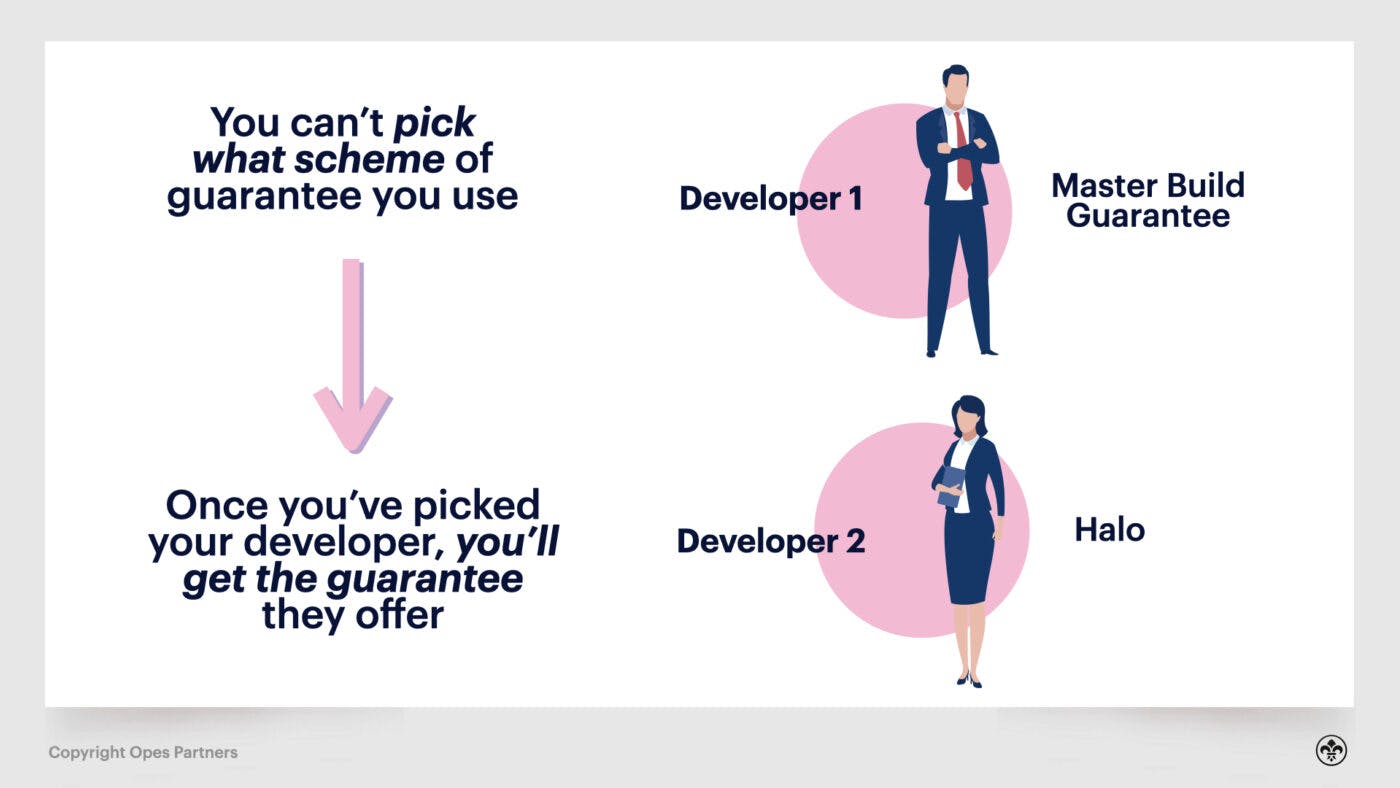

You can’t just pick and choose what scheme or guarantee you want.

Most of the time each developer will only have one type of guarantee. So once you’ve picked your developer, you’ll get the guarantee they offer.

For instance, Master Build is only available to members of the Registered Master Builders’ Association.

Similarly, Halo is only available to you if you’re using a builder who is a member of the NZ Certified Builders’ Association.

And you’re absolutely only going to qualify for a Golden Homes or Signature Homes warranty if you purchase through them.

The benefits and limitations of each warranty will be specific to who’s offering it to you.

However, the guarantee offered could play into your decision of which developer to use.

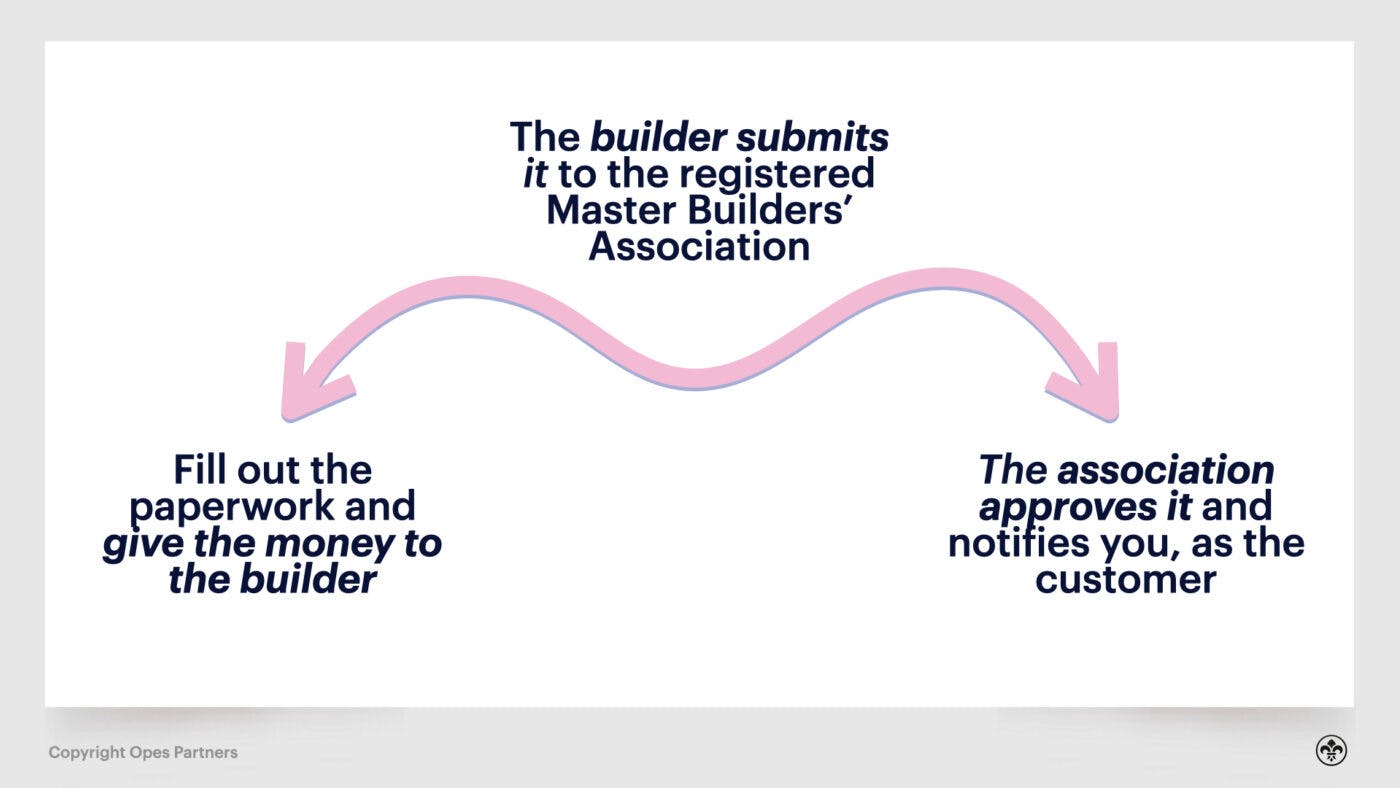

The process for obtaining a Master Build can be a bit fiddly, because it can involve a bit of backwards-and-forwards paperwork shuffling.

Here’s how the process works:

The important thing to note here is the builder submits your paperwork, but Master Build notifies you.

So, if you have not heard from Master Build in 14 days, you must get in touch with them.

Otherwise you can find yourself in a situation where the paperwork hasn’t been filed, and you aren’t covered by the guarantee.

Following up on your Master Build is your responsibility, even though you’re not the one who files it.

Here’s a recent example of 20 property owners left with unfinished projects with developer Jonesy Construction – a building company based in Wellington.

In this scenario, Jonesy Construction has gone bust and is in liquidation.

Some of the owners had (thought they) bought and signed paperwork for a Master Build guarantee. But then Master Build was not paying out.

Why? Because Jonesy Construction never submitted the paperwork and the guarantee wasn’t issued.

But there was another blow to come.

Master Build also added that even if they had received the paperwork, they wouldn’t have covered it because the owners had paid too much money upfront.

In the end, these property owners were left some hundreds of thousands of dollars out of pocket. Ouch.

The 2 key takeaways to protect yourself:

Most people assume a Master Build guarantee is an insurance policy – it isn’t. It’s a warranty.

In a nutshell, the difference is: a “warranty” will fix something if it goes wrong, but an “insurance policy” will pay money out.

Master Build is much more focused on trying to get the builder (or another builder) to complete the work, rather than handing over money.

That’s different to the likes of Halo, where if something goes wrong they’ll pay you money. After all, it’s an insurance policy.

So, here’s how they divvy up.

Some people complain that Master Build “doesn’t pay out claims.” This is largely to do with the assumption that it is an insurance policy.

Master Build simply doesn’t hand out cash. In every instance you have to negotiate first with your builder to fix the issue.

This is why a Halo guarantee might be valued (by some) as better than a Master Build. That’s because you’re paid out the money (after the first year) and in control of the process to sort out the issue.

Lawyer Shane Campbell says “the coverage for Master Build is not as comprehensive as most think, and there are lots of hoops to jump through.”

The main benefit for a Master Build guarantee is for the “non-completion” coverage during the build. This is because normal insurance won’t cover you in the event your builder goes into liquidation part-way through a build.

Essentially, you are buying insolvency protection.

There are already existing statutory protections in the Building Act, but often the issue is by the time you go to enforce that the builder is insolvent – this is where Master Build steps in as the process to provide that guarantee.

The key message is to know exactly what you are getting in the fine print – Master Build or otherwise. And you’ve got to know how you go about getting that coverage paid out.

Yes, it can be.

Master Build certainly has a place in the New Build arena to give that added layer of protection to ensure your property is built.

But, they aren’t the silver bullet solution many expect.

It’s also important to note Master Build isn’t the only option in the market to offer protection – and they aren’t necessarily the best one either.

In any case, it’s best to go into any guarantee with your eyes wide open, knowing what the clear limitations are for your situation.

Write your questions or thoughts in the comments section below.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.