Property Investment

Opes' FMA monitoring review outcome

Earlier this year, the Financial Markets Authority (FMA) carried out a routine monitoring review of Opes. Here are the findings 👇

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Private Property – our weekly newsletter that gives you insights into what's happening in the NZ property market. Written by managing director Andrew Nicol. Sign up to receive this in your inbox every Thursday.

You need to know your investment property’s cashflow.

That’s the money that comes in and goes out of your property’s bank account.

The property going up in value (capital growth) will make you rich. But you’re not going to get that unless you can afford to hold the property.

So … you need to get the cashflow right. But how do you figure it out?

Let’s go through the 5 steps – using a real property as an example.

What’s the property?

11 investors I’m working with have just bought these townhouses in South Auckland, on Walmsley Terrace (Favona).

They’re a set of 3-bedroom townhouses, bought for $899,000, which will rent for ~$750/week.

Investors make a mistake when crunching cashflow by leaving out too many costs.

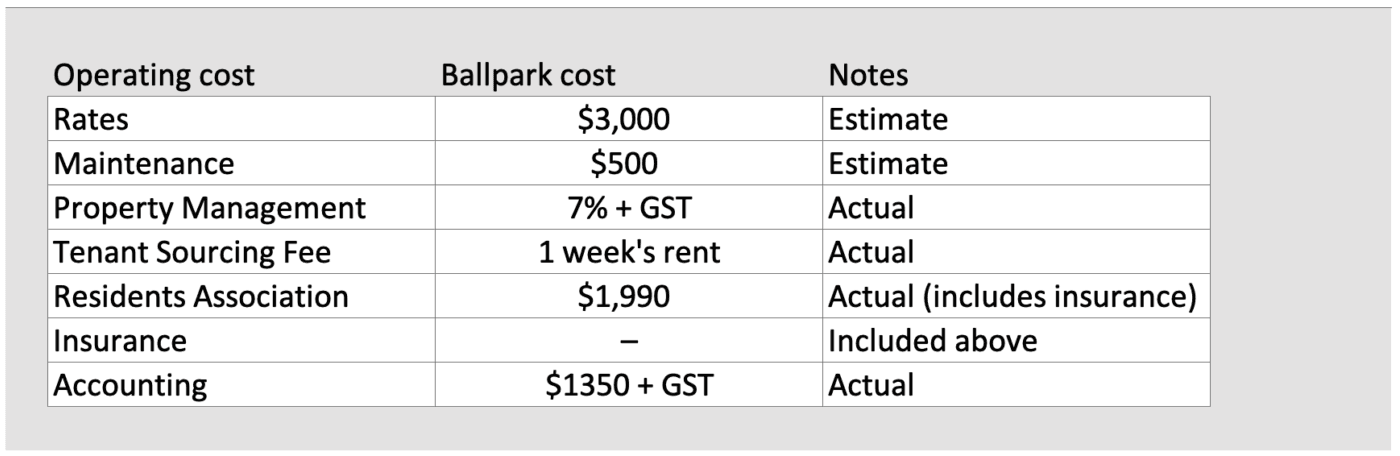

So step #1 is to collect (or estimate) all your property’s costs.

Here are the costs for Walmsley Terrace:

Since it’s a new build, you don’t always know all the costs. Today, I estimate the rates for new build properties in Auckland at $3k.

And budget for $500 of maintenance. Though, if it was an older property, I’d budget more.

The others are actual, verified costs.

Now you need a spreadsheet to crunch the numbers.

The best tool I’ve come across is our (free to download) Return on Investment spreadsheet. This gives a 15-year cashflow projection.

Over 8,000 investors have downloaded it, and I use it with all the investors I work with.

But, if you have your own (or another spreadsheet), that’s cool too.

>>> Download the ROI Spreadsheet here (for free)

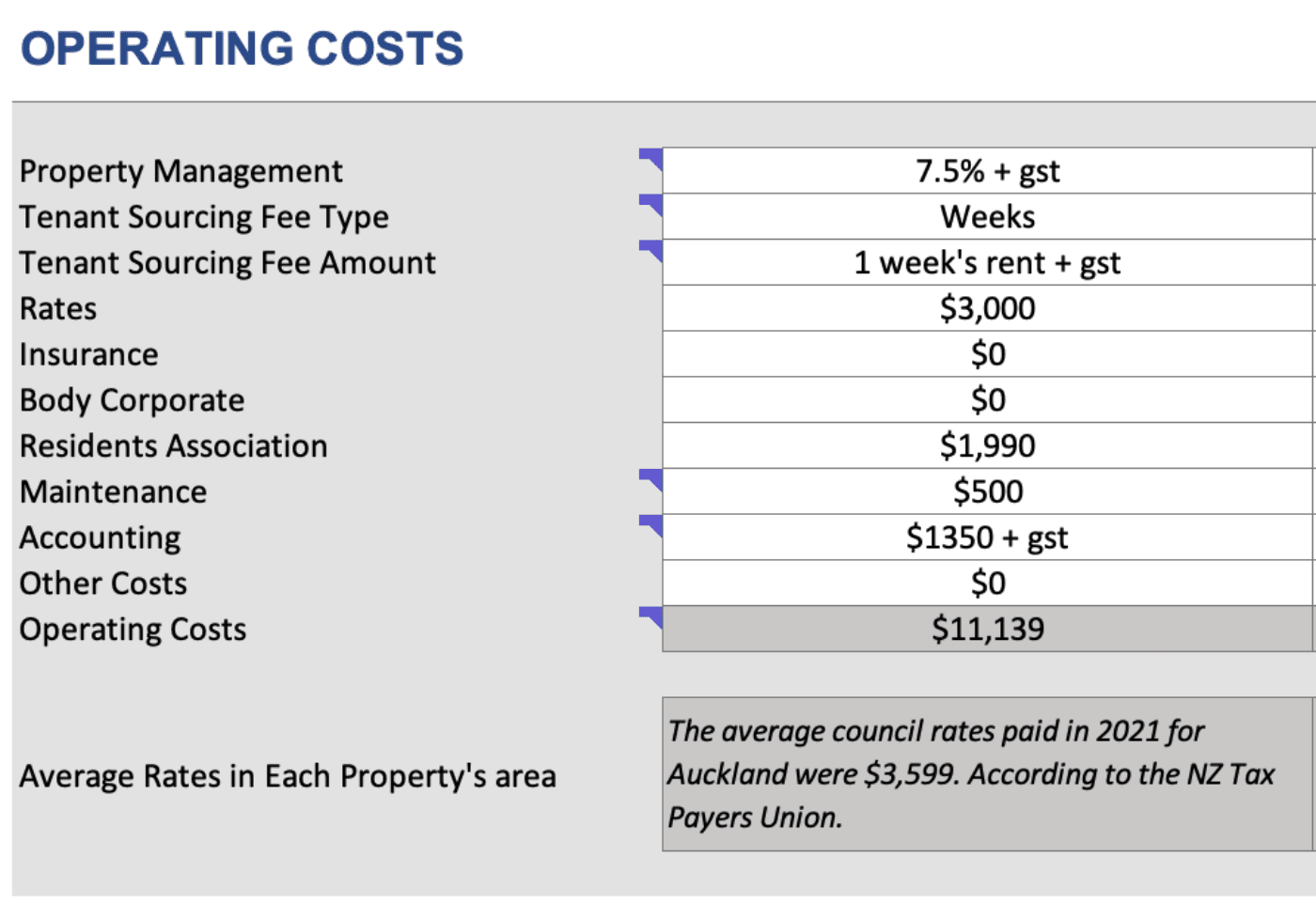

This is pretty self-explanatory. Enter all of the costs you’ve collected into your spreadsheet.

Here’s how it looks for this property:

Whichever spreadsheet you use, check the assumptions to ensure they’re accurate.

I’ve seen other property investment companies send out spreadsheets with bollocks assumptions.

Like assuming the interest rate will be 3.6% forever. Not going to happen.

My standard assumption is that rates will peak at 5.75%, then gradually come down to 4.5%.

I’ve stolen this off Tony Alexander and confirmed this with him when he was on the Property Academy podcast earlier this month.

Now the fun part. Let’s look at the cashflow.

See how terrible it is at the start when interest rates are high. The 11 investors buying this will have to top the property up.

This is very normal.

New build properties are often negatively geared initially, especially if you’re borrowing all the money to invest (no cash deposit).

It then gets better as rents rise and interest rates come back down.

There are strategies you can use to help ride the wave, e.g. using a revolving credit to fund part of the top-up. This is something to discuss with a property partner.

Why would an investor buy a property with negative cashflow?

#1 – The higher interest rates create opportunities. These townhouses have a registered valuation of $945 – $970k. The purchase price is $899k.

The day the property settles, the investor will make $58,500 in equity. It’s worth it for them.

#2 – Click on the ‘Results’ page of the spreadsheet, and you get the whole picture of the investment:

Over 15 years, the investor is expected to make:

To get those gains, they’ve got to put in:

That’s a 424% return on investment.

They get an extra $4.24 back for every dollar they put in.

Download this spreadsheet for free if you want to run the numbers like this on your own investment properties.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser