Property Management

How to work with a property manager during due diligence

In this article, you’ll learn exactly what you need to know about how to work with a property manager during the due diligence process.

Property Management

13 min read

Managing your investment property can be a full-time job. It’s a huge time commitment, you need to be well-schooled on recent legislation, and a firm but fair demeanour is essential when dealing with your tenants (who may or may not be paying your rent on time).

Most investors don’t have the spare hours in the day to be fielding calls about the broken tap, missed rent, or a tenant’s personal issues while you are at your 9-5.

And if you’re resorting to Facebook groups to ask legislation questions, it’s a good idea all round to outsource this entire headache to a property manager.

In this article, we go through what a property manager will do for you and your investment property and some of the fees you can expect to pay for these services.

Do you have a question or comment about property managers? Feel free to leave your thoughts in the comment section at the end of the page.

What you pay your property manager depends on who you choose to work with, and how they structure their fees.

For example, most property managers will charge for each service separately e.g. a management fee; a tenant sourcing fee; and inspection and maintenance fees - but not all.

Some only charge a standard fee with all services rolled into one e.g. 9.99% + GST of rent collected, all-inclusive.

There are three main costs/fees a property manager might charge:

This is a percentage of the rent collected, which usually sits around the 7 - 10 % + GST. Typically, management fees in Auckland are about 1% higher compared with other cities.

Why? Well, it costs more to run a business in Auckland.

For example, there are higher salaries and properties are more widely spread around such large cities, which means more driving time.

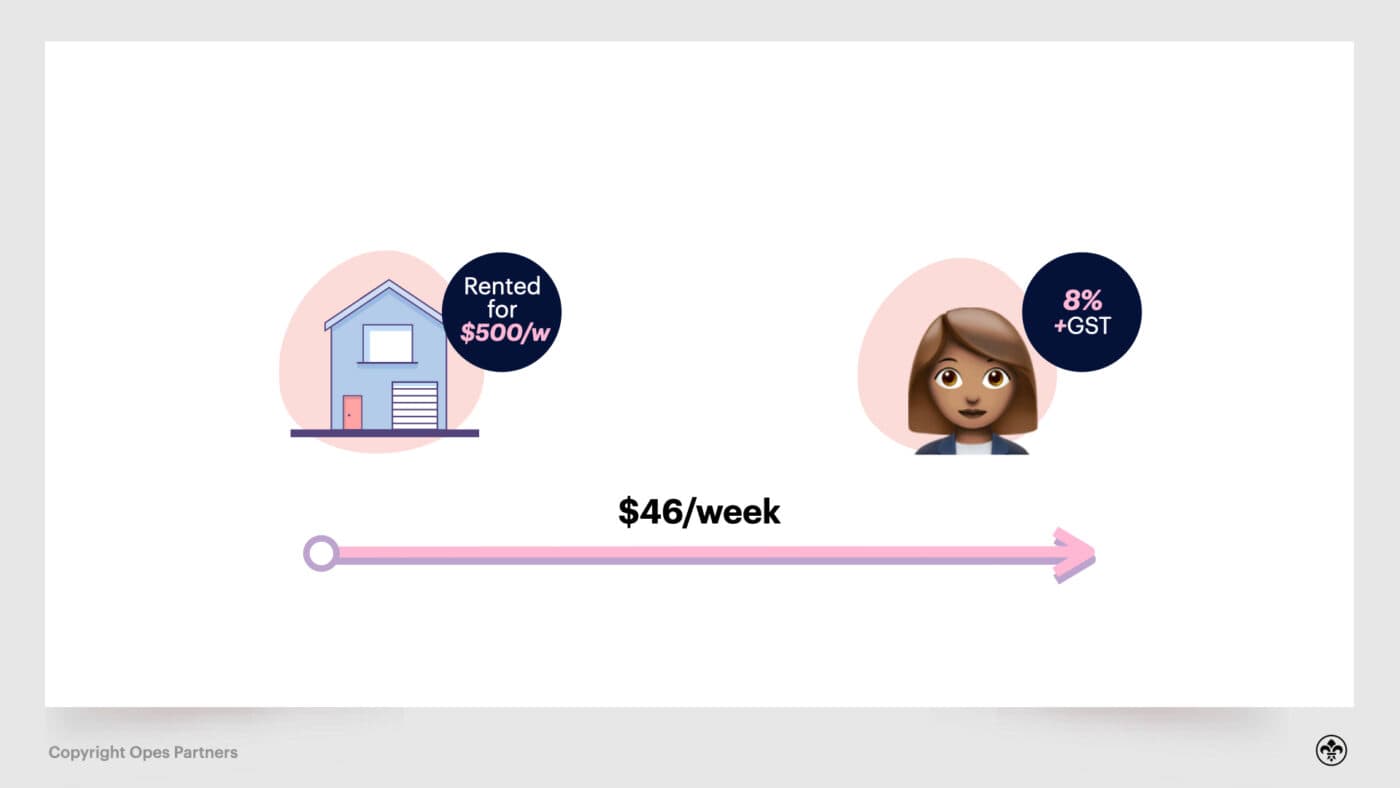

Let’s say you have a property that rents for $500 a week, and your property manager charges 8% + GST. You’ll pay $40 + GST ($46) a week for your property manager.

This fee covers collecting the rent, looking after the tenant, often inspecting the property and a whole lot more. More details on this below.

Formally known as a “letting fee”, a tenant sourcing fee is charged when you need to find a new tenant.

This is usually 1 weeks rent + GST. But sometimes it is a fixed price, like $500 + GST.

Following this, you’ll be charged the regular management fee mentioned above.

This used to be paid by tenants, but nowadays you pay it since property managers can no longer legally pass the costs on to tenants.

You might be wondering what does this include?

First, the property manager will advertise the property, as well as conduct viewings with prospective tenants.

Once they get applications to rent the property they will run a credit check on the tenant to make sure they are a ‘good payer’ and are likely to make their rent on time.

This includes checking regular payments like power bills and cellphone payments. A good property manager will use a credit check system for this, rather than asking the tenants for this information directly.

They will also check references from other property managers to make sure the tenant will be a good renter. Property managers will also contact the tenant’s employer to double check the information given by the tenant is accurate and that they can afford the place.

A property manager doesn’t want to rent a place to someone who can’t comfortably afford it. That’s no good for anyone.

Sometimes property managers will also charge:

And all property managers pass on the cost of bringing in other professionals.

For example, a smoke alarm and Healthy Homes inspection often start from $149 + GST, dependent on house size. Same for meth testing, which starts at $189 + GST.

Put simply, if you want these sorts of services – which fall outside the remit of a property manager – then you need to pay for them. But your property manager will organise them on your behalf.

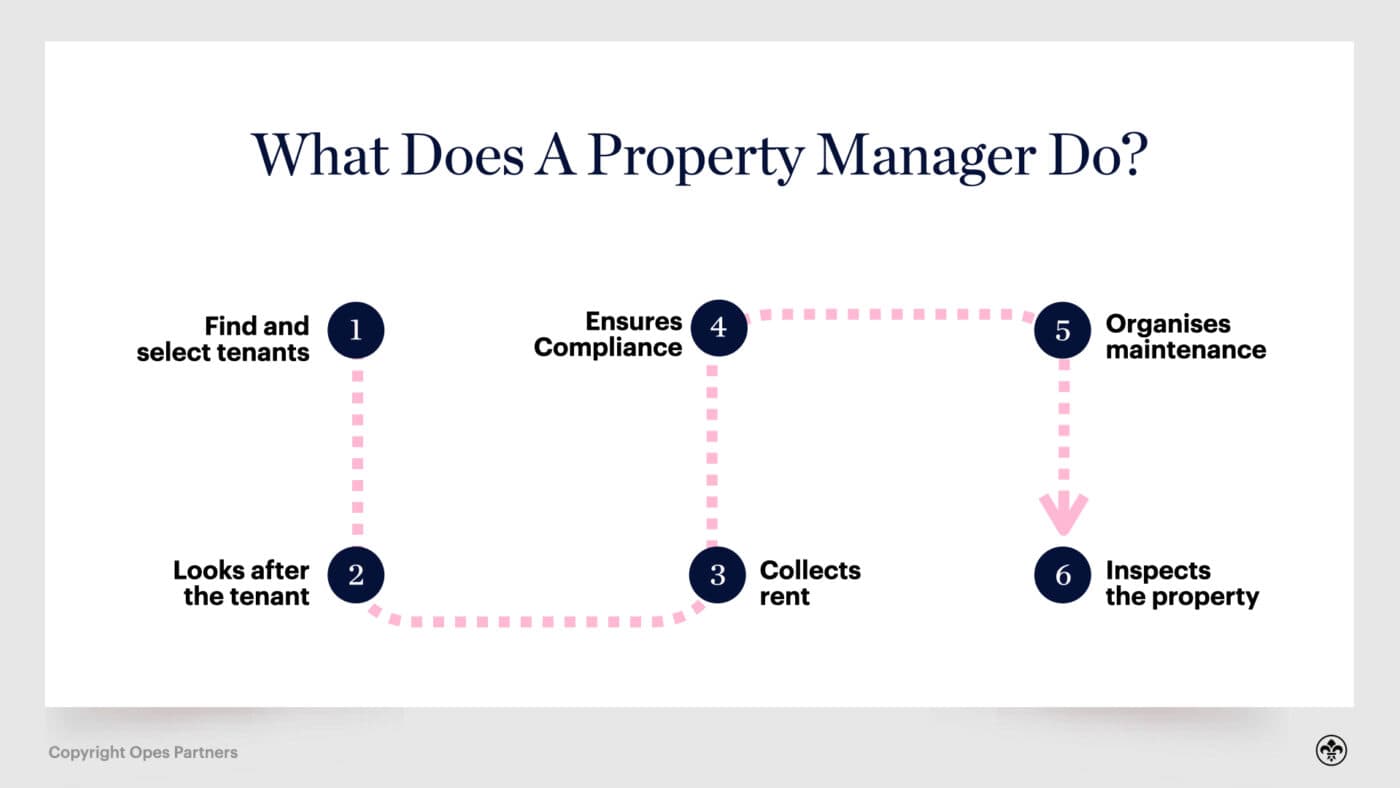

First up, a property manager finds tenants to rent your investment property.

This is the most important role for two interlinking reasons.

Why? Firstly, because your investment plan hinges on having regular rent coming in to cover the cost of your mortgage and overheads.

But secondly, you need to ensure you can hold on to your property for the long term to maximise the gains on offer some 10 or 20 years down the line.

So ideally, you want a good, long-term tenant that isn’t going to take a sledgehammer or a box of matches to your investment.

Picking a good tenant is an important job and, to an extent, being able to distinguish a good from a not-as-good one can come down to the experience of the property manager.

Property managers deal with tenants all day long, and typically when things go wrong.

Even the best of tenants can encounter massive life events that can affect their ability to make the rent. The life events we are talking about are divorce, redundancy or the like.

So, a property manager will manage these changes with the tenant to ensure the well-being of the tenant and your investment is looked after.

Sometimes this can mean helping the tenant move on to a more suitable property.

Or, if the life change is more temporary, the property manager can negotiate a plan for the tenant to catch up on rent over time – if appropriate.

The benefit for the investor is that the time and emotional stress of dealing with these issues is outsourced to the property manager.

Tenants getting into arrears, falling behind in rent, is something private landlords find is the biggest problem.

Because property management companies invest in systems to check rent – since they are dealing with hundreds of properties – they are diligent in making sure the rent has come in.

On top of this, property managers have specific procedures or “game plans” in place to problem solve and resolve quickly any missed rental payments to avoid the issue snowballing.

For example, if someone is falling behind, the first port of call is to contact them by phone and/or emails. Regardless of what the excuse is, the strategy and procedures are followed until the rent is paid.

Yes, landlords understand “life happens”. But property managers are there to ensure your investment works for you.

So, they do have to follow through to make sure the tenant holds up their end of the bargain – and sometimes this means the Tenancy Tribunal.

To be clear, there are great tenants out there, who pay rent on time, every time. But sometimes it doesn’t go to plan, and in those cases it is worth having a property manager to sort it for you.

You don’t want to be fielding these sorts of phone calls while you’re at work.

The workload of a property manager has increased by 30-40% in recent times. This is because the amount of new legislation being introduced has surged.

Previously, property managers never had to consider anything bar rent, repairs and admin. But now all homes must comply with Healthy Homes, smoke alarm checks, and a stricter Residential Tenancies Act (RTA).

Because property managers spend 8+ hours a day dealing with property, they have a good working knowledge of this legislation, which as a property investor you may not have.

All this time-consuming stress is managed for you and by someone who deals with these potentially finicky legislative details.

If you do run foul of the tenancy legislation, you can find yourself in the Tenancy Tribunal paying fines for small missteps you weren’t aware of.

A good rule of thumb is: if you find yourself asking a question in a Facebook group about the RTA, it’s time to get a property manager.

Similar to the above, when something goes wrong or needs repair on the property, the manager will organise this for you.

Usually, they will have a set of tried and true contractors to get the job done.

For these sorts of things, a private owner managing by themselves might be short of time.

Often the property manager will have a limit, where they will double check with you before approving maintenance over a certain amount e.g. $100. This means you don’t have unexpected bills coming your way.

Regular inspections are important, for insurance purposes. Because, in the fine print of most policies, your insurance is null and void if you don’t inspect on a regular basis (usually 3 months).

But it’s not just that, the keen-eyed observations of a property manager can let you know if there is a secret tenant or pet who has snuck in against the rental agreement.

For example, it’s not unheard of for property managers to take notice of the number of toothbrushes in the bathroom or a bag of dog food in the cupboard (even if the tenants have meticulously hidden the dog bowl away).

And if a tenant tries to make one room “out of bounds”, then that’s all the more reason for it to be inspected.

It’s important to remember, these measures aren’t there to violate the privacy of your tenants, but to ensure the property is well-maintained so you can hold the property for the long term.

It’s more that if you’ve agreed with the tenant that you don’t want a pet, and they have 2 pitbull dogs in the backyard, you probably want to know.

And if you’ve agreed that the maximum number of tenants is 4, but there are 20 toothbrushes, similarly it’s worth a conversation.

The reason for this is all about fair wear and tear on the property. Having twice the number of people living in the property than allowed will cause your property to wear out faster, so the tenants need to pay more for that.

A property manager is likely to be someone you, as an investor, is going to have a relationship with for many years. So the chemistry, and the communication, has to be just right.

You can choose whichever property manager you like, but ideally you want someone you click with and not just someone who can do the job well.

Often you won’t even talk to your property manager until something goes wrong and there’s something to talk about. So you want to make sure you’re going to be heard and listened to when that happens.

You also need someone who’s good with people. They need to be firm but fair, especially as they may need to have tough conversations with tenants.

They need to be diligent with paperwork and have a thorough understanding of legislation, especially RTA and Healthy Homes.

That said, there is an entire spectrum of property managers. Some are excellent and some are less scrupulous. And it’s hard to figure out which is which when Googling online. That’s why we cover our top 7 property managers in Auckland.

As we’ve said above, choosing the right property manager is important for your personal and working relationship.

Make sure you take the opportunity to quiz them in initial conversations, to make sure you’ve chosen the right fit for you. Here are a few questions you might want to ask:

Also, don’t forget the finicky details of:

It’s also a good idea to ask what contractor they use for maintenance and repair. It’s common for property managers to stay with one contractor forever, which means they might not have the best current deal.

Along your investment journey you might find yourself in a situation where you need to switch property managers.

If this happens there is the finicky job of switching from one company to another:

Your new property manager will often handle this on your behalf – including breaking the bad news to your current manager (in some cases).

So, when this happens, you’ll need to sign a management authority with a new property management first, and they will organise all these details for you.

Business Development Manager with over 5 years of experience in Property Management in Auckland.

Jess Knight is the Business Development Manager at Opes Property Management in Auckland. She has over five years of industry experience and is also an experienced property investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser