New Builds

New vs existing – Which is the best investment?

In this article, you’ll learn the top 6 problems with New Builds and their solutions. This way you can make an informed decision about which property type is right for you.

New Builds

13 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Ed McKnight

Our Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

New builds are becoming more popular. This is not just because buying an existing property is competitive – just think of lengthy auctions and the stampedes of people at open homes.

Rather, A) on the supply side, the government is incentivizing developers to build new properties.

And, B) on the demand side, the Labour government is rewarding investors and first home buyers who purchase New Builds with looser tax rules and, in some cases, cold hard cash.

So, it’s not surprising investors and first-home buyers are increasingly seeing New Builds as a viable option where they might not have considered it in the past.

In this article, you’ll learn everything you need to know about New Builds, including what a New Builds is, how the tax and financial incentives work, and whether New Builds are good investment or first-home buyer properties.

Do you have a question or comment about New Builds? Feel free to leave your thoughts in the comment section at the end of the page.

A New Build is a brand new property bought from a developer, where you are the first person to own the property.

Although you don’t have to buy it from the developer directly. You can go through a real estate agent, or an investment company like Opes Partners, for a property considered to be a New Build. What matters is you are the first person to buy it.

So what types of New Build are there? There are two broad categories.

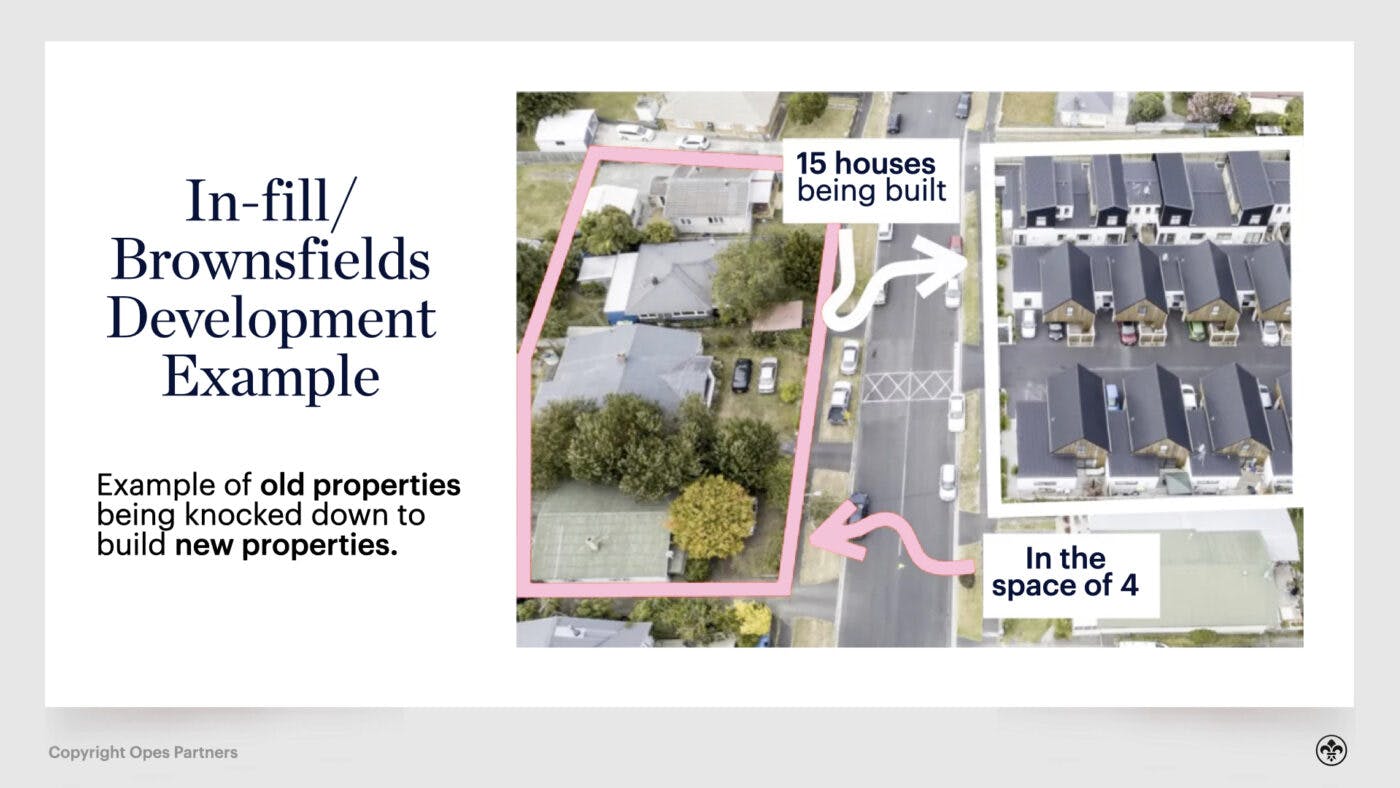

The first type, Brownfields or Infill developments, is where an existing property is ripped out and 6-8 townhouses, or the like, are built in its place.

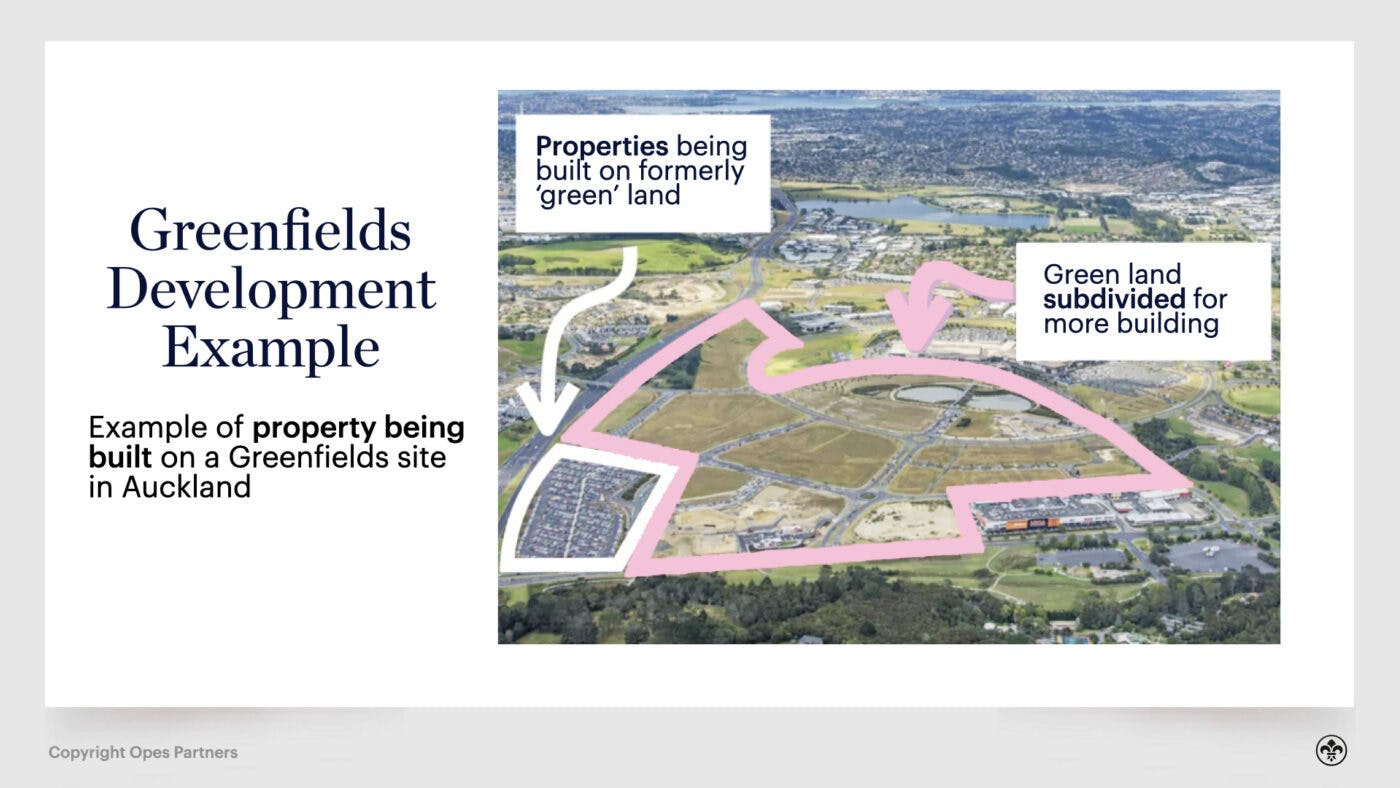

The second type, greenfields, is self-explanatory. This is where developments are built on “greenfields”. So, grass or land that has never been built on.

Infill properties tend to be more common in main cities. That’s because central city properties are expensive, so people are willing to live in denser housing like townhouses. And it’s also more likely that the zoning laws in main cities allow for infill development.

If you’re buying a New Build in these areas, you’ll usually purchase a townhouse or an apartment (sometimes).

Conversely, a standalone house is more likely to be a greenfield development. The reason being that greenfield developments happen on the edges of towns and cities where land tends to be cheaper.

If a standalone house was built in Auckland as infill development, it would be costly.

However, this doesn’t mean you can’t find excellent standalone investment properties.

It’s just that you won’t find them in central Auckland or Wellington. You’re more likely to see them in satellite towns like Rolleston and Kaiapoi, or on the edges of Christchurch.

Here is an example:

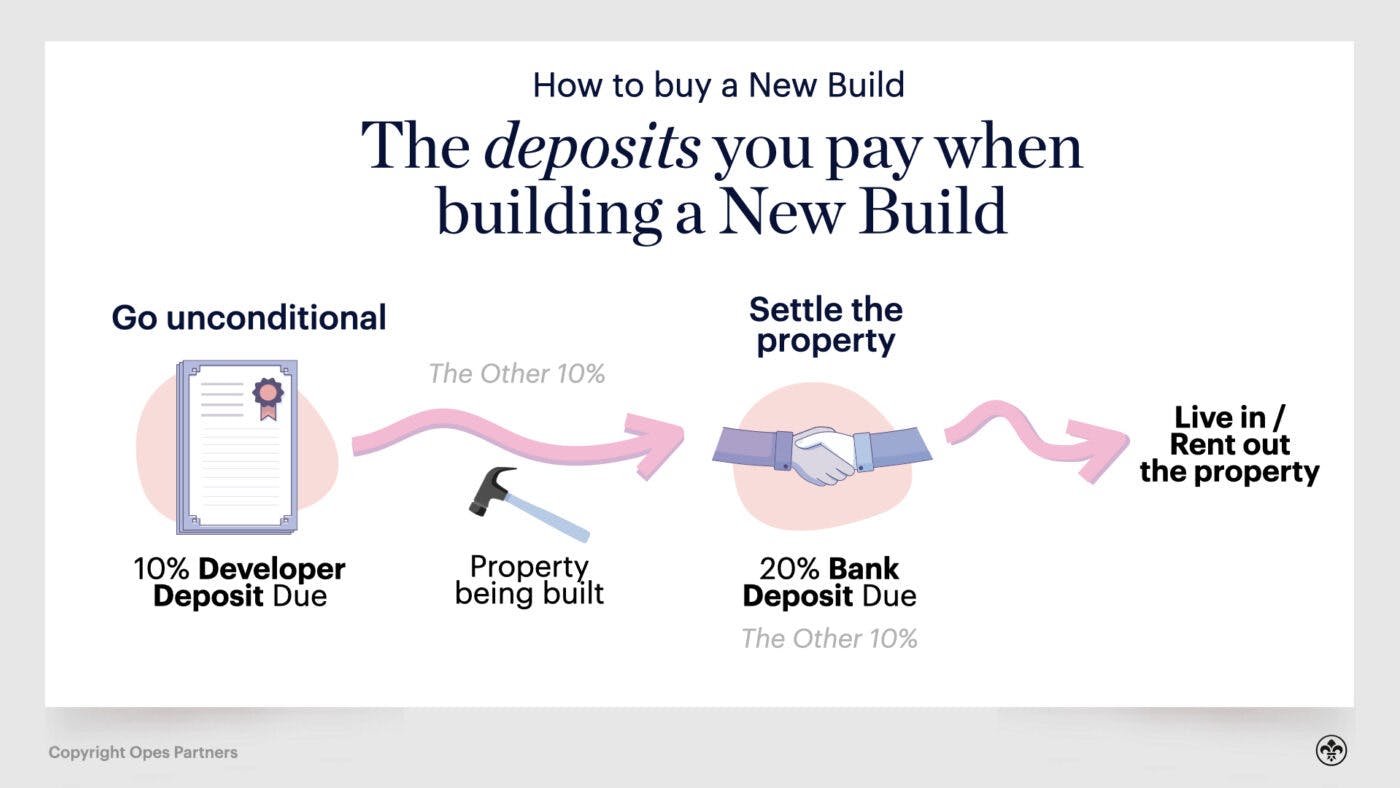

To answer this question, you need to know that there are two types of deposits – developer deposits and bank deposits.

A developer deposit is usually 10% (but can be negotiated down to 5%) of the off-the-plan property’s price.

You pay this to the developer when you go unconditional and confirm that you will buy the property. You’ll then pay the balance of the money at settlement once the property is built.

You pay this deposit to secure the contract, but the money doesn’t actually go to a developer.

Instead, the funds are paid into a solicitor’s trust account until the property is built. That means that if the developer goes bankrupt, you still get your money back.

On the other hand, a bank deposit is different because it dictates how much equity you need for the bank to lend you the money. And the amount you need changes based on whether you’re an investor or an owner-occupier.

New Builds are exempt from LVR restrictions and only require a 20% deposit.

This is smaller than the 35% deposit investors must front if buying an existing property. That’s because LVR restrictions mean banks will only loan you 65% of the value of an existing property.

To put that in monetary terms, let’s say you want to buy a New Build property priced at $600,000. You only need a $120,000 deposit (20%).

But if you wanted to buy the same $600k property as an existing property, you’d need a $210,000 deposit.

It’s a massive difference.

While the minimum deposit required for a property for you to live in is technically 20% under the LVR restrictions – many first home buyers will actually purchase a property with only a 10% deposit.

In fact, about 9.6% of new loans given out by banks to owner-occupiers use less than a 20% deposit.

So, for instance, let’s say you want to buy a New Build property priced at $600,000. If you can secure a loan with a 10% deposit, then you only need $60,000.

Some of this may come from the government through the financial incentives they give to first-home buyers.

Some investors think banks prefer to lend to people who buy New Builds.

Peter Norris, a mortgage adviser from Opes Mortgages, says this overall perception comes from banks. For New Builds banks:

“So, it could look like they are more willing to lend on new than existing, but it’s not quite that simple,” Peter says.

So, it’s not so much the case that banks are more likely to lend on a New Build, rather, they have a preference for turnkey purchases because they are a fixed price.

The question of: “What’s the definition of a New Build” has become a hot topic. This is because new interest deductibility tax changes encourage investors to purchase New Builds.

So, investors naturally want to make sure any new purchase receives the incentives.

The initial definitions have just been released by the IRD – however, these could change based on feedback and political maneuvering that may happen before the legislation is passed.

A property will be considered a New Build if

This is a more generous definition than was initially announced in the IRD's initial consultation paper. In that document, the cut-off date for the CCC being issued was 27th March 2021.

Bringing the cut-off date backwards will mean that more property investors can define their properties as New Builds. And those investors won't have to face paying higher taxes.

New Builds will receive an exemption from the tax changes for 20 years after the CCC is issued.

Put simply, if an investor had a New Build where the CCC was issued in July 2020 – they'll pay relatively lower taxes (compared to other property investors) until July 2040.

By that point, the property will have experienced 20 years worth of rent and house price increases. So it will likely be able to comfortably cover the higher taxes without the investor needing to dip into their own pockets.

It's also important to point out two other factors:

Say an investor purchases a property and decides to sell it after 5 years. The following person who purchases the property can still claim the tax exemption and pay lower property taxes for the next 15 years.

This gives confidence to both property investors and first-home buyers because New Builds are more likely to retain their value.

Because the New Build exemption starts once Code Compliance is issued, some property investors will be able to claim the exemption for more than 20 years. How?

Let's say you purchase an apartment in Wellington. It wouldn't be unheard of for the property to take 2 years to be built. Your interest over that time will still be tax-deductible.

The interest deductibility clock doesn't start until the property is built and signed off by the council.

That means by the time the investor potentially faces higher taxes, they've had 22 years of rental inflation to help them battle the higher costs.

Some properties that you wouldn't have thought would count as a New Build, will be defined as "new" under the new tax code.

These are broadly referred to as "Complex New Builds"

For instance, if you convert one house into two smaller dwellings, that’s a New Build under the new tax rules.

To come under this definition, an investor could purchase an old 5-bedroom villa in Ponsonby. The investor could then modify the house into two 2-bed dwellings. Both new residences count as New Builds, even though they have been crafted out of one existing property.

Another example of complex New Builds is a minor dwelling built on the back lawn – the debt associated with that would be considered a New Build.

Alternatively, if you relocate one property from down the street and put it on a new piece of land – that's a New Build too.

Finally, commercial office buildings converted to residential apartments are also considered New Builds under these tax rules.

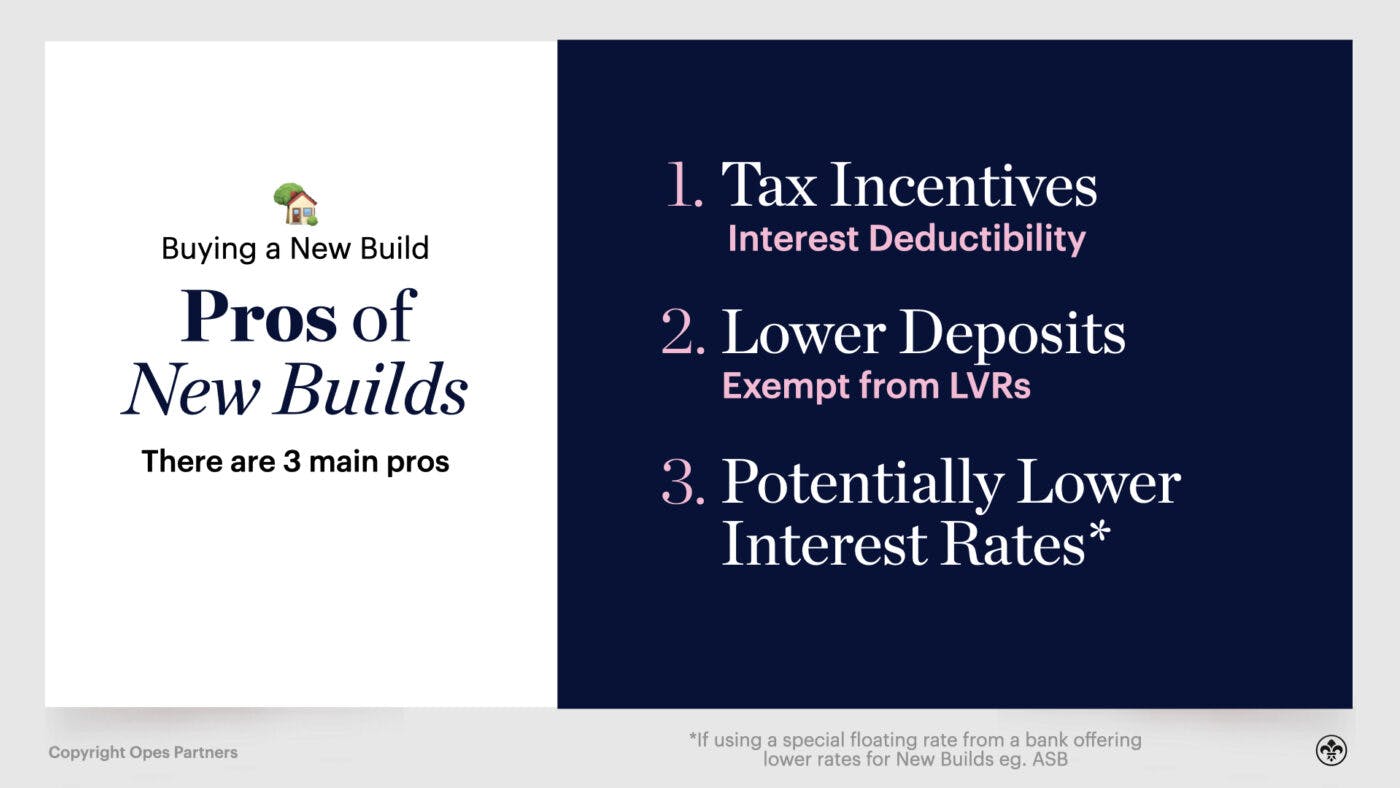

Recently, the highest-profile benefit discussed in the media is that New Builds are exempt from the government’s interest deductibility changes.

This means investors who purchase New Build properties will pay less tax than those who buy existing properties.

Let’s say an investor has a mortgage of $600,000. They will likely save about $5,000 a year in tax if purchasing a New Build. This creates a significant advantage for those buying new.

New Builds also require less deposit than existing properties. It’s only 20% for New Builds vs 35% for existing properties.

This means you can buy twice the number of properties with the same amount of deposit if purchasing New Builds.

Banks are also offering higher cashbacks and lower interest rates for would-be New Build owners for investors and owner-occupiers.

For instance, ASB will reward green developments with a 6-star rating or higher with a $3000 cashback in addition to any others they would receive.

And both ANZ and ASB are offering ultra-low floating interest rates for New Builds, just 1.68% and 1.75%, respectively, at the time of writing.

But pushing the figures to one side, there are also practical pros of investing in a brand-new building.

You can reasonably expect there will be lower maintenance. Not only is the standard of build getting better over time, but just-installed fittings aren’t likely to wear out any time soon.

A newer build can also be marketed at the more premium end of the rental market, which means higher rents – and fewer party-house tenants.

If purchasing as a first home buyer, you can get twice the cash contribution from the government if purchasing new compared with purchasing an existing property.

Lastly, the value of your New Build property often increases in value during construction because properties usually have to be sold at a discount for someone to buy them off the plans.

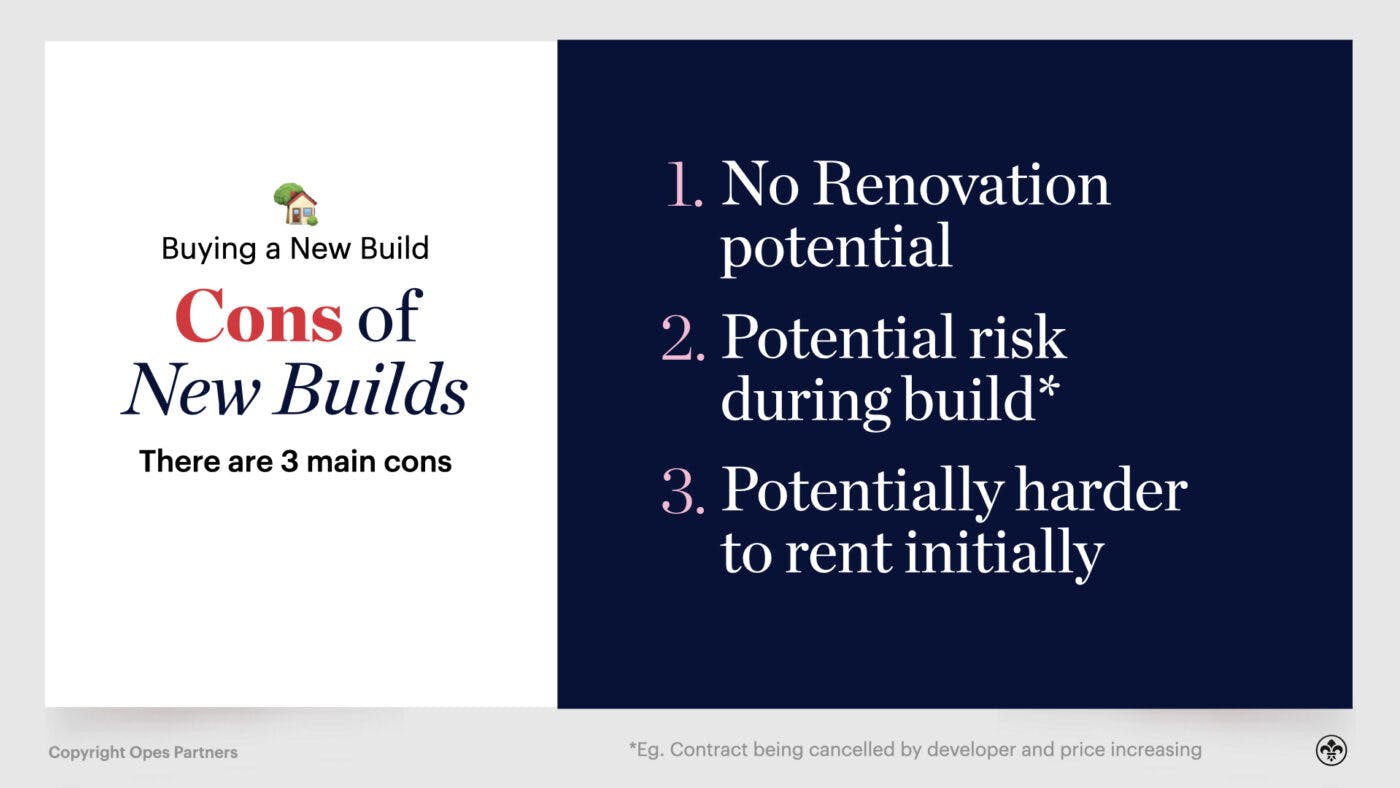

First of all, you can’t renovate a New Build. So, there’s no way to rapidly increase equity on your property.

You are signing up for a very long-term game of investing for capital gains.

In fact, if you were to renovate a brand new property, you would likely over-capitalise and not get a return on the money you spent.

Another point is you have to wait for the home to be built when you buy off the plans. You can’t necessarily move in straight away.

For owner-occupiers, this means waiting for your home before you can move in. For investors, it means waiting to be able to tenant the property.

Finally, investors need to consider what happens when a New Build is completed.

If buying into a block of 8 properties – all 8 may be looking for tenants simultaneously. That’s assuming all are purchased by investors.

This means you probably only want to buy into a development like this if the rental market can support the number of properties coming to market. Some areas can, others can’t.

Yes and no. It depends on both you as the investor and on the property itself.

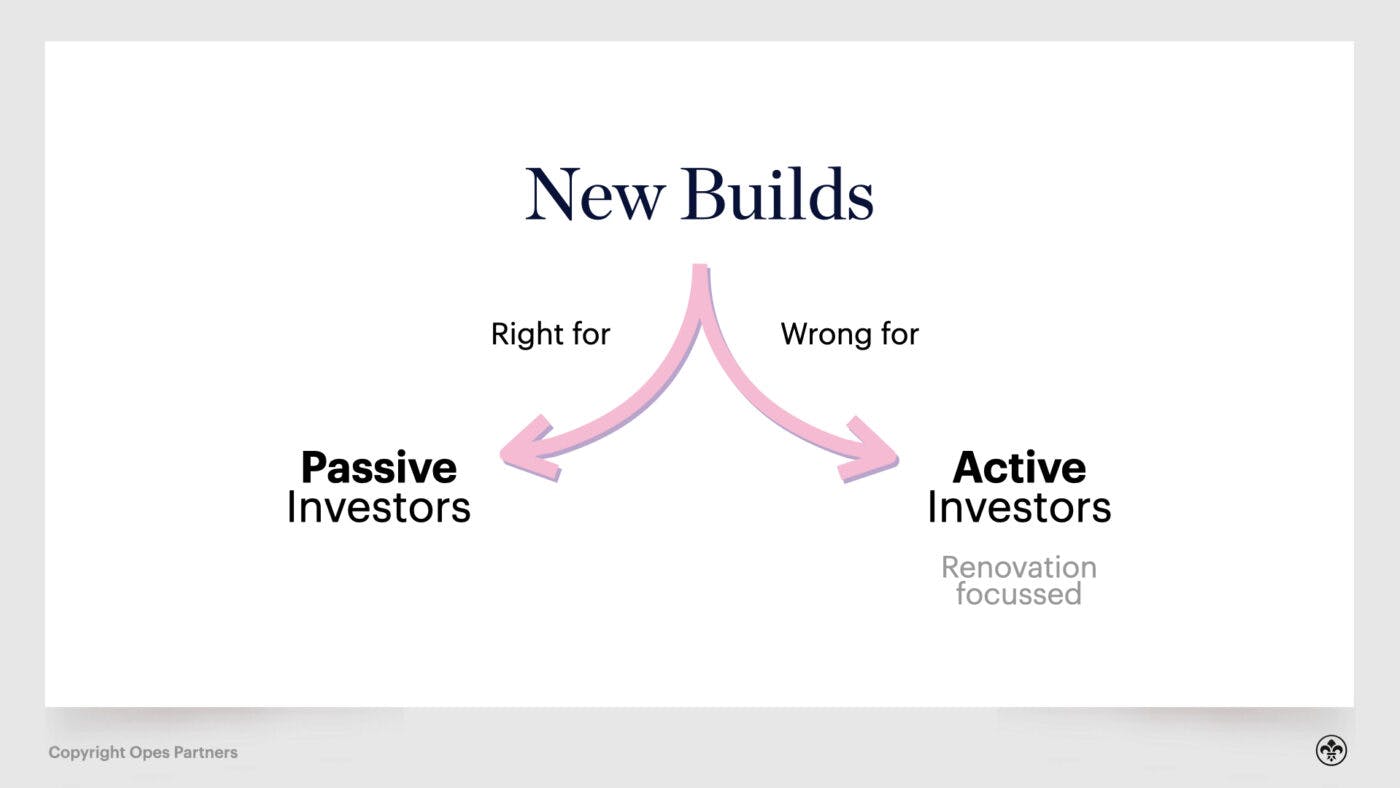

Firstly, New Builds are excellent investment properties for people who want a passive investment strategy.

Instead, these people would prefer to focus on their careers and family. For them, the alternative of being at the end of a paint brush every weekend doesn’t appeal.

But, if you are heart-set on renovating properties for fast equity, then no, New Builds probably aren’t a suitable investment property for you.

Even if you find a good developer – it doesn’t mean that every property they build is a suitable investment property.

For instance, Opes’ Partners regularly works with 57 developers we have looked into. These are developers who have a solid track record and have proven they build quality housing.

We then recommend these developers’ properties to investors as part of our coaching programme.

But would we recommend every single property that each developer builds? No.

That’s not because the properties are of lousy quality. It just means they aren’t smart investments.

To give an example, let’s say the developer is kitting out the build with high-end benchtops and finishings. All the walls are painted to a grade 5 architectural standard (extremely high quality).

These properties are going to be expensive compared with other properties on the market. And tenants are unlikely to pay a whole heap of extra rent compared to the additional cost.

So while you might indulge in these luxuries if buying a “forever home”, you probably wouldn’t buy these properties as an investor. That’s because the extra spending doesn’t equate to more rent from tenants, so it doesn’t make financial sense to pay the additional cost.

The “normal” routes for buying a New Build property can be the same as any other purchase. You can search TradeMe, go through a real estate agent, or go to a developer directly.

However, there is one other alternative that most Kiwis don’t think to consider, which is to use a property investment company like Opes’ Partners.

This is where you build a property investment plan with a Financial Adviser, who then goes and selects the suitable New Build investment properties to fit your plan.

This alternative is more popular than you might think.

For instance, between January and June 2021, Opes’ Partners helped investors and first home buyers buy more townhouses than all the real estate agents in the area combined.

It’s not the norm, but it’s a great alternative to consider. Especially if you think your property investing would benefit from a more financially holistic approach.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.