Property Investment

The ultimate guide to capital growth

Many property investors and homeowners need capital growth. They rely on house prices increasing, slowly over time, to fund future plans.

Capital Growth

4 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

It’s common to think that areas with strong population growth see faster rises in house prices (also called capital growth). But is this true?

Our data suggests, while there is a trend, it might not be as cut and dry as people think.

Yes, a rapidly growing public requires more housing. But a greater demand for housing also increases building. So, just because more bodies need more places to live, it doesn’t mean prices will also automatically surge.

So, while there is a trend/correlation between the two, it’s not a given. Let’s dive in and see what the data says.

The traditional way of thinking seems sound: More people equals more demand for houses, equals higher house prices.

And more population means better long-term prospects for a city. Larger populations can support more businesses and more people means more stuff going on. All in all, these factors equate to a vibrant city people want to move to.

So, for investors this means purchasing in areas of high population growth to see a better return in capital growth, right?

Opes’ managing partner Andrew Nicol admits he also believed the assumption that population had the biggest effect on property prices. But after looking through the actual figures, he’s says it’s not 100% the case.

The opportunity to test a well-believed assumption was the perfect excuse to delve into the data.

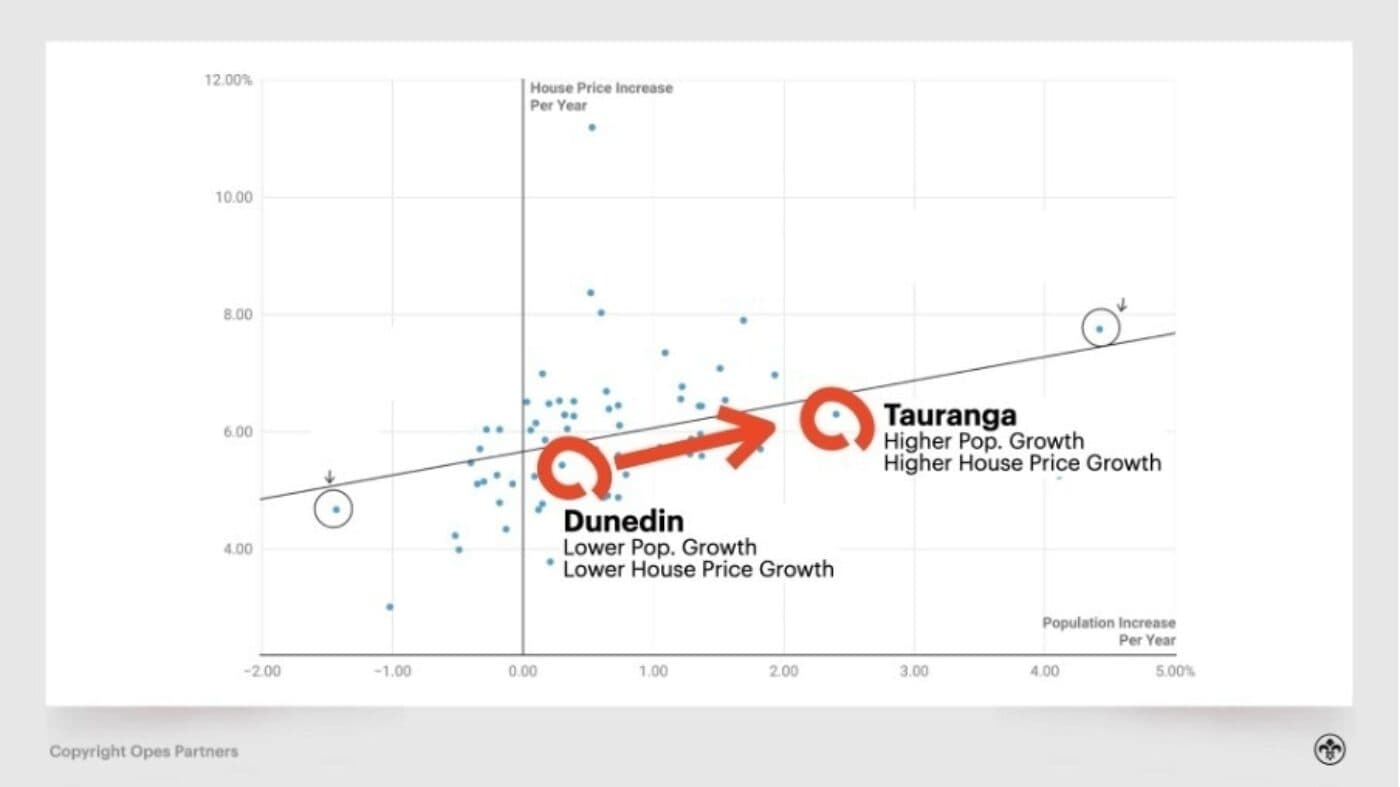

So, in the below graph we took the capital growth data from every council area in New Zealand and compared it with its population growth.

This data ranges from 1996 to 2018. This is the most up-to-date population data we could get at the time of writing in late 2021.

Nonetheless, even if the data is a wee bit stale, it can help us test the assumption.

There are three key takeaways from the data.

When you map out the data and draw a trend line – on average, an additional 1% of population growth per year turned into an extra 0.4% of house price growth per year.

Take, for instance, Dunedin vs Tauranga City. Dunedin had a population growth of 0.3% per year, while Tauranga received 2.4% per year.

So the trend line says Tauranga should get about 0.8% more house price growth per year – since the Bay of Plenty capital got 2.1% more population growth per year.

So how did house prices go over that time?

Dunedin City – 5.4% per year. Tauranga City – 6.3% per year. A 0.9% difference – not far off what the model predicts.

So, while extra population growth appears to influence house prices, the effect isn’t 1% point population growth = 1% point house price growth.

Even areas with a shrinking population still achieved healthy capital growth over the period we looked into.

Take Ruapehu District for instance. Between 1996 and 2018 the population declined by 1.43% per year. So, there are now a lot fewer people in the region to purchase houses.

But, over this time, house prices still increased 4.67% annually.

Yes, we’ve found a trend, but it’s not a rule. So it’s not true everywhere.

For instance, Selwyn District had enormous population growth but not an enormous amount of capital growth within this period.

Why?

There are other factors at play. Let’s take a look at rolleston (in the Selwyn District) as an example.

People moved to Rolleston after the Christchurch earthquakes. That’s because land was cheap and the dirt underneath the houses solid.

Because the town had a plentiful land supply at the time, and house building was strong, there were enough houses to meet demand … even as Cantabrians flocked there.

So we didn’t see the demand, supply imbalance that tends to cause house price to rise.

However, one thing you won’t see in the data (since it stops in 2018) is that since then house prices in Rolleston have skyrocketed by over $150,000.

Why? Because the land is no longer as plentiful, so house building is now restricted, but the population is still booming. In this case, Rolleston’s house price growth is catching up with its population growth.

How Important Is Population Growth?

Now, we’re not saying population growth doesn’t have an effect on house prices, or that it’s not important. It’s still better to have strong population growth than not.

The key takeaway for investors is it’s not the only aspect to hang your hat on. There are other factors that will impact the future value of your investment property.

For a full rundown on those factors, check out Chapter 3 of the Epic Guide to Property Investment.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser