Case Studies

Case study – retire on 150K passive income

Here’s how this couple plan to use investment properties to build $150,000 of passive income (per year).

Case Studies

6 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

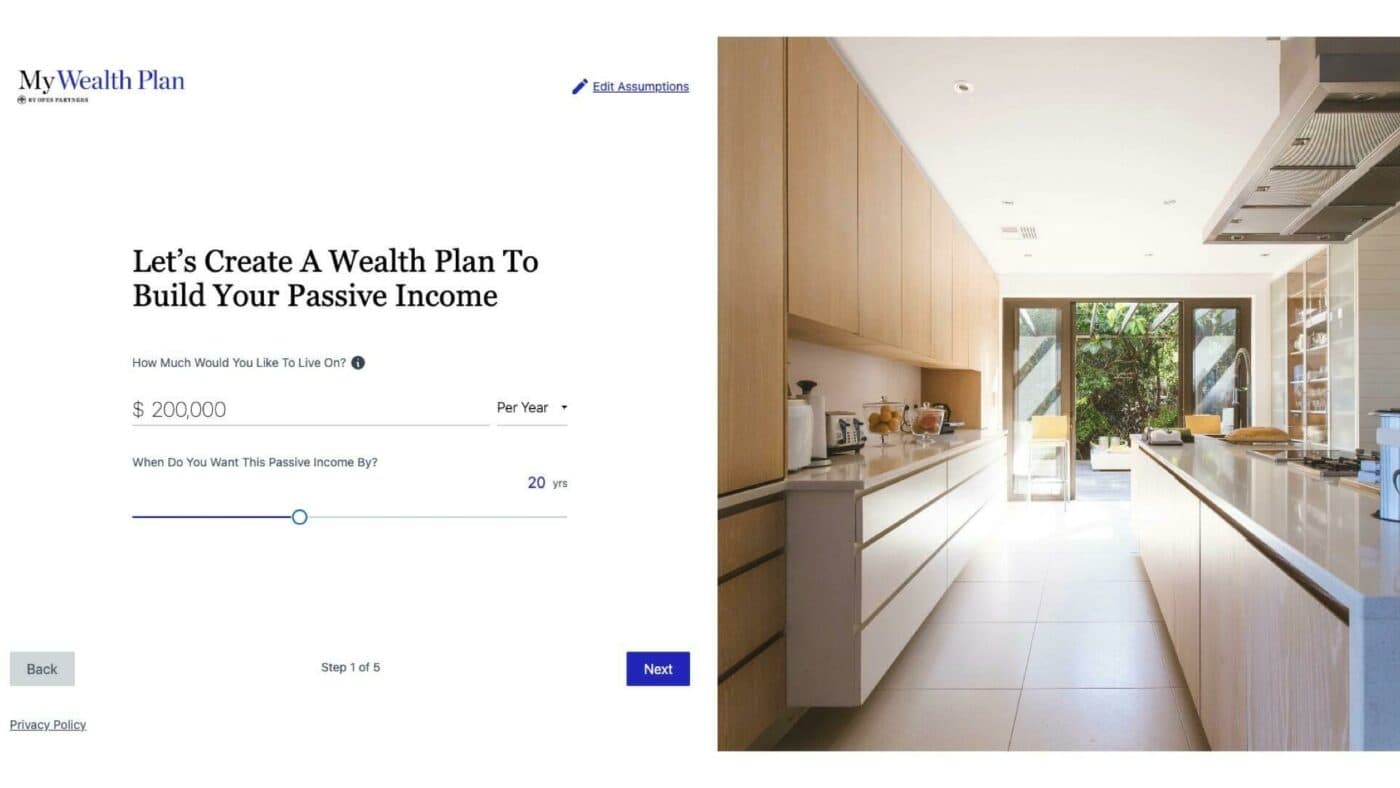

Property Academy Podcast fans (Brian and Deidre) wanted to retire at 55 on a $200K-a-year passive income.

They’re 33 and 35 now, so have 20 years to build this passive income.

Here’s how they plan to use investment properties to replace their current income before they hit early retirement.

Everything in this case study is true to life (goals, salary, property prices, the Opes financial adviser they used). Only the names have been changed to protect their privacy.

Young couple Brian and Deidre are 35 and 33 respectively. Currently, they are on a combined income of around 229K a year.

Before they met an Opes Property partner the couple were already well on their way to reaching their financial goals.

As well as their own Auckland home they had an investment property down the street and had recently bought 2 townhouses in Christchurch.

Together they set an ambitious goal to retire at 55, with a passive income of $200K by the time Brian turns 55. That means they’ve got 20 years to make it happen.

To create a property investment plan you need to figure out what you’re investing for (your goals). Once you have your goals figured out, you can decide how ambitious your plan needs to be.

As we’ve mentioned, our couple have plans to retire 10 years early, earning the same income (more or less) they are on now – $200,000.

To achieve that level of passive income the couple would need net assets of $5 million.

That’s because if you buy a high yielding property, after paying the operating costs (rate, insurance, maintenance etc.), it should return a 4% net yield.

So, if you own a $1 million high-yielding property (without a mortgage), it should earn about $40,000 in pre-tax passive income per year.

Because Brian and Deidre want a $200,000 passive income they’ll need $5 million of net assets (assets – the mortgage).

That sounds like a lot of money (and it is), but Brian and Deidre were already investing, so they were part of the way there.

Secure a comfortable retirement with 3 easy steps

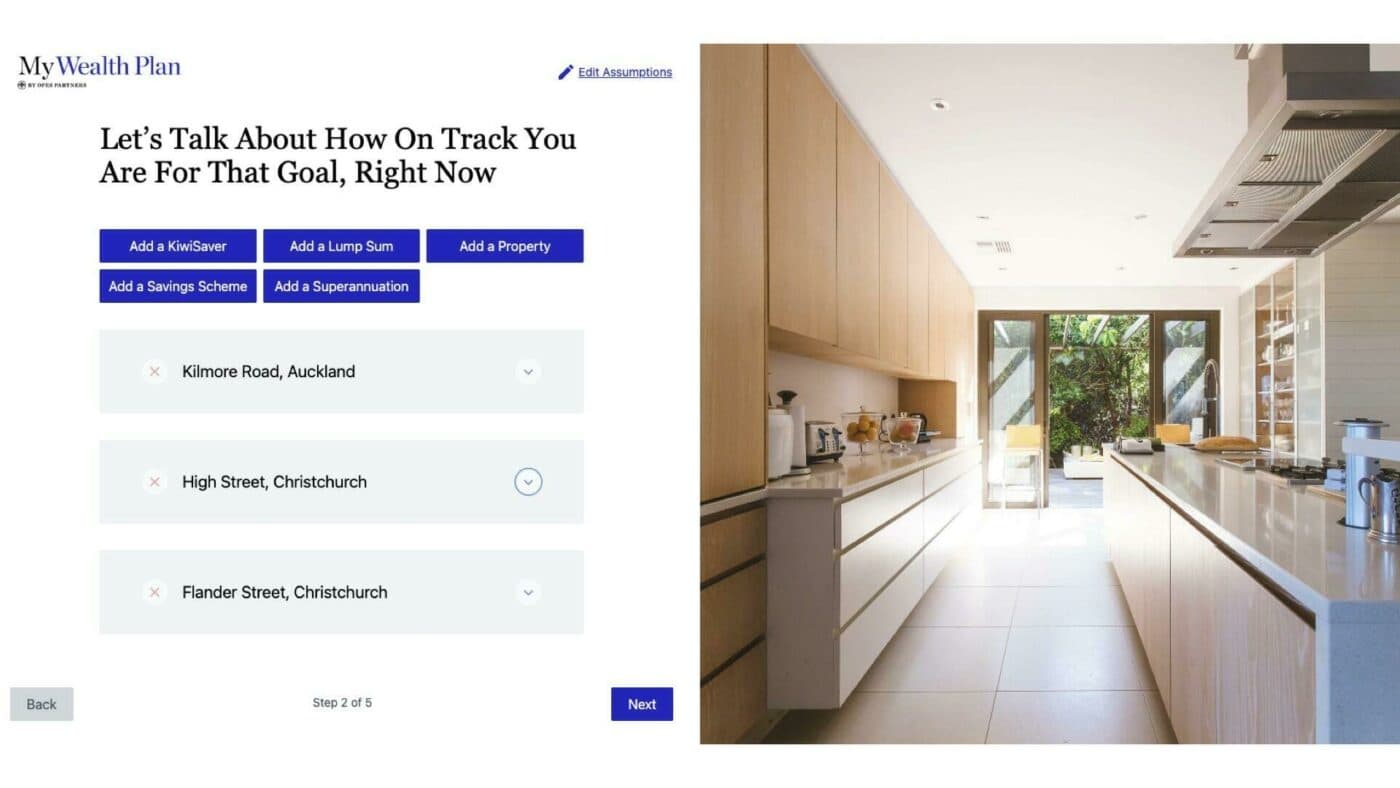

Book your free sessionWith their current investments, the couple were on track to build assets of $4.25 million.

That’s because they’d already racked up 3 investment properties – 2 in Christchurch (1 due to settle in a few months) and another in Auckland.

In addition, they already owned their own home.

Here’s how they looked up until this point:

So the pair already had $691,000 in net assets in their portfolio. And as property prices grow over the next 20 years, this is forecast to grow substantially.

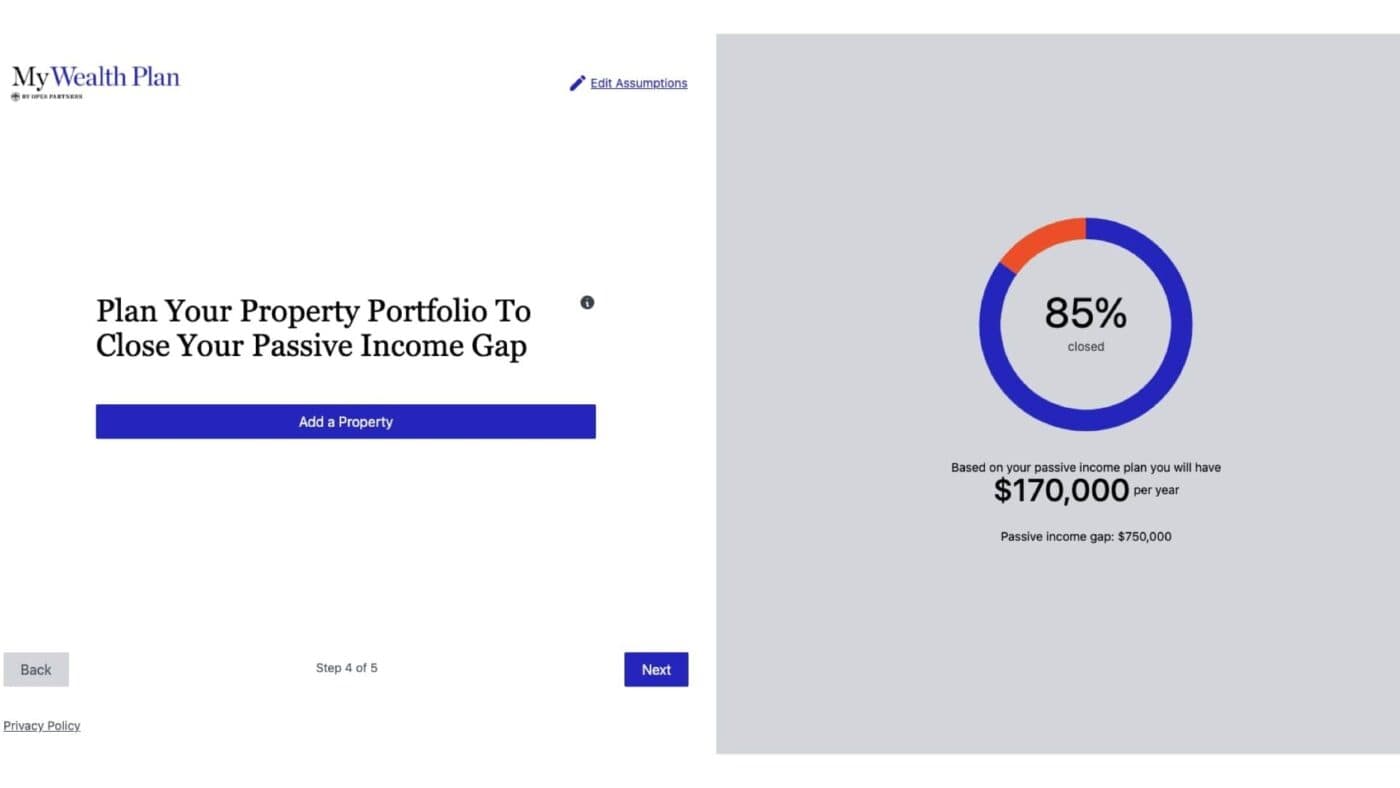

And this was forecast to achieve 85% of their goal.

It’s important to note that even though the pair had money in KiwiSaver, this couldn’t be used within the plan.

Why? Because they want their passive income to start by the time they’re 55, and KiwiSaver can only be accessed after the age of 65.

Similarly, this is why Brian and Deidre didn’t factor the government superannuation within their plan.

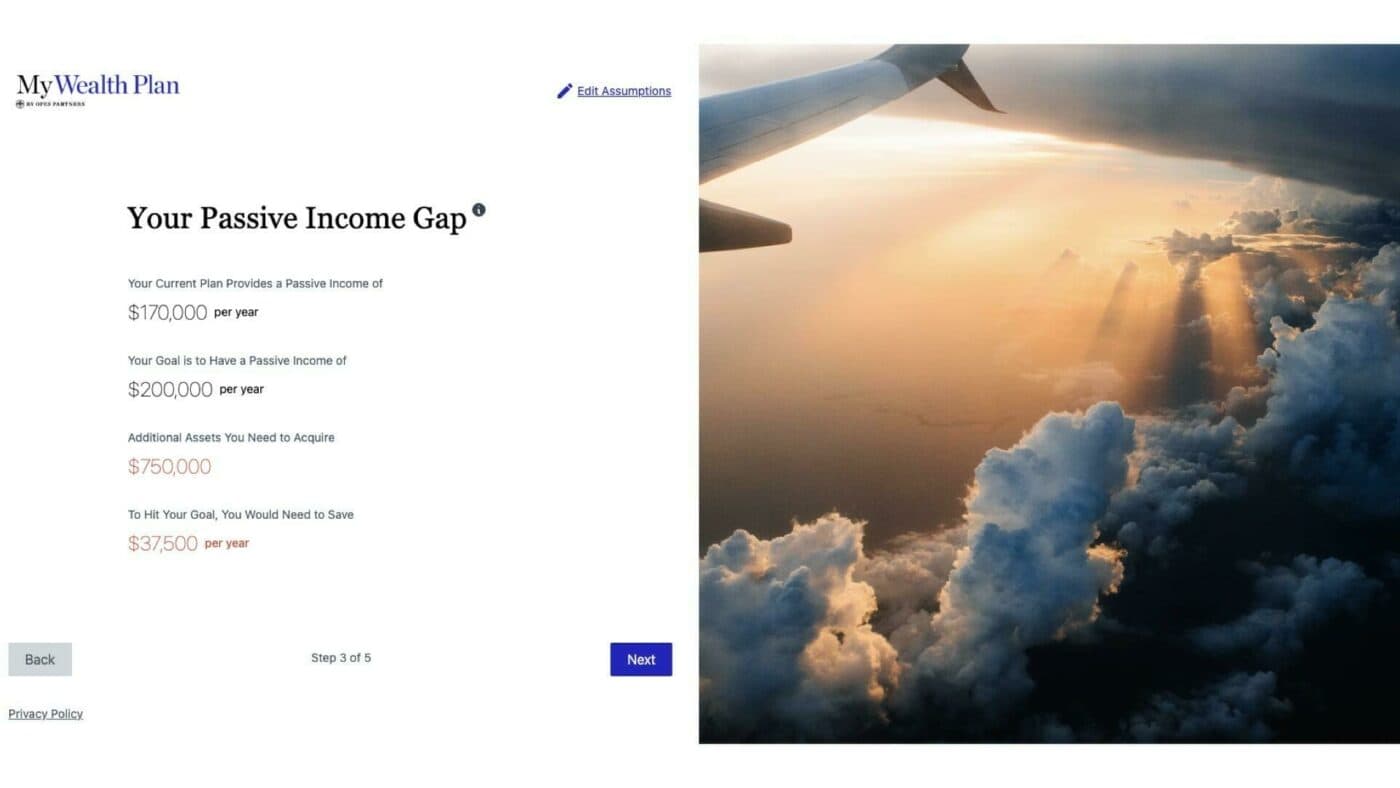

But while they had done extraordinarily well, they still had a Wealth Gap.

They still need another $750,000 of net assets to achieve their goal.

If they didn’t build these assets they’d be $29k short per year in retirement, compared to their goal.

It’s important to note that before this couple built their Wealth Plan they were already well on track to achieving their goal.

And, if we’re being honest, this couple was in a much better position than most investors we speak to.

So, if you’re reading this article thinking “Oh crap, I’m 35 and I don’t own any investment properties yet” ... don’t stress.

So, anyways, back to our couple … how did they make it work?

To achieve their goal, Brian and Deidre would only need one more property. And the minimum amount they’d need to invest was $500k in the Auckland market.

Yup, we heard you – “what can you buy in Auckland for $500K?”

Maybe a hotel room, a leasehold apartment? But you aren’t going to see the value of those types of properties increase in value quick enough to close the couple’s Wealth Gap.

That’s because hotel room and leasehold apartments are yield properties as opposed to growth properties.

Simple, buy a more expensive property right? This is where it gets a bit more complicated.

The bank said “no” to anything more than $500k.

They were stuck.

This is where Andrew – their Property Partner and financial adviser – paused. If they can’t borrow any more money, perhaps there was a better way to structure their current portfolio?

Instead of asking: “How many extra properties do I need to achieve my goals?”, the couple had to consider: “Are our current properties the right ones to continue holding?”

For instance, their Auckland investment property was worth $1 million, but it’s deemed as an existing property, so it gets caught under the government’s new tax deductibility laws.

This will make the property heavily negatively geared, so Brian and Deidre will have to top it up.

In the end, the couple figured out if they sold this Auckland property they would have enough lending to purchase two $750,000 townhouses in Auckland.

For this sort of money, in today’s market, you could probably get a 2-bed townhouse in Glen Eden or Avondale.

That would mean instead of having $1 million of assets in Auckland, they’d have $1.5 million. The extra amount being the additional $500,000 of assets they needed.

On top of this, cashflow would be significantly improved since the newly-purchased properties would be New Builds and have special tax incentives.

From Opes Partners modelling, these new properties would also give a better return.

If Brian and Deidre held onto the existing Auckland property they would get a return of an extra $2.30 per dollar they invested.

But they would get $4.11 back for every dollar if they bought another 2 properties and sold the first one.

So, they were looking at 80% more value, simply by redistributing the money into another property.

There are two tricks involved in Brian and Deidre’s situation.

#1 – Don’t Trigger The Bright-line Test

If the couple did sell their Auckland investment property to buy 2 New Builds, they would have triggered the Bright-line Test.

This would mean they’d pay about $110,000 worth of tax and agent’s fees.

So what did they do?

Instead of selling their Auckland investment property, they decided to sell their own home (which was down the street) and move into the Auckland investment property.

Why would they do this? Because if they sell the investment, they pay tax. If they sell their own home, they won’t.

This will free up enough equity to still progress their Wealth Plan.

#2 – Shaving $400,000 Off Their Home Loan

The other trick is, because they still had a sizeable personal mortgage, the couple plan to take any additional money from the sale and pay down their mortgage. This will decrease their personal home loan by about $400k.

In doing so they will decrease their mortgage repayments so they have more money to contribute to their investment properties.

Brian and Deidre have made big moves to increase the size of their property portfolio.

They’ll sell their own home and move into one of their investment properties all so they can buy an extra rental.

But in doing so, they’ll close their Wealth Gap and be on track to build that $200k passive income by the time they’re 55.

The sacrifices are worth it.

As you can see from their story, often investors will have opportunities to increase the size of their portfolio (even if the bank says “no”). But, to see these opportunities, you sometimes need to work with a financial adviser who has worked with many other similar investors in the past.

If you want the same service Brain and Deidre got, your next step is to book a Portfolio Planning Session with us here at Opes Partners.

This is where you and a financial advisor will use the MyWealth Plan software to create a similar plan to Brian and Deidre’s.

Your next step is to book a portfolio planning session. This is where you and a financial adviser will create you a financial plan.

Book your free sessionJournalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser