Case Studies

Case study – retire comfortably at 55

Here’s how they plan to use investment properties to replace their current income before they hit early retirement.

Case Studies

6 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Here’s how this couple plan to use investment properties to build $150,000 of passive income (per year).

Everything in this case study is true to life (goals, salary, property prices, the Opes financial adviser they used). Only the names have been changed to protect their privacy.

Steph and Bayley are 47 and 37 years old. Bayley is a nurse and earns $70,000 a year. Steph is in HR and earns $137,000.

Because there is a reasonable age gap (10 years) between this couple, their retirement timelines are different.

They want to retire at the same time – with Steph retiring at 65, and Bayley at 55.

It’s important they stop working at the same time so they can spend their retirement travelling 6 months at a time. They plan to move to warmer climates – like Greece – during the New Zealand winter.

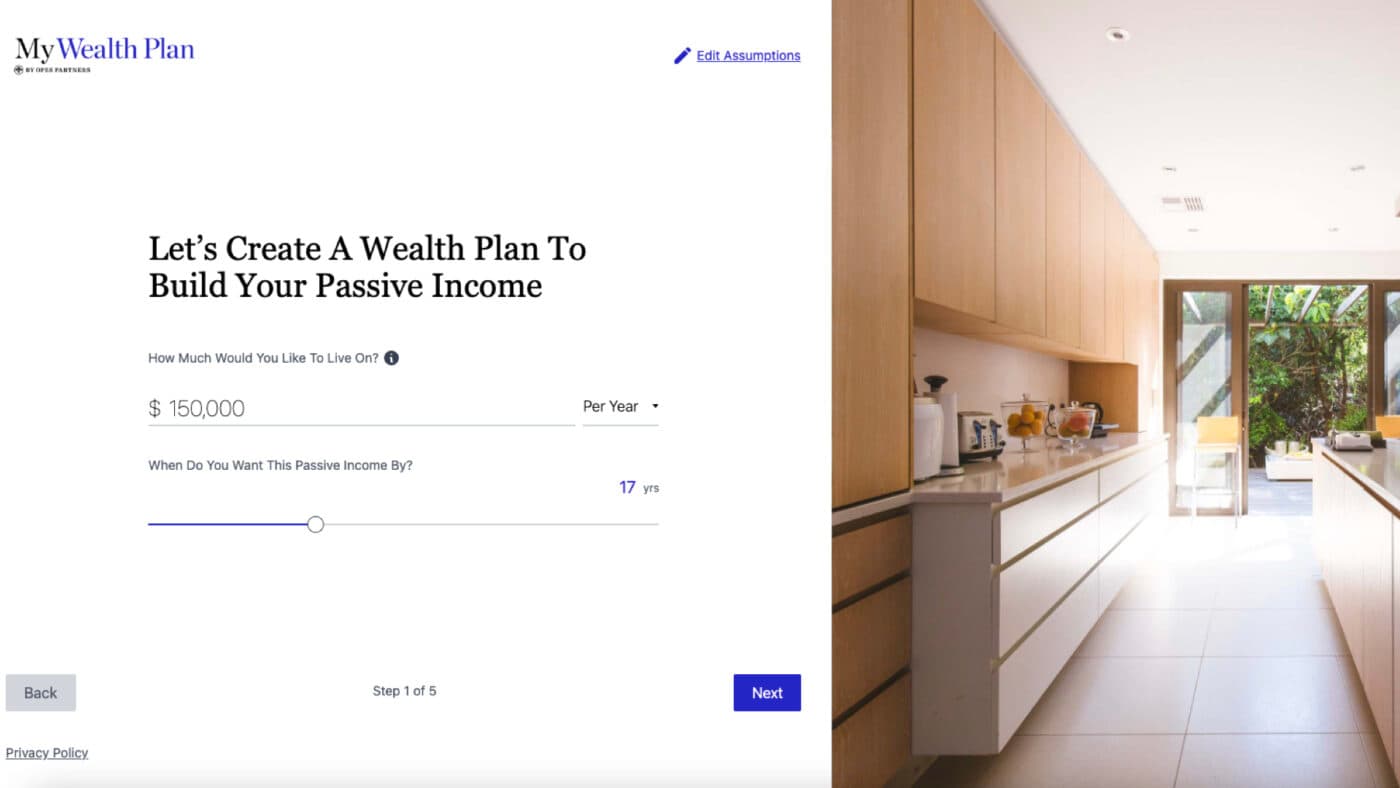

To achieve this goal, the couple set themselves a target of $150,000 annual passive income, by the time in 17 years time – when Steph turns 65.

In addition to their retirement goal, they also want to help their son to get on the property ladder.

To create a property investment plan, you need to figure out what you’re investing for (your goals). Once you have your goals figured out, you can decide how far you’ll need to go in property investment to achieve.

So, let’s look at our couple: Steph and Bayley.

Their goals for retirement are:

To make these goals a reality, they think they’ll need to generate a passive income of $150,000 when they retire (measure in today’s dollars).

This is a bit lower than their current, combined salary. But remember – in retirement they won’t be paying a mortgage, so they don't need to earn as much as they do today.

To achieve this they need to build $3.75 million of debt-free assets in the next 17 years.

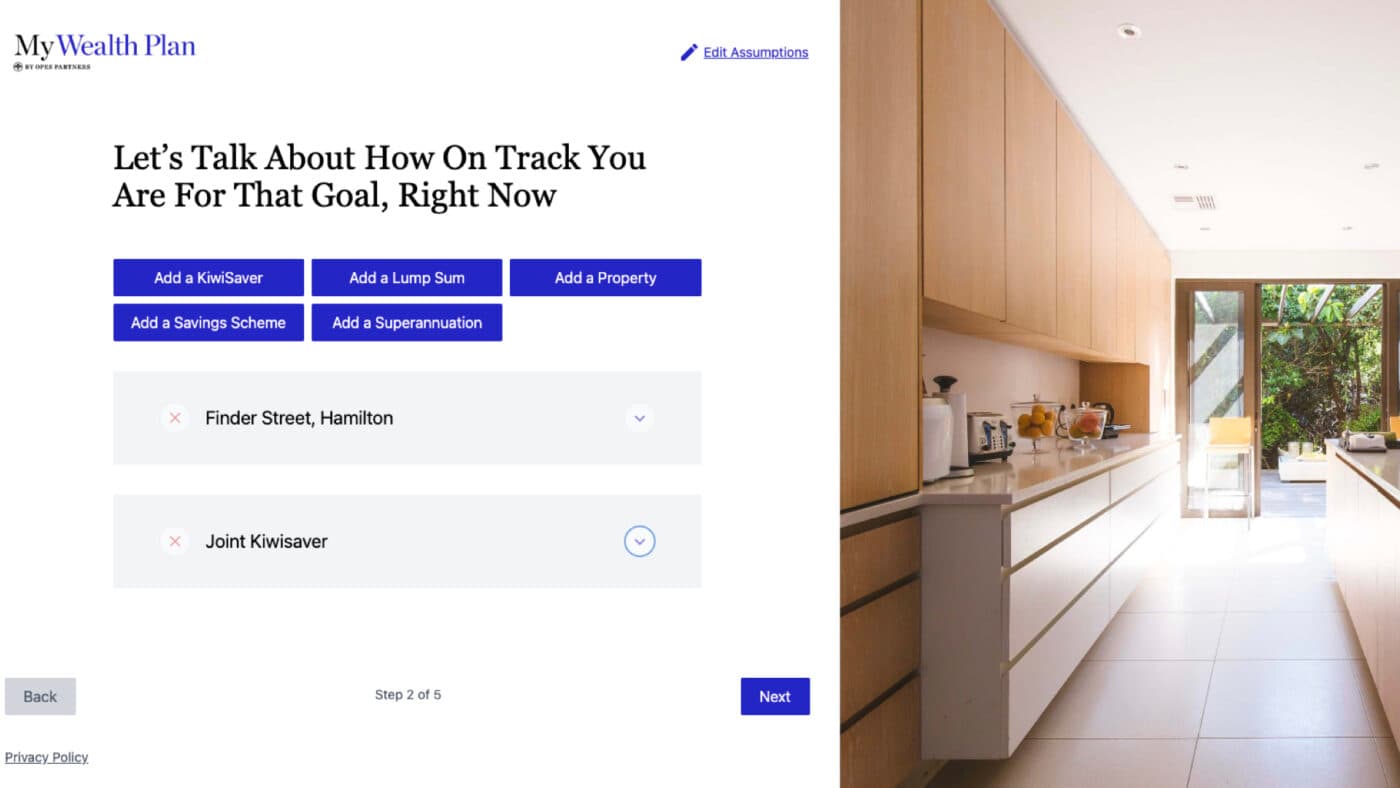

Once Steph and Bayley had their goal figured out (build $3.75million of debt free assets), they could figure out how close they’d be based on what they were currently doing.

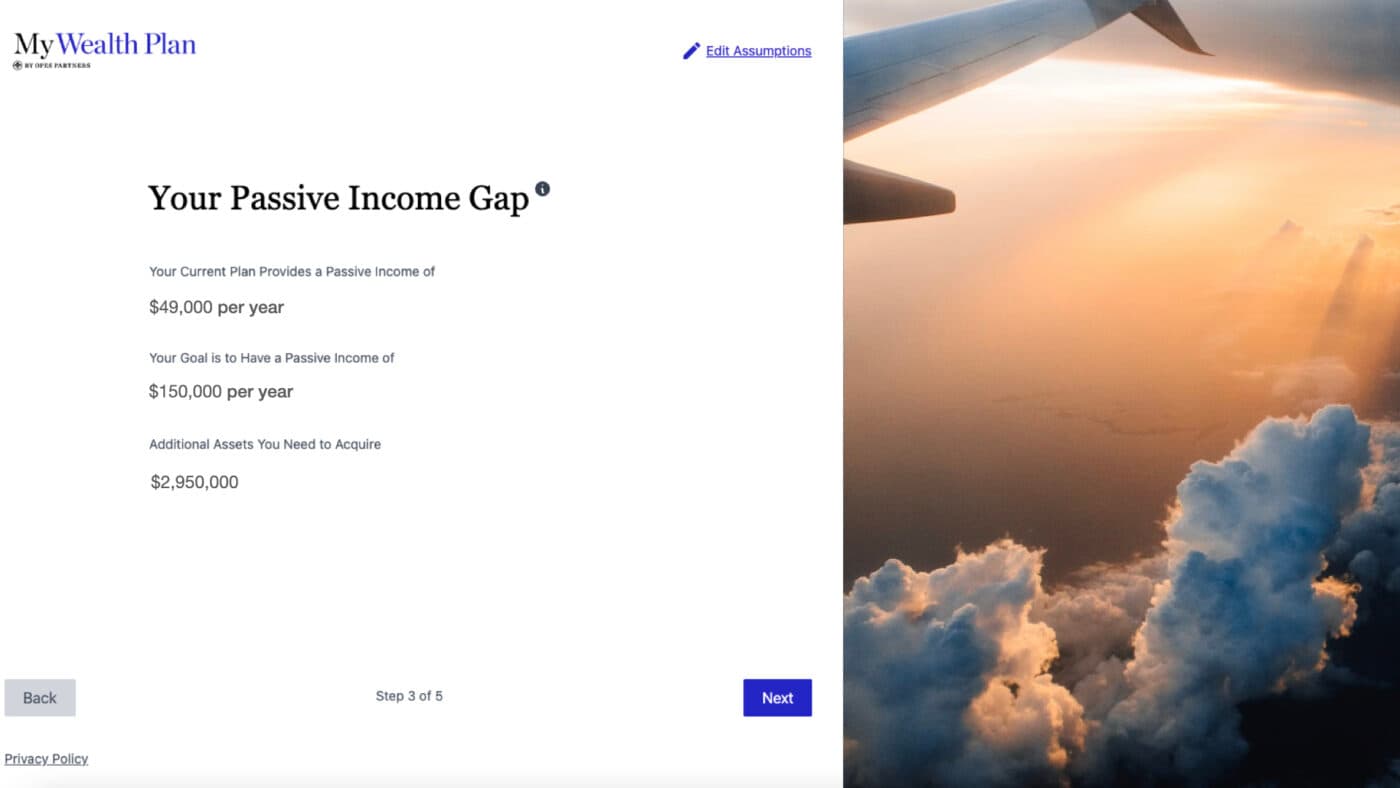

The Wealth Gap is the difference between your financial ambitions, and what you are on track to achieving.

Many investors find that they need to buy more assets because they are not currently on track to achieve their ambitions.

14 months ago, when the couple first began their property investment journey they were on track to hit one third of their goal.

This means if they did nothing else – they would have $49,000 a year of that $150K.

This passive income came from four factors.

Yet, even after these four factors, they would still need to build a sizeable number of assets.

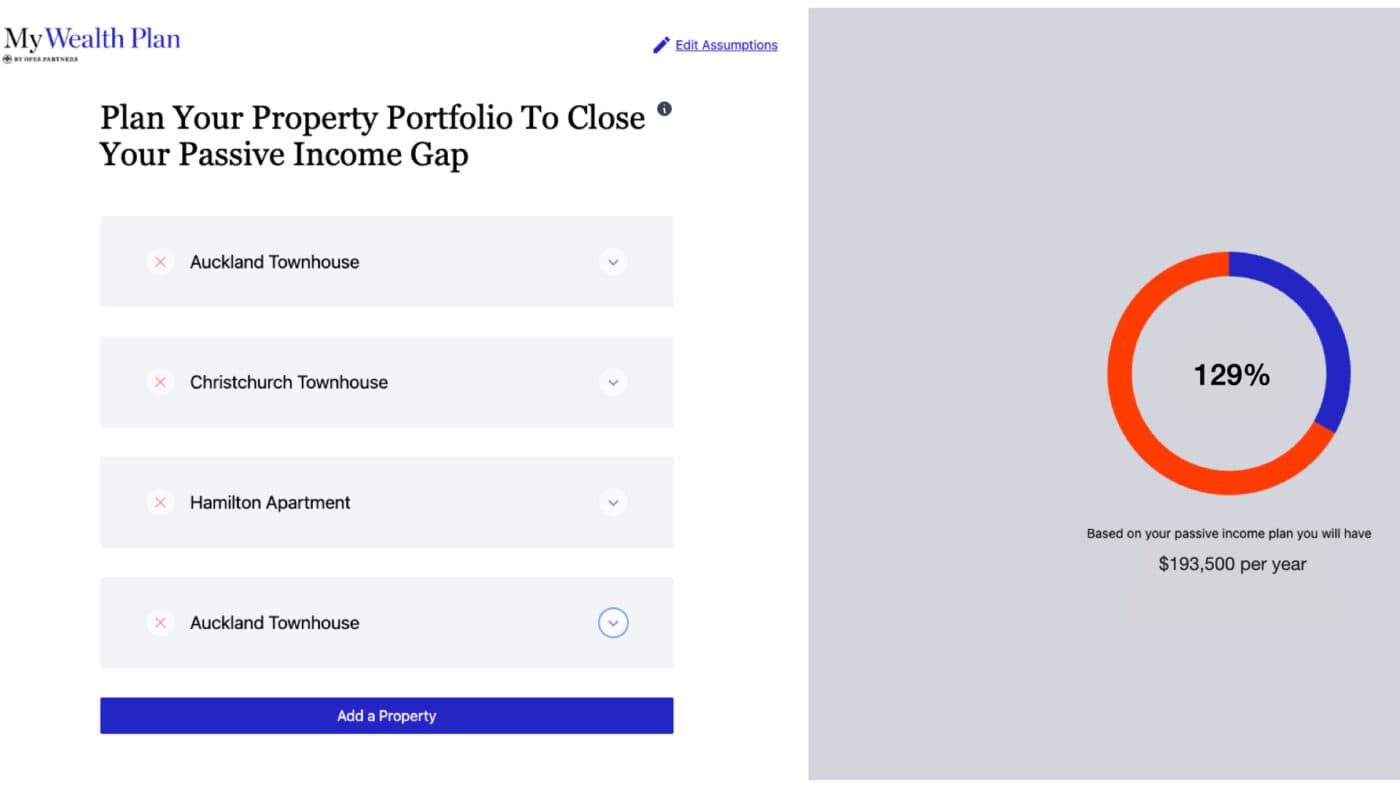

So in mid-2020, the couple planned to invest in:

Based on these properties increasing in value by 6% and 5% a year respectively, these properties would take them to 80% of their goal – $120,000 of passive income a year.

At the time, the couple decided to purchase both properties, which have now settled and been rented out. And since putting the properties under contract, both properties have increased in value substantially.

Today, the Auckland property is worth $900,000, and Christchurch is $650,000.

Together, these properties have contributed $250,000 towards the couple’s retirement plan in just 12-14 months.

And even though the properties were initially forecast to be negatively geared, since rents have increased the properties are now cashflow neutral. They pay for themselves.

I recently sat down with these investors again to review their plan and see how the investments were progressing.

They both said: “Let’s buy another one”. After all, they still had a wealth gap to fill.

For this property they wanted to invest in Hamilton.

This is not an area we tend to recommend at Opes (at the time of writing), because the rents haven’t kept up with house prices, so the rental yields are low.

Based on the couple purchasing a $700,000 property – likely a 2-bedroom apartment – the couple would close their wealth gap to 96% of their $150k passive income goal.

However, we also considered investing in a an addition property in Auckland, priced at $1 million to further close the gap.

These 2 extra properties would require Steph and Bayley to contribute $300 per week towards the negatively geared cashflow. That’s because they weren’t using a cash deposit, and were borrowing all of the money from the bank.

Together, these two properties are expected to close their wealth gap, and hit 129% of their passive income goal.

This gives the couple more options.

Based on the projections, Steph can retire 2 years earlier and still meet 100% of their $150K a year passive income target. That’s a bit more time to spend on the beach in Greece.

In Steph and Bayley’s situation, the inheritance factor was unique because it was such a sizeable amount.

The problem with adding inheritance to a wealth plan like this is … you must a) know the size of your inheritance (no guessing), and b) be sure you’re going to get it.

That means having the confidence that the person will pass by the time you kick start your retirement plans (harsh, I know).

Steph knows the exact amount of her inheritance. But, what if Steph’s mother lives beyond the 17 years leading up to Steph’s retirement?

Achieving their passive income goal hinges (in part) on this large sum of money.

That’s why, when Steph and Bayley re-ran their numbers with the additional two properties, they removed the inheritance from the equation.

Even with that $750,000 taken out, they’d still be on track to meet 114% of their goal.

So, in total the properties, Steph’s superannuation and their KiwiSaver will take them to $150,000 passive income they wanted – no inheritance needed.

The 5 properties (1 already owned and 4 newly acquired) doing the bulk of the heavy lifting.

If you want the same service Steph and Bayley got, your next step is to book a Portfolio Planning Session with us here at Opes Partners.

This is where you and a financial advisor will use the MyWealth Plan software to create a similar plan. Click here to book.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser