Property Investment

Quiz: Should I invest in growth or yield properties?

Find out if you should invest in growth or yield properties

Property Types

5 min read

Author: Nefe Teare

Financial adviser at Opes. Formerly a senior adviser at one of NZ largest investment firms. Owned 3 properties by 30.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

One of the big decisions property investors need to make is whether to buy a growth or a yield property.

After all, Growth properties increase their value faster. But they don’t have the best rent and cashflow.

On the other hand, yield properties have a much higher rent. But, they don't grow in value as quickly.

So people often ask me: “Kathy, what are the differences between the two? And which one should I invest in?”

Both are important parts of a property portfolio. But the right choice depends on your age, current portfolio size, and goals.

In this article, you'll learn the differences between property types. You’ll also learn how to figure out which one works better for your portfolio.

As mentioned, growth properties go up in value faster, but they don’t have the highest rental return.

These properties tend to be standalone houses and townhouses in a good area or neighbourhood.

Often, they're the sort of properties owner-occupiers want. That means you’ve got lots of demand when you sell, and buyers bid up the price.

It's traditionally thought that owner-occupiers make more emotional buying decisions, compared to investors. So they'll "overpay" for their dream family home.

Because of this, a growth property tends to be a single dwelling in which one family can live.

Here's an example of a high-growth property:

A yield property tends to get a higher rental return. But, they don’t go up in value as fast.

For example, room-by-room rentals are a classic yield property. That’s where you have a four-bedroom property, each with its own self-contained en-suite. But there is a small communal lounge and kitchen area.

(In this set-up, you sacrifice living space for bedrooms.)

The result is a high yield because the investor can rent each room.

This is great for investors but less attractive to owner-occupiers. Think about it, families tend to want more space in living, kitchen, and dining spaces.

Because this set-up will likely appeal only to investors, the property's value will grow more slowly.

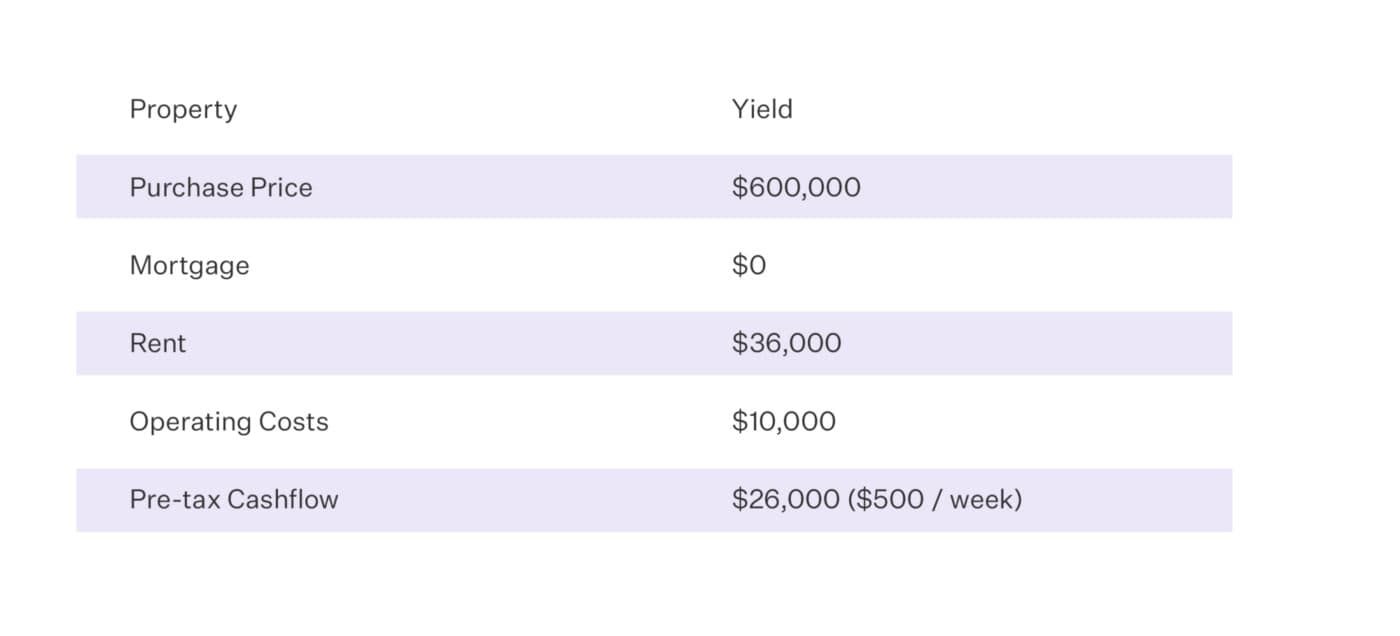

Here's an example of a high-yielding property:

More from Opes:

A growth property will provide a better return overall.

But there is a trade-off.

Growth properties often start out as negatively-geared. This means the rent only covers some of the expenses of owning the property.

So, the investor needs to "top-up" the bank account to cover mortgage and rental property costs.

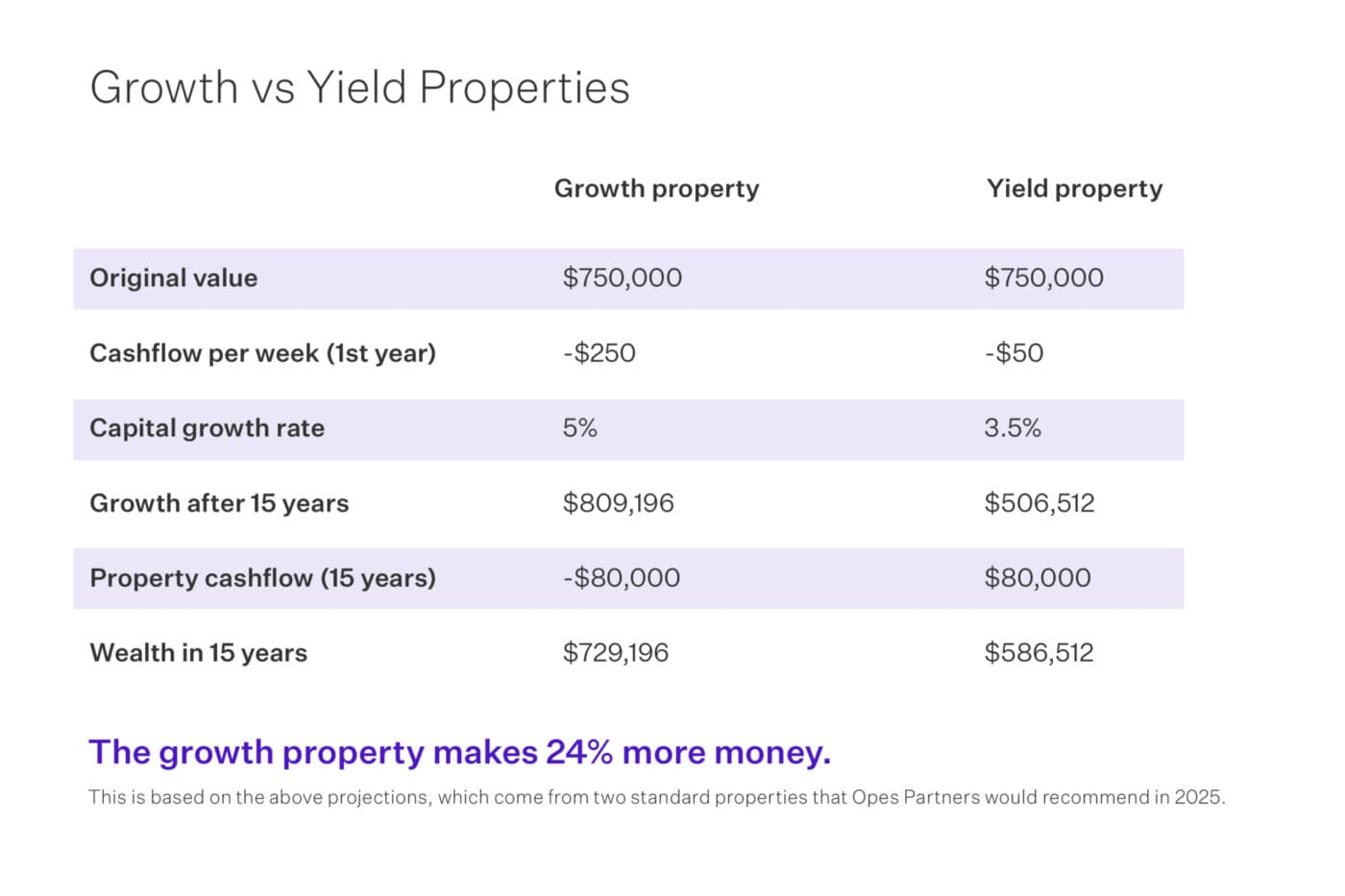

Here's a look at how the numbers tend to stack up over 15 years. This is if you are borrowing 100% of the money to invest in property:

In this example, the growth property earned 24% more than the yield property.

Although the property initially lost $250 a week in cashflow, overall, the property is expected to make $1,037 a week in capital growth.

In contrast, the yield property is expected to lose less money and become cashflow neutral faster. But it’s only expected to make an average of $649 a week in capital growth.

The type of property you choose will be influenced and suited to your stage in life.

There are two stages in property investment.

People in this stage are wealth-focussed. They are, usually, 10 to 25 years away from retirement or from wanting a passive income.

Growth properties are better suited for these sorts of people.

Why? Working professionals aren't concerned about creating a passive income immediately. They already earn an income.

They can afford to wait out the time it takes for capital growth to do its thing.

Once you retire, you're ready for all your hard work to pay off. Now, you're ready to live off the proceeds of those assets you have built.

Yield properties are better suited for these sorts of people.

Why? These people want immediate cashflow or want to live entirely off their portfolio.

Often, at this stage, they'll buy a yield property without a mortgage (or a very low mortgage). They will then live off the rent from the property.

Here's how the numbers tend to look when you buy a yield property without a mortgage:

Once an investor can buy yield properties without a mortgage ... cash flow starts to look very attractive.

A very comfortable retirement only takes 2 to 4 yield properties – fully paid off.

However, investors need to start building their equity before moving on to the second stage.

This is the reason investors will start out buying growth properties before transitioning over to yield properties in time.

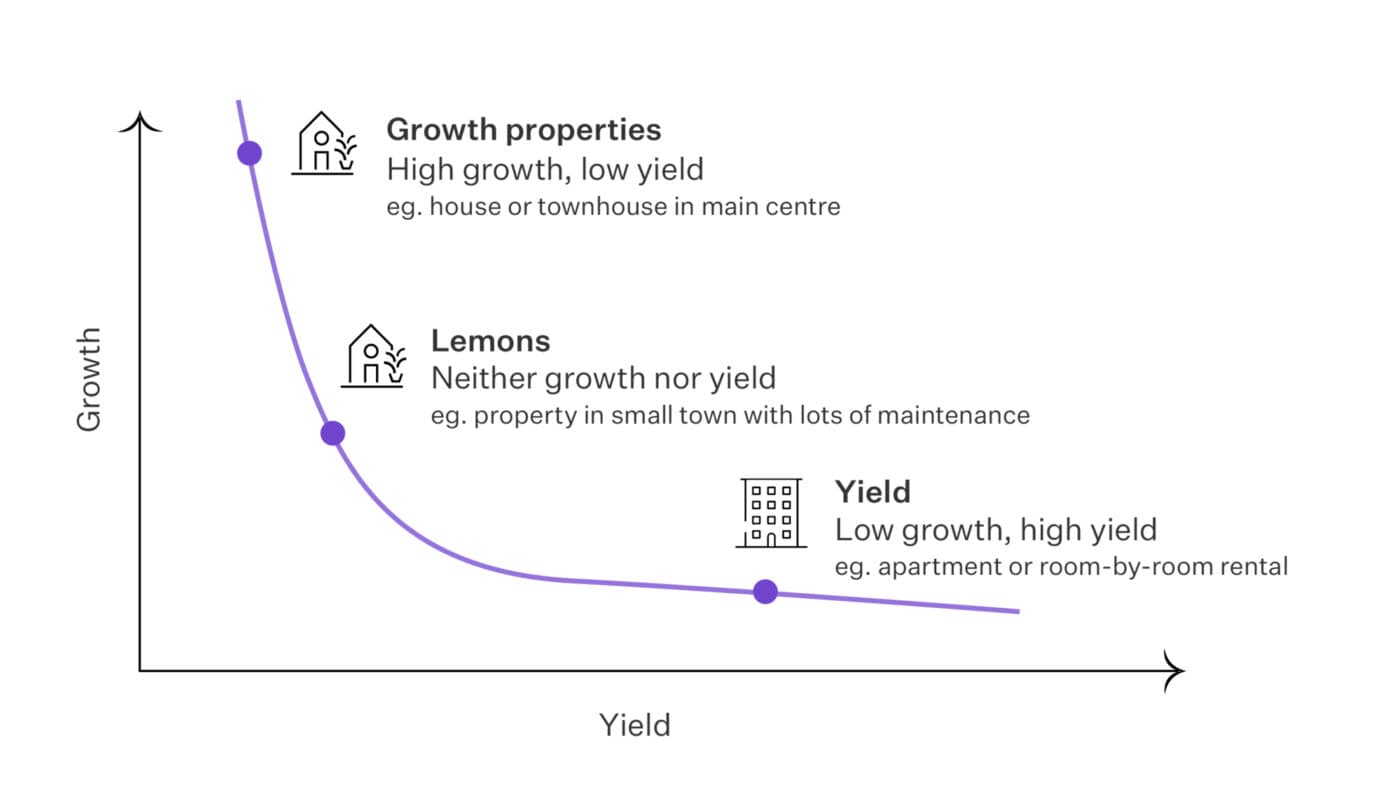

Property investment is about trade-offs.

There is a trade-off between getting really good capital growth and getting yield.

Simply put, if you are following a passive buy-and-hold strategy … you can't have both.

For example, consider this chart.

On one side, you'll have high growth, and on the other, great yields. But each side sacrifices the other.

What's most important is you don't end up in the middle. That's with properties that neither produce high growth or high yields

Here at Opes, we often get asked: What is a good gross yield and capital growth rate?"

After all, you want to ensure you're buying a good investment.

For growth properties, we typically aim for a :

For yield properties, we typically aim for a :

But we are forever checking to make sure we are comparable to others on the market. So these are always changing.

Growth properties are typically the way to go if you're still building wealth.

They build your long-term equity, even if you must cover some upfront costs.

If you're ready to live off your investments, yield properties can provide the cash flow you need for a comfortable retirement.

Remember, the right strategy depends on you.

Financial adviser at Opes. Formerly a senior adviser at one of NZ largest investment firms. Owned 3 properties by 30.

Nefe is a Registered Financial Adviser at Opes Partners with 7 years’ experience in financial services. Before joining Opes, she was a senior adviser at one of New Zealand’s largest investment firms, managing $13 million in KiwiSaver and managed funds. She’s helped clients invest over $26 million in property and owned 3 properties before her 30th birthday.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser