Property Investment

Property Investment

44 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Our Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

A mere 11% of people are confident they will be financially comfortable in retirement, according to the Financial Markets Authority (FMA).

This means a massive 89% aren’t confident their current retirement savings will allow them to live the lifestyle they want when they retire due to the high cost of living.

Chances are you're probably in that 89% … not just because you're reading an article about retirement planning but because almost 9 in 10 Kiwis are in that group along with you.

It’s OK, we’ve got you.

Because in this article – The Epic Guide To Retirement – you are going to learn exactly how to plan for your retirement and how to use investment property as a way to live comfortably once you decide to step away from work.

So, why aren't Kiwis confident they'll be well catered for when they stop working?

Well, there’s a growing realisation that the government can’t and won’t provide us with the dream retirement we all want.

So, we need to take more responsibility for the lifestyle we’ll have later on in life.

There are three reasons for this:

Back in 1950, life expectancy for the average man was 67. For women it was slightly longer at 71.

Some 70 years later, a male born today is expected to live to 91, and females to 93.

It's a massive trend. Just check out this graph with data sourced from Statistics NZ:

So, what does this means for you and your retirement?

For starters, you're probably going to spend more time actually in your retirement than your parents or grandparents did, which means you'll need more money to live the same lifestyle they did.

Secondly, healthcare tends to get more expensive as we age – and not all of it is covered by the government. This means we'll need to spend more on healthcare to keep ourselves going.

Right now the government superannuation is $411.15 per week if single and living alone or $632.54 per week for a couple (both after tax).

That works out to an annual income of:

It's not a lot of money, especially if you're used to living on a combined salary of significantly more.

According to research by Massey University, even if you live a “no-frills” lifestyle in provincial New Zealand (where the cost of living is lower), the average retiree living alone will still be $163 a week short.

And those figures are for current retirees. As our population ages, the generosity of superannuation is likely to be diminished as it becomes more unsustainable.

The World Economic Forum has called for sweeping changes to government pension systems around the world, given their unaffordability.

In fact, “the world's six largest pension saving systems – in the US, UK, Japan, Netherlands, Canada and Australia – are expected to reach a $224 trillion gap by 2050,” according to the organisation.

While New Zealand doesn't feature within that specific stat, Kiwis have a more generous pension system than the UK and Australia, according to the OECD.

Basically – we're not exempt from needing to change.

Although you might think you'll live off the pension when you retire, there is no guarantee it will exist in the same way when you do eventually stop work.

Now, to be fair if you’re already over 55 right now the pension system is unlikely to change for you.

But, if you’re 35 you’ll need to consider how much you can rely on government assistance during old age.

It's conclusive.

New Zealanders aren't saving enough for retirement. But it's not because we don't know we need to squirrel money away.

A recent ASB survey found that 46% of New Zealanders know they should be saving 10% of their income for retirement. Still, less than half of that - 22% - are actually saving that much.

The Listener also wrote that New Zealand’s household debt is around 93% of GDP.

What all these figures suggest is we Kiwis love to spend, but we don't like to save.

On top of this, the number of retirees who have fully paid off their mortgage is falling.

In 2007, 78% of people over 65 had a debt-free home.

That fell to 72% in 2017 … and it's only falling further, according to the Commission for Financial Capability.

This is of particular concern because more of our incomes are going towards paying off that debt rather than saving, and also because superannuation was never designed to cover housing costs.

So, what does all this mean?

It means most Kiwis have a retirement gap. This is the difference between the desired retirement lifestyle and what we're on track to achieve.

It also means, as individuals, we need to figure out the cost of living and what will be required to fund the retirement lifestyle we want. And then we need to figure out if we are on track to build that level of wealth, based on what we’re doing right now.

If there is a gap we need to figure out what we can do to start building our wealth more quickly.

But what does this retirement gap actually look like in practice, and what does it mean for you?

Let's look at an example ...

Let's take the typical couple aged 45 who plan to retire at 65.

They're financially prudent, having saved $60,000 through their collective KiwiSavers (matched at 3% by their employer) and they've got a household income of $120,000.

At retirement they want an income of $1500 per week (in today's dollars), and let's assume they plan to live to 90, so will have 25 years in retirement.

To live the retirement lifestyle they want, if the couple continues and changes nothing, they'll require another $1.3 million in savings by the time they turn 65 (in today’s dollars).

That number will probably come as a shock to many. For all intents and purposes our couple appears to be doing everything right. Yet they still fall short.

But to make matters worse, this $1.3m figure presumes that superannuation continues to increase at the current rate (tied to the average increase in wages).

Given the increasing unaffordability of a government ‘super’ scheme, that increase is unlikely to be sustained over the couple's lifetime. So, they'll probably need more than that figure.

To prove the point, let's take it to the extreme and assume there will be no superannuation.

The couple would need to save an additional $2.2 million above and beyond what they are currently on track for to reach their weekly income goal of $1500.

If the couple saved this amount, they would need to put away $2,102 a week, every week, for the next 20 years of their working lives.

This is entirely and utterly unachievable for most people.

This is the reason you want to put a comprehensive retirement plan in place to close this gap and sort yourself out for retirement as soon as possible.

Most people we work with here at Opes Partners have a gap between what they want in retirement and what they are currently on track for.

Use our retirement calculator to help you estimate whether your current savings plan will be sufficient enough to fund your retirement lifestyle you want:

So how do we plan now, so we can retire comfortably tomorrow?

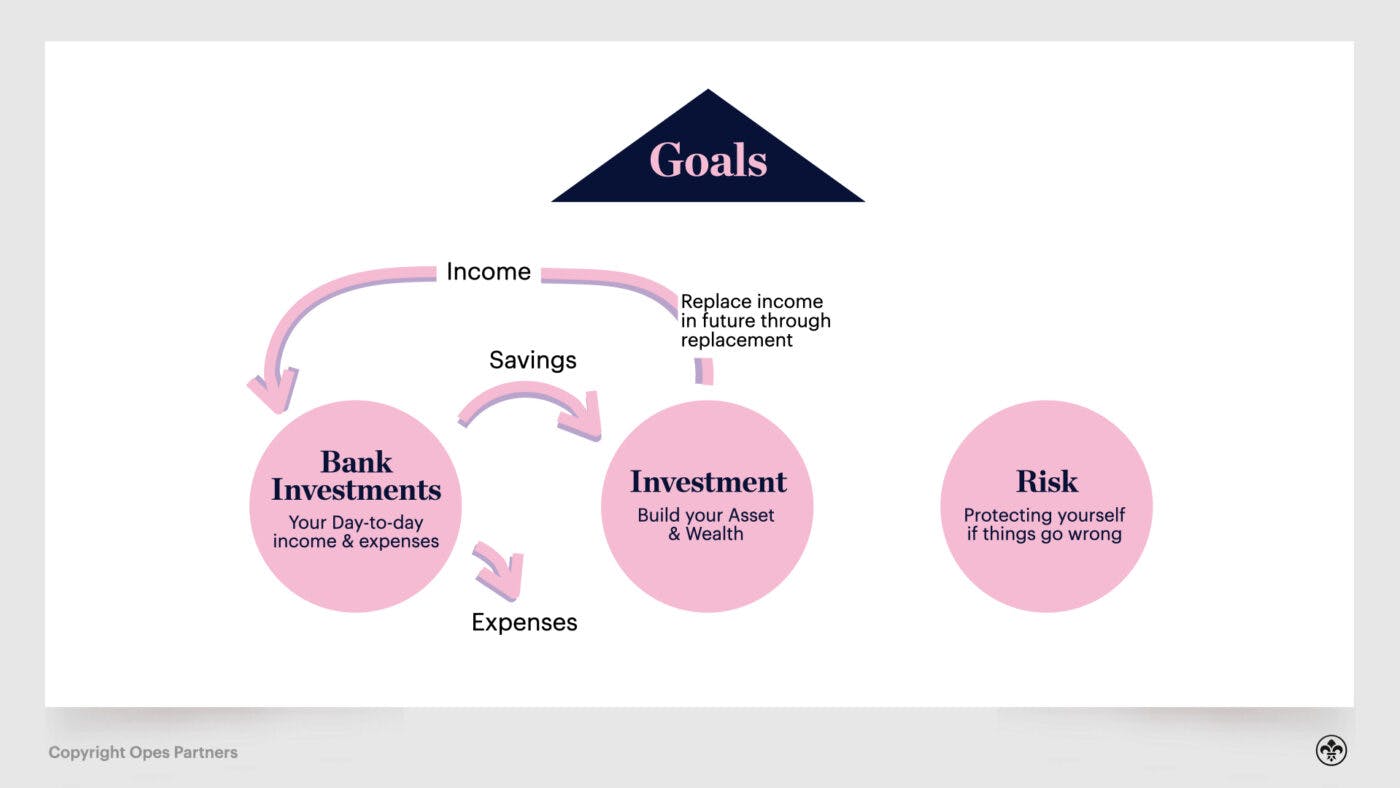

From our perspective, there are four parts to any sound retirement plan.

Let's cover these four parts before deep-diving into each of them. The model you're about to read has been adapted and improved over time.

The four parts to any retirement or financial plan are:

The first part of your financial plan has to be goal-setting, because only when you've set this goal will you be able to create a plan to reach it.

You need to know where you're going so you can plan to get there. Or as Laurence J. Peter put it:

“If you don't know where you're going, you will probably end up some place else.”

The core goal you'll set in a retirement plan is:

- The lifestyle you want to live in retirement, and

- What that lifestyle is going to cost.

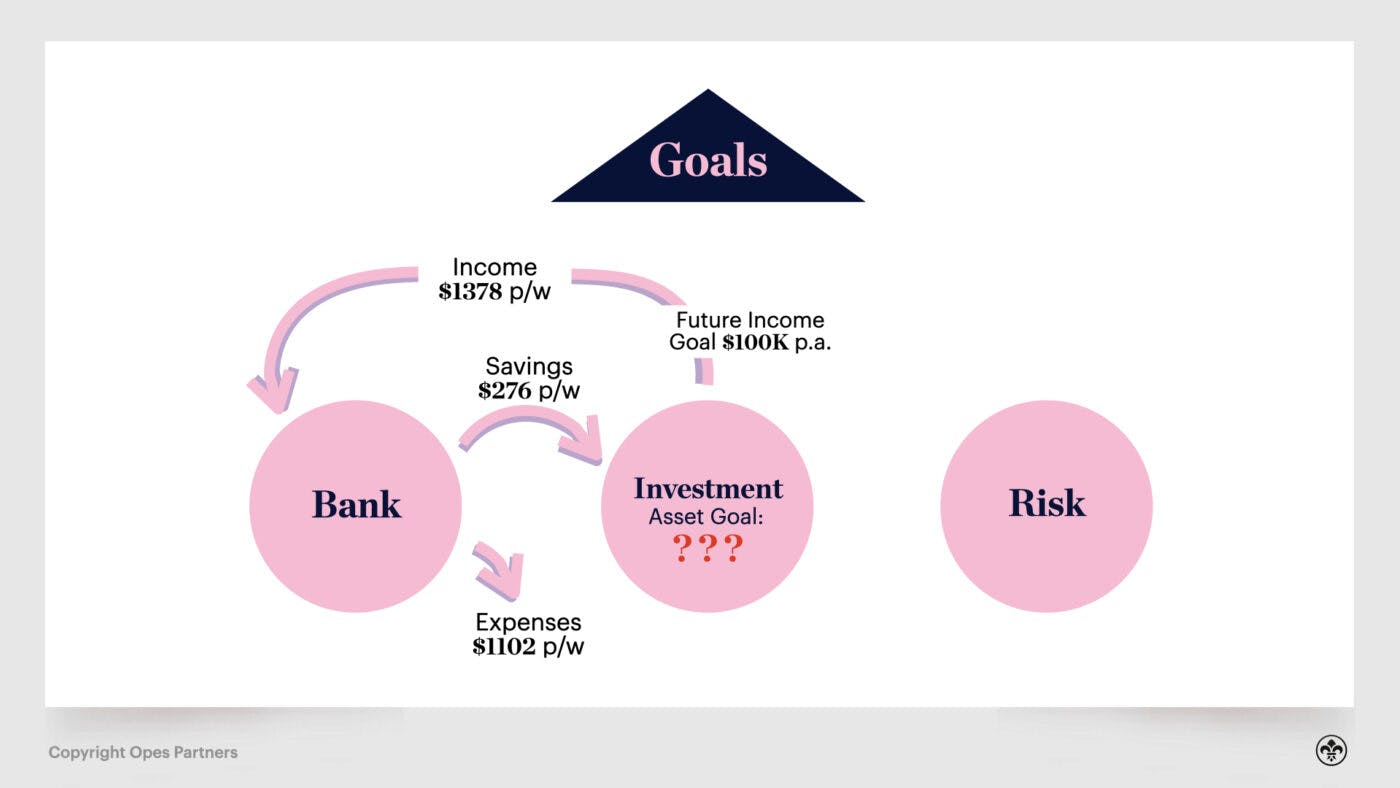

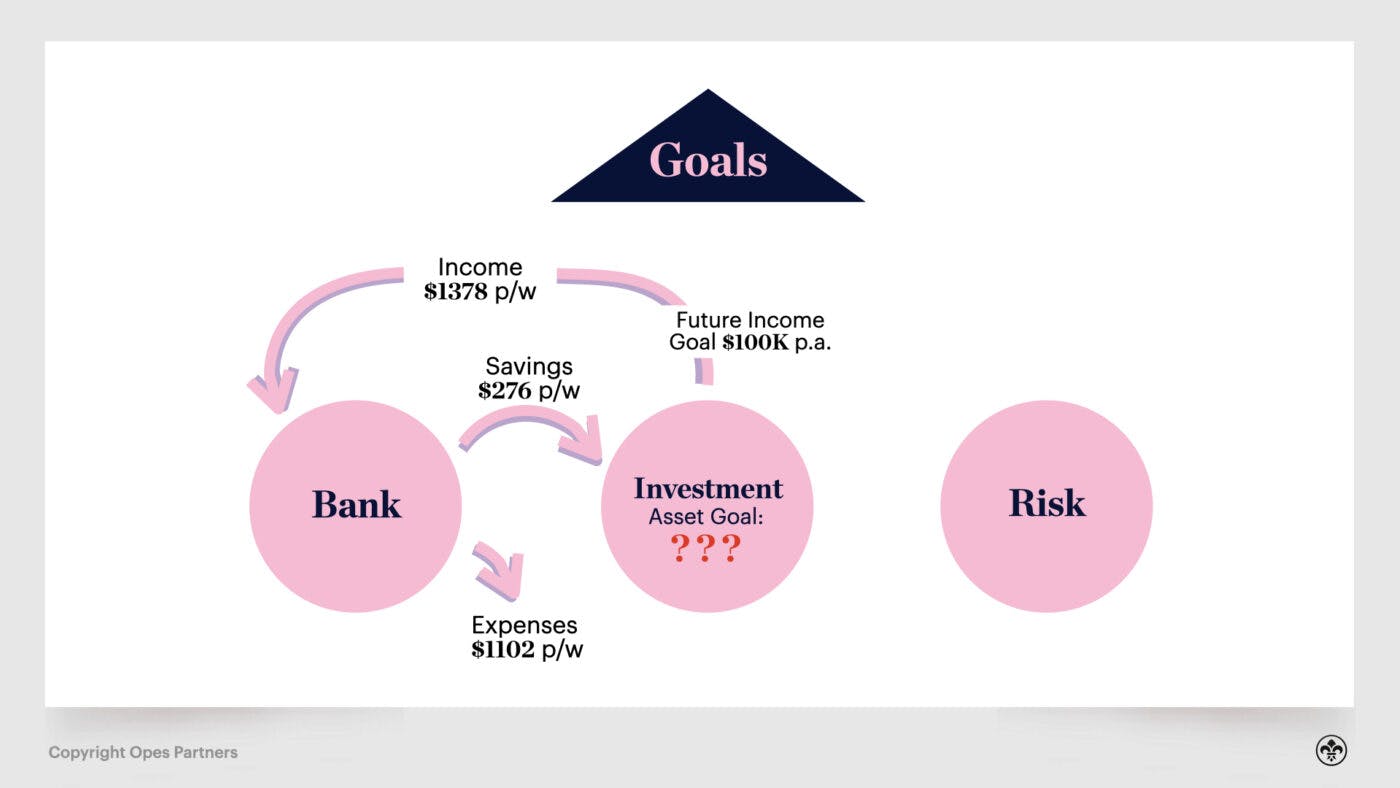

The second part of your financial plan – and the first of the three pillars – is what we call: “Bank”.

We’re not talking about where you save your money. But, instead it’s the money in and money out of your bank each week.

For example, as income comes in some will be spent on your living expenses, but any surplus cash (savings) can be used to build the third part of your financial plan – investment.

The second pillar for consideration in your retirement plan is investment.

The purpose of this part of the plan is to build up enough assets so that when you retire you can replace working for your money with an income stream from your investments.

This is what is meant when you hear people say “make your money work for you”.

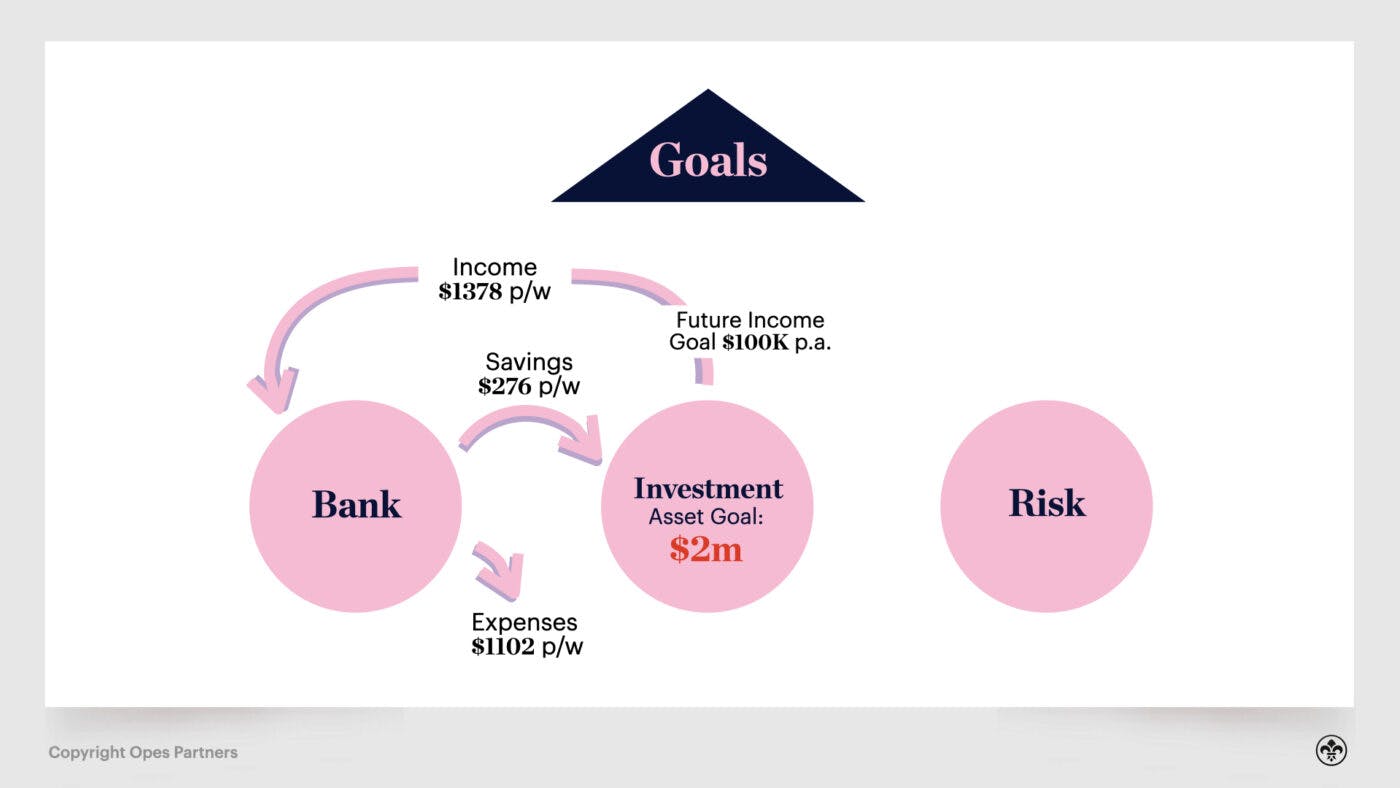

This can be seen here:

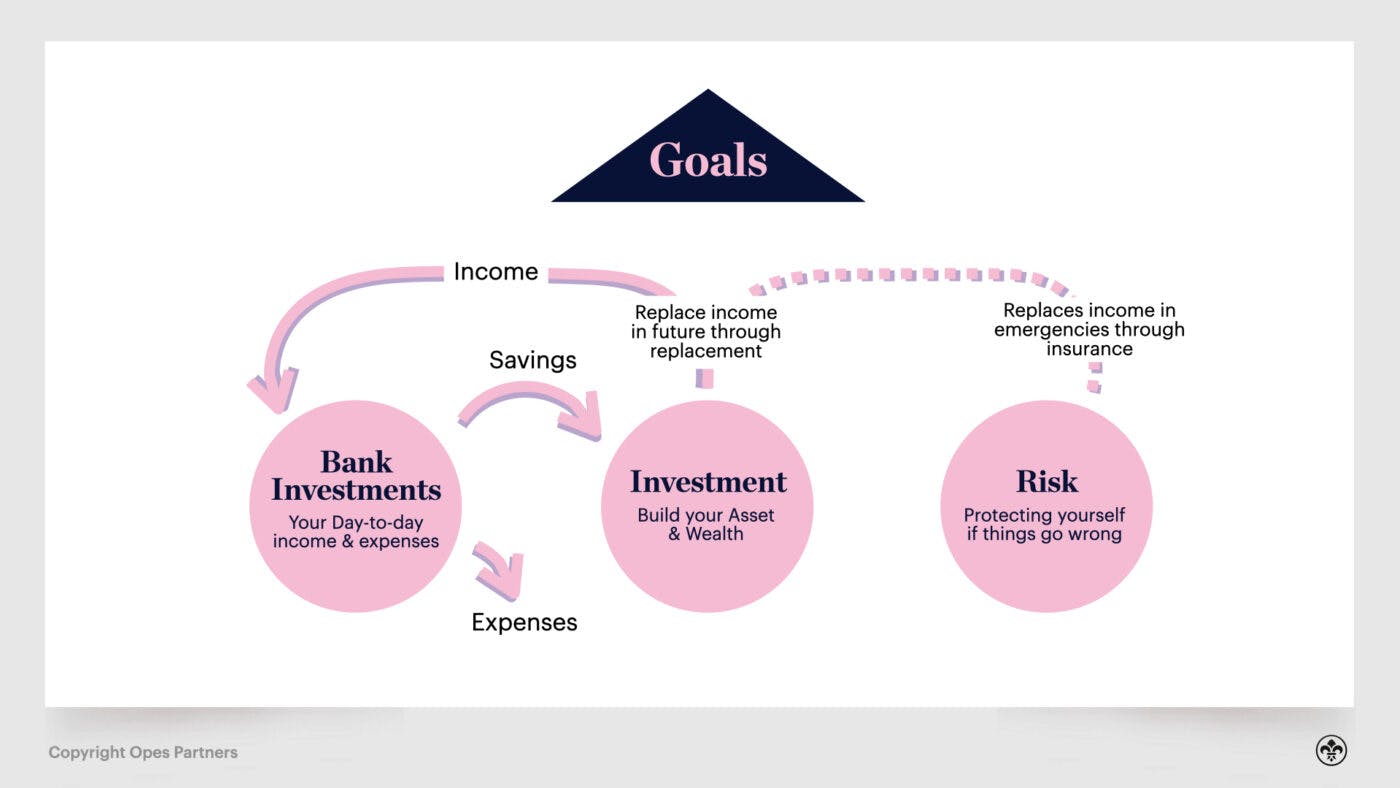

Finally, the last part to a solid retirement plan is protecting yourself if you unwittingly find your strategy heading towards an iceberg.

In other words, you need a contingency plan just in case the proverbial hits the fan.

Let’s say things happen outside your control. For example, a sudden illness of a family member or there's an uncertain economy and you lose your job.

The right insurance and risk protection will replace your income if you can't work. This means there is still income coming into your first “Bank” pillar, and your strategy remains on track.

Getting this part right builds fat in your financial plan and gets you through an economic winter.

This is how the three parts of a financial plan work together:

Now that we've got all four parts of a financial strategy together, let's go through each one in depth so you can see how to start building your own strategy:

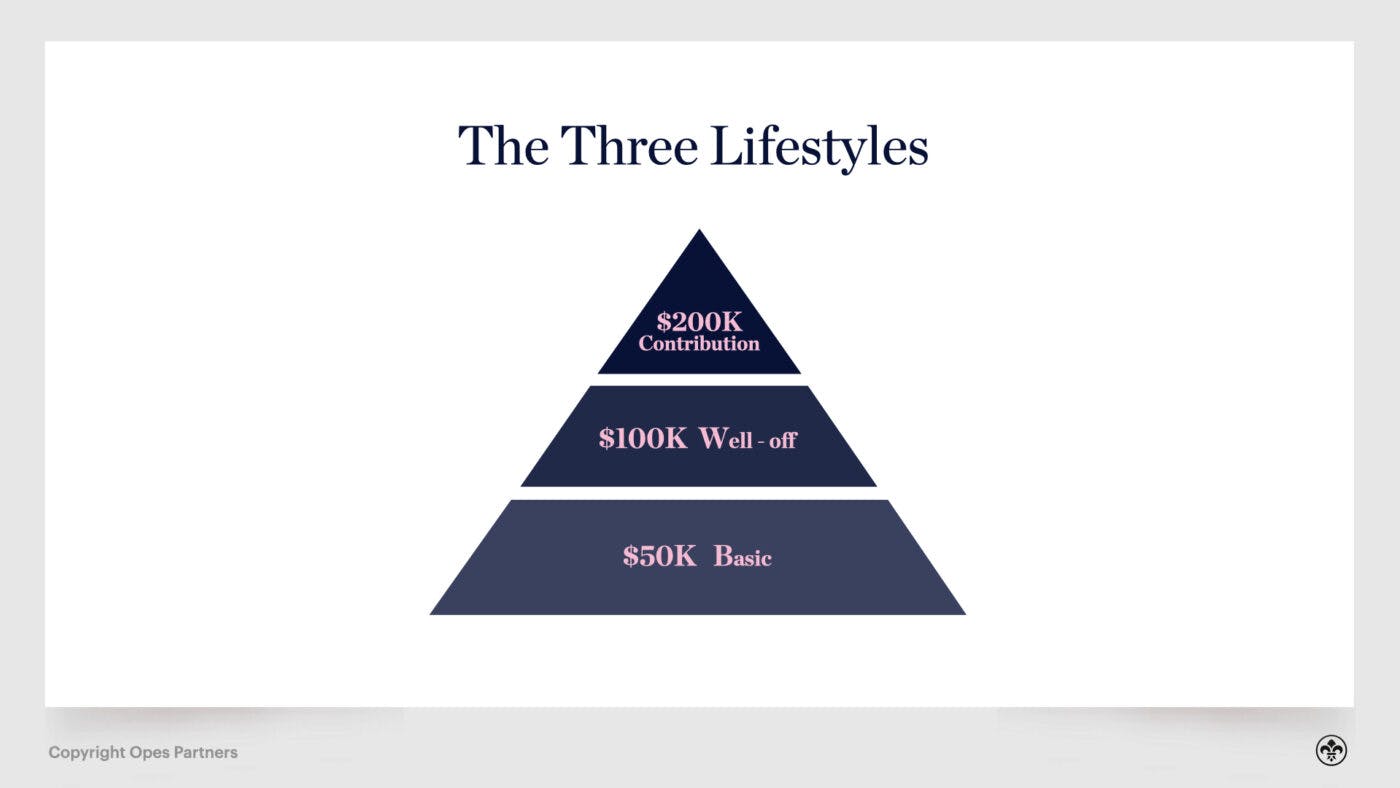

The first step to choosing your retirement goal is to determine the lifestyle you want to lead.

Generally speaking, there are three types of lifestyle:

The first level is the 'basic' lifestyle.

Provided that you own your own home outright and have paid off the mortgage, you should be able to enjoy most of the basics in life without a lot of extras.

You will still always have to be careful with money.

This is at the base of the pyramid because this is the lifestyle that most New Zealanders will have if they haven't planned their retirement correctly in advance.

This lifestyle requires about $50,000 a year.

The second level is the 'well-off' lifestyle.

This level of income starts to give you some real choices. The home you live in, the holidays you take, the cars you drive etc. You can easily handle health concerns and be able to pay for treatment if it is needed.

This is the next tier of the pyramid because not as many Kiwis will get to this stage.

This lifestyle requires about $100,000 a year.

The final level is the 'contribution' lifestyle.

This amount allows you a very high quality of living. You have lots of choices and can support the charities you hold dearest to you.

You can also help out your children and be generous with your friends or grandchildren.

It is the final and smallest tier of the pyramid because very few Kiwis will build the level of wealth required to support this lifestyle (and some wouldn't want to).

This lifestyle requires about $200,000 a year.

The lifestyle you choose is a personal choice, and one is not necessarily better than others. Naturally, the more financially secure the lifestyle, the more options you'll have in retirement.

While your lifestyle is a personal choice, we can get a sense of which lifestyle most New Zealanders would pick based on research from the FMA.

Here is what most Kiwis care about in retirement:

Based on these figures, it looks like most Kiwis would choose a 'well-off' lifestyle, with an annual income of $100,000.

Some of the choices contained within a 'well-off' lifestyle, like travel and new cars, wouldn't be affordable on a 'basic' lifestyle's income.

Similarly, there doesn't seem to be a massive desire for the 'contribution' lifestyle from most people, as less than 40% of people think it is really important to leave behind an inheritance.

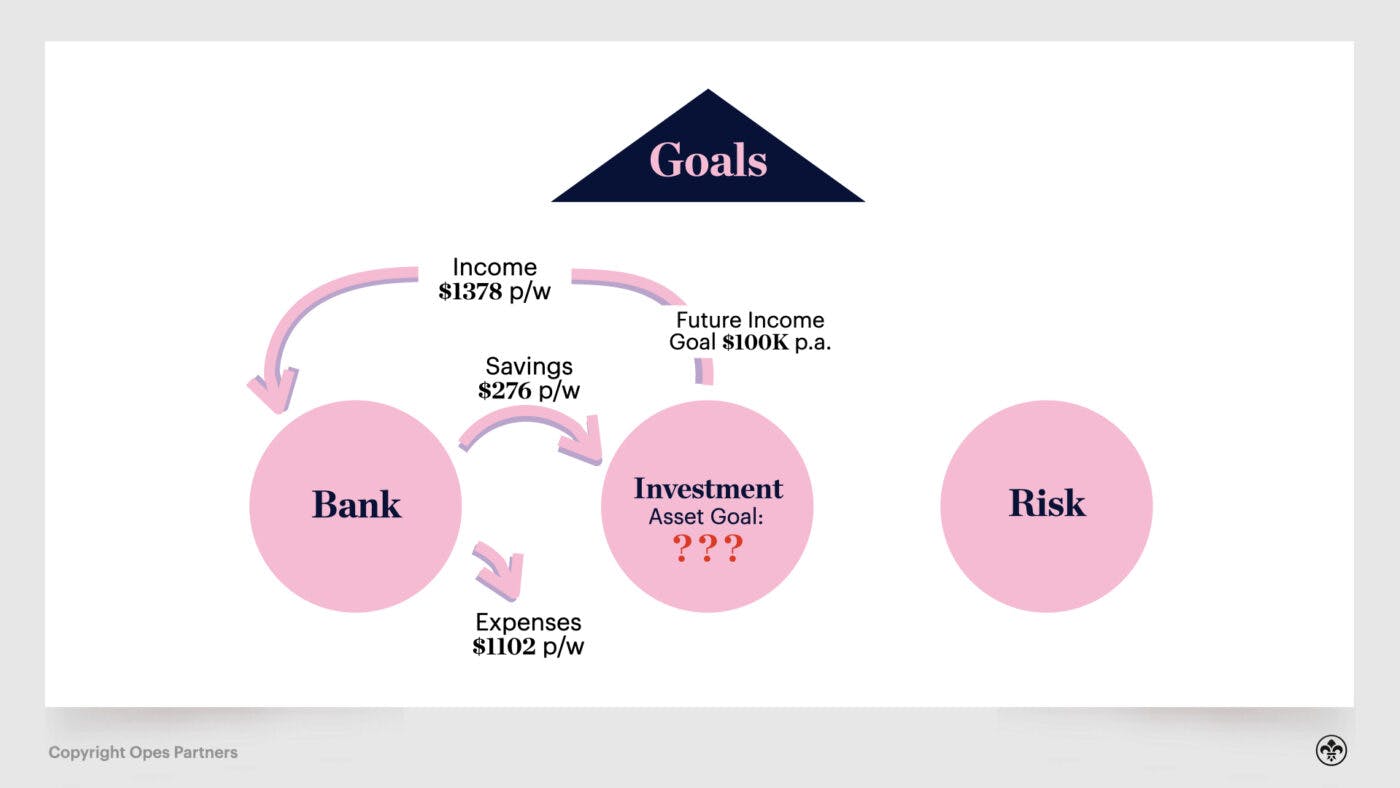

Now that you've chosen your retirement lifestyle goal, you know how much your investment circle needs to pay into your Bank circle each year.

This means we can create a plan to build up the level of assets you need to fund that lifestyle.

Because this article aims to get into the nitty-gritty of retirement planning, there's going to be a few numbers thrown around.

It's important to know that you don't need to work out the exact number you need for retirement down to the very last cent.

You really only need to know the ballpark you are aiming for so that you can work towards it.

It's natural that if you miss your retirement target by $5,000 or overshoot it by $10,000, you'll adjust your lifestyle over time to suit.

So be aware of the numbers, but don't stress if they're not exactly correct to the last dollar.

Now that you know how much income you need to fund your bank circle each year, you need to determine how large you need to grow your investment circle to make it happen.

We usually use the strategy where you build up your assets to the point where you can live off the proceeds of your savings or assets.

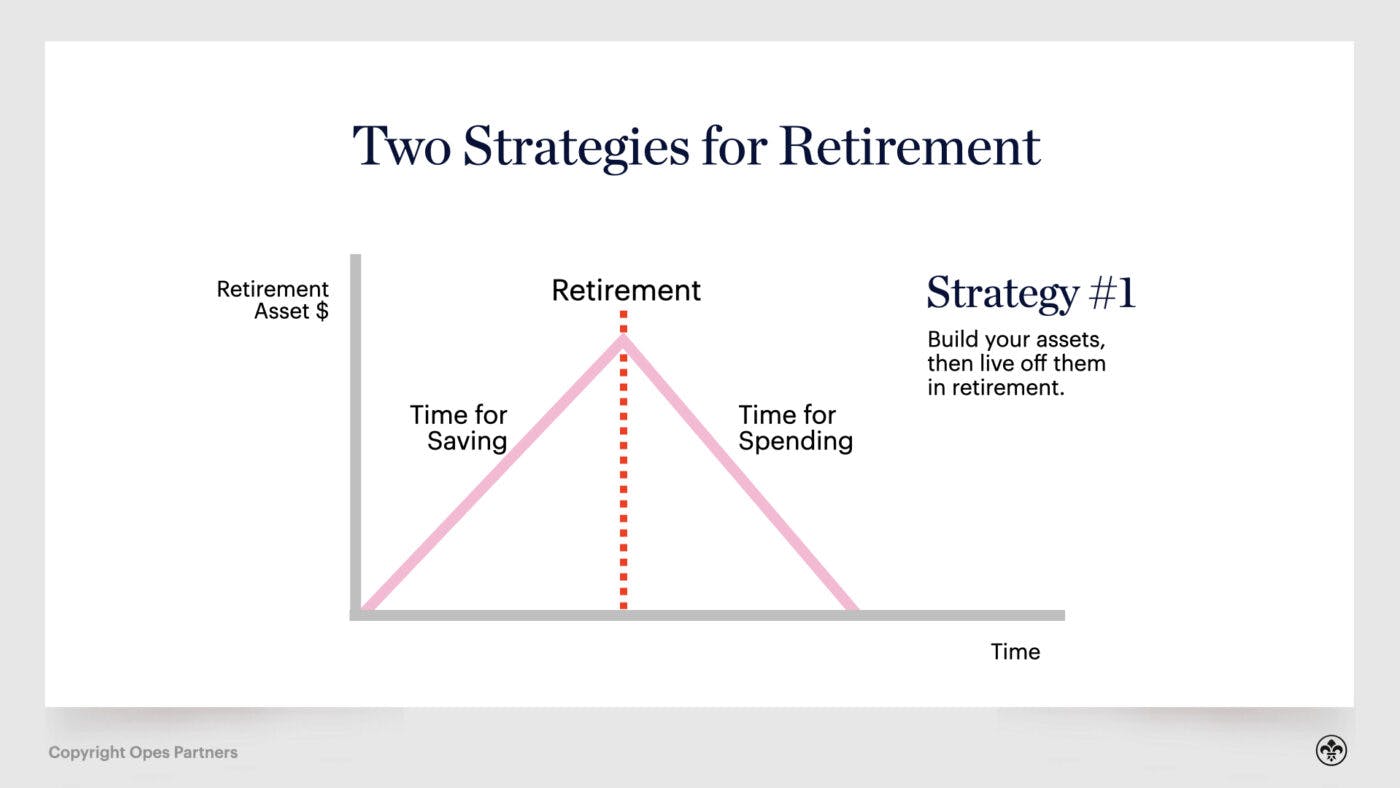

For instance, most retirement planning looks like this:

You build up your retirement savings while you work. Then, you gradually draw them down as you spend them to live.

That means that you gradually get poorer in retirement since your assets are shrinking.

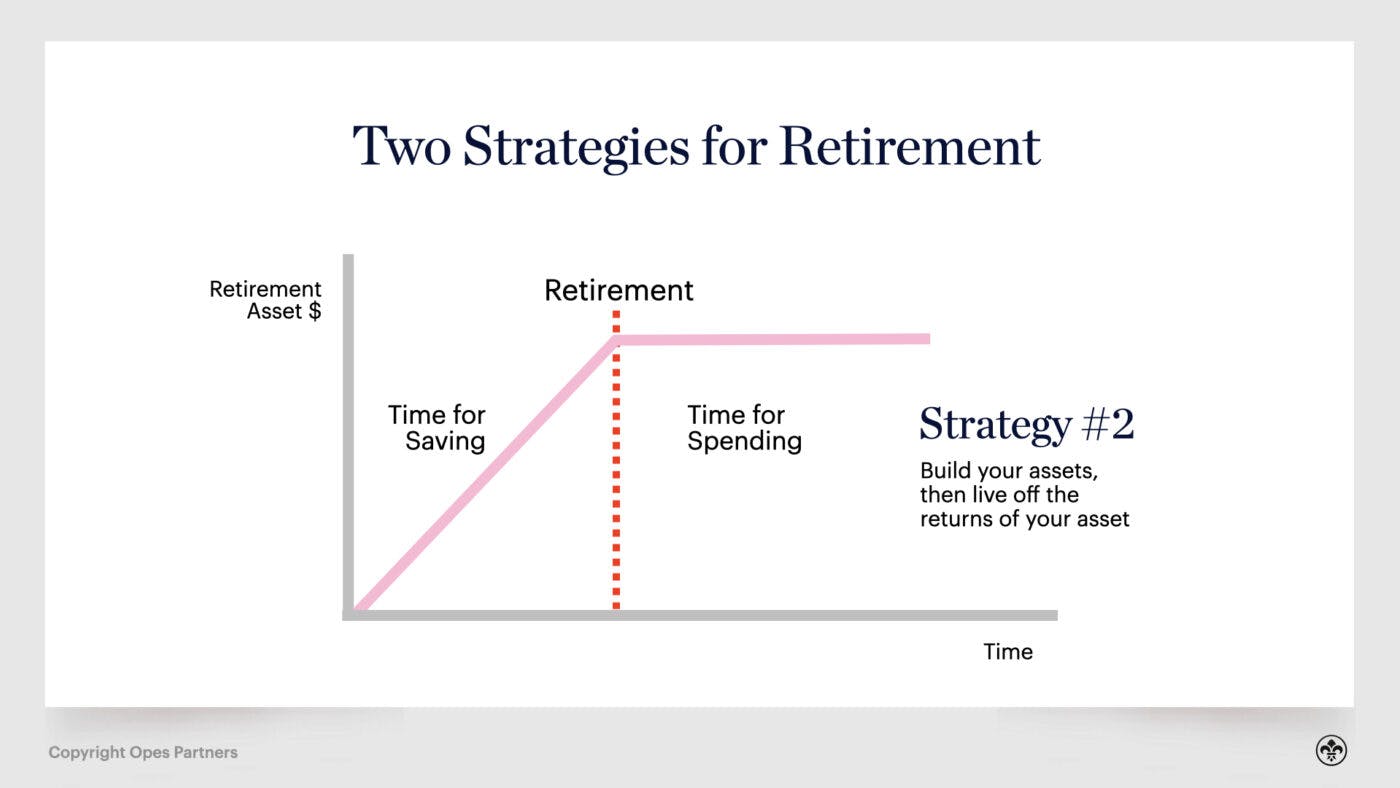

However, we tend to encourage Kiwis to aim for this strategy:

Under this strategy, you build up your asset base to the point where your investments provide the income for you to live off. So you never draw down the principal and just live off the interest.

The benefit of this strategy is twofold:

By the way, you might not actually live off the interest from a bank. It could be (and is more likely to be) proceeds from other investments, like rent from properties or dividends from a share fund.

To calculate the volume of assets you need for the lifestyle you want, you can generally use the rule of 20.

The rule of thumb says: take whatever annual income you want in retirement and multiply it by 20. That's the level of debt-free assets you need to fund your chosen retirement lifestyle forever.

Say you want $100,000 annual income at retirement, that means you'll need $2,000,000 of debt-free assets.

It's based on the idea that you can take your debt-free assets and could typically get a 5% yield every year on those assets.

That could be through a 5% yield on your properties, or if you were to invest them in a balanced mutual fund.

Continuing with the example, if you take the $2,000,000 and multiply it by 5% (the same as dividing it by 20), you would have the $100,000 income that you are looking for.

So this is what your retirement plan would look like:

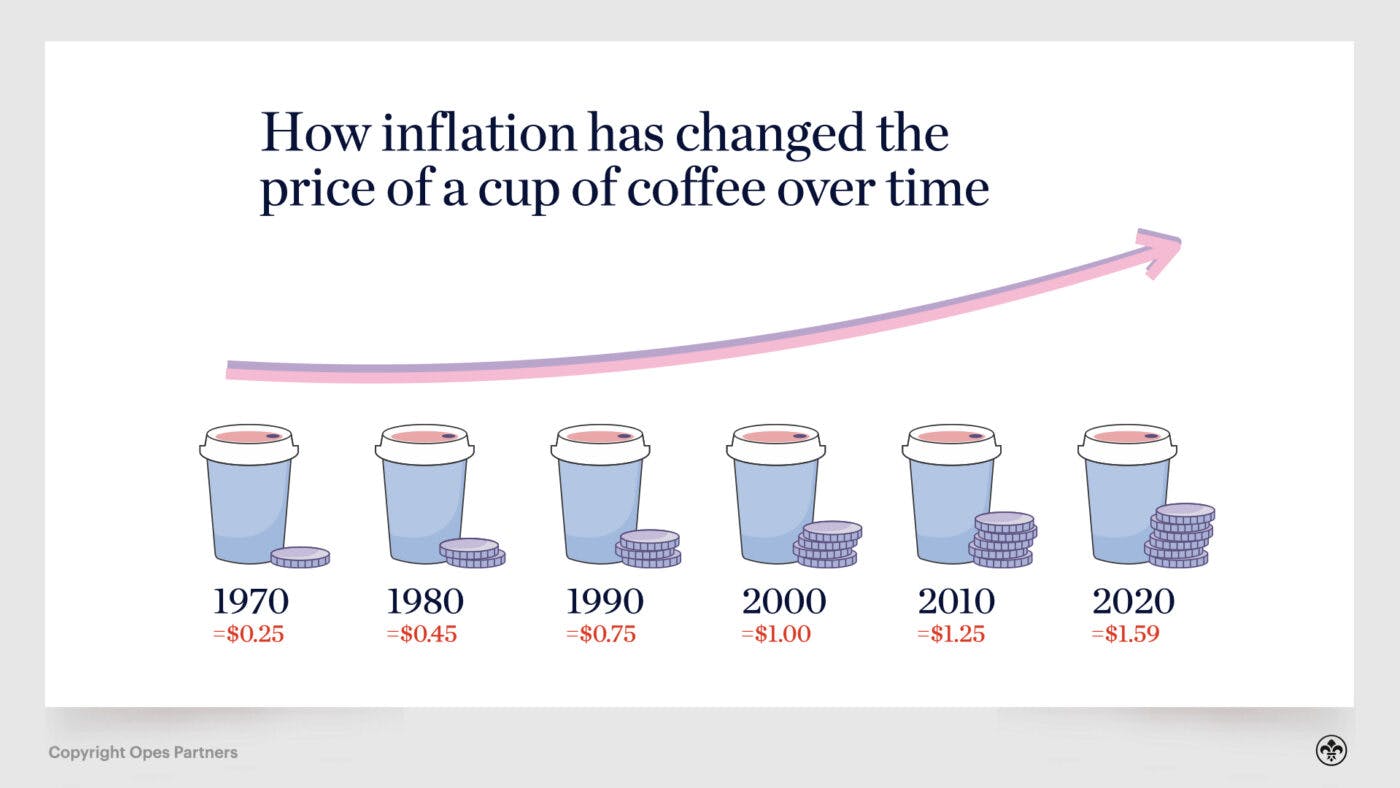

Do you remember when you were a kid, and a 50c lolly mixture would get you tons of lollies?

These days you get slim pickings from a $2 mix at your average dairy.

This is called inflation – prices tend to increase over time.

Let's take another example. A cup of coffee has increased hugely over the decades.

The below prices come from America. Over the last 50 years the price of coffee increased on average by 3.8% every year.

Because by the time you retire, most of the things you want to buy will be more expensive.

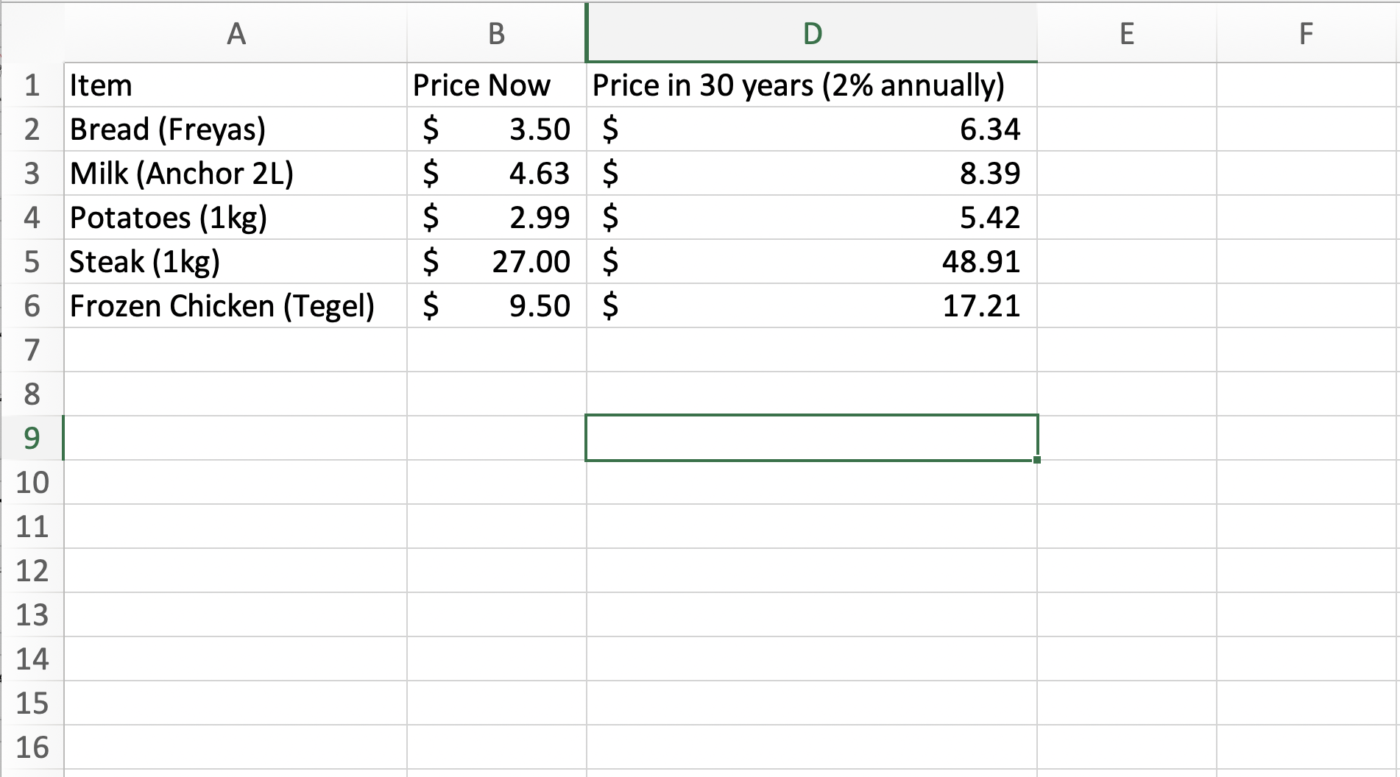

Here is a list of items most Kiwis buy, along with how expensive they will be in 30 years if prices increase at 2% each year.

That's the midpoint of what the Reserve Bank of New Zealand tries to keep inflation between in the medium term.

Because the things you want to buy will be more expensive, you'll need more income in the future than you do right now.

So, if you chose that you want to live on a $100,000 at retirement, you need to inflate that target so that you'll still be able to buy the same things you'd be able to purchase today.

To do this, use the following calculator to see what income level you are really aiming for by the time you get to retirement:

You should also note that under the rule of 20, your assets aren't protected against inflation.

That's because this rule assumes you'll live off the 5% return you would get through your investments.

If you wanted to protect your assets against inflation, you'd actually need an 8% return per year.

That's because 5% of that goes towards your living expenses (which is then taxed as your current income is).

That leaves a 3% total return, which if taxed at the top tax rate of 33%, leaves you with 2% to add on to your assets to protect against inflation.

An 8% return would typically require a level of risk and volatility most retirees would not be comfortable with.

Which is why we'd suggest using the rule of 20 and accepting that the value of your assets will incrementally and very slowly diminish over time.

Over the next three chapters, let's deep-dive into each circle to see how you use them to build up your assets to achieve your financial strategy.

In investment, it takes money to make money.

If you're going to build up your asset base to replace your income, you need money to invest.

That's why the Bank circle is the first part of your financial plan.

This circle manages the day-to-day income and expenses that flow in and out of your bank account.

You want to allocate enough towards your investments so they can build up. Yes, this is a fancy way of saying live beneath your means.

Most salaried workers have income coming into their bank account each week, fortnight or month.

When all is said and done, you then have two options for that money:

Kiwi financial personal trainer Hannah McQueen, of EnableMe, agrees. In her books Kill Your Mortgage and Sort Your Retirement and The Perfect Balance, she discusses figures between 10-20% of pre-tax income.

There are different ways to manage this process, which we'll go through in a moment. But, remember the core objective as part of your retirement plan is to direct more cash towards your investment circle.

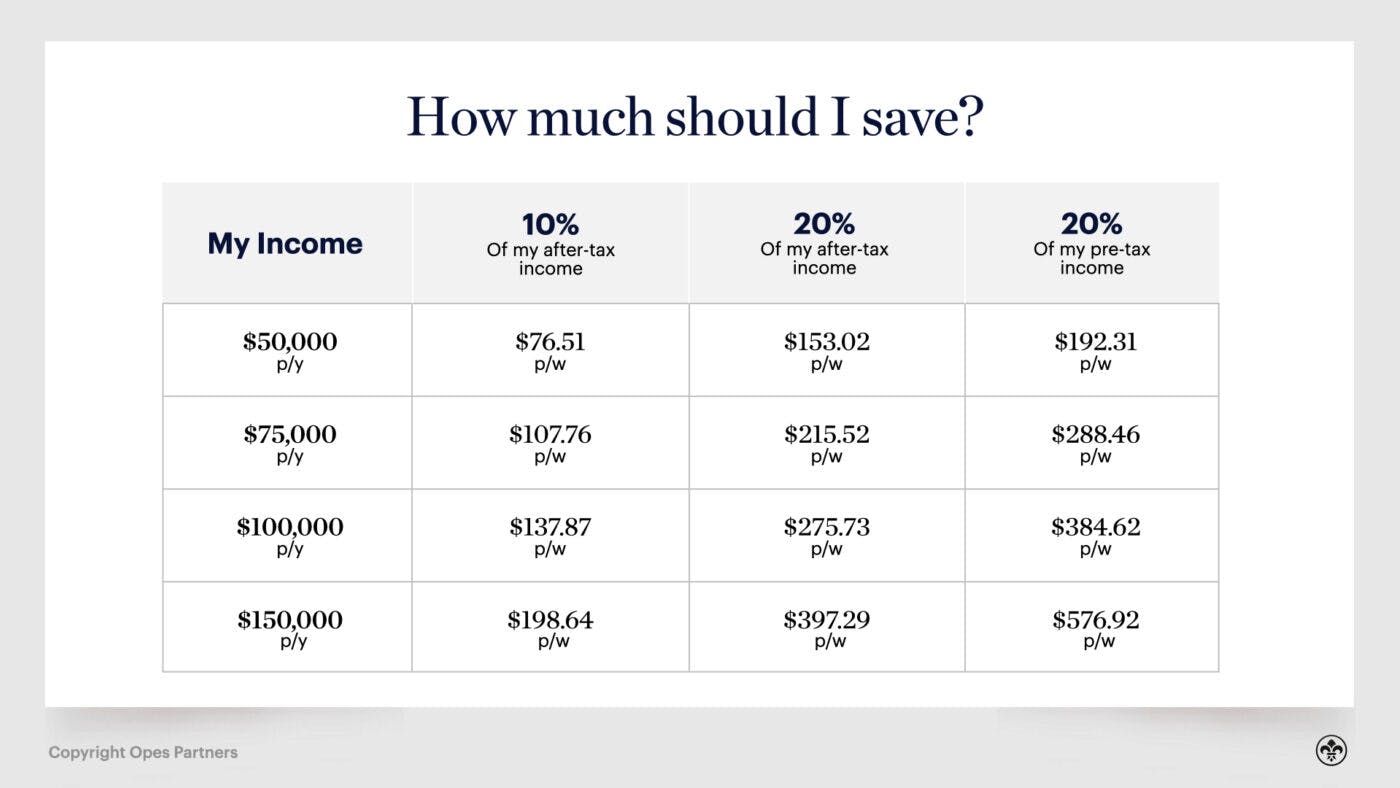

There are differing views about how much is needed, and of course, the answer depends on how big your asset goal is. However, most financial commentators agree that the answer is somewhere between 10-20% of your after-tax income.

Where do these figures come from?

The 10% figure comes from everyday Kiwis talking about how much they think is the right amount to save (this comes from the FMA survey)

The 20% figure comes from financial planning expert Scott Page, author of The Barefoot Investor

But, what does that actually look like? Here's a table showing different levels of income and the level of savings at each level:

This is based on personal income, rather than household income, and assumes you're already saving 3% through KiwiSaver.

You can also use this calculator to determine how much you should be saving per week based on your income:

If you're just starting out saving, then it makes sense to start small and build from there.

Better to start small and grow, rather than go 'cold turkey' and potentially not have a savings habit stick.

So use the above calculator to work out the savings you'd need to make a 10% start each week.

This is a feeling many of us have. But, here's the thing: if you're in KiwiSaver, you're already saving 6.7% of your after-tax income.

Let's say you earn $100,000 a year and are contributing to KiwiSaver at 3%.

That means you're saving $3,000 a year.

But that's not 100% true.

Yes, you're saving $3,000. But, that money is taken out of your pay packet after tax.

On $100,000 annual salary, you pay $25,310 in income tax and ACC contributions.

That leaves you with $74,690.

$3,000 of that amount is 4.02%. That's awesome news. You're already saving over 4% and didn't know it.

Your employer is also contributing 3%.

But that 3% is taxed.

So instead of receiving $3,000, you actually receive $2,010 because you were taxed at the top tax rate (33%).

Add it all up, and you are already saving $5,010 into KiwiSaver each year, which is 6.7% of your take-home pay.

You'd then only need to save $2,459 a year ($47.29 a week) to hit the 10% goal.

That's good news, but what else has this taught us?

That if the money is automatically taken out of our bank account we don't miss it.

If you were to have the $3,000 a year that you save through KiwiSaver put into your bank account ($57 a week), you are very likely to fritter it away.

Later, you would probably forget what you even spent it on.

But, because you never saw it, you didn't spend it, and saving didn't hurt.

This is precisely the same logic or life-hack that you can use to save more.

Instead of trying to will yourself to save whatever you don't spend,

flip it around ... you can spend whatever you don't save.

This is essentially the idea of paying yourself first, where you make an automatic transfer to your savings account whenever you are paid so that your savings are taken out.

You can then live on and spend the rest.

Within our financial model, set up an automatic payment so that your retirement savings are taken out and moved into the investment circle before you are tempted to spend them.

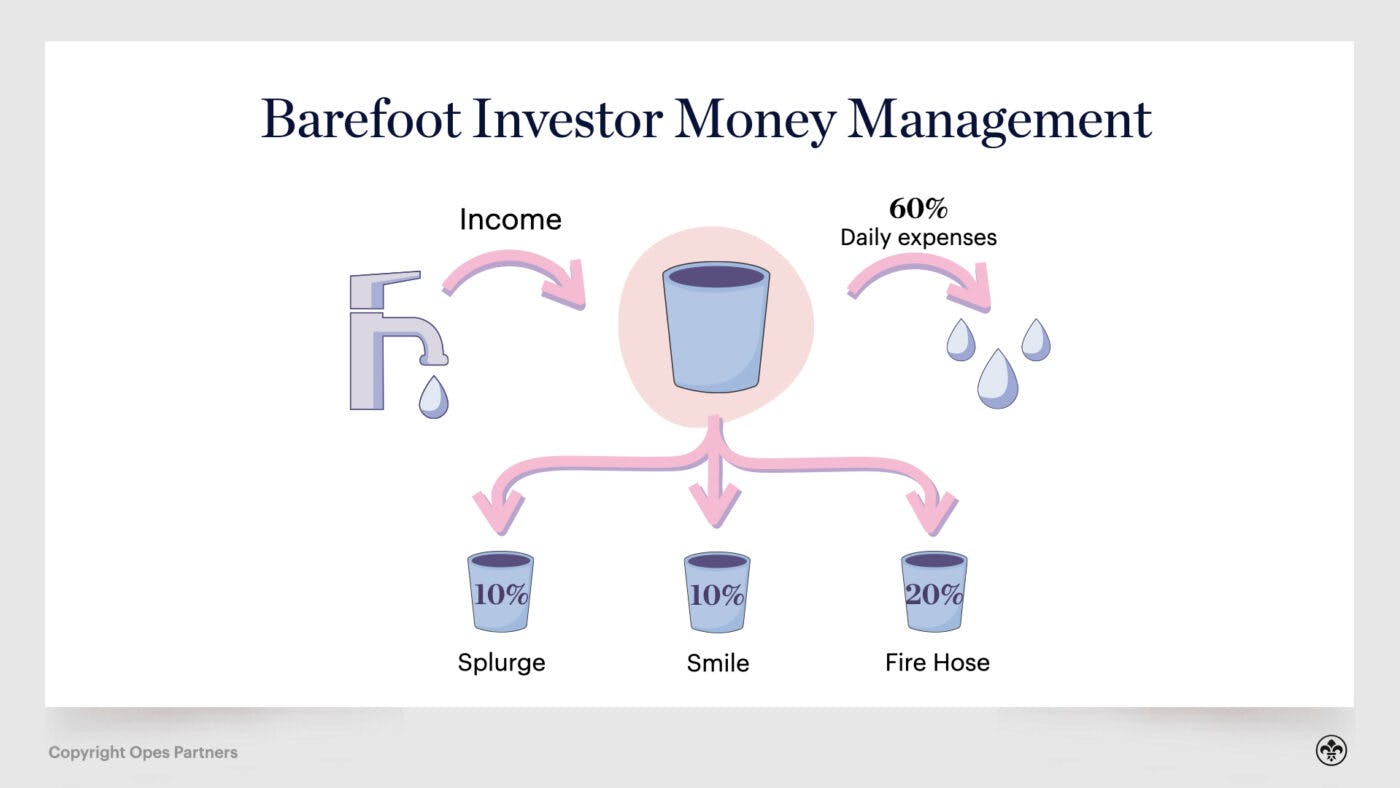

This is very similar to The Barefoot Investor strategy. This money-handling plan has a few more bank accounts. But, it's very useful to know and implement if you're struggling to manage your money and put enough away in your investment circle.

In his book, The Barefoot Investor, Scott Page talks about dividing your money into different buckets.

Your income is like a tap, streaming into your primary bank account.

Every week money comes into this bucket, but it also drips out since you need to spend money on your day-to-day expenses so you can live.

He calls this your 'Blow' bucket.

You can spend that money on whatever you need to live – and you're allowed 60% of your after-tax income on these day-to-day expenses.

He then encourages you to have three other buckets: Splurge, Smile and Fire Hose.

Your Splurge account can be spent on whatever you want that wouldn't be considered day-to-day expenses. You can whip out your Splurge debit card for things like going out to restaurants, shouting your friends drinks at a bar, or shoes and clothing.

Your Smile account is a medium-term savings account where you put money away for holidays or other goals you need to save for over 12 months or more.

Fire Hose is for paying down high-interest debt or for investment – in our model that means stashing money away in your investment circle.

According to the model, 10% of your wage goes to your Splurge and Smile accounts, then 20% to your Fire Hose.

This is what it looks like:

The reason we started with the above strategies before talking about budgets is that, anecdotally, we know that many people find it hard to stick to a budget.

There is only so much willpower in each of us, and many find it challenging to stick to a budget, especially if it makes us feel deprived.

This is more thoroughly covered in Hannah McQueen's The Perfect Balance.

But, let's say you're trying to pay yourself first – transferring money into a savings or investment account – and find that you transfer money back into your everyday account. Just because you keep running out of money.

That's when you'll need to look into a budget.

A budget is really a document that shows how you intend to spend your money. However, intentions sometimes don't become reality.

That's why some financial planners like Dean Blair, of FoxPlan, suggest starting with an audit of your money, rather than jumping straight to a budget. That's because budgets can often bear little resemblance to what you actually spend your money on.

An audit is different because it shows you how you've spent your money in the past, not what you intend to spend your money on in the future.

That allows you to make changes if you don't think you're spending money in the right places and can make savings to free up cash to put towards your investment circle.

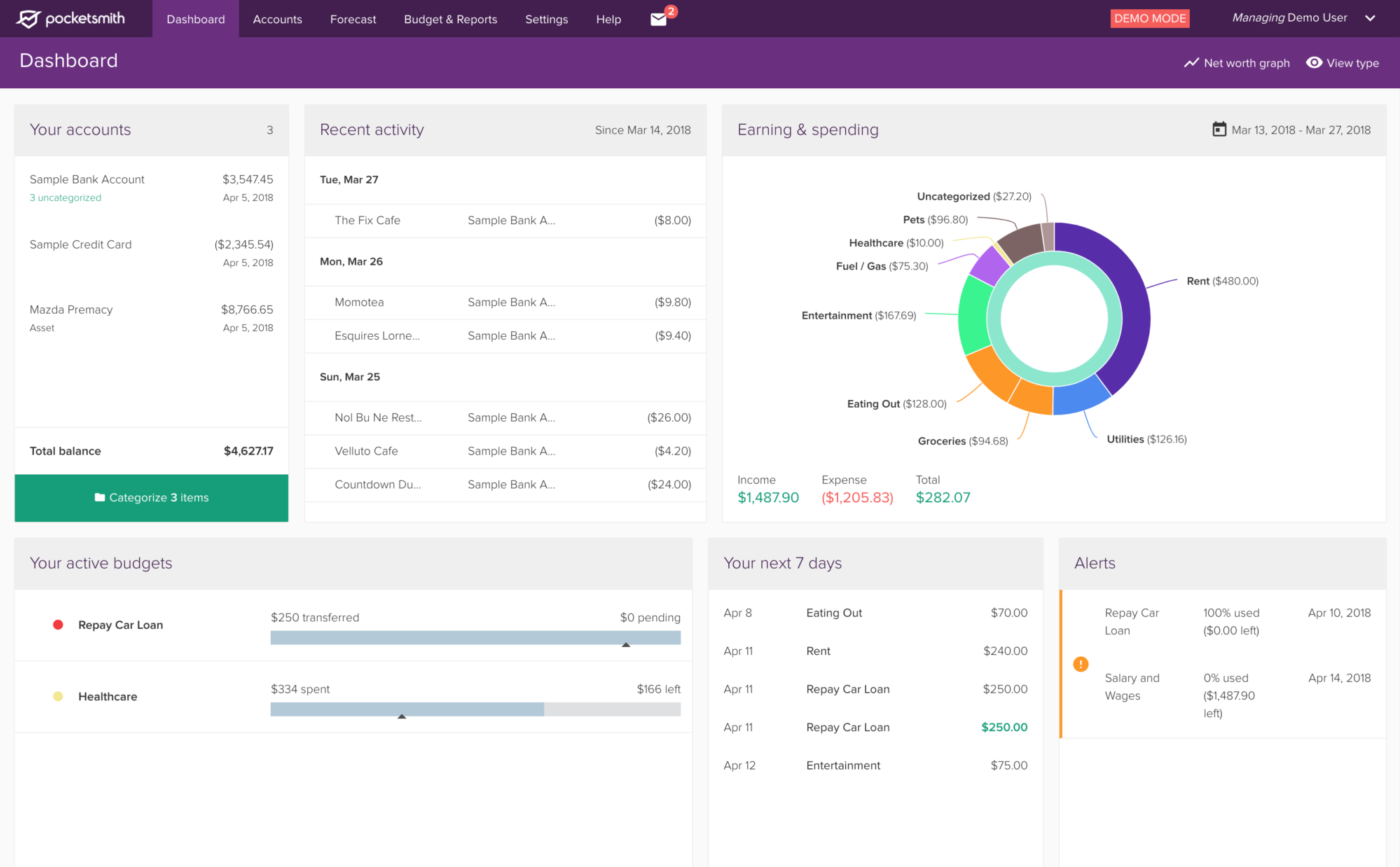

The easiest way to create an audit is by using financial tracking software like PocketSmith.

This will automatically go into your bank accounts and pull every transaction through even if you use multiple bank accounts.

You can then categorise every item into groceries, restaurants and dining, car expenses, giving you visibility of where your money is going.

After you've categorised a month's worth of expenses, you can step back and see what you're spending per month. This will allow you to work out where you are frittering money away, and where you can decrease spending.

Money is a highly emotive subject. It stresses us out if we don't think we've got enough and when the credit card bill arrives many are too scared to open it.

People feel negative about their money when they go into emotional debt.

Let's explain it this way:

The reason many people overspend is that they're not emotionally connected to their money.

It's easy to spend when using credit cards, finance or money that has been allocated for something else.

When we use this type of debt, we don't feel the pure pain of spending and parting with our money. It turns into a "future me's problem".

Of course, we go into financial debt in these situations, and we also go into emotional debt; we haven't paid the emotional price of parting with our money.

It's not until we receive the credit card bill, make a repayment, or find the money from elsewhere that we start to feel that emotional pain of spending.

That's why to make this first circle work, you probably shouldn't use credit cards and instead use cash whenever possible.

It's true, there are benefits to using credit cards, like points or interest-free periods.

But because you're not emotionally connected when you swipe that card at checkout, you're more likely to overspend.

In the end, you are likely to spend more money using your credit card than those points and benefits are ever worth.

That's why some people opt for withdrawing their salaries in cash and only spend with real, physical money (at least just for a short while).

Spending cash makes you feel the pain – you hand it over, and you see what you've got left.

Even if you only try this for a month, this tactic will make you more aware of how you're spending, so you're more likely to be able to manage it.

At this stage in your retirement plan, you've got your goals and Bank sorted, so you're allocating money each pay day that you can invest.

If you've got a weekly after-tax income of $1378 and you're able to save 20%, then you're putting away $276 per week into investment. This is what your retirement plan would look like so far:

This can either be used to pay down high-interest debt like credit cards, your mortgage or towards investments.

Whatever you do with it, you've got to find a way to match what you're squirrelling away with what your end goal is.

For instance, let's continue with the example above of the couple who are both 45 and want to retire at 65.

If they're putting away $236 a week and putting it into a savings account, by the time they reach 65, they will have saved $245,440.

Add in KiwiSaver contributions, and they'd have saved a total of $345,640. Not bad.

But, if their goal is to build a nest egg of $2.2 million, then they're shy of where they need to be.

So how do we turn the money this couple can afford to contribute into the long-term wealth that they want?

That's where the investment circle comes in.

The goal of the investment circle is to build it to the point that it provides a passive income for us in retirement.

At some point, the income tap that flows into the Bank circle will be turned off (or slowed down), and we want to ensure that we can still maintain a lifestyle that we enjoy.

Within this part of your retirement plan, you'll turn your cash into the assets that you need.

Remember, you're going to grow this circle not just through your own contributions, but through the returns you get through your investments too.

The only way to do this is to select the right investments that will give you the return that you need.

To figure out what this multiplier looks like, use this calculator:

The next step is to choose the assets that can give you the return you need.

There are many different investments you could potentially make. In this section, we'll cover the principles of each investment type and the differences between them.

Just before we get into that, remember: this is not personalised financial advice, and you should always get professional advice before committing to an investment strategy.

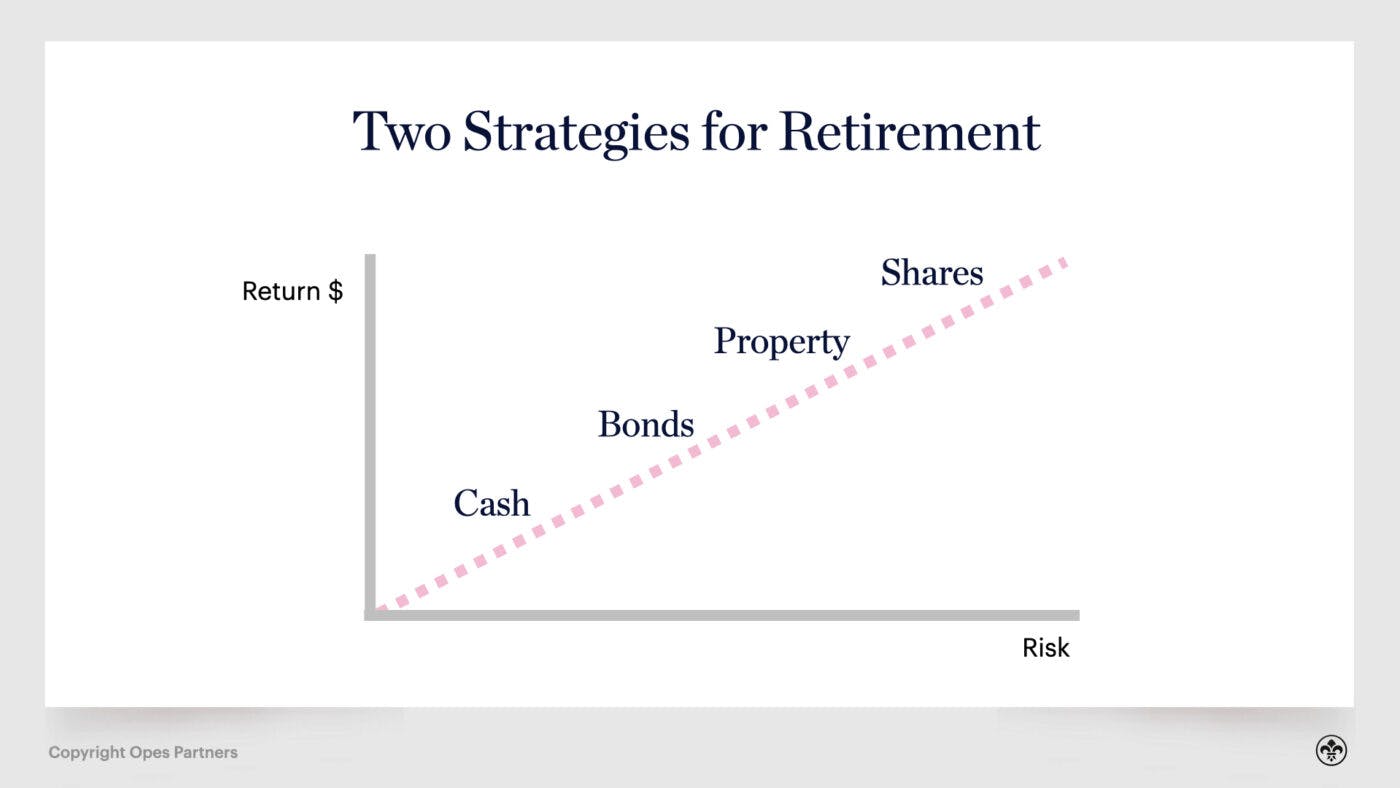

Investments can be broken up into different 'asset classes'.

These classes group together similar investment types, like property, shares, term deposits and mutual funds.

Each of these has a different combination of risk and return that looks a little like this:

Cash gets the lowest return, but also carries the smallest amount of risk. Shares, on the other hand, have the highest risk, but also get the highest percentage return.

Risk is often discussed in investing, but is rarely defined.

When we talk about investment risk we are really talking about two things:

A 'higher risk' asset is likely to have more volatility in its value and is more likely not to achieve the desired return. However, it tends to deliver higher performance over time.

Think about an individual share of a company.

Over time that stock price will increase and decrease based on how investors view the stock and the company's performance.

If the company does well, the value of the stock should increase.

But, a few companies may operate poorly, and some could fold or be wound up.

If a company closes its doors, your stock could become worthless.

Across the whole asset class, stock prices will be volatile, but their value will trend upwards over time.

There are four main assets you can invest in. Let's go through each of them:

Investing in cash means using a term deposit through a bank.

You'll make an agreement with the bank, allowing them to have use of your money for an agreed period (from 30 days to 5 years) and they will pay you a fixed rate of interest.

Banks are typically thought to be very safe because they are regulated financial institutions and because the government guarantees investments under $250,000. This means there is minimal risk.

Because term deposits are such a low risk, there is also a smaller return compared with other asset types.

In the current market, you will be lucky to get a 3% return per annum investing in cash.

When you buy a bond, you're lending money to a company, local body (like a council) or the government.

In return, they promise to pay an advertised interest rate.

But what makes a bond different from a term deposit is that you can sell your bonds on a secondary market.

That means you don't have to hold the bond to the point where you get your money back when the bond matures.

The interest rate that you get for your bond will be different based on the type of organisation you purchase the bond from.

A company will usually be a higher risk than a government department. That means you are more likely to get a higher interest rate from an NZX-listed company than you would from the Reserve Bank.

A standard return for bonds might be around the 4% mark.

Property can be broken down into two categories – residential and commercial.

Most Kiwi investors will opt for residential because it is more familiar and typically has a lower entry price.

It might only cost $400,000 to purchase an entry-level residential property, but $1.5 million to invest in an entry-level commercial building.

Similarly, many Kiwis use the property investment strategy of purchasing a house or a building and waiting for the property to increase in value over time.

Through this strategy, investors are likely to receive a 5-6% return from the property going up in value.

However, we should note that the actual return from property is much higher. And that is because investment property can be leveraged.

That means that you can use 'other people's money' to get a return.

Let's run through an example to show the point –

You might purchase a $500,000 property using a $100,000 deposit.

Now, if you get a 5% return on that property from increases in that property's value, then you get a 5% return on the whole $500,000, not just on your $100,000 deposit. This kind of growth rate is historically achievable, especially in the Auckland property market.

A 5% return on $500,000 is $25,000, which is actually a 25% return on your initial investment.

This is what separates property from other investment classes, which is why it is often the most used asset to build wealth in the investment circle.

The final asset class we'll discuss is shares.

When you purchase a share, you really are buying a small part of a company.

You can build your wealth in two ways – either by receiving a small annual dividend (a share of the company's profits) or through the value of the company increasing in value, making your part more valuable.

Instead of investing directly and buying lots of small shares themselves, many investors will buy through a fund that has high exposure to stocks.

This is similar to your KiwiSaver, where a fund manager is appointed and will pick the stocks themselves on your behalf, aiming for the highest return possible.

Shares often receive the highest rate of return as a percentage – at about 10% annual growth.

There are a couple of ways you can determine what you should invest in.

But the core criteria you should have in your mind is which of the asset classes will give you enough growth to hit your goal.

Remember, the core purpose of this part of your retirement plan is to turn what you can afford to save into the assets that you need for retirement.

Yes, it also needs to fit with your appetite for risk, but if it doesn't achieve the end goal, then what was the point in the first place?

The purpose of this article isn't to show you exactly how to invest (we have other guides for that, like the Epic Guide to Property Investment).

What's important at this point is to choose the right asset class for you that is going to multiply your wealth so you can achieve your retirement goal.

Once you've chosen your ideal asset class, you could start looking at properties, shares or mutual funds yourself by researching on Google. This works for a few investors who like to be very active in their investment approach.

On the other hand, some investors prefer to work with an expert coach or advisor to figure out what sort of assets best fits what they're trying to achieve.

Working with experts tends to suit people who are time-poor and don't want to invest the time to acquire the knowledge to pick and manage their own investments.

Others will use advisors because they want the confidence that comes from working with people who have done and seen it all before.

Neither way is better, it comes down to the type of investor that you (and your partner) are.

The final part of your retirement plan is getting your insurances sorted to protect you if the worst happens.

Ideally, the Risk circle will be the least important part of your retirement plan because you'll never get sick and won't have to use it.

But things do go wrong. People get sick, are made redundant, and some will pass before their time.

Having the right insurance won't stop you from being made redundant or getting sick. However, it will prevent you from having to feel some of the financial consequences.

Let's take an example: Say you lose your job through redundancy, or you get sick and can't work. One of two things will happen:

Your Bank circle will suffer because you have no income, but you still have expenses. You can't afford to live day-to-day and pay for your groceries or mortgage

You use your investments to replace your Bank circle, which means that your investments decrease and your long-term goals are placed in jeopardy.

While the second option is definitely preferable to the first, what this shows is if your Risk circle doesn't work, either your Bank or Investment circle will suffer.

But, if you had the right insurance in place, your first two circles can continue, and your whole financial plan will remain intact.

Let's take another example. Let's say you're a store manager in the retail sector. The store you manage is based in the CBD.

A major earthquake occurs in your city, like what happened during the 2011 Canterbury earthquake.

The retail business you worked for shuts down because there's no access to stock, no shop and the company can't operate.

You're made redundant along with all your staff.

Most other retail-based businesses do the same, and temporary unemployment spreads across the city as it sorts itself out.

For most people their income stops, and their Bank circle begins to suffer. They can't meet their day-to-day living expenses.

However, you've got income protection insurance and use that insurance to replace your income while you find another job.

In this instance, your Risk circle reaches over and continues to fill up your Bank circle.

This allows you to continue building investment assets without disruption. Not only is your income protected, but so is your whole financial plan.

Of course, there's much more to it than this example, and we keep saying the 'right' insurance because not every insurance policy is right for everyone.

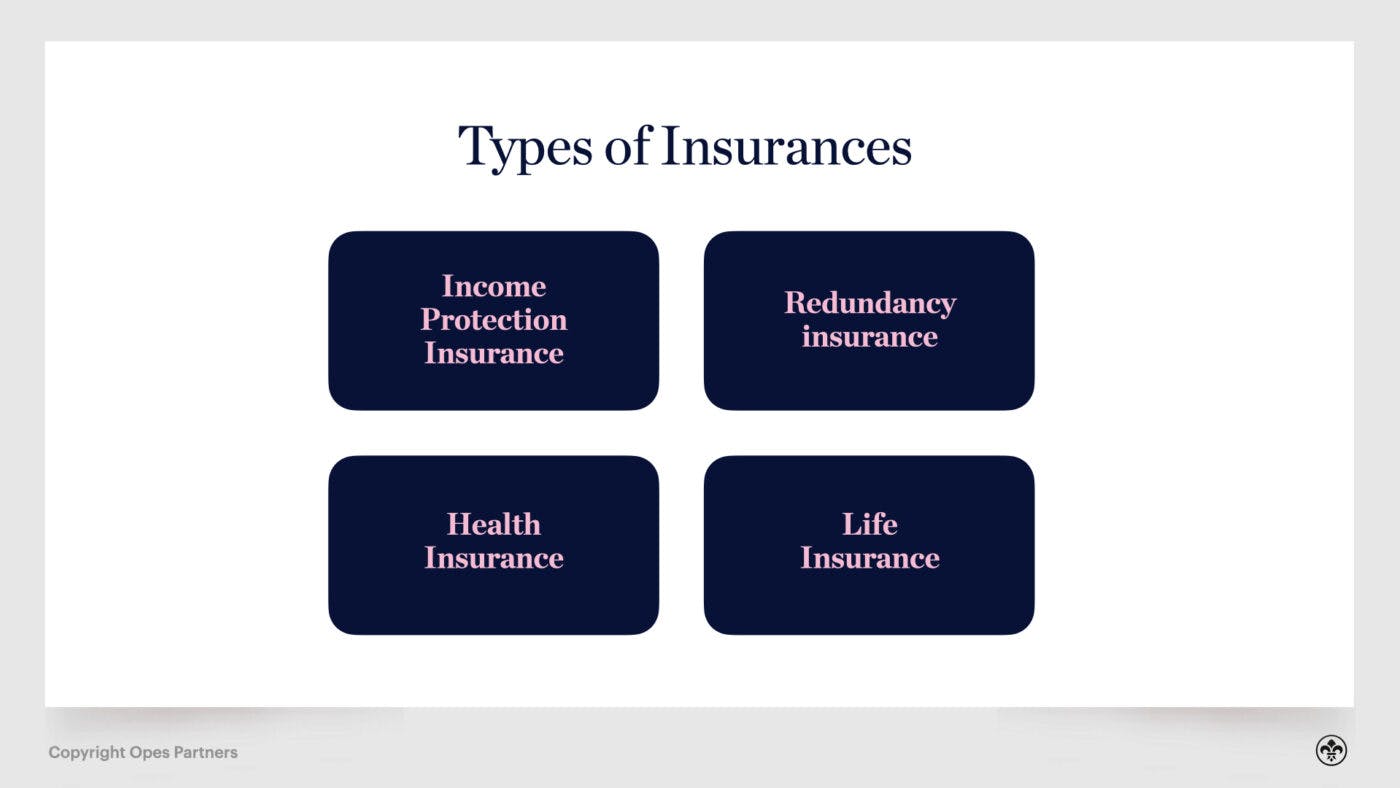

In fact, there are many insurance policies that you probably shouldn't buy. So, now let's work through the main types you should consider and talk about the people each insurance plan is most suited for.

Just before we talk about the four main types of insurance you should consider, it's good to know there are so many different types of cover.

That's why it is best to work with an insurance broker to get the best advice for you. A good broker will prepare a risk assessment and then only recommend the policies that are right for you.

That's because each of us carries different levels of risk.

If you drive motorbikes for a living, you've got a high-risk job. So it's more likely you'll want a higher level of health and life insurance.

Similarly, if you work in the tech sector, you are likely to be higher paid. But, there is also a higher risk of redundancy because the industry moves so quickly and start-up companies sometimes fail.

If this is you, you might want a higher level of redundancy cover.

Here are the four main types of personal insurance to think about:

Income protection insurance will replace your income if you can't work through illness or injury.

If you do get sick, the insurance company will replace your income up to a threshold, say 75% of your pre-tax income.

However, there is a waiting period before your payments actually start. This is a bit like a stand-down period between when you stop working and when they start paying you.

You get to choose that waiting period, which can be as little as 2 weeks and as high as 2 years. But, what you decide here can make a massive difference in the cost of your policy.

The shorter the waiting period, the higher the cost of your insurance premiums will be.

Similarly, you can choose the length of time the payments would last for, from 1, 2 or 5 years.

If you want cover for 5 years, you will pay higher premiums than if your policy only has 1 year of protection.

You might be asking 'who will get the most value out of this policy?'

Income Protection insurance is most valuable for people who are the chief breadwinner in their family and/or if they are supporting other people financially.

Say you're the primary income earner in your household. You have 2 children, a mortgage and your partner works part-time, just for extra income. Income protection is perfect for you.

If you can't earn an income, your whole family's quality of life will suffer. You won't be able to pay the mortgage with just your partner's part-time salary, and it is likely they will need to start working full-time.

However, your partner in this situation probably won't need this type of insurance.

If your partner is just working part-time for extra spending, your family's quality of life won't dramatically change if they are unable to work.

Sure, there will be less money. But the effect won't be as significant from a financial perspective than if you were to lose your job.

In this situation, income protection insurance is right for one partner but not the other.

Redundancy cover is an additional insurance policy that goes on top of income protection, rather than separately.

It protects your income if you are involuntarily made redundant, or your company is made bankrupt.

Just like income protection, there is generally a stand-down or waiting period before the cover starts, which is usually 30 days.

Although, unlike income-protection insurance, many policies will cover up to 85% of your pre-tax income.

Again, you might be asking 'who will get the most value out of this policy?'

Because there is a waiting period before the policy kicks in, this insurance is most useful for people who have very specialised skills. That's because it will likely take more than 30 days to find a new job.

If you can quickly get a job within 30 days, then you will get less value out of this insurance (save from the earthquake example mentioned above).

People working in the tech sector, like data scientists, often have highly specialised jobs, and there are a limited number of companies they can work for.

Because it will probably take more than 30 days for a data-scientist to find the next job for them, this type of insurance can be advantageous.

Health insurance is a broad policy that covers medication, surgery and care for a range of health issues.

With the right health insurance, you'll be able to get access to private healthcare, which means less time spent on public waiting lists.

Types of benefits include: Unlimited approved surgery; $500,000 per year for cancer treatment; or heavily discounted MRI and CT scans.

So, who is likely to get the most value out of this policy?

Although you might initially think health insurance is right for the elderly people, younger people will generally get the most value out of health insurance.

That's because health insurance will generally not cover any pre-existing health conditions.

If you've got a dodgy knee and you've been to see the doctor about it, the insurance company usually won't protect you from health issues that happen because of your knee.

Younger people, though, don't tend to have as many or any pre-existing health conditions. That means they can receive full cover without exclusions.

That means that when your knee does become dodgy (and it probably will at some point), your health insurance company will pay out.

The final type of insurance policy we'll discuss is life insurance.

This type of cover will pay an amount of money if you die (with a few exclusions).

It is most commonly used to look after the people you've left behind or to pay off debt.

You'll agree on a level of cover with your insurance company, and typically it's best practice to insure 10x your pre-tax salary.

Say you're on $75,000 a year, you'd want to insure a lump sum of $750,000.

This will allow your family to get sorted and still live a comfortable life.

Again, let's talk about who is going to get the most benefit from this policy.

Like income protection insurance, life insurance is most valuable for people who are the primary income earners in their household, and those who have children or dependents.

If you die suddenly, so does your income.

What happens then? Those who are dependent on you are going to be financially constrained, and their lifestyle will be negatively impacted.

Let's say your salary, like above, is covering your mortgage and you have a partner and 2 children.

If you accidentally die, then your family won't be able to cover the mortgage and will have to downsize their home or rely on charity.

If you have a policy in place, they can use the life insurance payout to pay off the mortgage, making it debt-free, meaning they can always live in your family home.

Similarly, life insurance is equally valuable for any business partners or people who have taken out debt together. In this case, if one partner passes too early, the debt can be repaid, and the other partner can continue.

However, these policies are less valuable for people who don't have extensive family responsibilities or dependents.

If you're a single young professional and renting, then you're less likely to need this type of policy.

That's the same for single retirees with adult children.

Because you have no dependents and low financial commitments, there is less need for this type of policy other than to act as an inheritance.

Risk and insurance are often thought of like the annoying part of financial planning, and many Kiwis think 'why do I even need this?'

The more important question to ask is 'when do I need this?' Or, 'when would I need this?'

If you're planning for retirement – which you probably are if you've read this far – don't be overwhelmed by the amount of content in this article.

Really there are just 8 simple steps to take:

It's taken over 8,500 words to get to these 7 steps. But, the most important are steps number 7 and 8:

From just the knowledge you've gained in this article, you are probably now more retirement-aware than most Kiwis across the country.

But, if you actually follow these 9 steps and commit them into action, you won't just be retirement-aware … you'll be retirement ready.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.