BRRRR

The ultimate guide to the BRRRR strategy

The BRRRR strategy is game plan for how to quite literally, build equity and value into a property through renovation improvement.

Property Investment

14 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Our Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

When you strip out all the extra details, there are really only two investments strategies used by property investors.

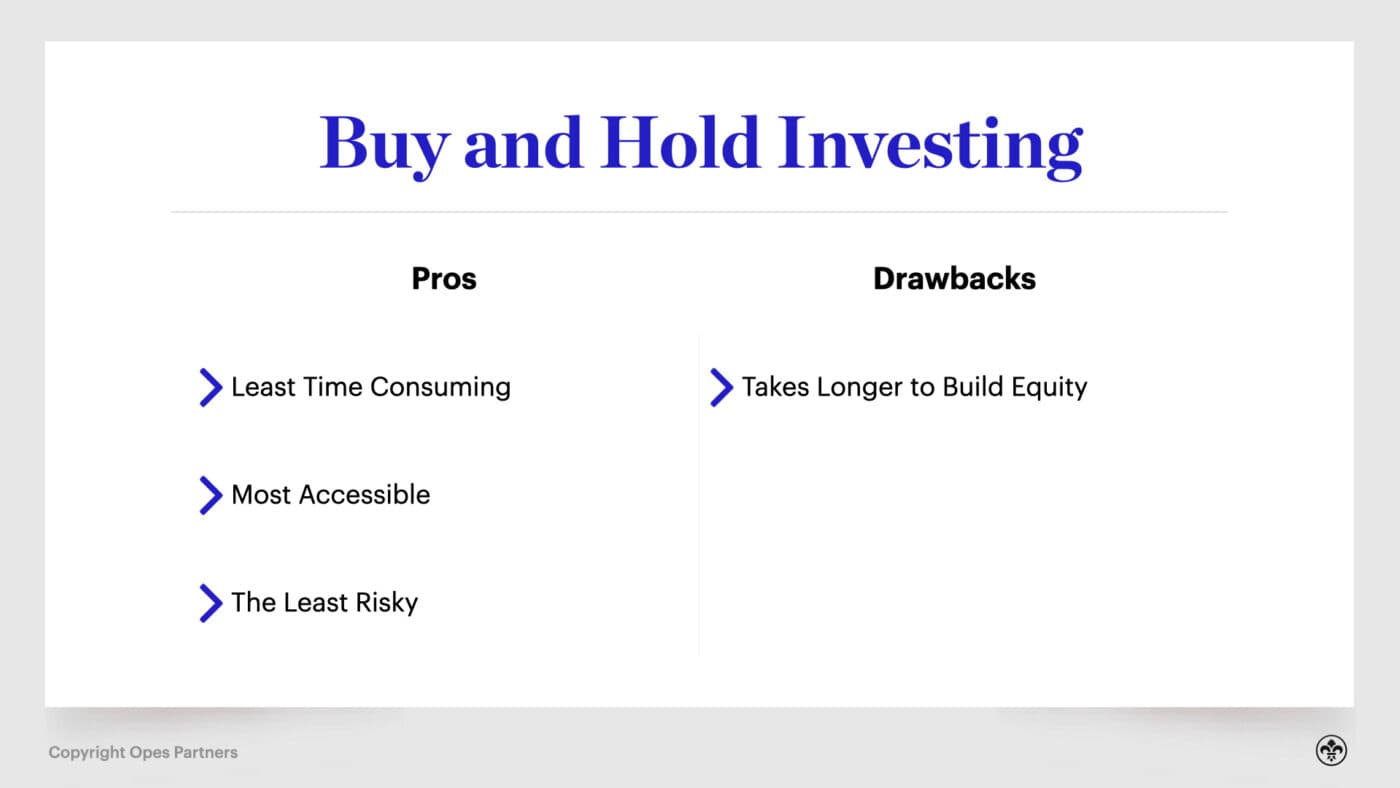

Property investors can make money using either strategy, and both come with their own set of pros and cons.

And underneath these two strategies, there are a whole heap of specific strategies you can use. So, in this article we’ll take you through the good and the bad of each strategy, and the different ways to use them, so you can decide which suits your investment goals over the long term.

So, there are two property investment strategies most commonly used in New Zealand:

In a nutshell:

The “Buy and Hold” strategy is purchasing property and holding it over the long term to get the best capital gains, while earning regular cashflow from tenants.

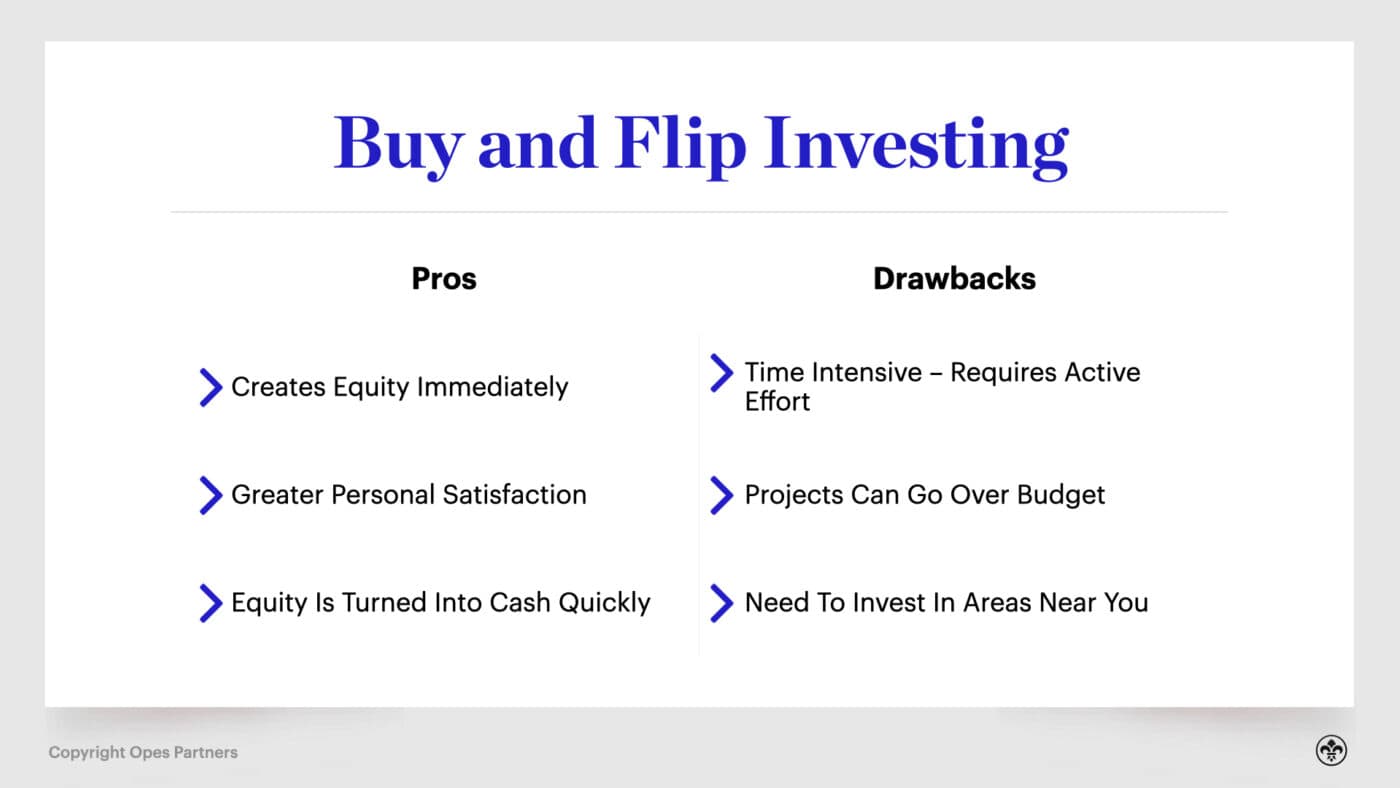

The “Buy and Flip” is purchasing property, renovating it to create immediate equity, and selling it straight away for profit.

Now, some “Buy and Hold” investors will renovate before they rent, but not all.

Some “Buy and Flip” investors may be working towards a long-term investment goal – despite short-term ownership of properties – but not all.

What we are saying is: the key difference between these two strategies is how long you hold onto the property.

While most investors end up being “Buy and Hold”, many think about flipping properties first.

Why?

Well, the speed of the “Buy and Flip” is just so appealing because there is the immediate reward of seeing money in the bank. It doesn’t require holding onto a property for 10-plus years, waiting for capital growth to grow while dealing with being a landlord all that time.

The other reason is that we see headlines in the media talking about property investors making quick wins in the property market and it’s tempting to want to go after it too.

I mean, how many times have you read an article in the NZ Herald that reads something like: “Auckland, Grey Lynn home sells for $755,000 profit in seven months.”

Let’s admit it, there’s an innate romanticism about doing up a rundown property we all dream of playing out - the kind we see on most popular TV shows and movies.

But make no mistake, it is more time-intensive, higher risk, and requires a lot more knowledge and precise execution compared with its sister strategy (buy-and-hold).

Usually, the buy-and-flip strategy is right for people who:

On the other hand, you have the “Buy and Hold”. This strategy, for want of a better word, is easier to get into. It’s not as time-intensive, the deposit required can be smaller, and it doesn’t require much prior knowledge to be successful.

And once the property is rented, you will primarily make money from the property going up in value, which is a ‘set-and-forget’ approach. (We’ll go into more detail below).

To make a blunt comparison – while you can do the “Buy and Hold” alongside your current job, flipping houses is like taking on another job.

In some ways, the buy-and-hold strategy is true investing – since once you purchase the property you make money over time without much additional effort. Whereas when you start flipping houses, you need to continually work to make money.

That might make us sound a bit biased. But, let us be clear – both strategies have merits. And even when we discuss the drawback to these strategies, it doesn’t mean we are trying to convince you one is better than the other.

The question you should be asking yourself is: What strategy is right for me?

Let’s begin with the “Buy and Hold” strategy, which is the most common strategy property investors use in New Zealand.

There are lots of pros for this strategy:

Firstly, the buy-and-hold can be a hands-off, passive strategy.

In some cases, you buy a property you know is going to be low maintenance, you rent it out, and you wait for 15 to 20 years for the house to increase in value. Meanwhile, you collect the rent. That’s it. When the buy-and-hold strategy works well, it’s a “set and forget” approach.

Aside from (maybe) dealing with a property manager or tenants once in a while, the buy-and-hold can be low maintenance enough for it to be achievable alongside your day job and realistic for working, everyday New Zealanders.

But it’s not all sunshine and rainbows. There are some cons to this strategy:

To be successful in this strategy, you must either:

If your property has neither of these, then it’s not worth holding the property over the long term, so it’s more suited for a flip.

Even if you’re purchasing properties that you expect will increase in value, they still need to have reasonable cashflow, because otherwise you can bankrupt yourself in the meantime.

You can’t pay your mortgage with capital growth.

For the same reason, most buy-and-hold investors will stay away from houses that require capital maintenance in the foreseeable future.

For example, impending roof replacements or busted hot water cylinders are expensive but don’t allow you to increase your rent or improve the property’s value.

New-builds are a popular choice for buy-and-hold investors for this very reason.

There are many variations of the “Buy and Hold” strategy – each based on location, type of property and the target tenant. But these all fall under 3 main categories –

This is where an investor purchases a newly-built property from a developer or through a buyer’s agent, like Opes Partners. They then rent the property out and primarily make money as the property increases in value over time.

The benefits of this strategy are:

But the drawbacks of this strategy are:

The passive buy-and-hold strategy that focuses on new-builds is one we are very familiar with here at Opes Partners. And it is the main strategy we run as part of our property coaching programme.

The next strategy property investors often use is the BRRRR – which stands for Buy, Renovate, Rent, Refinance and Repeat.

In this property investment strategy investors purchase houses that need some love and do them up.

The benefits of this strategy are:

But the drawbacks of this strategy are:

We are also familiar with the BRRRR strategy here at Opes Partners as we coach this strategy through the Opes Accelerate coaching programme.

Finally, there is one other group of investors who purchase existing properties and don’t renovate them – or renovate them very lightly.

These investors focus on purchasing properties ‘at a discount’ or ‘under what they’re worth’. This often happens in small towns where there are few buyers – or where a seller needs the cash from a property sale quickly.

That allows these investors to negotiate good prices, which keeps their mortgages lower than they otherwise would be.

In his book, 20 Rental Properties in One Year, Graeme Fowler often uses this strategy. He waits for good deals and then closes them quickly to secure good discounts.

The benefits of this strategy are:

But the drawbacks of this strategy are:

Let’s move on to the “Buy and Flip” strategy, which sits on the flip-side of any long-term wealth plan.

For investors who choose this path, you will see:

But these benefits come with several drawbacks:

Successfully executed, a buy-and-flip strategy is the quickest way to create immediate capital gain (equity) within the property, because once renovations are finished, the property is worth more.

Often, this strategy can be used by investors who are just starting out and need more equity to become buy-and-hold investors.

So by painting the walls, adding a bedroom, or changing the carpet, you can increase a property’s value relatively quickly and then sell for a profit.

As we mentioned earlier, we Kiwis like the idea of painting a room, ending our day tired, our clothes weary with paint drops. It’s a bit of a dream.

But it pays not to lose respect for the technical aspects and knowledge required to execute this strategy.

As much as it may sound like: “Let’s paint a room a nice colour”, if you want to be a successful “flipper” you need to know your stuff and have an eye firmly on the numbers.

In fact, the buy-and-flip strategy is a good option for people with a background in construction who have the skills and expertise to do renovations.

You need to know how to cost-effectively add to the value of the property, and then you need to have the know-how or the money to carry out those renovations.

Because any dollar you spend is a dollar off your profit margin. While that’s true for the BRRRR strategy too … the cost of the renovation is less of a concern for long-term investors since they also make money through rental income and market-made capital gains.

But one drawback, if not the biggest drawback, is once you sell the property you don’t make any more money from it.

That might sound obvious, but selling a property straight away to make way for the next project means you miss out on potential rent – the weekly cashflow figure you’ve just increased with all your renovations.

There are a few different ways to do the “Buy and Flip” strategy. Some of these are often called ‘trading’.

But we include them here since they are all to do with using property to make short-term gains, rather than holding for the long term.

Flipping houses is like we’ve described above. You purchase a property, renovate it and then sell it back on the market for a higher price.

The benefits of this strategy are:

But the drawbacks of this strategy are:

Trading houses is when you purchase a property – or you get the right to purchase a property – and sell it to someone else.

An example of this is if an investor (a trader) buys a property for $450k, and then sells the property directly to another investor for $460k. In this instance, the trader (the first investor) would make $10k without having to own the property or conduct renovations.

The benefits of this strategy are:

But the drawbacks of this strategy are:

There are many strategies you can use as a property investor. And there are many more variations than what we’ve listed in this article.

The important next step for any investor is to pick the strategy that is right for them. The one that’s right for you and your situation.

For first-time investors that often means starting out with one of the classic beginner strategies, like the Passive Buy and Hold strategy or the BRRRR strategy.

For a more in-depth and comprehensive guide on how to invest in property in New Zealand read our Epic Guide to Property Investment.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.