Property Investment

Property investment NZ – The epic guide to property investment

Explore the latest in NZ property investment with our comprehensive 2026 guide. Gain insights into strategies and detailed steps for success.

Property Investment

9 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Property investors get a bad rap. Private landlords are portrayed as greedy profiteers of the less-fortunate renters – and regularly get beaten up by politicians (aka Chloe Swarbrick), the media and by government policy.

But the numbers show tThe Ethical Argument For Property Investmenthat 80% of all rentals are owned by mum-and-dad investors. And 73.16% of private landlords only own a single investment property.

This article argues property investment is a societal necessity.

Investors provide much-needed rentals, they improve the standard of the housing stock and often soften the blow of housing crises - most of the time without massive profit margins.

Are property investors altruists who are investing just to house the needy? Of course not, they’re investing for a profit. But this article argues the desire to make a profit benefits the housing market, rather than making it worse.

To state the obvious, houses are expensive.

It’s always been this way.

And while we believe more people can own their homes, the truth is that not everyone can, and not everyone wants to.Why Can’t Everyone Be A Homeowner?

In other words, it’s not just high house prices that are keeping people out of the market.

For example, in 1991 house prices were 6.35x cheaper than they are today, according to the Reserve Bank of New Zealand. And yet 26.20% of people still rented.

Even if house prices halved not every person would be in a position to buy.

Why is that?

Buying your own home is one the biggest would-be purchases a person is likely to make in their life. Not everyone is at the right life stage where they are in a position to buy.

For example, no matter what the price of houses, students and young professionals are likely not to have the income to support a new mortgage. The bank is unlikely to lend to them, so they need rental accommodation.

Immigrants moving to New Zealand, or workers moving between cities, often want to find their feet before making a purchase. And those who travel for work, e.g. doctors who move towns for a year, may not want to tie themselves down when they know their stay will be temporary.

And, of course, there are those at the lower end of the<a href="

And we see that in the stats. Back in 1951, 38.5% of the population rented. Today that figure is 35.5%.

So no matter what house prices are, we need someone to provide rental properties. Not everyone is going to live in a home they own.

Landlords use their own equity to buy rental properties and rent them out for other people to live in. They take on large mortgages and the responsibility for maintaining those properties and in doing so take on risk.

Yes, we all know that to be true.

But if landlords didn’t exist, there would still be renters and a need for rental properties.

So, in the absence of private landlords, the responsibility would otherwise fall on the state, or the government, to provide rental accommodation.

What’s the issue with that?

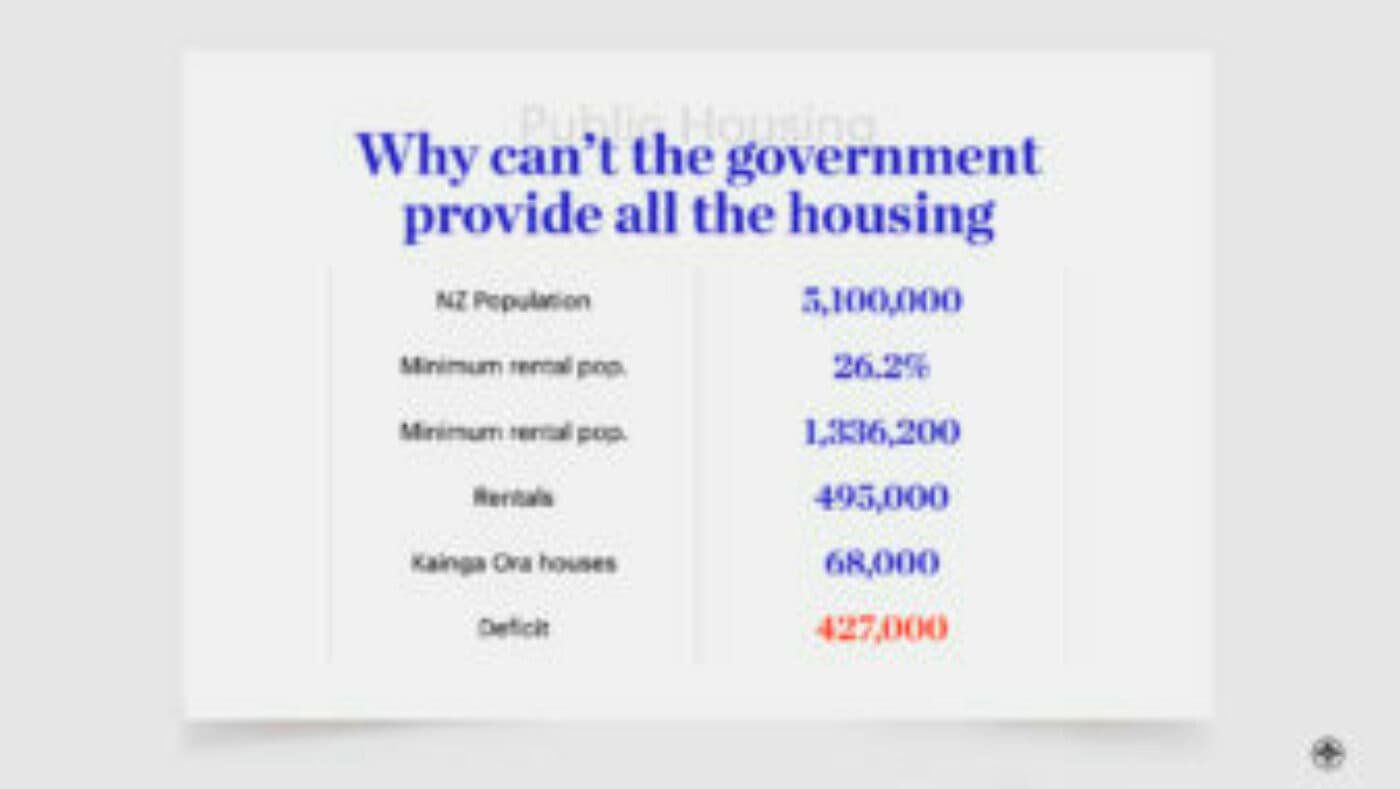

The government doesn’t have the resources to achieve this utopic vision.

The current value of the New Zealand housing stock is $1.386 trillion. In 2018, 35.5% of people rented – so the rental stock is worth about $492 billion (ballpark – admittedly rentals might be cheaper on average, but it gives you a sense of scale).

The government currently has $366 billion of assets and $103.3 billion worth of debt.

So if the government was to buy every rental in New Zealand, it would have to more than double its base and potentially triple its debt.

Now if the government did take on this much debt, the cost of servicing that debt would be enormous, even after collecting rent from tenants.

That means either significantly increasing taxes or diverting resources away from other services like healthcare, education and infrastructure.

Every additional rental property provided by the private market is a house that doesn’t have to be provided by the government.

Private households take on that debt and risk, so the state can spend on programmes like social emergency housing for those who really need it.

Those more fortunate can head to the private rental market. No politician is openly proclaiming it, but we need property investors.

Private landlords have a significant influence on the quality of the houses we have in New Zealand.

This happens through two key strategies landlords use to invest: renovating old properties and building new ones.

There is a subculture of property investors who focus on renovations. They meet at conferences, have their own Facebook group, and even their own magazine.

Their goal is to use their own money to buy rundown properties and renovate them to make them new. This improves housing stock quality.

You might think: “Well couldn’t first home buyers renovate properties?”

Some could. But, in some instances, first home buyers won’t have the deposit to renovate the property themselves but could afford to buy property if fully renovated.

Say, for instance, a first-home buyer purchases a do-up at a bargain of $500k. They need to front the $100k deposit and $50k (roughly) for renovations.

After the renovations are complete the property would likely be worth around $600k and for that the first home buyer would need to front with a total deposit of $150k.

But, if the property was bought by an experienced property investor, who achieved then sold the property for $600k, the first home buyer would only need a $120k deposit to purchase the property.

This is because when purchasing, first home buyers need to front with their deposit and any renovation costs on top of that. Whereas, if they buy a completed home, they can borrow more money against the property’s completed value.

There are lots of renovations-focused investors. So, while the first home buyer doesn’t get the equity, they might be able to purchase it.

The other way property investors improve housing stock is through building new properties.

You might ask: “If investors buy new-builds off the plans … doesn’t that mean there are fewer new-build properties available for first home buyers?”

Nope.

A new-build development often needs 75%+ of properties sold off the plans before banks will give the developer finance.

This bank-imposed threshold is tough for developers to reach if they’re only selling to owner-occupiers.

Selling to a few investors means the developer can get the funding they need more quickly and start building. Once done, they’ll move on to the next building project.

More investors = more development projects getting off the ground = more chance for owner-occupiers to get on the ladder.

As a side benefit, including renters within a development improves the diversity within the newly built community. That's because renters are more likely to be racially and economically diverse than the average home buyer.

Often the answer is “no”. The rich and greedy landlord is a gross misconception, despite what Green MP Chlöe Swarbrick claims on the Am Show.

The truth is, many investors don’t make a profit at all and most of them don’t own that many properties.

Last year, over ⅓ of investors didn’t make a profit and a mortgage is often higher than the rent coming in.

A lot of residential properties – especially when first purchased – are also negatively-geared, which means the investor is putting money into the property each week and the rent doesn’t cover all the associated expenses.

In effect, that means the investor is susidizing the tenants to live in the property.

Even for properties that aren’t negatively geared, many investors will keep the rent artificially below what they should really charge.

Investors will often say things like: “I like to charge below-market so I can keep my good tenants” in facebook groups and at conferences.

Granted, property investors aren't solely altruistic. The investor is likely to be looking for long term capital gain, and if they increased the rent to cover all expenses they might not have a tenant.

But the point is:

Yup.

Anyone who buys a house contributes in part to market demand, and so plays a part in pushing house prices up.

First home buyers push house prices up; owner-occupiers moving house push house prices up; the government buying state houses pushes pricing up; and yes, investors push prices up too.

We’re all “part of the problem”.

Remember, if an investor sells a property to a first home buyer, that’s not the same as saying there’s one more household that owns property and one less household that no longer needs to rent.

It’s more complicated than that.

Let’s say a student in Christchurch finishes university, moves out of student accommodation and decides to buy their first home.

If they purchase a property from an investor, then the family who currently rents that property will need to move out. There’s one less rental property in the market, but the family who used to rent that property still needs a place to call home.

Investors selling properties doesn't necessarily mean they transfer over to renters.

Under Article 25 of the United Nation’s Universal Declaration of Human Rights, adequate housing is said to be a human right.

As is food and clothing. But that doesn’t mean farmers shouldn’t be paid for their crops, or that H+M or Zara shouldn’t be paid for selling you clothes.

Human rights can be aided by having open markets, not hindered by them. The fact that The Warehouse can make money by selling cheap clothes means it’s very easy to go out and buy clothes.

Similarly, making money from providing rental accommodation means there is an incentive to provide that service.

Yes, housing is a human right. But so is food, and no one is complaining that NZ’s largest business and exporter – Fonterra – makes millions for farmers and the rest of the country by selling milk and food products abroad.

Of course not. Not all property investors are at home polishing their halos, steadfast in their desire to cure the housing crisis and aiding the homeless.

But equally, neither are all first home buyers inherently good neighbours.

Not all tenants are perfect either. A short gander through any Tenancy Tribunal ruling will tell you that. Some would shock and appall you.

Yes, investors buy properties to benefit themselves. That’s the same as anyone else in business. Dairies, fish and chip shops, furniture stores and all businesses are there to make money. In doing so they provide products and services we can benefit from.

As we said above, never in the history of New Zealand has less than 25% of households rented property.

We need rental properties, and for that we need property investors.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser