Mortgages

How do I get a mortgage and pay it off?

This 9,500-word Epic Guide to Mortgages is the definitive article on how to get a mortgage and pay it off faster, today in 2022. The Ultimate Guide.

Mortgages

8 min read

Author: Peter Norris

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

A reverse mortgage is when the bank gives you a lump sum of cash, borrowed from the equity within your house.

The main point is that you don’t have to pay any money back to the bank until you die or sell the property.

Sounds like a great deal, so why don’t we here at Opes Partners count it as a retirement strategy?

In this article, you’ll learn what a reverse mortgage is. You’ll also learn the pros and cons, and when it could be a good option for your retirement.

A reverse mortgage is a very specific type of loan. It is usually used by retirees.

Essentially, it gives you access to a large amount of cash. This is by taking a loan out against the existing equity of your home.

The cool thing is, you don’t have to pay back any of that loan straight away. In fact, you don’t have to make any repayments at all, at least not initially.

So long as you continue to live in your home, there are no repayments.

There is still interest, but the interest is compounded and rolled into the mortgage.

You don’t pay the bill until you either:

It can be a great way for retirees who are cash poor, but asset rich. So, if you need access to money in retirement, this could be an option for you.

It does come at a cost (we’ll cover this below).

But you have access to cash that you otherwise wouldn’t have. And as a retiree, it’s hard to get a normal loan since your income is usually low.

We have a saying here at Opes Partners, “Becoming mortgage-free is not a retirement strategy” because you can’t eat your house.

But you kinda can … with a reverse mortgage.

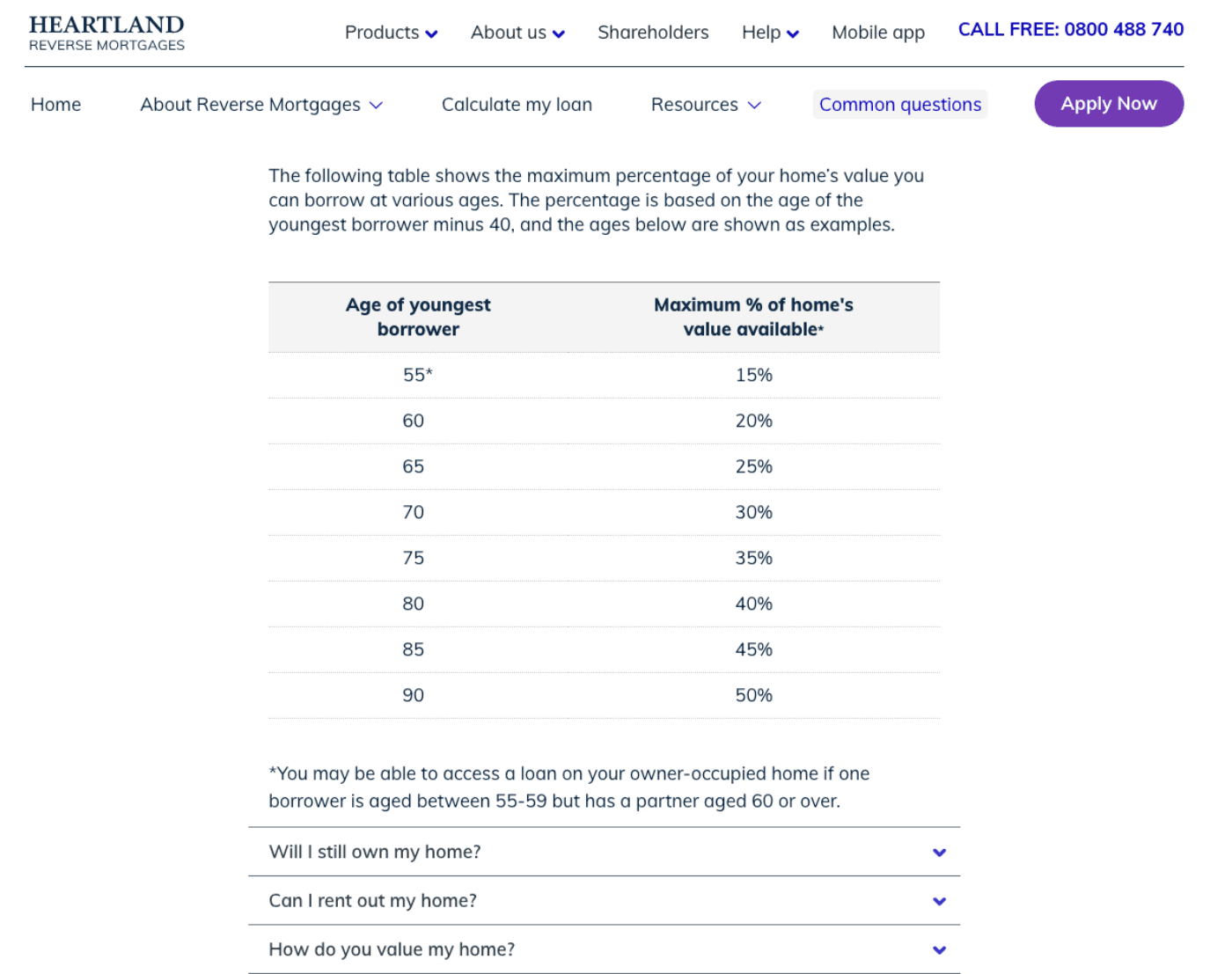

The amount you can get for a reverse mortgage depends on how old you are.

So, if you’re 60 you can get a mortgage of up to 20% of the value of your own home.

If you’re 90, you can borrow 50%.

Here’s an example of what you can borrow. This comes from Heartland bank.

The maximum amount you could borrow is estimated on the value of your house.

Let’s go through the pros and cons of reverse mortgages, that way you can decide whether one is the right fit for you.

Many retirees are cash poor, but equity rich.

If you haven’t saved or had time to invest, reverse mortgages can help fund your retirement.

Particularly, if you:

Unlike a standard mortgage, you don’t have to make any payments until you sell your house, or the owners pass away.

The loan is then repaid with the money you get from selling the house.

It’s really important if you are a couple to put both names on the reverse mortgage because if one partner dies, the payment could be due. Then the other partner has nowhere to live.

Now let’s go through the cons.

Heartland Bank’s interest rate is 9.75% per annum (at the time of writing). This is high, which is likely to be in line with other high-interest rates.

On top of that, interest compounds. So it’s calculated on the balance outstanding and then rolled into the loan each month.

For instance, if you borrow $100k and you pay 9% in your first year, aka $9000, that interest gets added to your initial $100k.

So in year 2, you’re paying interest on $109k. Now, you’re paying a high-interest rate on an even larger mortgage, and so on and so on.

Each year you pay more interest on a growing mortgage.

It can very quickly erode your capital.

The interest rate is often larger than how fast your house goes up in value.

For example, let’s say you take out a $50,000 loan at 70. By age 85 you’ll owe the bank $202,000.

A reverse mortgage locks you into your house … sort of.

This is because it quickly erodes your equity.

So, if (in a few years) you decide to sell your house, or move to a retirement facility, you won’t have as much equity to lean on, so you might be less likely to sell or move house.

Reverse mortgages can work well in some circumstances. But because they are expensive, they aren’t going to be the right fit for everyone.

Ideally, you want to have a reverse mortgage for as little time as possible.

For instance, let’s say Jan is 65 years old. She’s a retired nurse and lives in her own home. She’s got $100k in KiwiSaver and is getting superannuation.

At this point in her life, Jan should use her KiwiSaver to top up her superannuation first.

But, Jan’s situation may change later on in her retirement.

Let’s say Jan is now 80. She’s exhausted all her savings, her KiwiSaver’s depleted, and she’s struggling to pay her bills.

At 80, Jan’s got a life expectancy of 86. A reverse mortgage could be a good idea for her now.

Here at Opes Partners we think reverse mortgages have their place, but they should be used as a last resort.

Here are 5 alternatives to try before you take out a reverse mortgage.

Sometimes children will rally together to give their parents cash.

In some cases they will even borrow money against their own homes.

For instance, 2 children could each borrow $25k against their own homes.

They give their parents $50k to solve that immediate cashflow issue.

Yes, the kids have to pay the interest on that money, but the interest will be far lower than the compounding 9.75% of a reverse mortgage. It might be closer to 7%. And, the equity will be preserved in the family home.

So, when the parents do pass, the kids inherit that money back.

If you have a 4-bedroom home worth $1.5 million, you could downsize.

So, instead of borrowing $50,000 at a 9%+ interest rate, you could sell your $1.5 million property and buy a $1 million property.

That might free up $400,000 at 0% interest (after paying the real estate agent).

Sure, that does mean you are going to have to move, and you may not want to move.

But the financial drive might outweigh that desire.

If you can carve off a piece of land and sell that it could be a good move.

You get to stay in your home, and get the cash as well. You’ll just need to give up a large part of your back garden.

Of course, not everyone owns a section that can be subdivided.

Ryman Healthcare, a retirement village company, has a “deferred management fee”, also known as a departure fee.

It means you can live and enjoy the facilities as long as you live there without immediate cost, but when you permanently vacate your unit, there is a bill to pay.

In this instance, you can free up cash to enjoy your retirement years.

If you’ve got a larger home, consider renting it out to get that additional income, or maybe you can convert the downstairs to an Airbnb.

Other retirees sometimes build a minor dwelling on their property and rent that out.

Our favourite one here at Opes - plan ahead. Talk to a financial adviser about your retirement, long before you get there.

Reverse mortgages can work well in some circumstances.

If you’re all out of options money-wise, but you own your home – then a reverse mortgage can be a good last resort.

But you still want to be doing it for the shortest amount of time possible, because they’re expensive.

So, generally, you’d spend all your other money first. This is because the interest rate is high, and the costs compound over time, so you don’t want to hold that debt for very long.

Compounding interest is great in your savings account, but not in a reverse mortgage.

Is it a retirement strategy? No. Here at Opes Partners, it’s our opinion that this should be a last resort. It’s not a good idea to cash in your hard-earned equity at 60 to go on a holiday.

Instead, start thinking about retirement at about 40.

And then get your investment properties to pay for your overseas holiday.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser