Property Investment

Cashback wars

Fancy pocketing up to $7,500 just for switching banks? Here’s why that’s suddenly on the table👇

Mortgages

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Interest rates are dropping. Fast.

At the last count, ANZ has slashed its 1-year rate 7 times since January. It’s a big deal.

But with interest rates dropping, many investors ask me: “Andrew, how long should I fix my interest rate for?”

This can be a tricky question since interest rates change all the time.

So I spent $4,850 to build you a calculator. That way, you can run the numbers for free.

In the past, I’ve said there are three ways to select your rate:

Pros: Over the last 20 years, this has led to the lowest average rate.

Cons: You won’t always come out ahead. No guarantee the strategy will keep working.

If you don’t want to put all your eggs (or mortgage) in the same fixed-rate basket – hedge your bets and split your loan.

You could fix $250k for 1-year and another $250k for 2 or 5 years.

Pros: This gives you an average of the market over time.

Cons: It won’t give you the lowest overall rate. You’ll just get an average of the market.

Or, you could use a spreadsheet to run a few scenarios.

Pros: Gives you a better, more nuanced answer

Cons: It’s math-heavy. And my previous spreadsheets caused more questions than answers.

Because those old ways of choosing your rate have drawbacks … I built this new interest rate calculator. You can use it here for free. But here’s how it works:

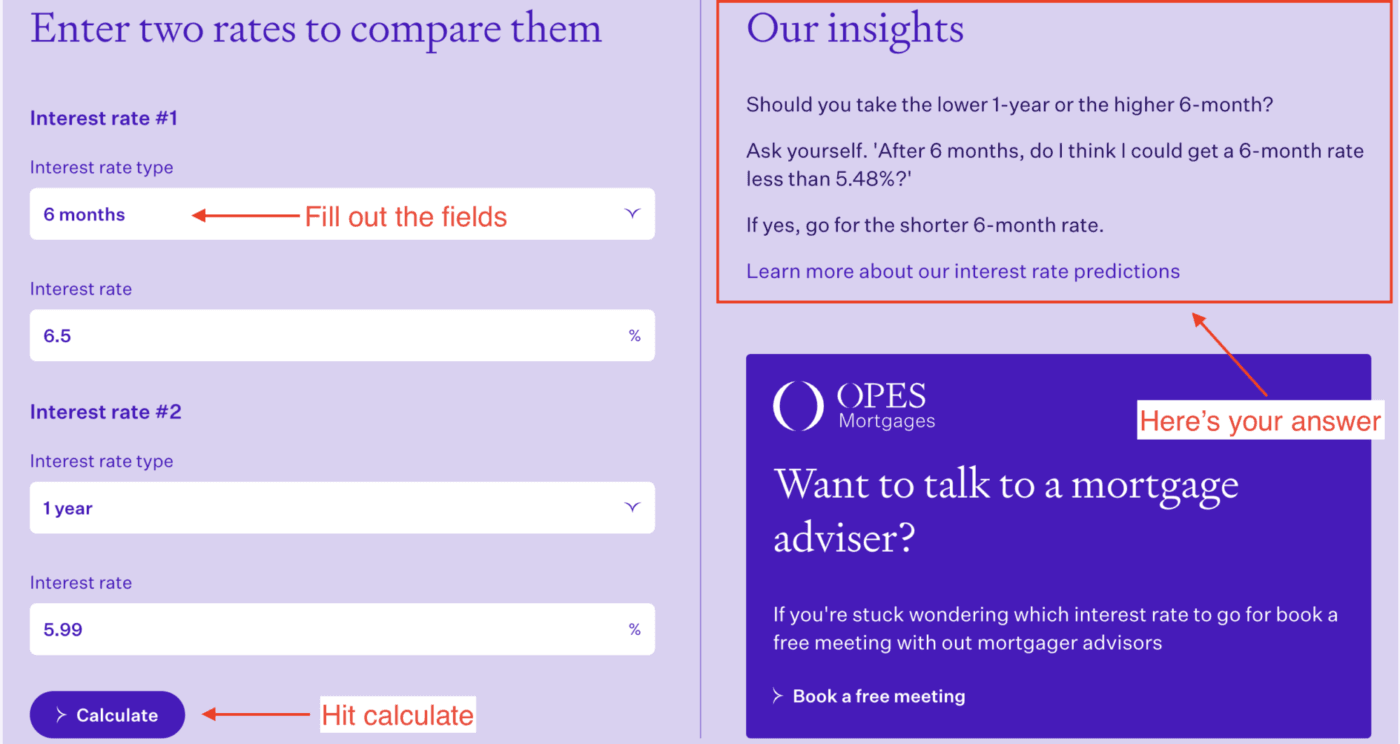

Let’s say you’re weighing up the 6-month and 1-year rates.

The 6-month is more expensive, but you think: “But if interest rates come down, maybe I’ll be better off.”

So, does choosing the more expensive, shorter-term rate make sense?

Pop the details into the calculator, hit calculate, and you’ll get your answer:

For the shorter term, 6-month rate to make sense, in 6 months, you’d need to be able to lock in at 6 months at 5.48% or below.

So ask yourself: “Will the 6-month interest rate fall over 1% in the next 6 months?”

If you’re like me and think that seems unlikely, go for the 1-year rate.

But – remember – when you go to fix your interest rate, the bank will likely offer you a discount.

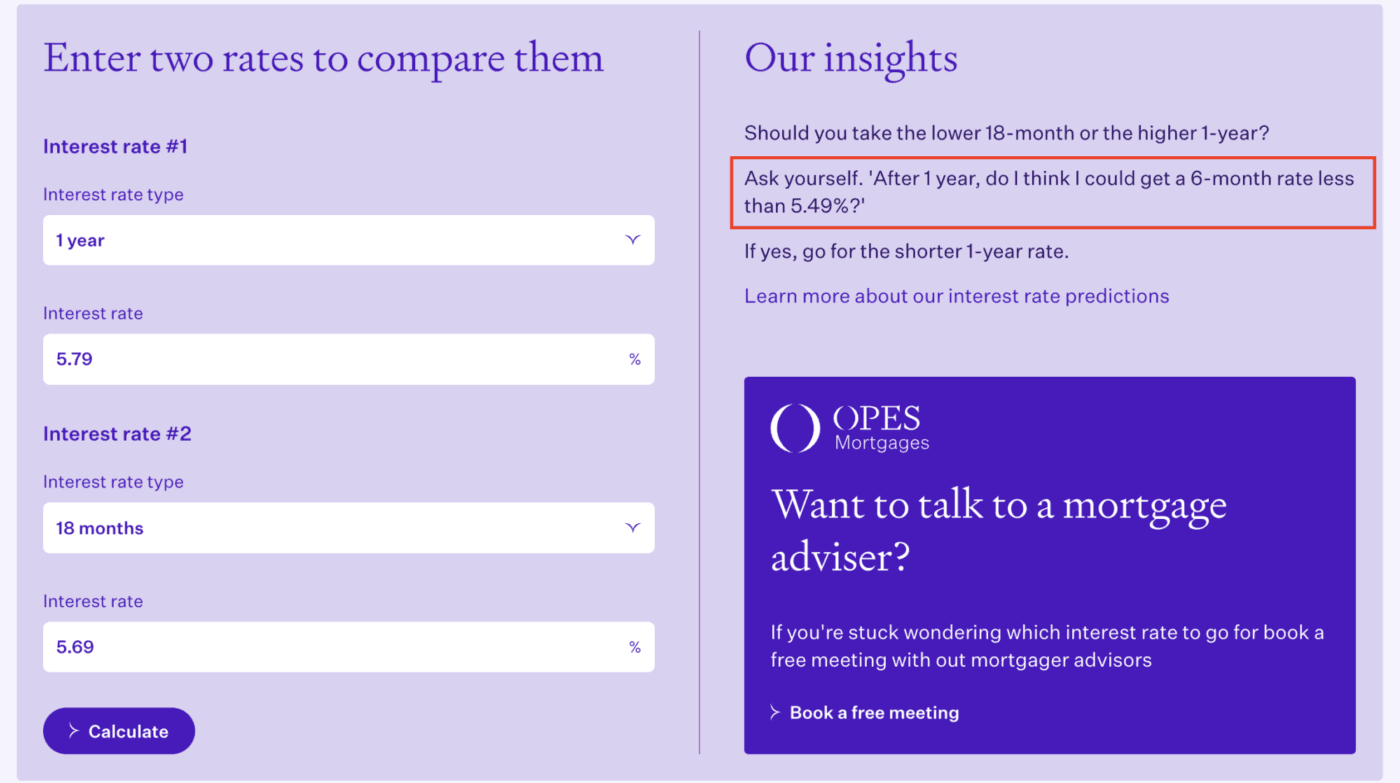

So let’s say they offer you 5.79% for the 1-year rate and 5.69% for the 18-month.

When does it make sense to go for the more expensive 1-year rate?

Ask yourself: Will I get a 6-month rate under 5.49% in one year?”

The answer might be “maybe”.

That’s a 1% decline over the next year, comparable to the 1% drop in the last year.

So, if you’re like me … you might be comfortable taking the more expensive 1-year rate.

Click this link (below) to try the calculator yourself.

👉 I want to try the calculator and run my numbers

You might also wonder: “What happens if I choose the wrong interest rate?”

Well, you might. No one knows for sure where rates are headed.

Sure, experts provide forecasts, but we can’t predict the future.

So you have to give it a punt.

The point of this calculator is that it’s more of an educated guess rather than a random pick.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser