Property Investment

Property Investment

5 min read

Author: Tiffany Bracey

Property Manager Team Leader at Opes Property Management Auckland.

Reviewed by: Jess Knight

Business Development Manager with over 5 years of experience in Property Management in Auckland.

One of the most common fears investors have is getting the wrong tenants.

But property investors can get good tenants by using research, buying the right house, presenting it well, and maintaining the property.

As a property manager I see the common mistakes investors make. They choose not to do a reference or credit check, or they buy the wrong property for the right location.

That’s why in this article you’ll learn the top 5 things you can do as an investor, to get the best possible tenant.

There aren’t many good statistics showing how many “bad” tenants there are.

But one way to get a sense of it is by looking at applications to the Tenancy Tribunal. After all, these are cases where the tenant/landlord relationship hasn’t gone well.

Every year there are around 24,000 applications that go to the tribunal. Some of those are double-ups because the tenant puts in an application, then the landlord puts one in against the tenant.

There are around 600,000 rental properties in New Zealand, so I estimate that around 4-5% of rental properties have a Tenancy Tribunal application per year.

That’s roughly 1 in 20 properties have an issue with tenants each year.

So how do you make sure you’re in the 95% of investors who don’t have issues with tenants – and not in the 5% of investors who have them?

The biggest issue I see is that investors buy a house in a good area – but they don’t buy the right house for that area.

That’s why I encourage investors to use our Tenant Tool.

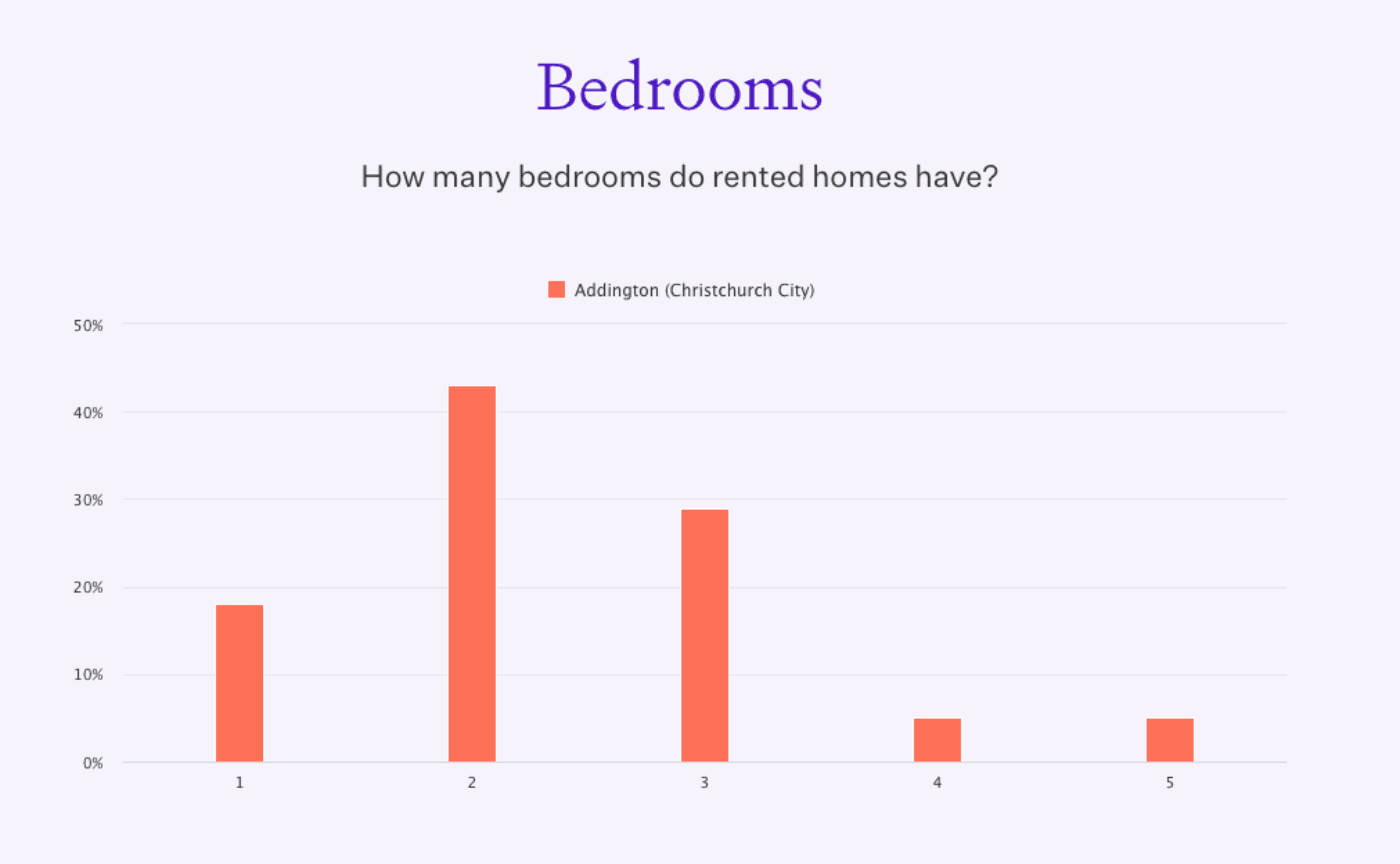

This is where you can research any suburb in the country to understand what sort of properties tenants rent in that area.

For example, you can type in a suburb like Addington, Christchurch. If you did that you’d see most tenants rent 2-bedroom properties in that area.

So investing in a 2-bedroom property will give you a wider tenant pool compared with buying a 5-bedroom property. There aren’t as many tenants looking for those larger types of properties in this suburb.

If you buy the property your tenants want, then the more tenants you can potentially rent to. That gives you a wider range of tenants to choose from.

One of the best ways to get good tenants is to make sure there are lots of tenants who want your property.

Again, that means you can choose the best one.

One error some investors make is they buy a house that’s too premium.

For example, if you’re buying a 4-bedroom house, you’re not always going to be renting to a family.

In a lot of cases you’re setting up your house for a flatting situation. So, you’ll have 4+ people living in the same space to pay the rent.

For instance, the average rent for a 4-bedroom New Build in South Auckland is $850. That’s a lot for 2 parents to pay, especially if they have 2 or 3 kids.

The rule of thumb is that the more expensive the house, the more people you need to pay rent.

So just remember that the most premium property will not always attract the most premium tenants.

You need to buy something that is affordable for your target tenant.

One other mistake investors make is they forget to do the proper checks on their tenants.

I recently met a few tenants who were looking to rent a property. They interviewed well, but when I did a credit check on them their report lit up like a Christmas tree.

They had a history of taking out loans, renting properties, and taking on credit … then not paying the bill.

I told the property investor this and they weren’t comfortable taking a risk on these tenants. So we agreed we’d look for other tenants who had a better history of paying their bills on time.

So as well as doing your research, the other way to avoid bad tenants is to screen them out from the start.

If you choose the right tenant, then you’ll have fewer issues later on.

Things tend to go wrong with tenants when there’s a breakdown in trust from the tenant’s side.

This often happens when the tenant reports maintenance issues and they aren’t addressed.

If the tenant keeps reporting issue after issue and the landlord does nothing, then the tenant thinks, “This investor doesn’t care about me. So why should I bother?”

But if you approve maintenance requests often and show tenants you want to keep the property in good nick, they tend to reciprocate.

Finally, you can be more choosy over tenants if you invest in an area where there is high rental demand.

Let’s say you invest in a desirable area like Fendalton in Christchurch.

There are a lot of people who want to live in Fendalton, but there aren’t that many renters who can afford to live in that area.

It’s the same if you invest in a small town of 1,000 people. Your tenant pool will be small, so you can’t afford to be as choosy.

But if you invest in an area like Waltham, Christchurch, there are more people who rent, so you’re more likely to find a tenant.

The other thing you can do is use a property manager. They find tenants for properties every week, so they know what to look for.

That includes doing the reference checks, which means they’ll call the tenant’s employer to make sure they have the job they say they do, and previous property managers to make sure the tenant pays rent on time.

They’ll also regularly inspect the house to make sure it’s looked after. These regular inspections will usually reveal if there is a secret tenant or pet who’s snuck in against the rental agreement.

EXTRA LISTENING:

Property Manager Team Leader at Opes Property Management Auckland.

Tiffany is an experienced property manager who understands the importance of strong systems to deliver top-tier service. She is committed to staying ahead of the ever-changing compliance requirements under the Residential Tenancies Act 1986.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser