Number Crunching

How much do rents increase in NZ? (Rental inflation)

Find out how fast rents have increased in New Zealand so you can decide what to use when forecasting your investment properties.

Property Management

10 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Rising rents are part and parcel of owning investment properties.

The cost of holding onto your investment property is forever going upwards. Between rates, insurance, and those pesky changes to the interest deductibility law – property investors have to boost rents to keep properties as viable assets.

But some investors fear that increasing the rent will cause their good tenants to move into another property.

You might think: Why – for the sake of $20 a week – should I risk losing my quiet “tea-sipping” tenants for a rowdy bunch of 20-somethings setting fire to couches outside on the front lawn?

Another question property investors ask is: “How much should I increase the rent by?”

This article goes through how to increase the rent on your property; how to figure out what to increase the rent by; and the reasons why rent increases are a normal and necessary part of the renting lifecycle.

Do you have a question or comment about increasing the rent on your property? Feel free to leave your thoughts in the comment section at the end of the page.

Every 12 months you have the right to serve your tenants with an increase in rent. It used to be 6 months, but the government extended this in January 2021.

By law, you are required to give 60 days’ notice, in writing, when increasing your rents. You must follow the legal process to a T. If you don’t your rental increase may not be valid and you’ll have to serve another 60-day notice.

To be clear, you’ve got to state:

You can send this via a letter, but email is acceptable and much more common.

Here is an example of a real letter sent to a tenant advising of a rental increase:

Across the board property managers should contact you when the 12-month period has passed and you have the opportunity for a rent review. It’s as standard a procedure as extending a rental contract.

Some property management companies, like Opes Property Management, make sure the right to increase the rent is written into all contracts signed with tenants. This way it isn’t a surprise.

On top of this, some property investors write a default rent increase into the contract. Through this clause the rent then automatically increases every year by a set percentage e.g. 3 or 4%, so the investor and tenant have certainty about what those rental increases will be.

You can’t just pick a number out of thin air.

You need to base your decision on data and facts.

But to give you a rule of thumb, generally a 3 to 5% increase is pretty standard. So, it’s usually a small amount like about $20 a week.

Now, there is a 5-step process to establish what to raise your rents by:

But how much the rent increases very much depends on:

And business experts caution against settling on an inflexible, percentage-value increase, because it just doesn’t work like that every time, everywhere.

For instance, in some years the market may have gone up substantially, so you can raise your rents. In other times the market will be flat, so you don’t have that opportunity.

But what is important to note is that while rents in some areas will increase more quickly than others for a short time – the long term increase in rents around the country is pretty consistent.

Here’s a case study of an investor deciding to put rents up and figuring what the right number is.

No. Currently, the law does not limit how much landlords can the increase rent by.

There have been murmurings in the past about introducing some sort of highest amount the rent can increase by.

At around the same time there was also discussion about not giving your owner a choice about allowing pets inside the houses.

Neither were turned into law or set in stone.

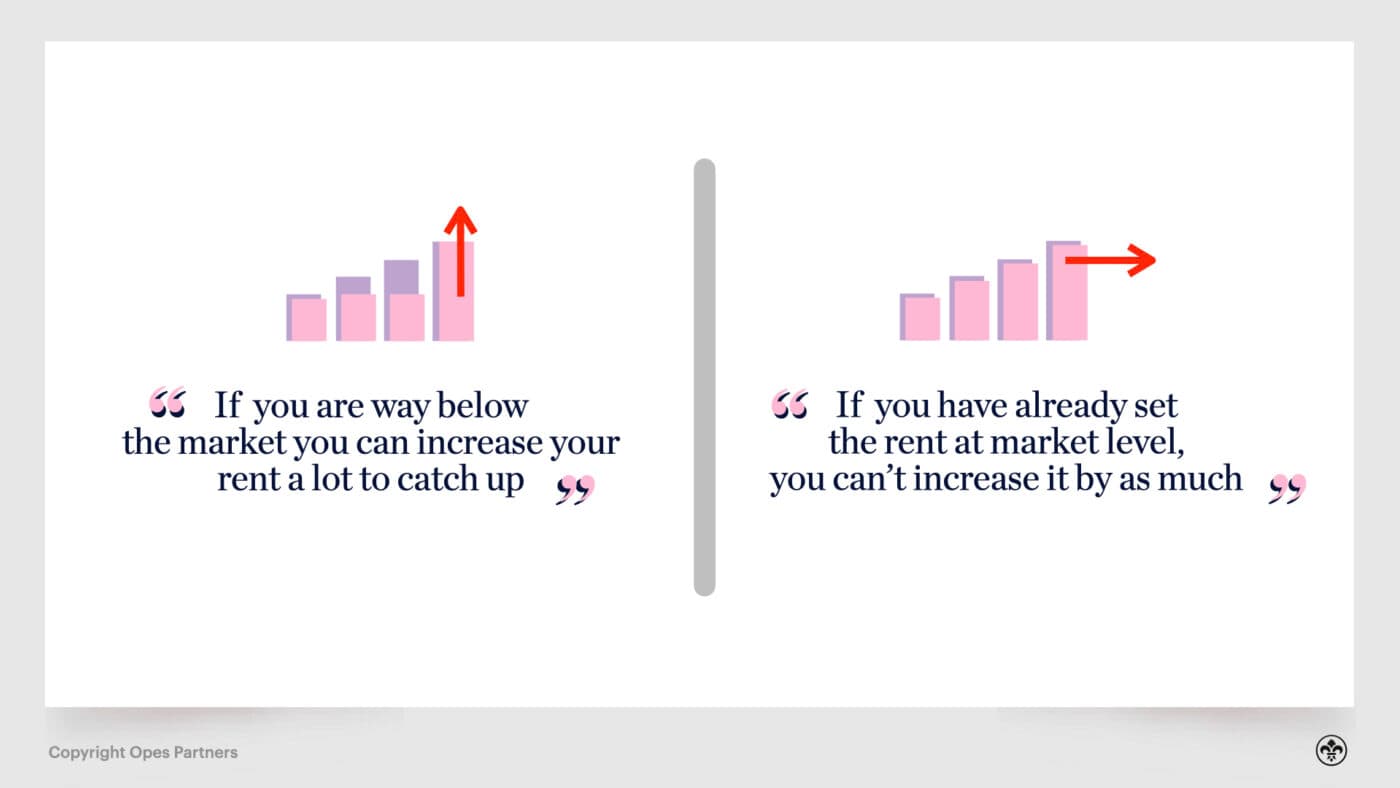

But while there isn’t a cap on what you can increase the rent by, there is a “soft limit” to what the new rent can be. You can only increase the rent to the current market level. You cannot raise it to substantially more than what similar properties are charging.

For instance, say you rented a property to a tenant for $400 a week. Then let’s say that tenant started causing you hassles. You can’t double the rent (if other properties aren’t charging that much), just to get rid of your tenant.

That’s because if you are now charging way more than the rest of the market and similar properties, your tenant can challenge the rent increase through the Tenancy Tribunal. More on that below.

Some property investors think a maximum increase might come in at some point - but that is not the case currently. It is something to put on your radar, just in case.

This is a dilemma a lot of property investors face: If I have a good tenant why would I risk losing them by raising the rent?

This conundrum is something property managers often deal with.

Technically speaking, any rental increase has to be agreed by the tenant. But in practice, is this really agreed? Not really. They either accept or they move out.

Let’s think about the worst-case scenario - you raise the rent and your good tenants up and leave.

Unfortunately, that is the risk of doing business.

It’s important that you weigh the risk of whether your tenant is likely to leave or not. This comes down to 2 considerations.

Firstly, who your tenant is, and how easy it is for them to move. Because moving is costly. It takes time, stress and money to move.

So, if your tenants are a family of 4 with lots of furniture and their kids go to school down the road, they’re less likely to move out. This is because the whole family is settled into that area and it will cost more money to move all that stuff to a new house.

On the other hand, a single person living in a fully-furnished Central Auckland apartment has no trouble moving. They can pack their clothes and leave.

So investors have more pricing-power/ability to increase the rent in the first situation, compared to the second.

The second thing to consider is the availability of alternative accommodation.

If there aren’t many other properties around (and they’re about the same price as the new rent you’re asking for), then the tenant has few alternatives and they’re more likely to accept the new rent.

Whereas with apartments, there are usually lots of them around, so there are many options, so you have less pricing-power/ability to increase the rent.

The key message here is that you need to actually weigh the risk of whether you will lose your tenant or not.

As a property investor you are in the business of providing accommodation. You’re not in the business of subsidising accommodation or providing charity. And you need to be adequately paid for the product you provide. Ultimately, if you aren’t charging your tenant the going rate you are only kicking yourself in the back pocket.

The thing is, tenants expect rental increases. But they aren’t exactly going to chase you around to put the rent up either. So, it is your responsibility to make sure you are charging the right amount.

Yes. There may come a time where your tenant will file to the Tenancy Tribunal, disputing the rental increase.

That will happen if you try to increase the rent more than the market level.

There are a few hoops they will have to jump through, and the tenant will have to prove you are charging “substantially more” than similar properties. They’ll need to give clear examples, and then the adjudicator will make a decision.

Realistically, this doesn’t happen too often. In practice, if tenants don’t agree they decide to leave. But, if they think you’re taking them for a ride, and the increase isn’t warranted by market movements, expect tenants to kick up a fuss.

That’s why it is important to get the “market level” right. Follow the process outlined above and you should avoid any Tenancy Tribunal trouble.

All things considered, don’t let worries about losing those perfect tenants stop you from keeping your rent in line with market averages. There are things you can factor into your consideration to make sure you aren’t going to shove them out the door.

Currently there is no ceiling price for rents, but that doesn’t mean you can start charging ridiculous amounts either. At the end of the day supply and demand will dictate how much you can charge, and this depends on where your property is.

But just keep in mind, any time you try to increase your rents … follow the legal process. Put it in writing 60 days before it takes effect, and state both the increase and the date that increase starts.

Write your questions or thoughts in the comments section below.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser