Property Market

What is the average house price in New Zealand?

Find out the average house prices by council area in New Zealand in 2026. Here's everything you need to know including what factors make house values go up.

Property Market

5 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Investors often ask: “Are Christchurch properties harder to insure because of earthquake risk?”

This is a fair question.

In 2010 and 2011, Christchurch had a pair of earthquakes. They destroyed the city and damaged half the houses in the city.

The cost of your insurance (the premium) is based on risk.

The more risky your property, the higher the cost of insurance will be.

So can you still get insurance on a Christchurch house? And is the cost of insurance too high?

In this article, you’ll learn how much it costs to insure a house in Christchurch. You'll also learn whether it's hard to get cover for your property.

And if you have a question, write your questions or thoughts in the comments section below.

Christchurch isn't the most expensive place to get insurance in New Zealand.

Yes, it usually costs more to insure a house in Christchurch compared to Auckland.

But, insurance premiums in Wellington are often higher than in Christchurch.

Let's say you took 2 identical properties. One is in Christchurch and the other is in Wellington.

The premiums for the Wellington property could be x2 those for the Christchurch property.

Stepping outside the main cities, other parts of NZ are more expensive to insure too.

Properties in Hawkes Bay (or areas with a higher flood risk) will pay more for insurance.

Insurance premiums will also vary within each city too.

For instance, in Christchurch, the cheapest premiums are in Sydenham, Spreydon, or Rolleston.

Most of the houses in these suburbs were built post-earthquakes.

Developers built these properties to a higher standard. So they pose less risk to the insurance company. That means home owners get access to cheaper insurance.

It is easy to assume that Christchurch will be at risk of another earthquake, because they had one before.

But really, the likelihood of it happening again is lower than some other parts of New Zealand.

According to GNS Science, Christchurch has a moderate risk of future earthquakes.

Earthquakes happen when tectonic plates move together.

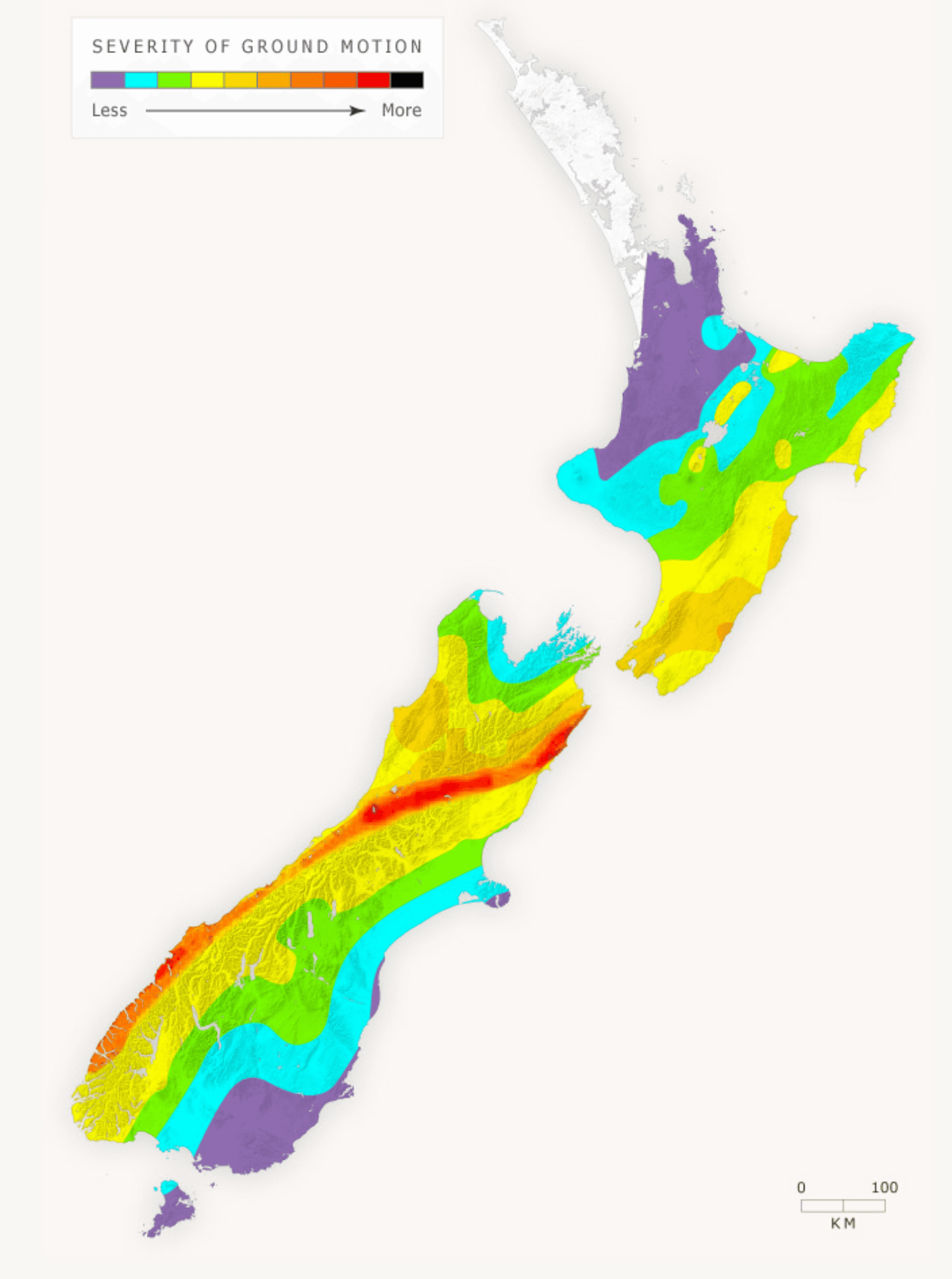

The main fault line in NZ comes up from the Southern Alps, through Wellington and up to Whakatane.

This means the areas at most risk are:

In Christchurch, the risk is lower.

Auckland is so far away from a fault line, they are low risk.

2023 started as the worst year in history for insurance claims in New Zealand.

Auckland is now known to be a hot-spot for insurance claims. But after the Auckland Anniversary floods, premiums have gone up.

This is happening across the country, not just in the flood-affected areas.

Aucklanders helped to pay for the Canterbury earthquakes.

Now Christchurch was helping to pay for Auckland and Hawkes Bay.

We're all in it together – premiums wise.

Essentially, this means that premiums aren’t going to get cheaper.

From this perspective, buying a New Build can help you mitigate the cost of insurance. That's because they are built to the new council flood requirements.

For example, New Builds have to be built higher off the ground. This is to compensate for flooding and the potential for seawater rises. So insurance premiums are lower.

After the earthquakes Christchurch was zoned into technical categories 1, 2 and 3.

These are known as TC1, TC2 and TC3.

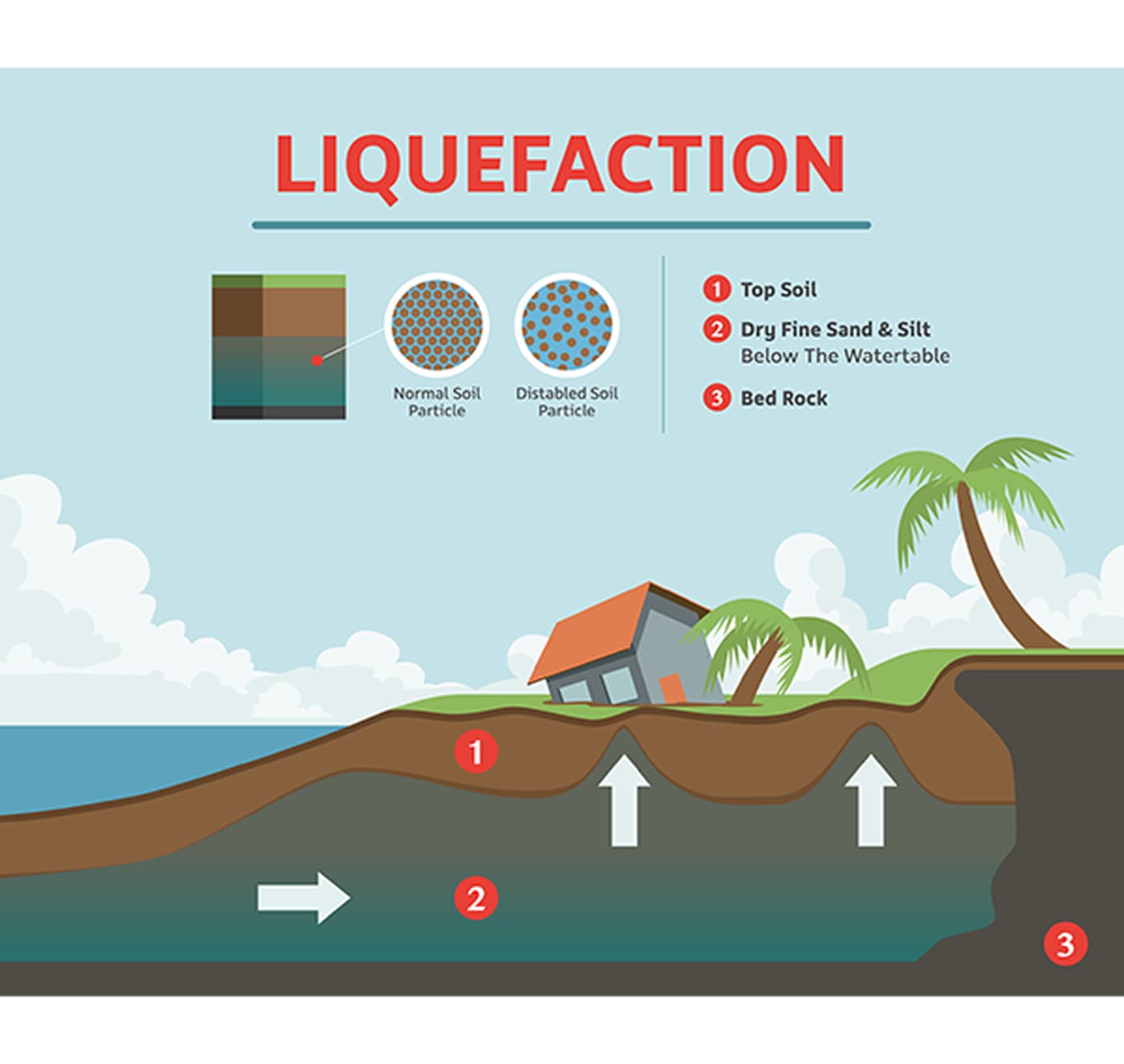

While many investors think these show the risk of an earthquake happening. It's not. Rather these categories show the risk of “liquefaction”.

Liquefaction is how much the soil gives out and acts like a liquid during an earthquake.

The more liquidy the soil becomes, the more potential damage to your property. This is when your house sinks into the ground.

All three types of land are safe to build on, according to the Christchurch City Council.

But the council requires properties built on TC3 land to have stronger foundations.

So it's not that buying a house in TC3 land is more risky, but it's that the building has to be built to a different standard.

When it comes to insurance premiums, TC3 can be more expensive. But because new properties are built to higher standards, new builds have lower insurance premiums.

They balance each other out.

The bottom line is, the cost of insurance has gone up over the last year. That is true for most of the country.

But if you are in a good area (Auckland and Christchurch) and you invest in a new build ... the cost of insurance will be lower than it would otherwise be.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser