Property Investment

The emotional rollercoaster of investing (you didn’t see coming)

Property investment isn’t just about numbers — it’s emotional. Explore 20 years of market highs, lows, and the rollercoaster investors ride through it all.

Property Investment

5 min read

Author: Ed McKnight

Our Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Property investors can use Airbnb as an alternative strategy to traditional, long-term rentals.

This is where properties are listed on Airbnb to rent out to guests.

Right now, Airbnb is attractive. It improves your cashflow.

So, in this article, I’ll look at one of my investment properties and what would happen if I turned it into an Airbnb. This includes the actual before and after numbers.

Just before we dive in. Remember, here at Opes, we have our own property management company. It’s called Opes Property Management.

And we don’t manage properties that are listed on Airbnb. So, there is an incentive for me to show bias and say that renting properties on Airbnb is a bad idea.

I'm not going to do that. This will be a fair and honest comparison between the two options. That way, you can make the right decision for yourself.

This property is a 2-bedroom apartment in Christchurch. It currently rents for $515 a week. That’s about $73.50 a night.

But if I rent it out as an Airbnb, I’ll earn more money.

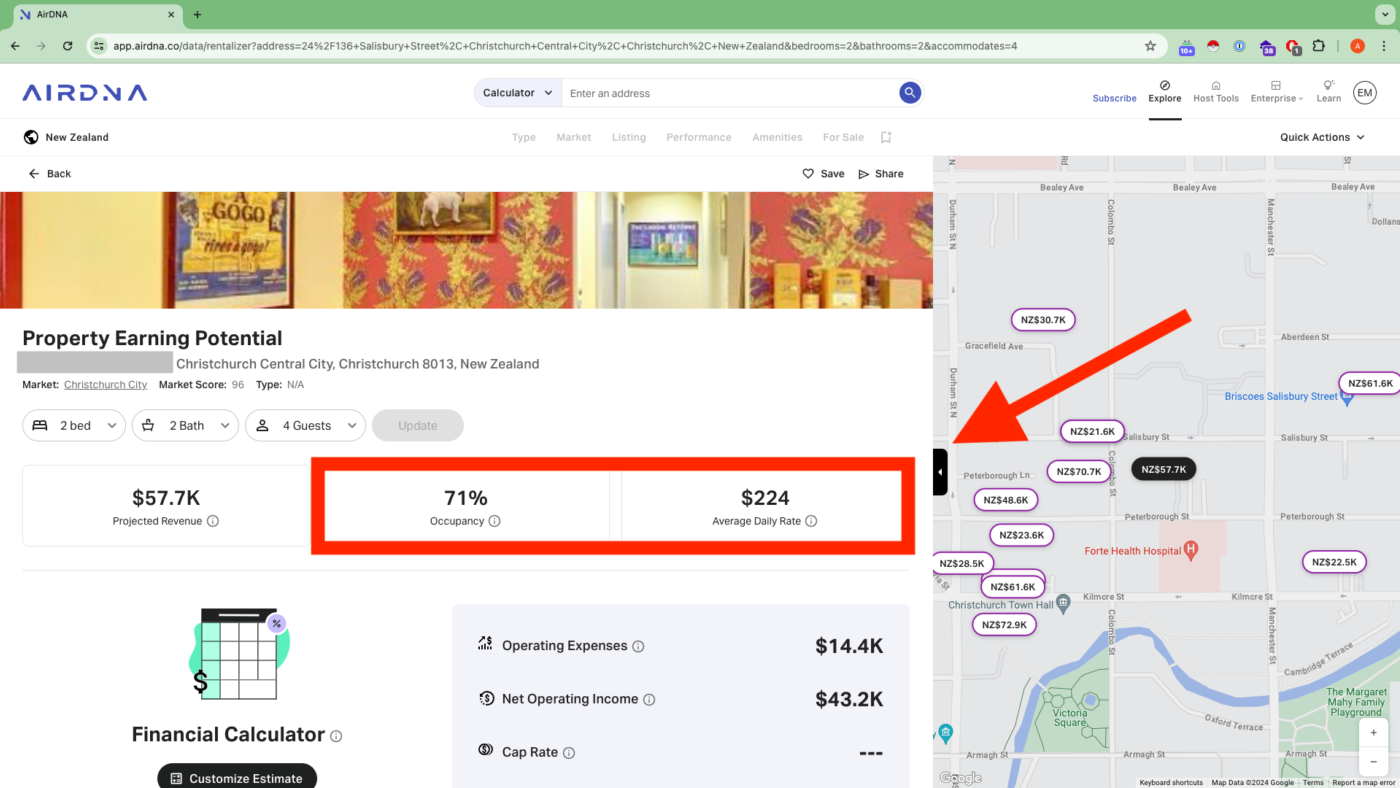

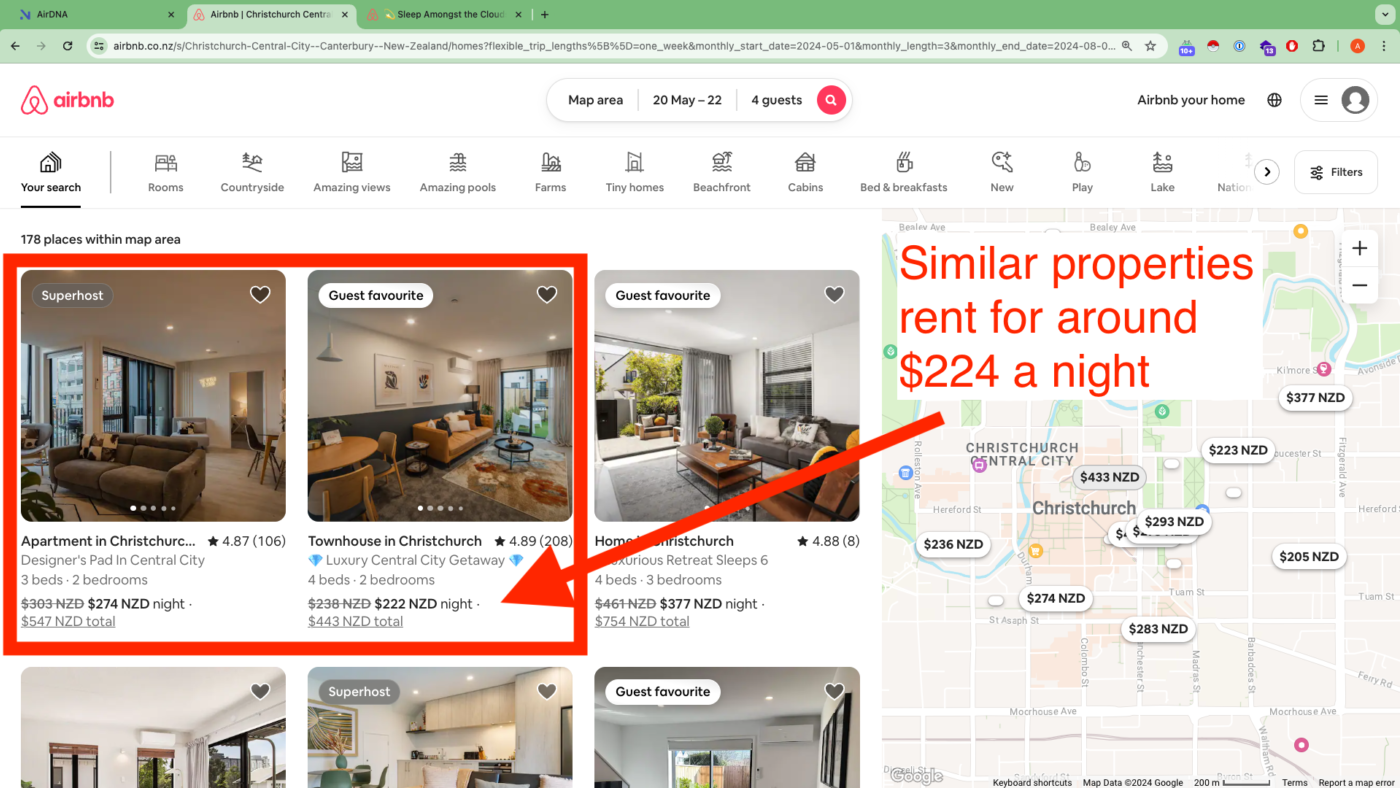

AirDNA’s calculator says I’d get around $224 a night. It also estimates that I could get a 71% occupancy rate. That means I’ll only get rent 71% of the time.

Looking at similar properties on Airbnb, that daily rate feels about right.

That means this property could potentially earn $57,200 a year. That’s over double what my apartment currently earns.

But if you rent your property on Airbnb, you’ll also face extra costs.

But the costs are higher for an Airbnb.

You might earn double the rent. But you’ve got double the expenses.

To rent this property out as a long-term rental, I have around $12.2k in expenses. This covers rates, property management fees, and body corporate fees.

But for an Airbnb, you’ve also got to pay:

The annual cost of renting my property on Airbnb is more like $26.4k.

On top of this, I’ll also need to pay to furnish the property. That means buying beds, couches and rugs.

I'll also have to shell out for cutlery, glasses, salt and pepper (and everything in between).

If I borrow the money to get this furniture, I’ll also need to pay the interest.

All up, it’s about an extra $12,800 in costs per year.

What does the cashflow look like once all the costs are considered?

Right now, my long-term rental is negatively geared by $168 a week. That’s how much I have to pay from my own pocket to cover all the costs. We sometimes call this the ‘top-up’.

As an Airbnb, I would be up $22 a week positively geared. That’s about $190 a week better off.

Airbnb has more risk. What if I struggle to find guests?

I stress-tested the numbers to quantify the risk.

For Airbnb to win, I’d need to get at least –

So, I can handle some volatility in the nightly rate or occupancy and still be better off. A lot of things have to go wrong before Airbnb has worse cashflow than a long-term rental.

Before I rush out and turn this property into an Airbnb, I’d also need to think about the pros and cons.

While Airbnbs get better cashflow, there is less stability. Some investors like to know that consistent rent is hitting their bank account.

It also means that I have to buy furniture. If I turn the property back into a long-term rental, I'll need to store the furniture somewhere (or get rid of it).

I also wonder if councils will take a harder line with Airbnb. For example, if you want to rent your property on Airbnb in Christchurch, you need to get council consent. They'll then charge you higher commercial rates.

So, Airbnb gives a better cashflow this year … but will it be as good in 15 years? I’m not so sure.

So, let’s say I decided to turn my property into an Airbnb. How do I make it happen?

In my case, I need to wait. My tenants have a fixed-term contract for around the next 10 months.

So before I even think about using Airbnb, I’d need to wait for their contract to end.

Then, the next steps are practical. I need to:

1. Check the Body Corporate rules. There might be rules preventing you from renting your property on Airbnb.

Because this is an apartment, the insurance might not cover short-term accommodation. So I’d need to check with the body corporate manager.

2. Think about access.

Again, this property is in an apartment complex. I’d need to check how the guests can get the keys. I don’t think there’s an obvious place guests could get the keys from the roadside at the moment.

3. Check if you need council consent.

In some parts of the country, you need council consent before renting your property on Airbnb.

After all this, I’d need to buy the furniture and get good photos taken. I’d then need to talk to an Airbnb property manager and get it listed online.

Our Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.