Property Investment

Cashback wars

Fancy pocketing up to $7,500 just for switching banks? Here’s why that’s suddenly on the table👇

Mortgages

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Interest rates are high.

So, a lot of investors ask: "How long should I fix my mortgage?"

What’s better – the 1, 2, 3, or even the 5-year rate?

Here are three strategies you can use to find the right interest rate for you.

First, we need to be clear about what we’re trying to do when choosing a rate.

Usually, it’s not about getting the lowest rate today. It’s about getting the lowest average rate for the next 5 years.

Right now, the 5-year rate is cheaper than the 1-year rate.

But if interest rates go down, today’s 5-year rate could look expensive in a few years.

You’ve also got to ask yourself if you’re ok with uncertainty.

The 5-year rate is usually more expensive in the long run. More on this below.

But you might be willing to pay that price for a stable interest rate. That way your repayments don’t change every year.

One option is to choose the 1-year interest rate blindly.

Why? Historically, it’s been the lowest rate on average.

Let’s say you fixed for 1 year every year for the last 20 years.

Sometimes, you’ll pay a higher interest rate.

Back in 2004, locking in the 5-year rate would have been better ... initially.

This is because the 1-year rate jumped quite

high. Over 9.64%

But the 1-year rate has come down quickly. So, you would have been significantly better off… over time.

In fact, on a $500k mortgage, you would have saved almost $90,000 in interest.

If you don't want to put all your eggs (or mortgage) in the same fixed-rate basket – you can split it up.

Let's say you've got a $500k mortgage.

Some investors will put $250k on a 1-year fixed. They’ll fix another $250k on a different term (e.g. 2-year or 5-year).

If you do this, you’ll never get the absolute lowest interest rate.

But if you choose the ‘wrong’ interest rate …. then you’re only half wrong.

An investor I recently worked with had a big chunk of their mortgage on the 5-year fixed when it was 2.99%.

The rest of their mortgage is on the higher 7% today.

They’re happy. Their interest rate is about 5% (on average). They’re stoked. It’s a win for them.

Right now, the lowest interest rate is the 5-year. The cheapest advertised rate is 6.25% from Westpac.

The lowest 1-year advertised rate is 6.99% from KiwiBank.

So when would it make sense to take the 1-year over the 5-year?

And how far would interest rates need to fall for it to be worth taking the higher rate?

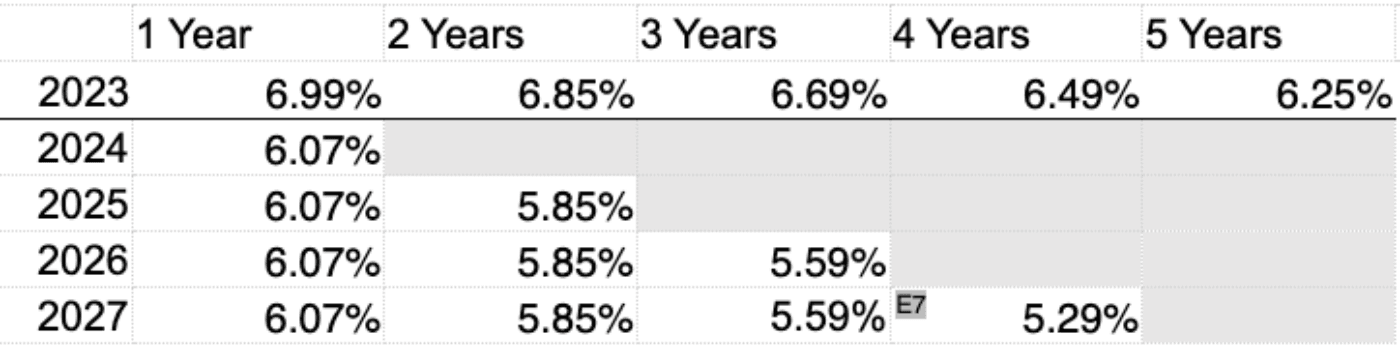

Here are the numbers –

You’d need to get an average rate under 6.07% over the following 4 years for the 1-year rate to be worth it.

So ask yourself – “once my first year is up, could I get an average interest rate of less than 6.07% (on average) for the next 4 years?

If you think the answer is ‘yes’, go for the 1-year.

If you think the answer is 'no', take the 5-year.

The purpose isn’t to guess the interest rate precisely right. It’s about giving you a frame of reference so you decide which rate to choose.

You can download the spreadsheet I showed above here.

Generally, if people think interest rates will go up, they fix for longer.

If people think rates will head down, they fix for shorter.

Sure, the 5-year rate is cheaper today. But in 3 years, you might kick yourself.

Just like many of us are kicking ourselves for taking the cheaper 1-year rate in 2021.

We saved a bit of money in the 1st year. But we are paying for it now.

Remember, the goal isn’t to get the lowest rate today. It’s to get the lowest average over 5 years.

A higher rate today might save you money in the long run.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser