Property Investment

Cashback wars

Fancy pocketing up to $7,500 just for switching banks? Here’s why that’s suddenly on the table👇

Mortgages

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Peter Norris

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Whenever I go on Facebook, I see people posting screenshots of their interest rates. They ask, “Are these good rates?”

While the bank may advertise a 7% (ish) interest rate, you can always ask for a discount.

So you might wonder: “How much discount can I get?”

Let’s look at the data.

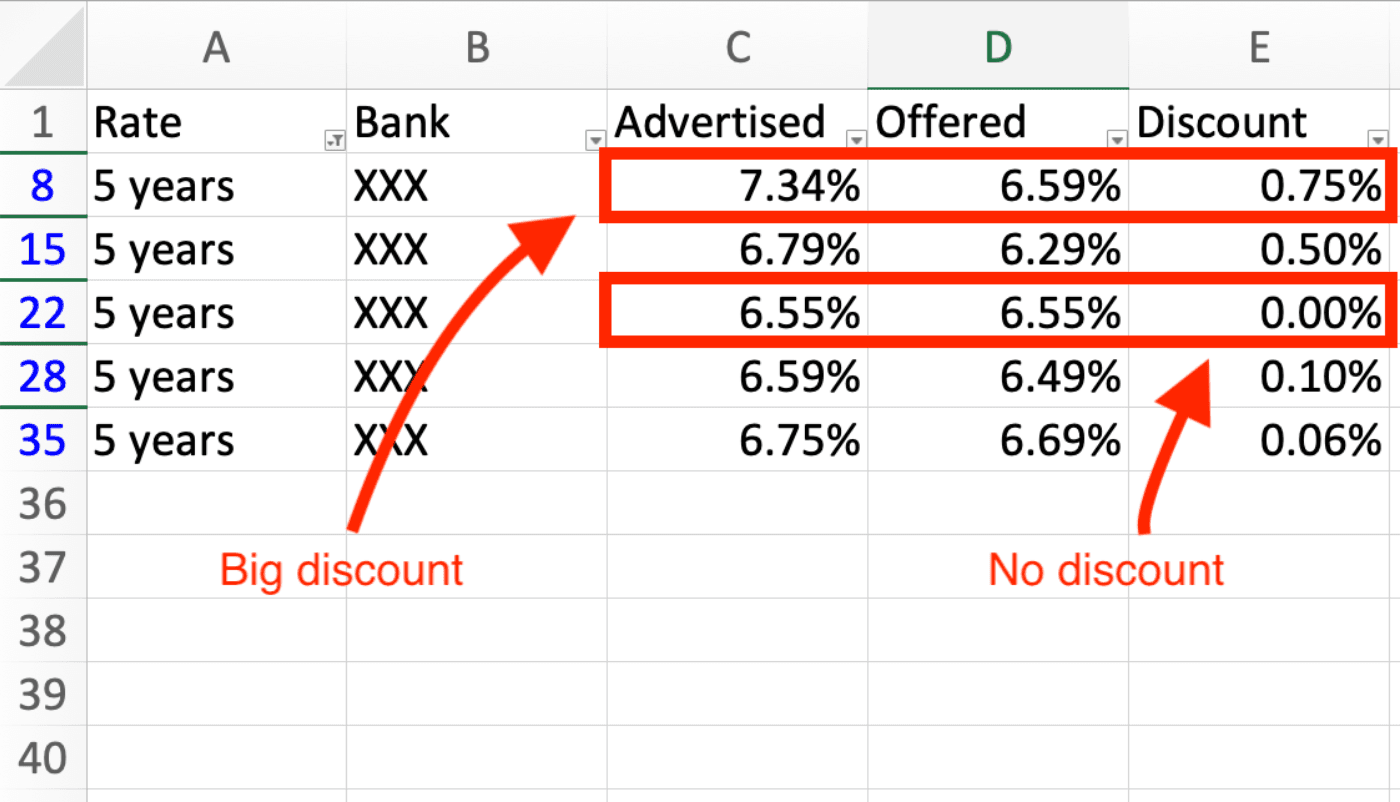

I’ve dug through the rates my brokers at Opes Mortgages got for clients over the last week.

The biggest discount our brokers could get was 0.75%.

This was a 5-year rate that went from 7.34% down to 6.59%.

But not all rates get a discount. Some have none at all.

The average 1-year interest rate advertised by the 6 big banks is 7.37%.

But last week, our brokers got this down to 6.94% (on average).

A 0.43% discount.

On a $500k mortgage, that saves you $2,150 a year. That’s $41 a week.

It’s a different story for the 2-year interest rate:

The average advertised rate is 6.86%, but the average discount is just 0.06%.

That’s the equivalent of $6 a week on a $500k mortgage.

The banks are discounting the 1-year and 6-month rates most heavily.

Then comes the 18-month, the 4-year, and the 5-year.

The smallest discounts are on the 2 and 3-year rates.

Most banks decreased their 2 and year 3-year rates about a month ago.

Since they recently lowered the rate, they’re unwilling to give as much discount. Makes sense.

But most banks haven’t changed their 1-year rates for 3 months. So they’re more willing to give a discount.

In today’s market … the longer a bank has kept its interest rate steady, the more room there is for a discount.

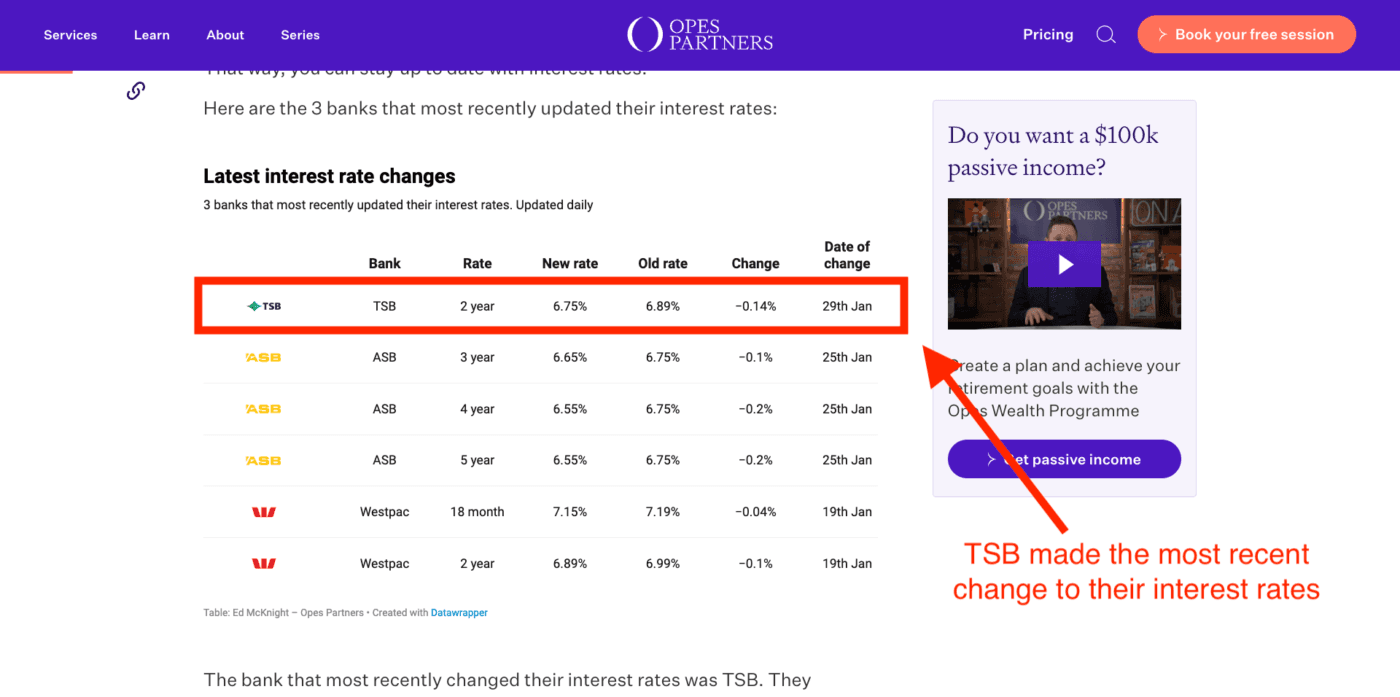

However, it’s hard to find this information online.

So Ed (our economist) created this page to show you can see when each bank last updated their interest rates.

Some brokers say that Adrian Orr wants banks to keep their rates high.

That’s not my take. I don’t think the Reserve Bank governor is waving a big stick at the banks.

Wholesale rates are on the way down.

It costs the banks less to borrow money and lend it to us for a mortgage. So, their margins are increasing.

But, the market is uncertain. We don’t know when the Reserve Bank will start bringing the OCR down.

And there are costs when the banks change their interest rates. They need to launch new campaigns and update their marketing.

They don’t want to drop the 1-year rate today only to increase it next week.

So, the banks are holding off until the picture becomes clear.

It’s cheaper and easier for the banks to offer a discount before making a move.

If you got a mortgage a month (or two) ago, you might think, "Hang on, my mortgage broker didn’t get me these big discounts.”

Interest rates (and their discounts) change day to day.

So, these are the discounts my brokers could get last week. But that doesn’t mean they were available a month or two ago.

Similarly, they might not be available in a month or two.

So don’t walk into the bank and say, “Andrew Nicol says I can get 0.43% off the advertised 1-year rate … where’s my discount?” ... It doesn’t work that way.

Instead, use this to get a general idea about what discounts are happening.

If you need a (good) mortgage broker, give my team at Opes Mortgages a ring.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser